BOOM Finance and Economics 17th December 2023 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available at LinkedIn and at Wordpress https://boomfinanceandeconomics.wordpress.com/

THE ROTHSCHILD INVESTMENT TRUST -- RIT CAPITAL PARTNERS

THE US STOCK MARKET STRONG PERFORMANCE SINCE OCTOBER 2022 AND OCTOBER 2023

MORE LOSS OF TRUST -- PFIZER SHARES PLUNGE YET AGAIN

STATE OF TEXAS VERSUS PFIZER

URSULA AND ALBERT — TOGETHER AGAIN

ARGENTINA – LOSS OF TRUST IN A SINGLE CHART

HYPERINFLATION – WHAT IS THAT? -- CURRENCY COLLAPSE

THE ROTHSCHILD INVESTMENT TRUST -- RIT CAPITAL PARTNERS

There are many narratives concerning the Rothschild family to be found on the Internet. If you wish to join forces in investing with the Rothschild family expecting to enrich yourself beyond your wildest dreams, you can. However, you may be disappointed.

RIT Capital Partners (formerly the Rothschild Investment Trust) is a listed investment trust on the London Stock Exchange whose objective is “to deliver long-term capital growth, while preserving shareholders’ capital”.

From the RIT website -- “RIT Capital Partners plc was listed on the London Stock Exchange with net assets of £ 281 Million on 1st August 1988. It is now one of the UK’s largest investment trusts, with a market capitalisation of around £ 3 Billion. Jacob Rothschild chaired the Company from inception until 30 September 2019, when he stepped down as Chairman and from the Board. He is today Honorary President and his immediate family interests remain the largest shareholders with a holding of about 21%.”

That leaves 79 % in other hands. All of this information is readily available at the RIT website. There are no secrets.

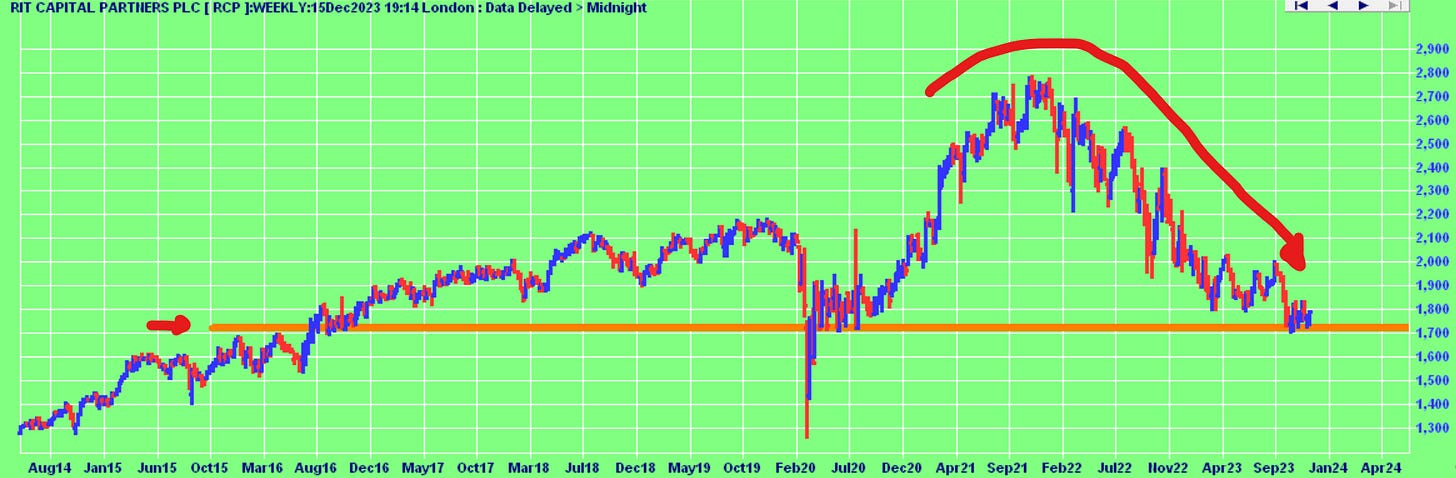

The 10 year chart shows almost no growth in capital value over that period with the share price being just below its level from 5 years ago. The 10 Year period is equally revealing. The current share price is close to where it was in early 2016. Thus, there has been no growth in capital for 8 years. The share price has been in steady decline over the last 2 years, having moved from 2,800 British Pence per share to 1,700 Pence, a loss of 40 % to investors who purchased in early 2022.

