BOOM Finance and Economics 11th June 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

THIS WEEK IN BOOM

Saudi Arabia Cuts Oil Production

UK Highest CPI Inflation Expected

Official Bull Market in USA Stocks

WHO and EUROPEAN COMMISSION: Digital Health Partnership?

Increased Cancer Risk: Japanese Professor

Crypto and Bitcoin Attack by US Authorities

SAUDI ARABIA CUTS OIL PRODUCTION

Following publication of last Sunday’s BOOM editorial regarding decreased oil production in the USA, Saudi Arabia almost immediately announced a reduction in output by 1 million barrels per day. There is only one reason why Saudi Arabia would do such a thing on a Sunday. They were trying to stop global oil prices from collapsing due to decreased demand in the global markets (especially Europe and the US) and increased supply from Russia.

In response to the Saudi announcement, the price of West Texas Crude on the US market jumped immediately by $ 3.00 to open at US$ 75.03 but then fell back below $ 72 as the day progressed. Sellers came in hard early in the day and again at the mid way point. The price ended the week at $ 70.17.

The Saudi Ministry of Energy stated that Saudi Arabia will now produce 9 million barrels of crude oil per day. Their Press Release also stated that the decision was made to maintain "stability and balance of oil markets". That is clearly code for “maintain the price of oil globally”. The decision is not an OPEC initiative. It is a decision solely made by Saudi Arabia. OPEC also re-affirmed their April decision to cut production by a million barrels per day. So the Saudi decision adds another million barrel cut.

So let’s do the math – OPEC will cut by an amount to 1 Million barrels per day (Saudi is part of that). Then Saudi will cut by a further 1 Million independently. And, as explained by BOOM last week, the USA has already effectively reduced production by one Million barrels by holding daily output at 12 Million barrels per day since January. Thus, we are witnessing a sudden global reduction in output by 3 million barrels per day. That amounts to a 3 % cut in global production. However, there are other producers who will not be cutting and they may increase production. That list includes Russia, United Arab Emirates and African producers. They are now supplying oil in large volumes to India and China at low prices.

Joe Biden, in his last visit to Saudi Arabia, asked for increased production from the Saudis. However, it was clear that the Saudis have stopped listening to the USA. Joe was ignored and the Petrodollar link has now clearly broken down.

Global oil production is scattered. Average production is around 100 Million barrels per day. It dropped to 87 Million in early 2020 when the Covid Fear, Scare and Panic Campaign was launched but has recovered to 100 Million since then. Significant producers (estimated daily barrel volumes) include USA – 12 Million, Saudi Arabia 9 Million, Russia 9.8 Million, Iraq 4.5 Million, Kuwait 2.6 Million, UAE 3.3 Million, Iran 2.5 Million, Kazakhstan 1.7 Million, Mexico 1.6 Million. Other producers include Bahrain, Brunei, Malaysia, Sudan and South Sudan, Libya, Venezuela, Angola, Oman, Azerbaijan, Nigeria and Algeria.

The Big Three producers are USA, Russia and Saudi Arabia. The Big Three in Demand are USA, China and India. Oil use in India has been growing faster than in any other country. The world’s third biggest oil consumer increased its demand for oil significantly in 2022.

India’s purchases from Russia are now at record levels and are now more than the combined oil they buy from Saudi Arabia, Iraq, UAE and the US. India purchased 1.96 million barrels a day from Russia in May. That is 15 per cent more than the previous high in April -- according to data from energy cargo tracker Vortexa. Russia now makes up for nearly 42 % of all crude oil imported into India. This is the highest share for an individual country in recent years. Before the war in Ukraine, India purchased only 1 % of its oil from Russia.

So, India is now sucking in oil at cheap prices from Russia and China is also taking advantage of cheaper prices from Russia. The Ukrainian war has changed everything in energy markets and is causing havoc in the pricing of global oil. The war, provoked by NATO actions since 2014, is now backfiring badly against the protagonists.

The average cost of Russian crude including freight costs landing on Indian shores in April was (officially) US$ 68.21 a barrel but prices are almost certainly lower than $ 60 in many deals. The average cost of Saudi Arabian crude sent to India in April was US$ 86.96 a barrel, while Iraqi oil was priced at US$ 77.77 a barrel. Notably, much of that oil is being paid for using the Dirham, the currency of the United Arab Emirates and not the US Dollar.

It is clear that US, UK and Western European policies in regard to Ukraine are seriously harming their economies while changing the global Geopolitical landscape forever. The Big Three of Russia, India and China, representing over 3.2 Billion people are now becoming dominant.

Anthony Blinken, the US Secretary of State visited Saudi Arabia last week on a 3 day visit, trying to rebuild the relationship. However, this looks rather desperate.

