BOOM Finance and Economics 12th November 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

ALTERNATIVE ENERGY -- HYPE HOPE OR GLORY? -- COMMERCIALLY VIABLE OR NOT?

TRITIUM FAST CHARGERS

TESLA IN THE BALANCE? THE FUTURE OF ELECTRIC CARS?

THE EMPEROR HAS NO CLOTHES?

TESTIMONY FROM A READER"Boom’s finance and economics views are based on experience and wisdom, both of which are sadly lacking in today’s narrow-analysis focused commentary."

ALTERNATIVE ENERGY -- HYPE HOPE OR GLORY? -- COMMERCIALLY VIABLE OR NOT?

Is the alternative energy sector commercially viable? And, if not, are we embarked upon a fool’s errand which will inevitably make our economies less efficient and more fragile?

Those are very hard questions to answer from a fundamental viewpoint. Energy production, distribution and consumption is a massively complex matter. However, politicians don’t seem to care about analysing the situation. They just say “the science is settled” (whatever that means) while they are hell bent on revolutionising the energy industry in the quest for “Net Zero”. The perceived threat is carbon dioxide, a gas which we all exhale with every breath and which is essential for all plant life on Earth. Global net zero emissions, or simply net zero, is a state in which human-caused emissions are balanced by human-caused carbon dioxide removals over a specified time period.

One way to assess the outlook is to consider whether of not investors retain enthusiasm for companies involved in the alternative energy sector. If commercial viability is present, investors will vote with their wallets and support the companies involved.

Two months ago, BOOM looked at a range of major so-called “renewable” energy companies with annual revenues above US $ 3 Billion. Let’s check the progress of their share prices. The charts are all over a 5 year period unless stated otherwise.

Orsted (OTC Mkt Code: DOGEF) is the Green Energy Giant of Denmark. Over the last 2 months, its shares have continued to fall. They are down 25 % in that time frame. Investors are being overwhelmed by sellers.

Nextra Energy Inc (NYSE Code: NEE) has fallen by 17.5 % since BOOM checked it out 2 months ago. It has recovered from the first week of October when it was shockingly down 30 % since early September. However, the shares fell by over 7 % on Friday last week, the last day of trading, while the overall market was rising strongly.

Brookfield Renewable (NYSE Code: BEPC) has fallen 11.2 % since early September.

DAQO NEW ENERGY (NYSE Code: DQ) is down almost 21 % since then.

And ALGONQUIN Power and Utilities (CODE: AQN) is also down 21 %

It is not all bad news. Vestas Wind Systems (OTC Mkt Code: VWDRY) is a stand-out. Its shares have risen by 15.47 % over the last 2 months. But don’t get too excited – let’s put that short term rise into long term perspective over 5 years.

And Jinkosolar (NYSE Code: JKS) shares have also risen -- from $ 29.08 to $ 36.12. That is a gain of 24 % over the last 2 months.

However, the falls continue as Canadian Solar (Nasdaq Code: CSIQ), is down almost 20 % since the last review.

Remember, all of those companies are large with annual revenues above US$ 3 Billion. They are mostly energy producers. Of the eight companies, the shares of six have continued to fall significantly since early September. The rates of decline over the last 2 months are disturbing. Two have risen. But all eight are in long term price downtrends.

There are other smaller companies in the alternative energy business that specialise in niche markets. Electric car companies are an example. Let’s look at a company that provides essential infrastructure for charging electric cars that are already on the road.

FAST CHARGERS — TRITIUM DCFC LIMITED

Tritium DCFC Limited (Nasdaq Code: DCFC) is a company founded in Australia and listed on Nasdaq in the US. It is a self acclaimed “global leader” in the design and manufacture of DC (Direct Current) fast chargers for electric cars. That is certainly a high expectations sector in the alternative energy world. Surely, here, we should see investors flocking into the hype for electric cars? And alternative energy? After all, the car batteries need to be recharged reliably and the infrastructure has to be easily accessible in all situations. Also, the company has survived for over 20 years and has current annualised revenues in excess of US$ 200 Million. Unfortunately, it made a loss of US$ 120 Million last year so 20 years has not been sufficient to generate a commercially viable outcome with recurring profits.

On the Home page of its website, it explains itself -- On a Mission to Electrify Transportation, Founded in 2001, Tritium designs and manufactures proprietary hardware and software to create advanced and reliable DC fast chargers for electric vehicles.

It sells its products in 47 nations and has sold 14,500 DC fast chargers worldwide. Again, from the website -- Tritium’s compact and robust chargers are designed to look great on Main Street and thrive in harsh conditions, through technology engineered to be easy to install, own, and use. Tritium is focused on continuous innovation.