BOOM apologises to those readers who imagined that this would be a sure-fire way to riches beyond their wildest dreams. It just shows how difficult the last 10 years have been for the world of investors.

As at 30th June 2023, the RIT investment portfolio was 9.1 % exposed to direct investment in listed shares, 15.4 % to Long Only Funds and 9.1 % to Hedge Funds. Derivatives make up only 0.3 %. Thus, the total for Quoted Equity was 33.9 %. The Fund was 39.8 % invested in Private Investments – 27.9 % in Private Investment Funds and 11.9 % in direct corporate investments. 25.7 % of the Fund was in Uncorrelated Strategies. Interestingly, Government Bond exposure was only 3 % -- all in UK Treasuries.

As at 31st October 2023, the fund had Net Assets of $ 3,488 Million Pounds with a Net Asset Value per share (diluted) of 2,362 Pence and a share price (then) of 1,770 Pence. Thus, the discount was 25 %. Buying shares at a 25 % discount to “Net Asset Value” sounds like a great opportunity to get on the Rothschild train. However, the world of investment is an extremely complex one where reward and risk must always be considered and balanced. Private asset valuations can be a potential unseen danger. Such valuations can be optimistically biased. Too much Diversification can become “Diworsification” (a term popularized by the famous investor, Peter Lynch). BOOM does not offer investment advice to readers. However, caution and regular review is always a good strategy.

The Asset Allocation of the Fund at 31st October is freely available. It contains some interesting decisions that are worthy of note. The Fund has only 2 % of the total invested in Real Property while 30 % is invested in “Private Investments – Funds” and 26 % is “long” in quoted stocks. Currency exposure of the Fund shows 43 % Sterling and 37 % US Dollar. The Geographical Exposure is 58 % North America and 14 % Emerging Markets with 5 % exposure to Europe.

Dividends of 38 pence per share have been declared for the last 12 months. This gives the Fund a Dividend Yield which is acceptable but not stellar.

Let’s look at the recent share price performance of the Rothschild Fund.

RIT CAPITAL PARTNERS OVER 2 YEARS

Investing with the Rothschilds carries all the usual risks of investment. There are no secrets here, no magic. Investing is hard work, extremely complicated. That will disappoint some readers looking for fast, easy gains but others will find it reassuring.

As always, please note that BOOM does not offer investment advice to readers.

THE US STOCK MARKET STRONG PERFORMANCE SINCE OCTOBER 22 AND 23

Over the last 2 years, the US S & P 500 Stock Index was in downtrend from January 2022 but found a base to its decline in October 2022. At the time, global investors felt overwhelmed by CPI inflationary pressures and higher interest rate settings from aggressive central banks.

BOOM saw through the gloom and wrote on October 15th 2022 -- “…. overall, the inflation statistics and retail sales figures were a good result, offering some firm evidence that the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here”

That comment proved deadly accurate. And on 5th November, this year, 2023, BOOM wrote --

“In summary, BOOM is expecting US investors to become more aggressive here in buying all financial assets. If so, a new Bull market especially in stocks but also in bonds will be confirmed if (and when) the S & P 500 stock Index rises above 4,600.”

S & P 500 INDEX OVER 2 YEARS

(BOOM’s bullish forecasts are indicated by the two red arrows)

MORE LOSS OF TRUST -- PFIZER SHARES PLUNGE YET AGAIN

Last week, BOOM’s editorial focused on the dramatic loss of trust that has developed in the major institutions of the advanced, western democracies. This is clearly a major concern for citizens living in those nations. Other recent BOOM editions have focused on the loss of trust in renewable energy companies, electric car manufacturers and Hydrogen energy companies with investors selling out hard in most. The commercial viability of these enterprises seems highly suspect. Investors are fleeing despite politicians and the mainstream media claiming that they represent the future.