Prior to the meeting, the US State Department released a statement that said Blinken would “meet with Saudi officials to discuss US-Saudi strategic cooperation on regional and global issues and a range of bilateral issues including economic and security cooperation”. There is cooperation and there is “strategic cooperation”. The difference is not lost on the world of diplomacy.

After 9 years of vicious warfare, fuelled by foreign weapons, Blinken also now apparently wants to create “a comprehensive political agreement to achieve peace, prosperity, and security in Yemen”. Many observers will wonder why this is now on the agenda.

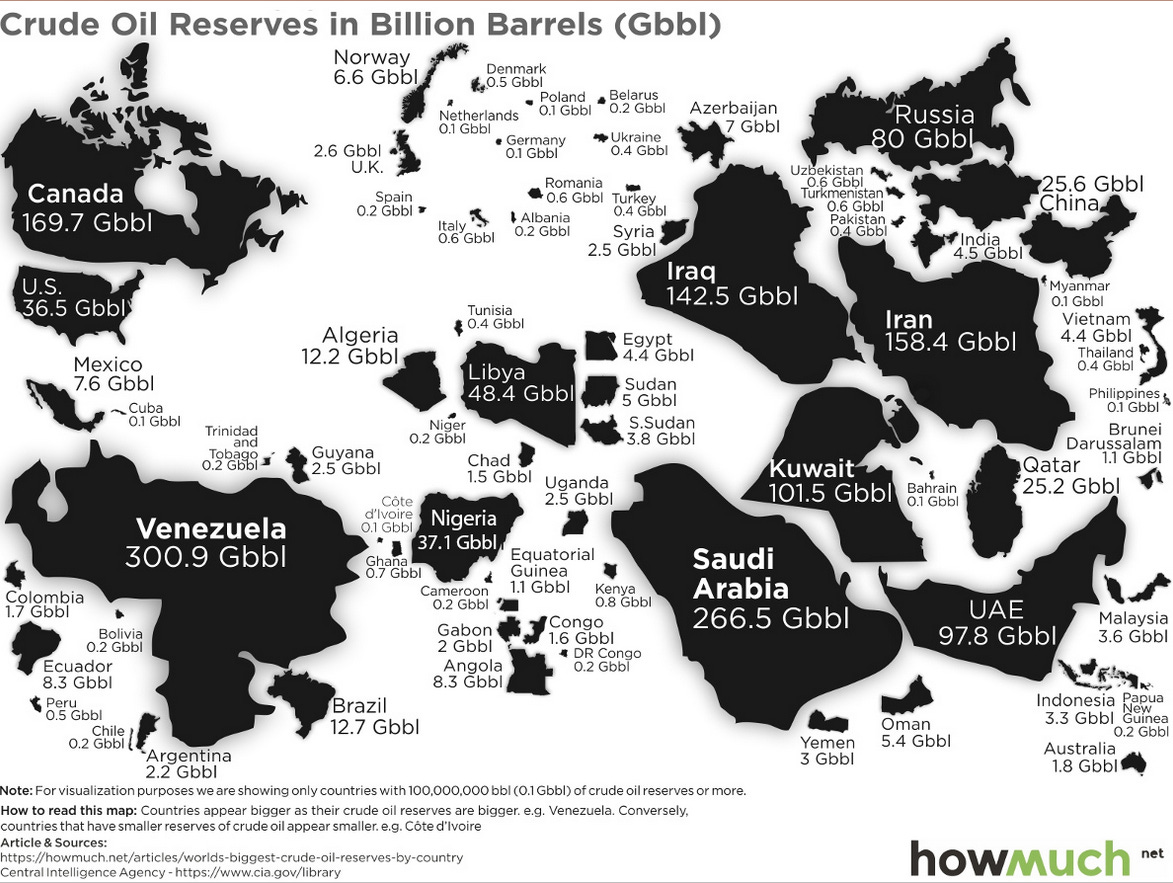

Global Crude Oil Reserves — from HowMuch.net

UK HIGHEST INFLATION EXPECTED

Meanwhile in the United Kingdom, the economy continues to struggle just as BOOM has forecast. On February 13th, BOOM wrote “The British economy is heading into a stagflationary mess with GDP growth at Zero.”

The OECD (Organisation for Economic Cooperation and Development) released a report last week showing that UK inflation is expected to be the worst of the advanced economies this year. Grocery price growth reached 19.1% in April, which is the highest rate in more than 45 years, according to the Office for National Statistics. Responding to the OECD data, UK Chancellor Jeremy Hunt admitted that inflation was still “too high,” adding that “we must stick relentlessly to our plan to halve it this year. That is the only long-term way to grow the economy and ease the cost-of-living pressures on families.” Referring to a “plan” sounds good but the aim of halving CPI inflation is simply unrealistic. Politico-speak is just that, politico-speak.

