BOOM Finance and Economics 10th September 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

ADVANCED ECONOMIES IN EUROPE ARE SLOWING AS EXPECTED

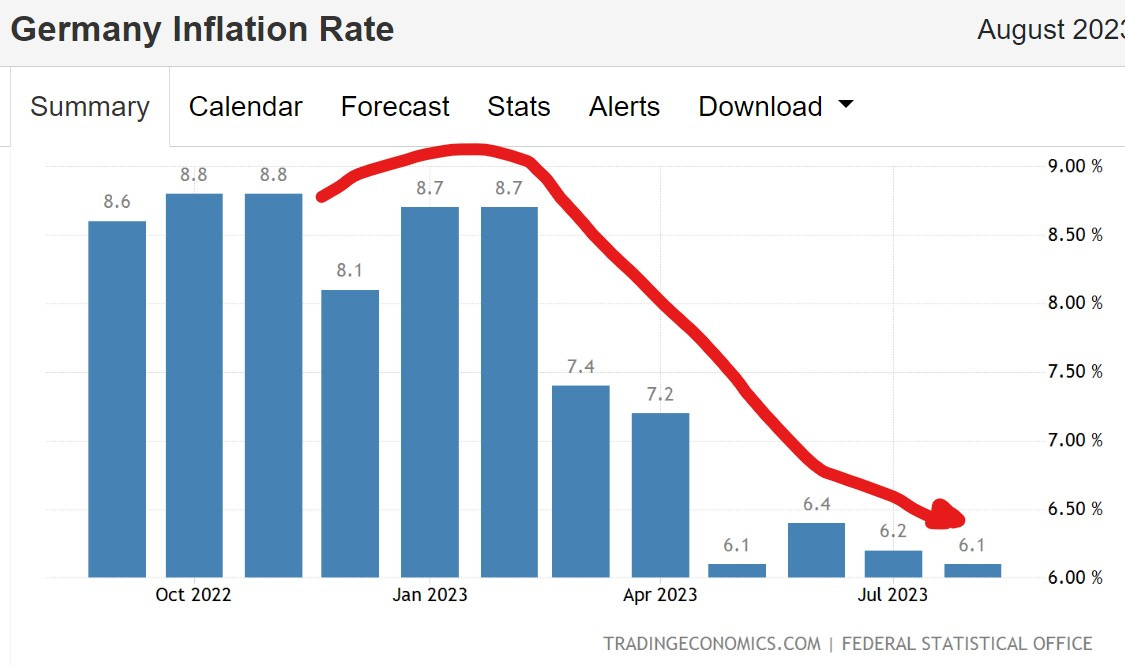

Globally, demand for consumer goods has slowed but especially in Europe and the United Kingdom where 500 million people reside. Consumers there are worried about their (uncertain) cost of energy, their job security, the war in Ukraine and last but not least, their poor political leadership at national level. They are also worried about the poor leadership of the EU and NATO. Thus, consumers have steadily closed their wallets. The tendency for CPI prices to rise has slowed (that is called dis-inflation) and in some nations, we are seeing some consumer prices actually decline (deflation).

As regular readers will know, BOOM announced the peak of CPI inflation for most advanced economies and the bottom of most global equity markets in October last year.

In Germany, the economic powerhouse of Europe, industrial production has been flat overall for 2 years now. July figures show that it is down 2.1 % from the previous July in 2022. Capacity Utilisation has been slowly falling since July 2021. This means that industrial potential is rising because there is falling demand for the products that can theoretically be produced. In other words, production plants are increasingly falling silent. It is not panic stations yet but the slow, steady decline in capacity utilisation is, indeed, worrying. And Germany’s Manufacturing PMI -- Purchasing Managers’ Index – has been in a rather steep decline for over 2 years.

Capacity utilisation in France and Italy is still holding steady but, in Spain, a decline is notable from late 2022. Spain’s new orders for industrial goods have been falling for almost 12 months with no sign of a pick-up. And Spanish business confidence has also been falling significantly for the last 12 months. Industrial production decreased 3.04 % in June of 2023 compared to the same month in 2022.

Looking at the Eurozone region (where nations use the Euro as a common currency), the Eurozone Composite PMI was revised lower to 46.7 in August 2023, pointing to the biggest contraction in private sector activity since November of 2020. New orders also dropped the most since late-2020. The overall retreat in activity is broad-based across the manufacturing and services sectors. The Services PMI has fallen since April this year and is now below 50, which indicates that a possible Eurozone recession is already here. BOOM has been expecting this for some time.

Of course, these nations are not dominated by their goods manufacturing. Their economies are principally services based. However, a persistent decline in demand and production for goods is a warning sign of deep seated economic hesitation because goods have long supply chains whereas services can be supplied (or not) more rapidly in response to changes in demand. This means that manufacturing is a litmus test for economic resilience. And any sharp drop in demand for services, over and above a decline in demand for goods, spells immediate economic danger and also danger for the long term.

