BOOM Apologises - Let's Look at QE (Quantitative Easing) - Was QE the Right Thing to do? - US Financial Crimes, Crimes and More Crimes - Covid Shares - US and China Stocks and Bonds

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive Further long term archives are available at LinkedIn and Wordpress https://boomfinanceandeconomics.wordpress.com

BOOM is human. BOOM is not an Artificial Intelligence and never uses AI to assist in writing BOOM each week.

BOOM APOLOGISES -- CORRECTION

In last week’s email to subscribers, BOOM mistakenly left out a few (important) words in the following paragraph — (except in a rare QE program) . The words were published on the website but not in the email. The words are highlighted in bold here for readers to think about their importance. The paragraph is part of last week’s discussion about the US Government’s Debt total of US $ 36.2 Trillion and how it is funded.

To most people, that sounds like an extraordinary amount of Debt. But the fact is that NO NEW MONEY is ever created to invest in government Treasury securities (except in a rare QE program). It is old money that is used to buy Treasury securities and fund the government’s deficit spending program. That money was created previously, originated in bank loans or in physical cash. So – Government Debt does NOT increase the money supply (except in a rare QE program). Private debt is the main cause of increased money supply. Economists should focus in on excessive private debt creation, not sovereign national debt.

With that in mind, let’s look at the QE (Quantitative Easing Programs) that have been conducted by the Federal Reserve (America’s central bank). The US has implemented quantitative easing four times. The first was in November 2008 in response to the global financial crisis. The last was in 2020 and peaked in 2022.

US QE PROGRAMS 2008 – 2022

Quantitative Easing (QE) is actually a rare event in the 110 year history of the Federal Reserve.

What (exactly) is QE? Quantitative easing is a monetary policy that can be implemented by the central bank of a nation in times of deflation or threatened deflation or if a severe economic contraction appears imminent. The goal is to increase the supply of fresh new money, reduce interest rates further in the real economy and drive more lending from commercial/retail banks to consumers and businesses. All of this aims to stimulate economic activity during a financial crisis and keep credit flowing. In modern, advanced economies, credit in digital form is 97 – 98 % of the fresh new money supply. It is originated as commercial/retail bank loans to willing customers (the remainder of the fresh new money supply is in the issuance of fresh new physical cash).

How is this done? QE involves the large scale purchase of assets by any central bank in order to stimulate or stabilise their national economy. QE is typically implemented after other monetary policy tools have already been used—usually when interest rates are at their lower bound and economic output is still below the central bank’s target. In order to buy assets on the market, the central bank creates new bank reserves. This process is commonly referred to as printing money although it is accomplished digitally. Nothing is “printed”. With the newly created funds, the central bank can buy securities such as Government Bills, Notes and Bonds from major financial institutions or directly from the Treasury. They can also buy stocks on the stock market or REIT’s (Real Estate Investment Trusts) trading as ETF’s on the stock market. Or, if they wish, they can also buy real assets in the open market. Of course, they can also buy commodities and precious metals. Each central bank will be guided by its constitution on where to allocate funds under a QE Program.

Any central bank can create money appear out of thin air -- so-called money printing -- by creating digital entries on its balance sheet called bank reserves denominated in the national currency. In a QE program, the central bank will usually begin by using those new bank reserves to purchase long-term Treasuries from the government’s Treasury or in the open market from major financial institutions. In the United States, there is a special group of selected banks called Primary Dealers who act as an intermediary between the Treasury and the open market, thus acting as a market maker of government securities. Some governments sell their securities only to primary dealers; some sell them to others as well. For example, the following large nations use a Primary Dealer system – Canada, the European Union, Hong Kong, the USA, Ireland, Japan, India and China.

QUANTITATIVE EASING IN THE UNITED STATES IN RESPONSE TO BANKING FRAUD

From 2008 through to 2022, four QE Programs were conducted to save the US banking system and the US economy after the outbreak of the Great Financial Crisis caused by US Bank insolvency. That began in late 2007 (also called the Global Financial Crisis). The crisis was caused by large scale banking fraud in many large US banks, some of which were Primary Dealers (!). Let’s be honest here. The fact remains that huge banking criminality was rampant in the United States leading up to 2007 and that is what led to the crisis. But then the Federal Reserve and the US Government had to deal with the damage done. Some large Primary Dealers, large banks and insurance companies were put into bankruptcy or rescued in orchestrated takeovers – such as Bear Sterns, AIG, Countrywide Financial, MF Global, Merrill Lynch and Lehman Brothers. Many key figures in the United States government and the financial industry played roles in the crisis, both in causing it and helping to recover from it. But Kareem Serageldin, a managing director and trader at Credit Suisse Group, was the only Wall Street investment banking executive to go to jail for their role in the financial crisis. That fact speaks volumes. Financial crimes were committed by criminals working inside banks and other financial institutions and they walked away free of any criminal investigations, indictments/charges and prosecutions.