Meanwhile, someone of note has decided to leave the sinking ship. His name is Boris Johnson.

OFFICIAL BULL MARKET IN USA STOCKS

The broad US stock market index, the S & P 500, has now “officially” entered a Bull Market. In other words, it is now up 20% since its most recent low on October 12th 2022.

On 16th October last year, BOOM wrote in regard to the US -- "the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here". US stock prices started rising 2 days later and US bond prices started rising 5 days later.

No commentator on the planet except BOOM picked those changes of CPI inflation fundamentals and market sentiment in October. And remember, as BOOM often says – financial markets look to the future, economic data always reflects the past. There can be a significant dis-connect between financial asset prices and economic performance. One may rise as the other falls and vice versa.

The S & P 500 Index of US Stocks (5 years) — from Stockcharts.com

WHO AND EUROPEAN COMMISSION: DIGITAL HEALTH PARTNERSHIP?

Two institutions which have no officers elected by the people (zero) have decided to take control of your life in a draconian, totalitarian grab for yet more power. The European Commission and the World Health Organisation (WHO) have announced the launch of what they call “a landmark digital health partnership”.

In their Press Release on the 5th June, they stated that they would “establish a global system that will help facilitate global mobility and protect citizens across the world from on-going and future health threats. This is the first building block of the WHO Global Digital Health Certification Network (GDHCN) that will develop a wide range of digital products to deliver better health for all”.

The scheme is set to be expanded to include all the vaccinations covered by the “Yellow Card” International Certificate of Vaccination or Prophylaxis. BOOM wonders if it will come with a Yellow Star to be worn on the chest if you refuse to carry their “certificate”?

How do these un-elected people claim the right to do anything in regard to your health after the fiasco that was the Covid Fear, Scare and Panic Campaign? They are accountable to nobody. No-one oversees their policies on behalf of the people and no-one independently audits their outcomes.

However, the Press Release assures us that they have abundant good intentions, clearly stated.

“This cooperation is based on the shared values and principles of transparency and openness, inclusiveness, accountability, data protection and privacy, security, scalability at a global level, and equity. The European Commission and WHO will work together to encourage maximum global uptake and participation. Particular attention will be paid to equitable opportunities for the participation by those most in need: low and middle-income countries.”

How does the saying go? Oh yes … “The road to Hell is paved with good intentions”.

We now know that the Covid Vaccines did not stop infection or transmission. We know that the Astra Zeneca and Janssen viral vector Covid vaccines have been quietly removed from many markets. We know that the adverse events reported to all Covid Vaccines are at record levels compared to all previous conventional vaccines (combined). We also know that the remaining mRNA vaccine “boosters” are being refused by the vast majority of people in most nations with millions of vaccine vials being destroyed as they pass their “use-by” date.

Last week, the Food and Drug Administration (FDA) announced it had revoked the emergency use authorization (EUA) of the Covid-19 Vaccine by Janssen.

Janssen Biotech, a unit of US healthcare giant Johnson & Johnson, had requested the voluntary withdrawal of the EUA for this vaccine on May 22nd. The company informed the FDA that the last lots of the vaccine purchased by the US government had expired, that there is no demand for new lots of the vaccine in the USA, and that the company does not intend to update the strain composition of the vaccine to address emerging variants.

We also know that a world expert in Genomics and Gene Sequencing – Dr Kevin McKernan -- has tested some of the Covid vaccine vials and found serious levels of contamination with unexpected amounts of foreign DNA present and foreign, unexpected DNA Plasmids.

The WHO and the European Commission appear to know nothing of all this. Or perhaps they do?

But they have good intentions. Is that enough? Or is there a hidden agenda?

INCREASED CANCER RISK SAYS JAPANESE PROFESSOR

BOOM is certainly not an expert in vaccines or in molecular biology. BOOM is not a virologist. But BOOM can read. And BOOM recently read this on a website provided by Dr Mark Trozzi in Canada. It may not be true. BOOM cannot tell. But, if it is, then it is a cause for major concern as it has been reported that 5.55 Billion people have received at least one Covid vaccine shot. That is 72 % of the global population.

“Professor Murakami expresses concerns over the alarming discovery of Simian Virus 40 (SV40) promoters, associated with human cancer development, in DNA plasmids within Pfizer vials.

“The Pfizer vaccine has a staggering problem. I have made an amazing finding. This figure is an enlarged view of Pfizer’s vaccine sequence. As you can see, the Pfizer vaccine sequence contains part of the SV40 sequence here. This sequence is known as a promoter. Roughly speaking, the promoter causes increased expression of the gene. The problem is that the sequence is present in a well-known carcinogenic virus.

