BOOM Finance and Economics 14th July 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and (for very long term archive) Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

RENEWABLE ENERGY HAS A PROBLEM — LITHIUM PRICE COLLAPSE

A LITHIUM SUPPLY PROBLEM — IT IS CALLED CHINA

A COBALT SUPPLY PROBLEM — IT IS CALLED CHINA

A NICKEL SUPPLY PROBLEM — IT IS CALLED CHINA

JOE BIDEN’S BRAIN --- MORE THAN DEMENTIA?

JOE BIDEN’S PREVIOUS BRAIN ANEURYSMS AND BRAIN SURGERIES

THE POSSIBLE ROLE OF COVID VACCINES ON JOE’S BRAIN

AUTO-IMMUNE ENCEPHALITIS?

COVID VACCINES AND RAPID ONSET OF CREUTZFELDT-JACOB DISEASE -- LUC MONTAGNIER’S LAST PAPER

MRI SCAN OF JOE BIDEN’S BRAIN IS REQUIRED ASAP

LITHIUM PRICE COLLAPSE -- LITHIUM SUPPLIES DISCUSSED

Almost anything can be scaled up in production over a short period with adequate finance. But if/when the finance runs out and the revenues generated are inadequate, the clock starts ticking.

Last week, a reader pointed out to BOOM that global Lithium supplies had effectively doubled in volume over the last 3 years (some reports show a tripling). The suggestion was that the supply of Lithium could continue to grow at this pace in the future thereby providing sufficient Lithium supplies to fuel the future renewables based, energy transition revolution.

Theoretically and logistically, there may be an argument that this could happen. However, BOOM makes the point that there is a practical limiting factor here in the long run and that is finance.

Lithium carbonate prices fell past CNY (Chinese Yuan) 91,000 per tonne in July, the lowest in three years, due to a surplus of raw materials for electric vehicle battery manufacturers. Despite this, Lithium miners and producers have continued to expand capacity and hunt for new reserves, magnifying expectations of oversupply.

The EU has recently put tariffs of up to 38% on Chinese EV producers in response to subsidies-supported dumping. These tariffs begin immediately. The US has quadrupled duties on Chinese EVs to 100%. That has caused a 15% monthly drop in June of new energy vehicle exports from China.

Bloomberg BNEF, in its recent New Energy Outlook report, stated that its net-zero scenario would cost US $ 250 Trillion by 2050. That is a staggering amount of investment money to contemplate.

To put that into perspective, currently, at the end of 2023, the total global volume of sovereign and corporate bond debt outstanding stands at about US $ 100 Trillion, similar in size to global GDP.

So, the “transition” to the renewable “revolution” will add another $ 250 Trillion to global debt and global GDP? Solely to finance and build a completely new energy system? This will be no mean feat.

BOOM asks the tough questions. The problem is this — investors will have to be found to take on this debt, be it either private or public. So where will they come from? Mars?

BOOM cannot see any scenario whereby these huge, planned future expansions in renewables and electric vehicles can be adequately financed in the long run. Lack of commercial viability is the ultimate test. Finance demands returns. And all finance moneys in a capitalist money system MUST (eventually) come from the private sector unless huge Quantitative Easing “money printing” Programs from central banks are used. If private sector investors are convinced that these dreams are not commercially viable, dis-enchanted and unwilling to invest, then the private finance simply will not and cannot flow. And surging CPI inflation will be a limiting factor if governments decide to finance it all through QE programs (“printing money”).

Almost all of the crashing share charts that BOOM displayed last week in renewables companies and electric vehicle companies demonstrated clearly what is already happening. The exceptions, currently, are Tesla and BYD. Their shares peaked 2 - 3 years ago but are not falling as quickly. They are still able to attract finance but for how long?

Tesla and BYD must (eventually) create solid post tax profits from making cars. Then, they must pay adequate compensatory dividends to their shareholders. And if they cannot, then the finance will stop for them too. The clock is ticking. Is this the beginning of the end with only the true believers holding on?

LITHIUM PRODUCTION PROBLEMS

As explained last week, for the “renewables” revolution to continue in the long run, global Lithium production will have to grow by almost 9 fold by 2040. That means an annual Lithium production exceeding 1.8 Million Tonnes in just 15 years time. Current production is around 200,000 Tonnes.

Data Source: Energy Institute - Statistical Review of World Energy (2024)

No commodity in history has increased at such a rate for long periods of time. Theoretically, maybe even logistically, it can be achieved if sufficient Lithium exists in a state ready for mining. But private finance does not increase at such a rate. It never has and it never will.