This chart shows how the QE Programs were funded by the central bank to rescue the situation. Note that the QE Program in 2020 was the largest of all — more on that later.

FEDERAL RESERVE BALANCE SHEET EXPANSION

The US Federal Reserve’s Balance sheet was expanded from $ 900 Billion in 2008 to $ 9,000 Billion in May 2022. That is a ten fold increase during those 14 years. Roughly an $ 8 Trillion increase. During that time, the Nominal Annual GDP of the US economy went from $ 14.7 Trillion (2008) to $ 25.7 Trillion (2022) -- roughly an increase of $ 11 Trillion per annum.

But, more importantly, the CUMULATIVE GDP during that time frame was $ 280 Trillion. So $ 8 Trillion of fresh new money created by QE was used to save the banking system and the economy of the United States (and possibly the Globe) and it resulted in $ 280 Trillion of US economic activity in that 14 year period.

$ 8 Trillion to save $280 Trillion of US economic activity seems a good trade off to BOOM.

And, without QE, there would have been a financial Armageddon, resulting in a severe global Depression with MILLIONS of people unemployed and MILLIONS of homes lost with many thousands of banks lost all over the world.

None of that, however, excuses the US bank regulators and the US banking criminals who created the massive crisis of potential bank failure in 2008. In BOOM’s opinion, the US government should have prosecuted hundreds, if not thousands, of bank executives and government regulators but chose not to. That was disgraceful and Barack Obama is responsible for that (along with his choices as Attorney General) as he was President from January 2009 through to January 2017. Donald Trump should have corrected that mistake but chose not to during his first Presidency. Again, look at his Attorneys General.

WAS QE THE RIGHT THING FOR THE US CENTRAL BANK TO DO?

BOOM thinks that they did the right thing. If the Federal Reserve had not acted with financial support, then massive financial chaos would have ensued. Millions of citizens would have lost their savings in bank failures and many of those would have lost their homes and jobs.

QE was the lesser of two evils. All central banks know that this is not a consequence free policy but, in the circumstance that prevailed, there was little real choice.

The big question that needs to be answered is this – How did the massive US banking fraud accumulate over the preceding years under the so-called “watchful” eyes of Federal bank regulators, Departments of Justice, State regulators, consumer groups etc etc. It reflects very badly on the United States of America as a nation, as one whose financial institutions cannot be trusted. Quite frankly, the US financial system was lucky to escape with any reputation for ethics intact.

An article in Forbes Advisor magazine published in February 2021 and written by Anna-Louise Jackson summed up another problem with QE. Quote: “A final danger of QE is that it might exacerbate income inequality because of its impact on both financial assets and real assets, like real estate. “It has benefited those who do well when asset prices go up,” Winter says.

This potential for income inequality highlights the Fed’s limitations, Merz says. The central bank doesn’t have the infrastructure to lend directly to consumers in an efficient way, so it uses banks as intermediaries to make loans. “It is really challenging for the Fed to target individuals and businesses that are hardest hit by an economic disruption, and that is less about what the Fed wants to do and more about what the Fed is allowed to do,” he says.”

QE WAS USED BY THE FED TO COMBAT THE EFFECTS OF COVID – ANOTHER SET OF CRIMES

The Fed relaunched Quantitative Easing in response to the economic crisis caused by the Covid Planned Panic Demic in early 2020. Policymakers announced plans for QE in March 2020 — but this time, without a dollar or time limit.

The unlimited nature of this latest instance of QE is the biggest difference from the financial crisis.

Now remember, the whole Covid Planned Panic Demic and the reaction to it was created by yet another set of criminals, most of whom reside in the United States, the United Kingdom, Western Europe and China. These criminals are involved in the world of pharmaceuticals, vaccine production, government “Public Health” departments, “philanthropic” organisations and many major, well known NGO’s (Non Government Organisations). In BOOM’s opinion, they should all be subject to criminal investigations and possibly prosecuted. In the United States, that process is slowly happening. Criminal Referral Requests have recently been filed in seven US State jurisdictions against Anthony Fauci and other top COVID officials. A growing list of victims have accused federal health leaders of murder, assault, abuse, and medical terrorism over COVID-era policies. Soon, BOOM expects that executives at pharmaceutical companies will be investigated for Covid Crimes. Watch that space.