This week, BOOM will look at loss of trust in the pharmaceutical companies that have created the Covid vaccines. The shares of these companies have now been falling for 2 years. Last week, Pfizer shares accelerated that fall. They ended the week down 7.47 %. Mid-week, they were down almost 10 %.

The following charts are from Stockcharts and Incredible Charts for all 4 Covid vaccine companies over the last 5 years.

PFIZER SHARE PRICE 5 YEARS

BIONTECH SHARE PRICE 5 YEARS

NOVAVAX SHARES 5 YEARS

MODERNA SHARES 5 YEARS

Long term, Pfizer investors have been even more disappointed. Their shares have now fallen back to where they were 10 years ago.

PFIZER SHARE PRICE 10 YEARS

Concerning the dramatic falls this year in the company’s revenue and falls in anticipated profits, their CEO, Albert Bourla said last week -- "Although I'm not happy, all we can do is to execute on our strategy so that investors will see that this is a good growth opportunity".

BOOM can think of a few other things that the management could do in this situation. Pfizer’s shareholders would also have some suggestions but they are busy leaving the scene of the …..

For investors buying here, there is a well known, old and wise investment adage which perhaps should be at the forefront of their minds -- “Don’t catch a falling knife”.

BOOM has written extensively in the last 2 years about these companies that manufacture Covid so-called “vaccines” using mRNA technology -- (except Novavax which uses a different technology without the genetic material present in the mRNA products). BOOM has been warning investors of potential insolvency if pending class action legal cases in the US result in massive damages claims being awarded. The companies may be forced to seek Chapter 11 protection in such an event.

BOOM is also aware of pending human rights cases being launched against various governments involved in promoting these products. The companies will inevitably be indirectly damaged by those challenges, win lose or draw.

And now the State of Texas has launched a legal case with a new approach. Texas is suing Pfizer for "unlawfully misrepresenting the effectiveness of the company’s COVID-19 vaccine and attempting to censor public discussion of the product.”

In a Press Release, the Texas Attorney General Ken Paxton said “We are pursuing justice for the people of Texas, many of whom were coerced by tyrannical vaccine mandates to take a defective product sold by lies”.

From the Press Release:

“Pfizer engaged in false, deceptive, and misleading acts and practices by making unsupported claims regarding the company’s COVID-19 vaccine in violation of the Texas Deceptive Trade Practices Act.

The pharmaceutical company's widespread representation that its vaccine possessed 95% efficacy against infection was highly misleading. That metric represented a calculation of the so-called “relative risk reduction” for vaccinated individuals in Pfizer’s initial, two-month clinical trial results. FDA publications indicate “relative risk reduction” is a misleading statistic that “unduly influence[s]” consumer choice.”

It is now common knowledge that the mRNA Covid jabs do not prevent you from becoming infected by the virus and neither do they stop you transmitting the virus to others, even Granny.

Thus, the word “vaccine” appears to have been miss-used to describe them. And the word “effective” also appears to have been miss-used in promoting them. We all remember the message “safe and effective” delivered ad nauseam. It now seems that Pfizer’s Covid jab has almost zero effectiveness on a population basis at preventing the disease known as COVID-19 and, worse still, it appears to come with a long list of potential side effects that are far worse than COVID-19 itself—such as blood clots, heart damage, brain damage, neurological conditions, auto-immunity, possible damage to the immune system, possible infertility (no-one knows) and even death. One Canadian expert, Professor Denis Rancourt, has estimated 17 Million deaths worldwide to date, with more to come presumably.

Then we have to consider that the products that have been jabbed into 5 Billion arms globally are not the same as the products that were used in the clinical trials. To solve the scale up problems of mass manufacture, apparently “Process 2” has been used. Process 2 is reportedly very different to Process 1 which was used to make the products for the clinical trials which were used to declare the products “safe and effective”.

BOOM read a brilliant summary last week written by Australia’s most senior expert Pharmacologist, Dr Phillip Altman. His summary on Substack should be compulsory reading for all human beings on Planet Earth. Please Note: Bolded emphasis provided by BOOM.