BOOM’s hypothesis is that private sector reluctance is now, already, VERY obvious in regard to investment in renewables and EV’s. This is no theoretical problem for the future.

If private investors cannot (or will not) fund this commercially non-viable expansion, then nation states will have to do so. That will require huge increases in their budget deficits because taxation revenues cannot possibly provide sufficient funding for such ambitious government spending over and above current levels.

The energy “revolution” and “transition” cannot be funded either by private investors or by public bodies. That is the hard truth; the reality we all will have to face, sooner or later.

The Lithium Price Chart and the charts for most renewable companies plus the charts for most EV companies reveal what is happening. The future is here already. Investors just don’t believe the hype anymore.

LITHIUM PRICE CHART 5 YEARS — Source: Trading Economics

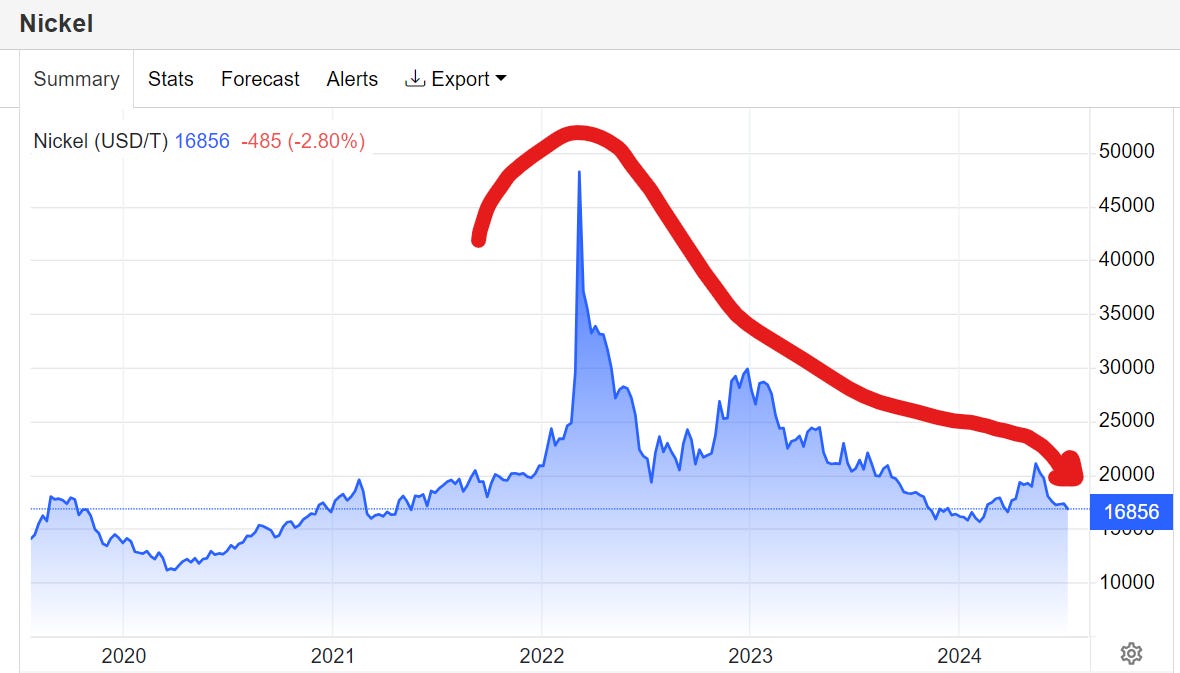

The Nickel price chart and the Cobalt chart reveal the exact same phenomenon.

NICKEL PRICE CHART 5 YEARS

COBALT PRICES OVER 5 YEARS

THERE IS ANOTHER PROBLEM FOR LITHIUM — IT IS CALLED CHINA

China has risen quickly to become not only the top Lithium processor and refiner, but also a major miner of the commodity. In fact, China was the third largest lithium-producing country in 2023 in terms of mine production, behind Australia and Chile.

Chinese companies are mining in other countries as well, including top producer Australia, where they are part of major Lithium joint ventures. For example, Australia’s largest Lithium mine, Greenbushes, is owned and operated by Talison Lithium, which is 51 percent controlled by Tianqi Lithium Energy Australia, a joint venture between China’s Tianqi Lithium and Australia’s IGO.