Now, let’s look at the real world of commerce. Tritium shares were listed on Nasdaq in January 2022. Its shares initially traded around $ 11. However, they have been in persistent downtrend since then and now trade for 24 cents. First, let’s look at the 3 year chart and then the last 12 months of price action in the second chart.

THREE YEAR STOCK CHART

TWELVE MONTHS STOCK CHART

The company issued a Press Release last week. It was titled “Strategic Plan to Achieve Profitability in 2024”. The aim is to reduce reliance on external capital via profitable trading. Yes, that is actually a radical plan (!) in the world of endless promises and government subsidies that we call the alternative energy sector. However, nonetheless, the company has bravely decided to shoot for a profitable future in the real economy where goods and services are exchanged.

Rather than selling promises, it is seeking to survive on its own by selling its products in the world of commerce. It is a commendable ambition and is certainly a “make or break” strategy -- refreshing to see. BOOM would like to see more companies in the energy tech sector adopt the same adventurous spirit.

But is it really a plan to compete equally with internal combustion cars or is it yet another elaborate quest for government largess?

The company plans to continue its investment in technology development, services and software, as sales grow. It will retain and grow its 200-person research and development team and test facility in Australia. However, it will close its Australian manufacturing operation and the sales effort will be focused on the United States where all the manufacturing will now take place. Why?

Tritium opened its Tennessee manufacturing plant in August last year. The opening of the factory was an important step in the company’s strategy to achieve Buy America Build America (BABA) compliance, as required by the $5 Billion National Electric Vehicle Infrastructure (NEVI) Formula Program which is funding fast chargers every 50 miles along American highways.

So, unfortunately, as per standard operating procedure in the alternative energy sector, the company apparently cannot survive in the real economy without massive government assistance. The ambitious plan for profitability will depend upon state government orders in the USA flowing from the funds granted under NEVI.

Let’s look at NEVI. A $ 5 Billion Program sounds like a big incentive. However, there are 50 states in America and large state and local bureaucracies to deal with in each one. $ 100 Million per state does not sound like a lot of money in a $ 22 Trillion economy.

The US Department of Transportation’s (DOT) Federal Highway Administration NEVI Formula Program will provide funding to states to strategically deploy electric vehicle (EV) charging stations and to establish an interconnected network to facilitate data collection, access and reliability. Funding is available for up to 80% of eligible project costs, including:

The acquisition, installation, and network connection of EV charging stations to facilitate data collection, access, and reliability;

Proper operation and maintenance of EV charging stations; and,

Long-term EV charging station data sharing.

EV charging stations must be non-proprietary, allow for open-access payment methods, be publicly available or available to authorized commercial motor vehicle operators from more than one company, and be located along designated “Alternative Fuel Corridors” (AFCs). If a state government and the DOT determine that all AFCs in the state have been fully developed, then the state can propose alternative public locations and roads for EV charging station installation.

The FHWA (Federal Highway Administration) announced approval of all initial state plans on September 27, 2022.

BOOM can see large state government bureaucracies being established to make the decisions regarding geographical locations, to purchase the sites, to establish them and to dish out the orders for DC fast chargers (or AC powered ones (?). Private enterprise will not build this infrastructure unless it is a profitable venture. But where are all those charging stations going to be built? And by whom? And what equipment will be preferred? This game is far from over.

BOOM offers, in French, “Bonne Chance (!)” to Tritium. That means “Break a leg (!)”, “Go for it” or just “Good Luck”. Let’s take a closer look at the landscape they operate in. After all, the future of transport is electric cars say the all-knowing politicians.

TESLA IN THE BALANCE? THE FUTURE OF ELECTRIC CARS?

The electric car dates back to 1832 when Robert Anderson built the first one in Scotland. Batteries that could be recharged came along in 1859, making the electric-car idea more viable. The Electrobat was the first commercially viable electric car, patented in 1894.

In the year 1900, over 120 years ago, electric cars accounted for about one-third of all vehicles in the United States. In New York city, they were 90 % of the cars as they dominated the taxi industry. There were many manufacturers. However, it all came to an end in 1935 when there were no electric cars left on the roads. Henry Ford killed the industry with the internal combustion engine. His Model T Ford arrived in 1908 and sold in millions until 1928.