None of this is any surprise to BOOM readers as the slowing European economy has been a topic covered in many BOOM editorials over the last 2 years. However, the big question is this. Are we witnessing a temporary slowing of economic activity in the West or is it permanent? And if it is permanent, is it likely to worsen from here? BOOM thinks it is permanent and likely to worsen unless major overhauls are undertaken to correct monetary imbalances that are, quite frankly, becoming untenable. For example, falling working age populations are a major problem because they represent a decrease in the potential number of borrowers. And if borrower numbers decline, then the money supply in the advanced western nations will tend to decline over time.

PEOPLES BANK VERSUS THE US FEDERAL RESERVE

BOOM has often referred to the disciplined, tight control that the People’s Bank of China (PBOC) holds over its financial sector and its money supply. In contrast, BOOM has been critical of western monetary systems which are way too reliant upon the emergence of fresh new borrowers to appear at commercial banks searching (or begging) for loans.

To explain that further, readers must understand that Credit Money in the West, created when commercial banks make loans, is the chief source of fresh new money origination there. And most of that loan money requires a link to collateral assets as security for the bank (usually in the form of a house or other real property). In fact, in most advanced western economies, the Ratio of Credit Money at origin versus Cash Money is now at the ridiculous level of Credit Money 97 – 98 %: Cash Money 2 – 3 %. Such a ratio is fraught with risk to the real economy at large.

A move to a “cashless society” would make everything worse, much worse. In fact, Western economies must move the other way and incentivise the use of Cash. Increased Cash volumes would help stabilise the ship as Cash is non interest bearing and can be issued by the Treasury upon increased demand. Cash is a stabiliser, a buffer to excessive Credit money creation. Governments could even pay their bills with Cash – especially their wages bills. This would improve the Velocity of Money immediately in the real economy and render it less fragile.

The central bankers of the West understand this and have openly dallied with their concept of electronic cash – otherwise known as CBDC – Central Bank Digital Currencies. BOOM is definitely not a fan of this concept for many reasons. Such a proposal is fraught with risk and uncertainty. In fact, most central banks cannot issue currency by law into the real economy and with good reason. They can only buy and sell assets to balance the balance sheets of the financial sector commercial banks. Thus, any proposal for a central bank to issue an electronic cash into the real economy would meet stiff resistance from politicians who understand money issuance. And the central bank clients (the commercial banks) would also object vehemently. Then the people may also reject it out of hand, being suspicious of unelected “independent” central bankers fiddling directly with their money.

In fact, in China, this has been the case. As BOOM reported 2 months ago, the Chinese experiment with a CBDC (Central Bank Digital Currency) seems to be failing. Despite what you read in the West, the E-Yuan has not been adopted by many citizens. As reported by Reuters, the central bank governor, Yi Gang, recently said that total transactions settled with the E-Yuan (e-CNY) amounted to just 1.8 Trillion Yuan since August last year. Expressed in US Dollars, this is equivalent to only US $ 257 Billion in just under 12 months. The Annual GDP of China is about $US 18,000 Billion. So, this is roughly equivalent to 1.4 % of total GDP transactions. He also said that e-CNY in circulation accounted for only 0.16% of China's M0 money supply, or cash in circulation.

These appear to be the cold hard facts concerning the Chinese Central Bank Digital Currency CBDC experiment as reported by the head of the Peoples Bank of China.

BOOM admires very few economic commentators on the planet but, occasionally (rarely), he sees wisdom. Such wisdom came recently in an interview given by Paul Gambles, head of MBMG Group in Thailand. In the interview Paul said --

“So far, the Peoples Bank of China has been very graduated, very incremental and very controlled. When we compare the PBOC (People’s Bank of China) policy to The Fed (US Federal Reserve), the PBOC is like a high-performance luxury saloon car gradually accelerating away when the traffic lights turn green, with a sense of always being in control, whereas The Fed is more like a pimped-up boy racer, flooring it, pedal to the metal, completely out of control. We're more worried that the Fed is going to drive the US economy and markets off the road and crash and burn horribly. With the PBOC, we don't see any signs of alarm. In the West the big worry remains stagflation. In China we have the opposite. Growth may be weaker but there is positive economic growth while we also have negative CPI inflation. This has never been achieved before. If this continues, it could be a lesson to other policymakers how to operate policy in a sustainable way.”

INVESTORS DOUBT RENEWABLE ENERGY -- REVIEW OF SHARES

The shares of Orsted (Code: DOGEF) which BOOM looked at last week – the Green Energy Giant of Denmark -- are down another 15 % in last week’s trading on the OTC market in the US. The chart tells all about investors lack of enthusiasm for the stock.