AND THERE IS A PROBLEM FOR COBALT PRODUCTION — IT IS CALLED CHINA

The Democratic Republic of Congo is the source of over 68% of the global cobalt supply. China's influence in the cobalt mining sector of the Democratic Republic of Congo (DRC) has been significant since the Sicomines agreement in 2007. As part of the agreement, the DRC provided mining concessions for copper and cobalt to the Chinese consortium. In exchange, the Chinese companies agreed to invest billions of dollars in infrastructure development in the DRC, including roads, hospitals, schools, and railways. This influence has led to most DRC mines being fully or partially owned by Chinese entities.

AND THERE IS A NICKEL PRODUCTION PROBLEM — IT IS CALLED CHINA

The United States and Western Europe, in particular, have a supply problem for Nickel. The US is the 9th largest producer of Nickel in the world. In 2022, it produced only 18,000 Tonnes. Russia produced 220,000 Tonnes. Indonesia produced 1.6 Million Tonnes. And the Philippines produced 330,000 Tonnes.

Increasing amounts of production capacity in Indonesia is now processing the country's laterite ore into other forms of nickel such as matte and MHP as a metallic route into precursor materials for batteries. Much of that production capacity is owned and operated by Chinese companies.

And China also has a reliable supplier of Nickel in Russia.

The simple fact is this — the major economies of the West have major supply problems for Nickel, Lithium and Cobalt. China is well prepared with supply. So, where will all the batteries come from for the coming “energy transition”?

And let’s not forget that China also dominates the production and supply of rare earth minerals AND solar panels.

To BOOM, it appears that the advanced Western economies are purposefully digging their own graves with their dreams of energy transition.

Are the so-called leaders of the Western world that dumb? Or dumber?

JOE BIDEN’S BRAIN --- MORE THAN DEMENTIA?

Two weeks ago, BOOM’s editorial dated 30th June had a section titled MUCH MORE TO UNDERSTAND HERE THAN DEMENTIA in which the recent US Presidential debate was discussed in broad terms.

“We are left with two old men, who don’t seem to be very talented, arguing over who is “the best” to become President of the United States. At one point, they engaged in an argument over their respective golf handicaps. It was like listening to two young boys arguing in a school yard, exchanging insults. Or perhaps, two argumentative old men in a retirement village or nursing home, exchanging insults.”

This week, BOOM wants to explore the subject matter more specifically in regard to the current US President, Joe Biden. Joe’s performance during the debate has caused a lot of concern about his health and his ability to run for President in November for another term of office. His gaffe on Thursday where he introduced the President of Ukraine, Volodymyr Zelenskyy as “President Putin” has hit headlines all over the world.

All of this calls into question the integrity of Biden’s medical staff. His doctors seem clueless and absent in the debacle.

BOOM is not a doctor of medicine and certainly does not give medical advice. However, BOOM can offer a few possible diagnoses which may explain President Biden’s seemingly rapid cognitive decline. They are presented randomly and not in any order of probability. And this is certainly not an exhaustive list. There are many other possible diagnoses to be considered. The list presented here is purely speculative and only aimed at stimulating a general discussion. And, remember, at such an old age, Joe Biden may have a mixture of co-morbid conditions. It is important to keep an open mind here. Here is BOOM’s list —

1. Vascular Dementia/Vascular Abnormality

2. Alzheimer's Disease/Dementia

3. Parkinson's Disease

4. Brain Tumour

5. Bleeding Blood Vessel Aneurysm in the Brain

6. Post MRNA Vaccine Auto Immune Encephalopathy

7. Post MRNA Vaccine Creutzfeldt Jacob Disease

BOOM will not discuss the first four conditions on the list. They are arguably obvious possibilities. However, the last three conditions are worthy of further discussion.

JOE BIDEN’S PREVIOUS BRAIN ANEURYSMS AND BRAIN SURGERIES

It is important to remember here that Joe Biden has had two brain operations for serious bleeding from blood vessel aneurysms when he was a much younger man, in 1988. BOOM quotes here from the Brain Aneurysm Foundation website.

QUOTE:

“Joe Biden bowed out of the 1988 presidential race after questions were raised about the lack of attribution of quotes he used in a speech. …. He was having regular headaches, requiring him to carry around a big bottle of Tylenol. He was also feeling pain in his neck.

In February of 1988, he suffered two life-threatening brain aneurysms.”