The modern electric car industry is now (again) plagued by significant uncertainties. Here are just a few that spring to mind -- insufficient recharging stations, range anxiety, increasing insurance costs, uncertain battery life, battery replacement costs, battery weight, increased tyre wear, high initial purchase prices, uncertain resale prices, inadequate model choice, mineral consumption, electromagnetic field radiation from the batteries (EMF) and its long term health consequences and, last but not least, the base energy source used to provide the electricity to charge the batteries (e.g. coal, gas, oil, nuclear, solar, wind etc).

An assessment by the International Energy Agency (IEA) made in 2021 showed that (aside from all the steel and aluminium) an electric car contains over 200 Kilograms of minerals compared to 33 Kilograms for a conventional car. These cars do not make themselves. Massive factories with massive energy requirements are needed. Volkswagen’s largest factory in Germany for conventional vehicles has two power stations solely dedicated to production. They also contain glass, silicon, rubber and plastics.

Here is the breakdown of the minerals involved.

Conventional Car – Copper 22.3 Kg per car, Manganese 11.2 Kg

Electric Car – Copper 53.2 Kg, Lithium 8.9 Kg, Nickel 40 Kg, Manganese 24.5 Kg, Cobalt 13.3 Kg, Graphite 66.3 Kg

So with massive energy requirements, massive minerals requirements and massive numbers of re-charging stations required, how can we assess the future for the electric car industry?

There are 36 electric-only car companies listed on stock exchanges. Seventeen of those are US based. Nine are based in China.

Their combined Total market capitalisation is US $ 808 Billion. Tesla (TSLA) is $ 685 Billion of that total, about 85 %.

The next 6 companies include Li Auto (Stock Code: Li $ 37.2 Billion), Rivian (RIVN $ 14.74 B), Vin Fast Auto VFS $ 14.15 B), Xpeng (XPEV $ 13.5 B), Nio (NIO $ 13.5 B), Lucid Group (LCID $ 8.7 B)

Stockcharts.com – 3 Year Charts – BOOM Advisory -- Please stay seated to survive the journey. They are (all) reminiscent of Olympic ski jumps. Possibly more frightening. Investors are fleeing.

And here are a selection of others – FUV Archimoto – USA based -- from almost US$ 750 to $ 0.55 cents. Now THAT is a plunge in price in just 3 years.

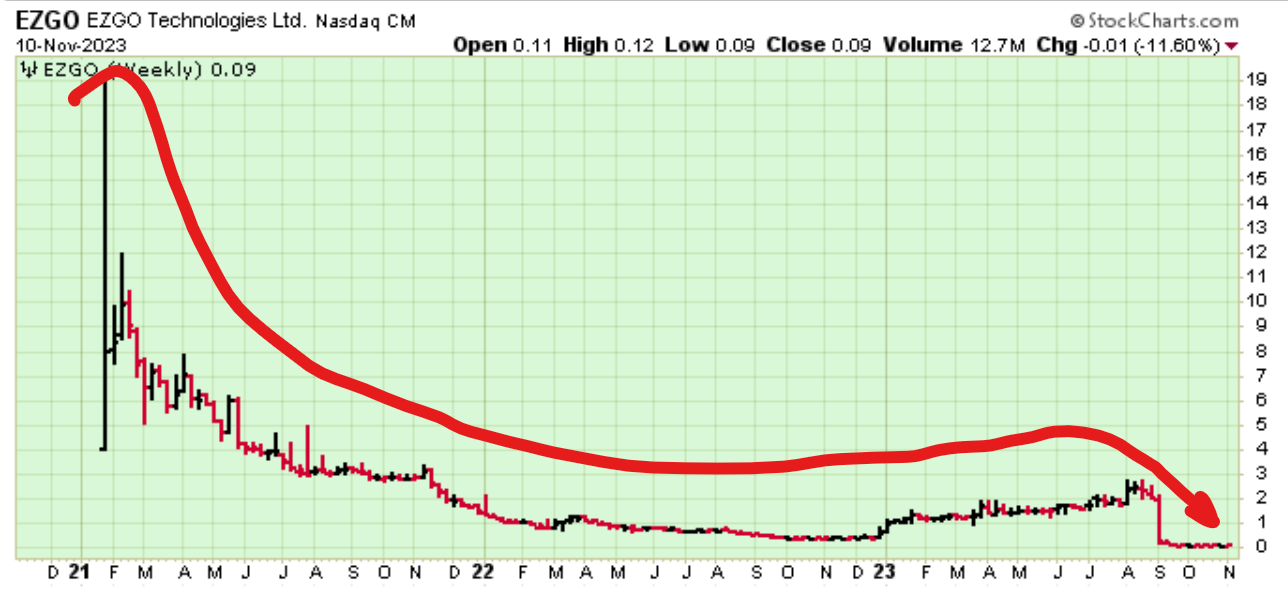

EZGO – from $ 19.00 to 0.09 cents

ZEVY – Lightning eMotors has fallen from $ 350 to $ 0.77 cents

ARVL – Arrival Ltd – from $ 1,800 per share, they have arrived at $ 1.00 – Is that a record in only 3 years?