The question is why such a sequence that is derived from a cancer virus is present in Pfizer’s vaccine. There should be absolutely no need for such a carcinogenic virus sequence in the vaccine. This sequence is totally unnecessary for producing the mRNA vaccine. It is a problem that such a sequence is solidly contained in the vaccine. This is not the only problem. If a sequence like this is present in the DNA, the DNA is easily migrated to the nucleus.

So it means that the DNA can easily enter the genome. This is such an alarming problem. It is essential to remove the sequence. However, Pfizer produced the vaccine without removing the sequence. That is outrageously malicious. This kind of promoter sequence is completely unnecessary for the production of the mRNA vaccine. In fact, SV40 is a promoter of cancer viruses.”

Reference: https://drtrozzi.org/2023/05/30/japanese-prof-murakami-weighs-in-on-pfizers-dna-plasmids/

CRYPTO AND BITCOIN ATTACK BY US AUTHORITIES

The US Securities and Exchange Commission (SEC) has effectively launched a war on the world of Crypto as forewarned by BOOM in recent editorials. The details are easily found from other financial news sources. Binance, in particular, is in the cross-hairs.

Prices on the Crypto markets have begun to fall significantly over the last week and the total market capitalisation is now teetering on the brink of collapse just above $ 1 Trillion.

The SEC is supposed to protect US citizens and corporations from securities fraud and crime. Since 2008, the world of Crypto, which was created by the US NSA (National Security Agency) as an offshore production facility for US Dollar Proxies to increase demand for US Dollars, has been a world of fraud and crime. So, the SEC has decided (after 15 years) to do what it is supposed to do. Why? Because the recent Stablecoin crisis in the Crypto world threatened to spread into the real world (as explained in previous BOOM editorials). The failures of Silicon Valley Bank and Signature Bank were the trigger for this.

On 9th April, BOOM explained it all --- QUOTE: “Last week, on March 30th, Janet Yellen, the US Secretary of the Treasury made a speech on Financial System Stability at the National Association for Business Economics. It was a lengthy one designed to obfuscate the true issue at hand – the announcement of increased regulation of the Crypto Stablecoin market.

She started the speech by stating that she had seen many financial crises in her 30 year career. This was followed by a plea for stability in the financial sector, stating that stability brings many benefits. All well and good. Nobody would argue with the goal of stability in the financial sector.

She then made this statement “Today’s financial system is characterized by increased complexity and interconnection across market actors and geographic boundaries. A single point of failure can cascade through the system like a wildfire – leading to a failure of the financial system to perform its core functions.” What could possibly be this “single point of failure”? Why had she used such language?

She went on to describe the theoretical threat of a debt deflation crisis – where asset prices fall and trigger sales. “The resulting price declines trigger further forced sales. At each stage, the net worth of leveraged investors falls, requiring additional liquidations.“ And then she referred to the recent bank runs on SVB Bank and Signature Bank as examples of unexpected bank crises.

Having said all that she stated “the US banking system remains the strongest and safest in the world”. So if that is the case, what the hell really happened at SVB Bank and Signature Bank? She pointedly did not tell us. As BOOM has pointed out over the last few weeks, these banks had to be rescued by the Federal authorities because a big depositor demanded it. And because a Stablecoin failure had been revealed as a potential disastrous outcome.

So, inevitably, Yellen then discussed Stablecoin risks and revealed the true purpose of her speech.

“We have recommended that Congress enact legislation to establish a comprehensive prudential regulatory framework for stablecoin issuers. Such a framework would include consolidated federal supervision, requirements for how a coin could be backed, capital and liquidity requirements, and restrictions on affiliation with commercial companies.” UNQUOTE

The SEC’s job will be to fill the regulatory vacuum with operational expertise. They will soon demand full surveillance of all Crypto exchange operations that service US based customers. As far as BOOM can tell, this means the effective end of easy accessibility to the world of Crypto for US based investors, both personal and corporate.

In response, Binance (and other Crypto exchanges) will probably cease all US operations as it did in Canada one month ago. Watch for a possible cascade in Crypto prices if this becomes common knowledge or if it happens. However, it will not be the end of Crypto. American citizens and corporations will simply access their accounts via offshore channels. The US currency hegemony cannot stop all capital movements everywhere and probably (almost certainly) does not wish to do so.

Bitcoin’s US Dollar price at present (time of writing) is $ 25,880 as quoted on Coinmarketcap.

Grayscale Bitcoin Trust — Code GBTC — US OTC Market over 3 Years — from Stockcharts.com

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS EDITORIALS AVAILABLE AT —

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Sad thing is for the Saudi’s is that Russia has to fund that war and will gladly make up the difference.