“Biden flew back to Wilmington the next morning, despite feeling weak and sick. Shortly after returning to his home, he was rushed to Saint Francis Hospital in Wilmington. The results of a spinal tap showed blood in his spinal fluid, meaning an artery in his brain was likely leaking, Biden wrote. A CT scan revealed an aneurysm lying below the base of his brain. Surgery was his best chance of survival.

He underwent a microsurgical craniotomy at Walter Reed National Military Medical Center in Washington, D.C.”

“That May, Biden underwent a second surgery, which was a success. While recovering, ….. he was thin, his right eyelid drooped and the right side of his forehead was immobile.

Initially, doctors weren't sure if his "dead face" would be permanent, Biden wrote. But six weeks later, the muscles in his forehead and cheek began to work again.”

Reference: https://www.bafound.org/news/what-joe-biden-learned-from-his-life-threatening-brain-aneurysms/

JOE HAS BEEN JABBED — THE POSSIBLE ROLE OF COVID VACCINES

It is also important to remember that Joe Biden may have had a number of Covid 19 vaccines over the last 2 -3 years. The Covid Vaccines have been associated with many adverse neurological conditions e.g. Brain Fog, Bell’s Palsy, Transverse Myelitis and Guillain-Barre Syndrome. Joe Biden would have almost certainly received some of these so-called “vaccine” products since the beginning of 2021. And he may have been given multiple doses.

These products trick the cells of your body into producing many Billions of foreign “Spike” protein molecules. The actual dosage in each person is an unknown. These foreign spike proteins then supposedly trigger an immune response which will, theoretically, provide some protection against the disease, Covid 19. Of course, we all now know that they do not provide any protection against becoming infected with the virus or against transmission of the virus. THIS IS WHY SOME PEOPLE NO LONGER CALL THEM VACCINES.

But the question this all begs is this – how many of these foreign proteins may become Prions?

Prions are misfolded proteins that can induce misfolding of normal variants of the same protein and trigger cellular death. Prions cause prion diseases known as transmissible spongiform encephalopathies (TSEs) that are fatal neurodegenerative diseases. The proteins may misfold sporadically, due to genetic mutations, or by exposure to an already misfolded protein. The consequent abnormal three-dimensional structure confers on them the ability to cause misfolding of other proteins.

Prions form abnormal aggregates of proteins called amyloids, which accumulate in infected tissue and are associated with tissue damage and cell death. Amyloids are also associated with several other neurodegenerative diseases such as Alzheimer's disease and Parkinson's disease.

AUTO-IMMUNE ENCEPHALITIS — POST COVID VACCINATION

The details as presented are from a Paper published in the Journal of Clinical Neurology -- The Diagnosis and Treatment of Autoimmune Encephalitis by Dr Eric Lancaster from the Unniversity of Pennsylvania.

Autoimmune encephalitis causes subacute deficits of memory and cognition. Auto-immune diseases have been associated with Covid 19 vaccination.

Autoimmune encephalitis is a difficult clinical diagnosis due to the similarities in the clinical, imaging and laboratory findings of many forms of autoimmune and infectious encephalitis. Patients generally have impaired memory and cognition over a period of days or weeks. There may be clues to specific causes on history of physical examination, but often these specific signs are absent. A broad approach to testing for infectious diseases and various neuronal autoantibodies can lead to the correct diagnosis.

COVID VACCINES AND RAPID ONSET OF CREUTZFELDT-JACOB DISEASE -- LUC MONTAGNIER’S LAST PAPER

The famous French Virologist, Nobel Prize winner and Molecular Biologist, Luc Montagnier was co-author of a paper towards the end of his career on rapid onset Creutzfeldt-Jacob Disease and its possible connection to recent Covid 19 Vaccine administration.

The Paper’s title was -- Emergence of a New Creutzfeldt-Jakob Disease: 26 Cases of the Human Version of Mad-Cow Disease, Days After a COVID-19 Injection

From the Abstract – Quote:

“In the Appendix to this paper, we highlight the presence of a prion region in the spike protein of the original SARS-CoV-2, and in all the “vaccine” variants built from the Wuhan virus. The prion region in the spike of SARS-CoV-2 has a density of mutations eight times greater than that of the rest of the spike, and, yet, strangely that entire prion region disappears completely in the Omicron variant.

In the main body of our text, we present 26 cases of Creuzfeldt-Jacob Disease, all diagnosed in 2021 with the first symptoms appearing within an average of 11.38 days after a Pfizer, Moderna, or AstraZeneca COVID-19 injection. Because the causal progression, the etiopathogenesis, of these atypical and new cases of human prion disease — cases of what is apparently a totally new form of rapidly developing Creuzfeldt-Jacob Disease — we focus on the chronology of the symptomatic development.