And REE Automotive is another contender – from $ 500 to $ 3.66 – again, within 3 years.

But here is the GRAND WORLD CHAMPION of the Electric Car Downhill --

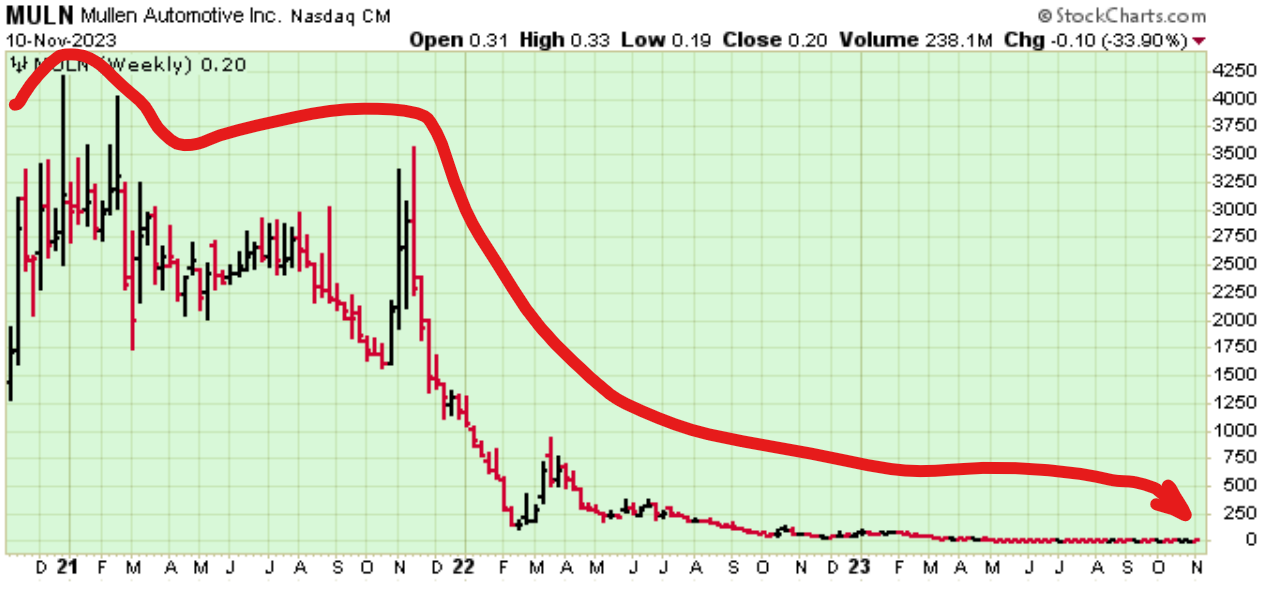

MULN – Mullen Automotive – From US$ 4,000 all the way to $ 0.20 cents in 3 years (!).

But that is not the full story. Mullen shares began life way back in 2012 around US $ 280,000 per share. Yes --- an intra-day High occurred of $ 275,652 to be precise in the first week of October 2012. The shares have since fallen to just 20 cents. Now that is some achievement. Extraordinary. BOOM has checked these numbers from a variety of sources but still cannot believe that they are true. There must be a data error – surely?

“The all-time high Mullen Automotive stock closing price was $ 200,025.00 on October 09, 2012”.

THE LONG TERM CHART SINCE 2012 – MULLEN AUTOMOTIVE

Chart from Incredible Charts -- https://www.incrediblecharts.com/

All of these companies may be viable in the long term with bright commercial futures. BOOM cannot tell without doing the fundamental research. However, the charts certainly suggest a different outlook. If investors won’t invest, then the industry is clearly in trouble, deep trouble.

The company most often associated with the electric car industry is, of course, Tesla. BOOM won’t attempt to analyse the arguments for and against Tesla and the various electric car technologies. Let’s just look at the roller coaster otherwise known as the Tesla share price and some simple financial parameters in the spirit of discovery.

Tesla’s shares were first listed on NASDAQ in June 2010. Thus, they have been publicly traded for over 13 years. Long term holders have been well rewarded for their patience. The Tesla long term chart shows the full picture from 2010.