COVID VACCINE COMPANY SHARES

BOOM has been watching the share price performance of several companies involved in the development and manufacture of Covid so-called “vaccines”.

Last week, during Friday’s trading session, Biontech SE, a German company listed on Nasdaq, collapsed in price by 15.36 %. The chart is dramatic, to say the least. Biontech SE is principally involved in the research and development of MRNA “vaccine” technology and therapeutics in the field of immunology. In the field of infectious diseases, BioNTech partnered with Pfizer, in the development of Comirnaty, the first approved mRNA-based vaccine, which was widely used during the COVID-19 plandemic.

BIONTECH CHART — Daily since November

The shares of another Covid “vaccine” company also dropped sharply on Friday – Novavax. Federal regulators at the Food and Drug Administration (US FDA) have asked Novavax to complete an additional clinical trial on its COVID-19 vaccine after previously delaying approval.

BOOM’s reaction? Maybe the US regulators have finally realised that the Covid Vaccines may not be ”safe and effective”, as described by many politicians worldwide?

NOVAVAX CHART

THE TARIFF “WAR” -- CHINA STOCKS VERSUS US STOCKS -- HONG KONG AND SHANGHAI STOCKS REBOUND STRONGLY – MUCH LESS DAMAGE COMPARED TO US STOCKS

Donald Trump’s Tariff “War” against the rest of the world is continuing but with notably less enthusiasm. Nations will “negotiate” as Trump has requested. Some may even “kiss his ass” (again, as requested) but BOOM thinks that most will listen politely and patiently, smile and then head home to “continue discussions”. Of course, they will work the telephones hard with other nations as they discuss what is happening. But the inescapable fact of the matter is that trust with the US has been severely damaged by the Trump policy of conducting trade negotiations between nations with threats. The idea that the United States is a “victim” in all of this will not be welcomed. After all, it holds the excessive privilege of being the issuer of the global “reserve currency”, the US Dollar.

Trump has done a great service to the BRICS group of nations and the nations who are involved in China’s Belt and Road initiative. Multi-polarity is certainly the winner here and the US is the loser. Of that, BOOM has no doubt.

So – let’s look for evidence of this in the financial markets to see what effect all of this bluster has had since Trump launched his Policy of Threats. Let’s look at China first – WEEKLY CHARTS from late 2022.

China’s stock markets on the mainland have been resilient in response to Trump’s threats but not so much in Taiwan – which is presumably “protected” by the US. MMMmmmm …...