QUOTE: “The COVID gene-based so-called “vaccines” have been a cataclysmic failure from a number of points of view.

After 3 years we now know, and it is widely admitted, that the “vaccines” do not prevent infection; do not keep you out of hospital; do not prevent transmission of infection; do not stay at the site of injection and travel to every cell in your body; linger for weeks or even months (think “long COVID”); and, have been temporarily associated with an enormous number of non-COVID, unexplained, Excess Deaths worldwide approaching several million (based on NZ Ministry of Health record level data and considerable other statistics).

Drilling down to the biochemical level there are even more disturbing facts which have come to light over these 3 years (all covered in my Substacks). We now know the shots which were used commercially were made by an entirely different manufacturing process (Process 2) as compared to those shots used in the original clinical trial used to support the claimed safety and efficacy. Use of this process meant that DNA contamination in the form of DNA plasmids and endotoxins were contained in the shots. Both are highly toxic and should not be there. In addition, it was more recently found that the Pfizer “vaccine” contained undeclared Simian virus promoter nucleotide segments which have been recognised has having oncogenic (cancer) potential. What could possibly go wrong?

Now it has been reported in one of the most prestigious scientific journals, Nature, that the mRNA gene-based injections can cause random production of unusual proteins which could have profound immunological and other effects on the body. The highly technical and detailed paper by Mulroney et al can be uploaded below:

Frame Shifting Nature Dec 2023

20.5MB ∙ PDF file

This is a bombshell. The implications are unknown but you can bet that the production of these random proteins due to genetic “frame shifting” cannot be good. You may expect the proponents of the Covid “vaccines” to declare “nothing to see here” based on zero evidence and shift the onus of proof of harm elsewhere.

Dr. Philip McMillan does an exceptional job at simplifying complicated scientific information and he has done a video to explain what “frame shifting” is all about. CLICK HERE to view his 18 min video. Basically, the use of N-methylpseudouridine in the unnatural mRNA in the shots causes the genetic code machinery to “skip a cog” as it were and produce something other than intended Spike Protein. Nobody knows the consequences. This was reported in this paper to occur in up to 30% of vaccinated individuals.”

And “Pfizer fostered a misleading impression that vaccine protection was durable and withheld from the public information that undermined its claims about the duration of protection. And, despite the fact that its clinical trial failed to measure whether the vaccine protects against transmission, Pfizer embarked on a campaign to intimidate the public into getting the vaccine as a necessary measure to protect their loved ones.”

STATE OF TEXAS VERSUS PFIZER

It is certainly worth reading the Press Release from the Texas Attorney General. Those readers who seek more detail can read the full petition.

State of Texas Press Release: https://www.texasattorneygeneral.gov/news/releases/attorney-general-ken-paxton-sues-pfizer-misrepresenting-covid-19-vaccine-efficacy-and-conspiring

To read the full petition, click here.

URSULA AND ALBERT — TOGETHER AGAIN

" Together Again " is a 1964 song by American country singer and guitarist Buck Owens . The song is best known as the "B" side to Owens' No. 1 hit, "My Heart Skips a Beat".

By the way, here is a photo of the carefully selected (not elected) CEO of Pfizer with the carefully selected (not elected) President of the European Commission which is the highest office in the European Union.

They are meeting at – where else? -- the Atlantic Council. The Atlantic Council is an American think tank in the field of international affairs, favoring Atlanticism, founded in 1961. It manages sixteen regional centres and functional programs related to international security and global economic prosperity and is headquartered (where else?) in Washington DC.

Does the word Globalist spring to mind?

Atlanticism, also known as Transatlanticism, is the ideology which advocates ever closer alliance between nations in Northern America (the United States and Canada) and in Europe (the countries of the European Union, the United Kingdom, Ukraine, Switzerland, Norway, Iceland, Turkey etc.) on political, economic, and defence issues.

Let’s look at associated groups of carefully selected (not elected) people.