The 5 year chart shows that Tesla shares rose spectacularly during 2020 and 2021 as the Covid Panic-Demic was promoted by politicians and the mainstream media to terrify the general public. Somehow, terror and anxiety turned into Tesla exuberance as if investors sought some brighter future elsewhere from their daily lives.

As economies and stock markets sank around the globe, Tesla seemed to be a haven of hope. Investors voted in favour of Elon Musk’s vision and the shares rose from around US$ 25 to a peak at over $ 400 per share. Spectacular indeed.

However, since then, the shares have fallen in a concerning downtrend which lasted for just over 12 months and halted at around $ 100 early this year in January. Since then, they have tripled in price to hit $ 300 in mid July – a roller coaster rebound ride, if ever there was one. And since then, the down trend seems to have (perhaps) been re-established as investors show signs of hesitancy yet again. Recently, they fell below $ 200.

Tesla is not a small company. It plans to produce 1.8 Million vehicles in 2023. To see if such a large company is spinning its financial wheels (or not), BOOM likes to watch share price action/current long term trend, changes in cash position, profitability on a per share basis, shareholder dividends and market capitalisation to see if a company is performing well enough or not. All data for Tesla is Quarterly unaudited as at End of September Quarter.

NET Income/Profit attributable to Common Stockholders = $ 1,853 Million

Net Income per share of Common Stock = $ 0.58

Net Income per share (Diluted) = $ 0.53

Tesla shares currently trade at around $ 214.65 so this Net Profit is equivalent to 0.25 % of the share price (approx). Tesla does not pay Dividends to Common Stock holders. There is clearly inadequate Net Profit to do so.

The cash position is currently (as at Quarterly Report, September 30th) approximately US$ 16,590 Million. This is a slight decrease on the cash position from the previous quarter of $ 16,924. Net cash provided by financing activities amounted to $ 1,702 Million for the quarter. However, the company lost $ 10, 780 Million to its investment activities. To summarise

Net Cash from Operations Activities = $ 8,886 Million

Net Cash (Loss) used in Investing Activities = $ (10,780) Million

Net Cash provided by Financing Activities = $ 1,702 Million

Cash and Cash Equivalents at beginning of Quarter = $ 16,924 Million

Cash and Cash Equivalents at end of Quarter = $ 16,590 Million

Market Capitalisation – at the current share price, Tesla is currently valued at $ 682.35 Billion. ($ 682,000 Million)

For detailed financial analysis of the company, BOOM suggests looking at the many analyses available from investment analysts on Wall Street and elsewhere. BOOM does not offer any opinion and certainly does not offer any investment advice. Value is always in the eye of the beholder. And each beholder will have different investment circumstances and objectives. Some shareholders will be content to hold the shares here for many years to come. Others will be bailing out if prices fall from these levels. And yet others will see this as a great buying opportunity. This is the glory of modern financial markets. Everyone involved may see a different picture. Tesla may be viable in the long term with a bright commercial future derived from being the dominant company in the sector. BOOM cannot tell without doing a lot more fundamental research.

BANKMAN FRIED AND THE EMPEROR

The fairy tale of the Emperor has no Clothes is always worth considering when looking at all companies in all sectors and their valuations. The saga of the recent collapse of the Crypto exchange FTX and Sam Bankman-Fried is one worthy of thought.

In previous years, Mr Bankman-Fried was seen as a Billionaire genius by some observers. However, a jury in New York decided otherwise last week and found him guilty of 7 counts of fraud and conspiracy. He will be lucky to avoid jail when sentenced.

The question must be asked. Is this the future for the alternative energy industry?

THE EMPEROR HAS NO CLOTHES

The Emperor Has No Clothes is a phrase that comes from a story by Hans Christian Andersen called “The Emperor’s New Clothes”. In the story, a vain emperor who is obsessed with fashion is tricked by two swindlers into thinking that his new clothes are invisible to anyone who is stupid. However, the swindlers are just pretending to weave the clothes, and the emperor ends up walking naked in a parade, unwilling to admit that he cannot see his own clothes.

A young boy sounds the alarm by shouting “Look, the emperor has no clothes” !

The phrase has since become an idiom used to describe a situation where someone is pretending to be something they are not, or when something is revealed to be a fraud. It’s a way of pointing out that someone is not as powerful or impressive as they claim to be, or of exposing a lie or deception.

It serves as a powerful reminder that sometimes, it takes a child’s innocent honesty to reveal the truth and bring about change. Meanwhile, the adults in the room are all too content with delusion. Humans seem to love delusion and illusion, especially politicians and mainstream media journalists.

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions.

BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.