We consider it from an anamnestic point of view — one in which we compare the typical development of pre-COVID cases of Creuzfeldt-Jacob Disease to the extremely accelerated development of similar symptoms in the 26 cases under examination. By such an approach, we hope to work out the etiopathogenesis critical to understanding this new and much more rapidly developing human prion disease. By recalling the sequential pathway of that the formerly subacute and slowly developing disease followed in the past, and by comparing it with this new, extremely acute, rapidly developing prion disease — one following closely after one or more of the COVID-19 injections — we believe it is correct to infer that the injections caused the disease in these 26 cases.

If so, they have probably also caused a many other cases that have gone undiagnosed because of their rapid progression to death. By late 2021, 20 had died within 4.76 months of the offending injection. Of those, 8 died suddenly within 2.5 months confirming the rapid progression of this accelerated form of Creuzfeldt-Jacob Disease. By June 2022, 5 more patients had died, and at the time of this current writing, only 1 remains still alive.”

Wikipedia describes Creutzfeldt-Jacob Disease thus:

Creutzfeldt–Jakob disease (CJD), also known as subacute spongiform encephalopathy or neurocognitive disorder due to prion disease, is a fatal neurodegenerative disease. Early symptoms include memory problems, behavioral changes, poor coordination, and visual disturbances. Later symptoms include dementia, involuntary movements, blindness, weakness, and coma. About 70% of people die within a year of diagnosis.

CJD is caused by a type of abnormal shaping of a protein known as a prion. Infectious Prions are misfolded proteins that can cause normally folded proteins to also become misfolded.

And from the Mayo Clinic --

Creutzfeldt-Jakob disease is marked by changes in mental abilities. Symptoms get worse quickly, usually within several weeks to a few months. Early symptoms can include:

Personality changes.

Memory loss.

Impaired thinking.

Blurry vision or blindness.

Insomnia.

Problems with coordination.

Trouble speaking.

Trouble swallowing.

Sudden, jerky movements.

Death usually occurs within a year. People with Creutzfeldt-Jakob disease usually die of medical issues associated with the disease.

Another rare form of prion disease is called variably protease-sensitive prionopathy (VPSPr). It can mimic other forms of dementia. It causes changes in mental abilities and problems with speech and thinking. The course of the disease is longer than other prion diseases — about 24 months.

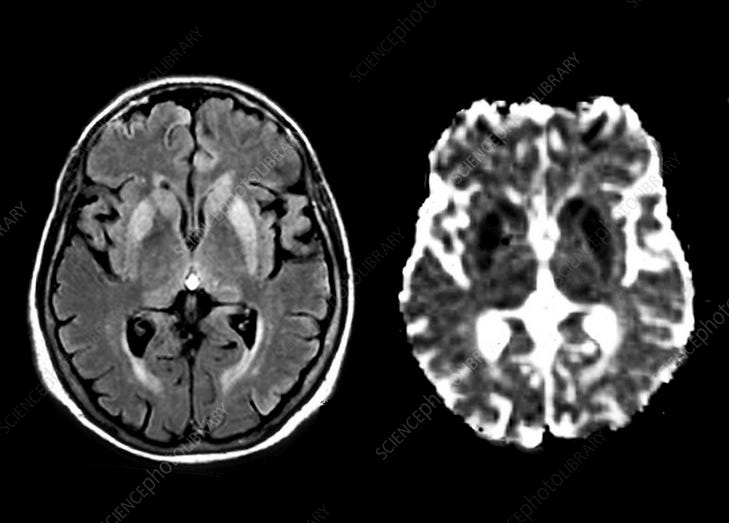

MRI SCAN OF JOE BIDEN’S BRAIN IS REQUIRED ASAP

The website Radiopaedia describes an MRI Brain Scan as “the modality of choice to assessing patients with suspected Creutzfeldt-Jakob disease”. On imaging, it classically manifests as hyperintense signal on DWI (and usually FLAIR) in regions of the cerebral grey matter (cortex, followed by the striatum, followed by thalamus).

Ref: https://radiopaedia.org/articles/creutzfeldt-jakob-disease

Can we please have Joe Biden undergo an MRI Scan as soon as possible?

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS SUBSTACK EDITORIALS AVAILABLE AT BOOM SUBSTACK ARCHIVE.

ALL PREVIOUS EDITORIALS AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.