SHANGHAI STOCKS – Shanghai Composite Stock Index

HONG KONG – Hang Seng Index

TAIWAN – Dow Jones Taiwan Stock Index — most affected adversely

THE TARIFF “WAR” -- CHINA BONDS VERSUS US BONDS

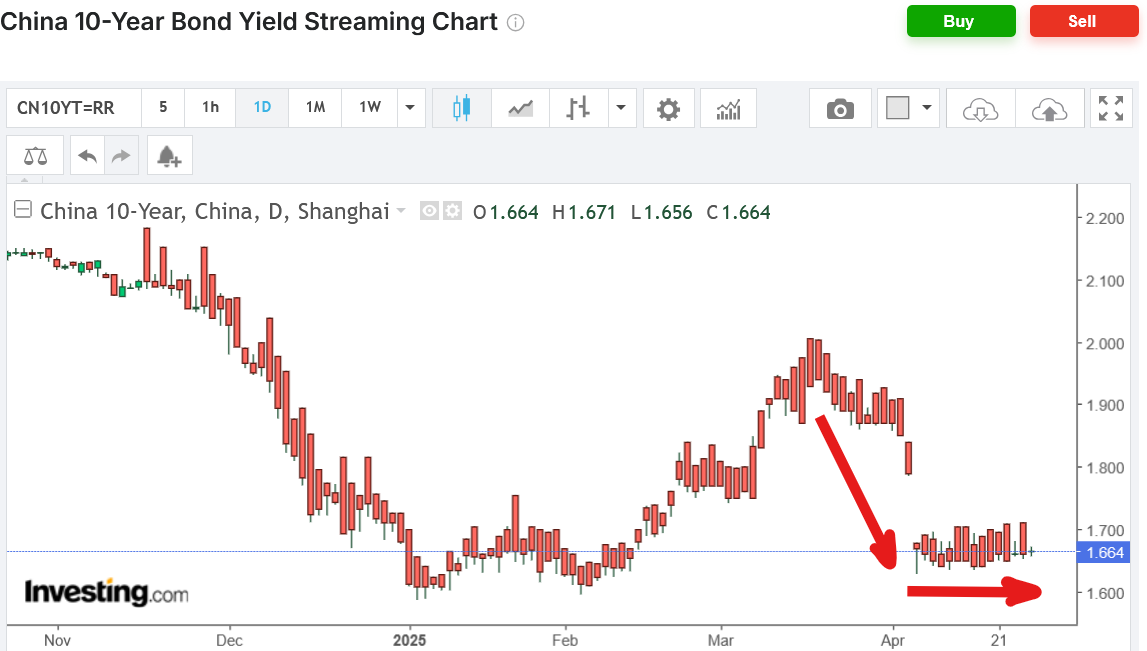

Chinese Bonds have fared well with investors buying strongly in response to Trump’s tariff threats, showing faith in the Chinese economy as a safe haven. Here is the 10 year bond chart. It shows that the yield (interest rate) has been steadily falling since 2018 and has continued to fall this year.

CHINA 10 YEAR BOND YIELD — long term — since 2015

This chart shows the China 10 Yield Bond Yield since the start of the year 2025. It shows that investors have purchased Chinese Bonds enthusiastically since Trump began his “war”. As a result, the yield has fallen from around 1.9 % to 1.66 % but it has held at that level since.

CHINA 10 YEAR BOND YIELD — short term — since November

Now, let’s look at the impact of Trump’s threat ideology on the financial asset markets of the United States.

US DOW JONES STOCK INDEX

The Dow Jones has fallen by almost 18 % (at its worst) in response to the Tariff “war”. A recovery is in process as predicted by BOOM on April 13th -- “Donald Trump’s 90 day “Pause” on the proposed reciprocal tariffs to all nations except China is clearly a back down. The “Pause” means that his disastrous tariff war is over. China and the rest of the world has won. The people of America can breath easy. BOOM expects US stock markets and bond markets to rally strongly on this knowledge next week. And the US Dollar should rally as well.”

NASDAQ STOCK INDEX

The Nasdaq Stock Index has fallen at its worst by 25 % -- a shocking result – thanks, Donald. But, it has also rebounded as per BOOM’s expectations.

US Bonds are a different story — here is the 10 year Bond Yield which fell initially in response to Donald’s threats but has since recovered well.

US 10 YEAR BOND YIELD — long term — since 2023

US 10 YEAR BOND YIELD — short term — since November

Donald Trump has tried his best to scare the world with his Tariff “war” but the Chinese financial markets (especially) and the US financial markets have looked through the Fog of War and decided that it has all been Huff and Puff — or as the British say — Much Ado About Nothing.

BOOM recommends the film The Fog of War to readers, by the way. Essential viewing.

TRUMP’S OPTIONS ARE FEW

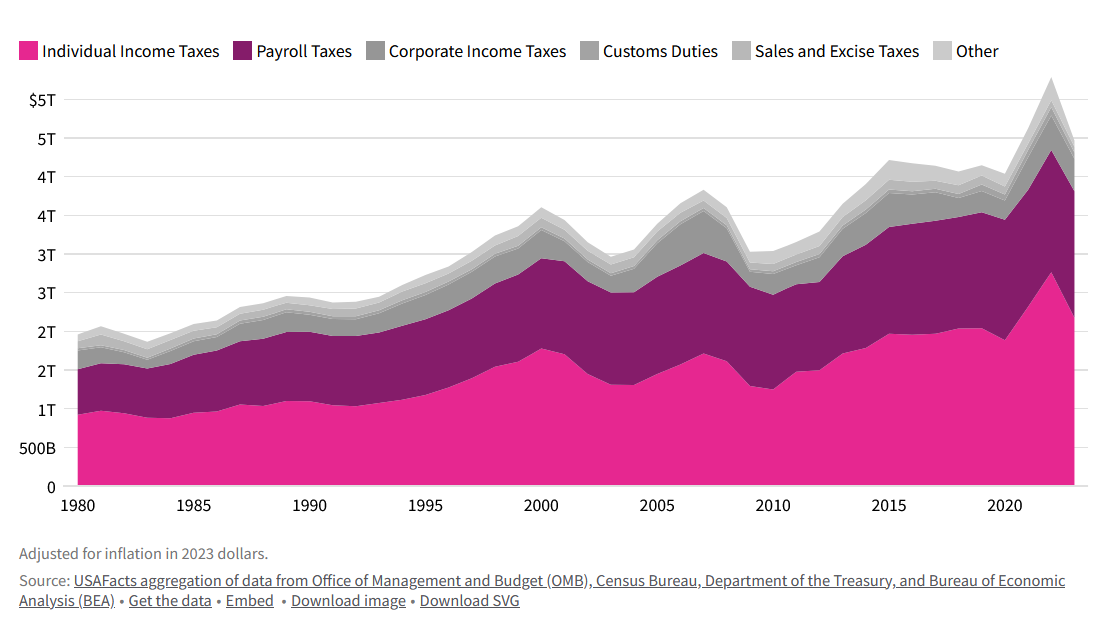

The fact of the matter is this. Trump has stated that he intends to replace Federal Government Income Tax revenue with increased revenues from Tariffs. BOOM thinks that this is akin to magical thinking. But let’s look at the facts.