This week, looking for perspective, BOOM looked at the share price charts for a range of top renewable energy companies to see if Orsted was an outlier in the sector. BOOM only looked at companies which have annual revenues above US $ 3 Billion. The renewables companies include Orsted, Nextra Energy, Vestas Wind, Jinko Solar, Canadian Solar, Brookfield Renewable, Daqo Energy, Algonquin Power.

There is a remarkable similarity in the charts with investor enthusiasm often peaking at the end of the year 2020. Since then, they all fall in price in steady downtrends. And most are falling at a faster rate lately.

The exception is the energy giant in the US, General Electric. Its recent share price trajectory is the exact opposite of all the other companies. General Electric revenue for the quarter ending June 30, 2023 was $16.7 Billion, an 18.21% increase year-over-year. General Electric revenue for the twelve months ending June 30, 2023 was $80.94 Billion, a 23.24% increase year-over-year.

An independent analysis of General Electric Revenues by Segment shows that Renewable Energy accounts for only 21 % of its total revenue. So GE cannot be called a “renewables company”. That appears to explain why its share price performance is the opposite of the “renewables” dominant energy companies in the list.

ORSTED

NEXTRA ENERGY

VESTAS WIND

JINKOSOLAR

CANADIAN SOLAR

BROOKFIELD RENEWABLE

DAQO NEW ENERGY

ALGONQUIN POWER

GENERAL ELECTRIC

US HOME PRICES KEEP RISING –

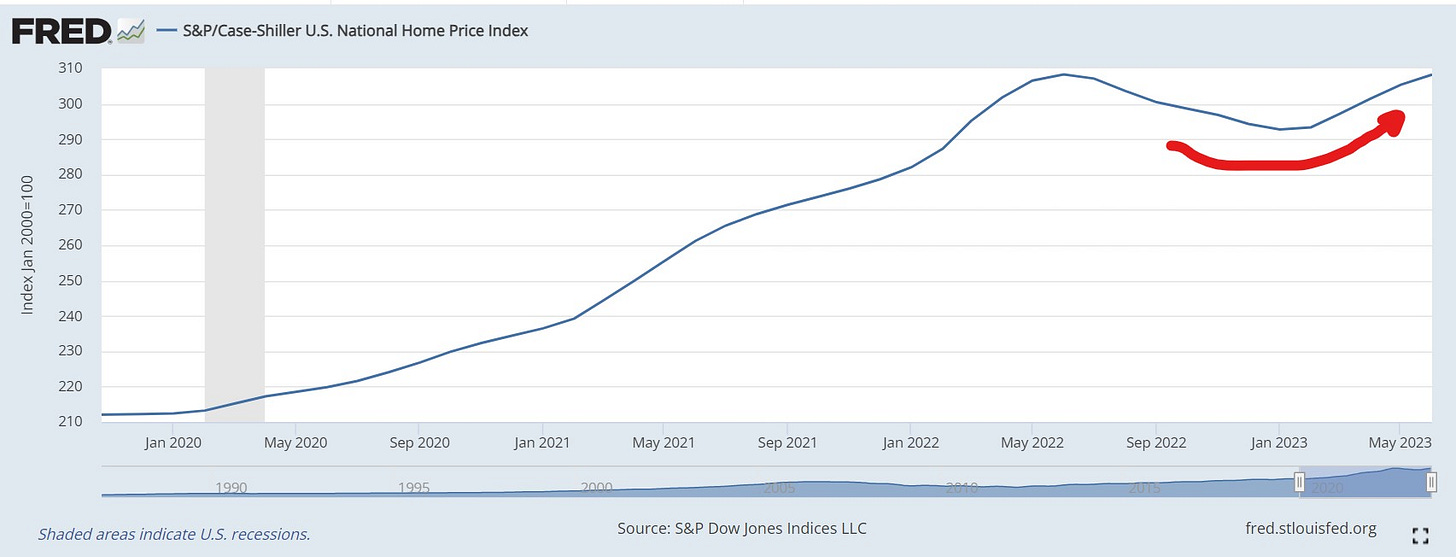

On 16th April, BOOM wrote -- “This suggests that US house prices may soon begin to rise in price”.

At the time, nobody was making such statements. However, the Case Schiller National Home Price Index is following BOOM’s forecast.

It has risen by 5.3 % since January – from 292.71 to 308.35 in June.

The 20 City Home Price Index has risen from 296.96 in January to 314.86 in June. That is a 6 % rise.

The 10 City Index has risen from 309.21 to 328.63. That is a 6.28 % rise. Prices cannot continue to rise at such rates. A pull back is expected in the next series of the data.

CASE SHILLER US NATIONAL HOME PRICE INDEX

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS EDITORIALS AVAILABLE AT —

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry

Over 6 years on a number of platforms, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.