US GOVERNMENT REVENUES

In 2023, the US federal government collected just under $2.2 Trillion in income taxes, or 48.7% of total taxation revenue. In 2023, beyond income tax, payroll taxes accounted for 36.6% of the federal government revenue. Both employers and employees contribute to these taxes, which fund Social Security and Medicare programs.

The bulk of the federal revenue comes from individual income and payroll taxes.

Federal government revenue, by category, fiscal years 1980–2023

US TARIFF REVENUES

Today, tariffs contribute a negligible share of total US Federal Government revenue. Since the mid-20th century, tariff revenue has remained below 5 % of total government revenue.

US imports of goods and services have risen rapidly since 2020 and are currently around $ 4 Trillion annually (of which approximately 25 % are imported services and 75 % are goods). The strong US Dollar has assisted in that.

So to raise tariff revenues sufficiently to cover income taxes would require an across the board Tariff of 55 % on all imports or roughly 75 % on imported goods. Remember, such an increase is equivalent to raising tariff revenues from 5 % of Government revenue to 75 % of government revenue. That is a HUGE increase and would cause increased CPI inflation and a huge disruption of global supply chains.

Such a scenario is almost too difficult to contemplate. Forward estimates are simply too complex to imagine. Some trading nations would be very adversely affected and may decide not to trade with the US at all because of decreased sales volumes. Historically, we know that high tariffs would cause US companies and consumers to reduce their purchases of imported goods (as these tariffs would make goods more expensive). When tariffs have increased in the past, import volumes have dropped as companies and consumers reduced their purchases of imported goods. Fewer import purchases means less tariff revenue, not more. The US tariff dog would end up chasing his tail. A catastrophic decline in the volumes of imported goods and services could then have a catastrophic effect on the US economy. Nobody can accurately forecast that scenario, so on the balance of probabilities, it will probably not happen. In which case, it will all be slowly abandoned over time or will become a much reduced reality compared to the lofty dreams of Trump.

US IMPORTS OF GOODS AND SERVICES

CHINA IS THE BIGGEST VARIABLE

And then there is China to consider (or not to consider if the “America First and Everyone else Last” mindset is applied). BOOM expects China to stay calm and deliberate in their actions in response to the Trump threats. They will limit key strategic exports to the US and add tariffs to damage US sales in the Chinese market. When the dust settles, all of this will have be largely unwound over time to achieve mutual benefit.

==============================================================

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.

Great Piece - If we do not take Trump Literally at his word that Tariffs will replace (all) income tax but rather it replace some income tax; there appears to be a policy of pursuing a 10% tariff on all imports (from those who come to the table and "do deals"). Some will (have already) and some won't.

If this results in say 400 billion in extra Tariff revenue and better trade deals with some countries then perhaps overall imports will not drop significantly but rather they will come from places where the best trade details will be made. The trade deals are two way so the US's current export of Tangible goods being around 2 Trillion could grow significantly; especially as its local production capacity continues to grow.

What is exported see: https://www.bea.gov/news/2024/us-international-trade-goods-and-services-december-and-annual-2023

If US Manufacturing sees two reasons to get off its backside

1) Cheaper to produce in the US

2) More Open Export Markets

Globalists currently manufacturing in third world locations and parking their profits in tax havens are forced to set up shop in the US (if they are to continue their near monopoly grip and control over most goods; let's hope some of that grip is lost).

This "forced" US activity makes it much more difficult to hide company profits (Whihc currently also make up an insignificant contribution to government revenue) and the US manufacturing companies have no choice but to contribute to US Payroll Taxes.

Who knows maybe people will be able to walk into a US retail environment one day and not have to scratch through the wares to find something NOT made in China or even find some things once again made in the US.

Prof Richard Werner explains modern banking three years ago which supports BOOM's contentions:

https://www.youtube.com/watch?v=2e7gme3CZbo&t=951s

Note at 9 min mark - discussion about the importance of cash! BOOM's baby!