The North Atlantic Council is the premier, governmental forum for discussion and decision-making in an Atlanticist context and is the principal political decision-making body of the North Atlantic Treaty Organization (NATO). Organisations that can be considered Atlanticist in origin include:

NATO

Organisation for Economic Co-operation and Development (OECD)

G-6/7/8

North Atlantic Cooperation Council (NACC)

Euro-Atlantic Partnership Council (EAPC)

The German Marshall Fund of the United States (GMF)

European Horizons

The Atlantic Council

The World Bank and International Monetary Fund (IMF) are also considered Atlanticist. Under a tacit agreement, the former is led by an American and the latter European.

Atlanticism essentially ignores 7 Billion people on the planet. It’s a cosy club of mostly selected (not elected), well groomed and well promoted people.

ARGENTINA – LOSS OF TRUST IN A SINGLE CHART

But let’s get back to BOOM’s current theme -- Loss of Trust.

Loss of trust in institutions is at a severe stage in Argentina. After almost 100 years of an economic roller-coaster and financial mayhem induced by successive governments who had no clue what they were doing, the people have been in a state of panic for the last 18 months, desperately buying shares in the hope of preserving some wealth. This is what happens when the people lose trust in their banking system, the value of their homes and their national currency.

The share market index, the MerVal Index, has doubled three times in the last 18 months. It has risen from around 100,000 points to over 1 Million. That is called a “10 Bagger” in investment terms. Some naive individuals may see this as a strong vote in favour of Argentina’s corporate sector with high expectations of future prosperity. However, that is clearly not the case. Argentinians are simply terrified of the future and desperately trying to find a “safe” place for their hard earned excess funds.

That one chart says it all. Sheer desperation writ large.

The nation’s annual CPI inflation rate is currently 161 % which sounds awful but is relatively low by historical Argentinian standards. In 1989, Argentina experienced a period of hyperinflation (currency collapse), with annual inflation reaching almost 5,000 % for a short period.

Here is a chart of inflation rates in Argentina since 1944. You can see the Hyperinflation events (currency collapse) clearly. Some events are not shown as it would be impossible to fit them all into a single chart.

The current top of the pops in Annual CPI inflation is Venezuela with a current figure of 283 % while Lebanon is runner up with just 215 %.

Argentina has now elected a new President called Javier Milei who is promising yet another economic nirvana by abandoning the national currency in favour of the US Dollar, closing down the central bank, turning away from the BRICS nations and sacking many thousands of public servants. If he does all of that (he may not), a crash of the nations’ commercial banks will eventually happen due to loss of inter-bank trust if there is no central bank to act as intermediary. History tells us that. And, if that happens, a crash of the national economy is almost guaranteed. Poverty will then go from 40 % to over 70% (BOOM’s estimate). Asset prices will collapse. Productive assets will then be (presumably) sold off to “international investors” for peanuts (US Dollars borrowed for that purpose from offshore Tax Haven banks).

BOOM often says “your currency is your nation” and “your nation is your currency”. The US Dollar has been used in Argentina for so long to settle large asset transfers (such as homes and apartments etc) that it is arguable that the Nation no longer exists and has not really existed in financial terms for decades.

The sad thing is this — the people of Argentina have little choice but to take the Milei gamble. It is called a “Hail Mary” pass in American football, a last desperate attempt to win the game. Seductive Utopian, Socialist ideas and Marxist dialectic have destroyed the nation’s economy. Of course, everything was done “for the greater good”.

This appears to be a repeat of the what happened to the USSR after it collapsed in 1990 - 1999 when the so-called “Harvard Boys” – the Harvard Institute for International Development -- turned up to “re-construct” the productive assets of Russia.

HYPERINFLATION – WHAT IS THAT? -- CURRENCY COLLAPSE

Let’s look at the worst episode of Hyperinflation in history. It occurred in Hungary at the end of World War Two. It makes present day Argentina look like a non-event. As recorded by Wikipedia --

QUOTE: “Between the end of 1945 and July 1946, Hungary went through the highest inflation ever recorded. In 1944, the highest banknote value was 1,000 Pengo (the Hungarian currency at that time). By the end of 1945, it was 10,000,000 Pengo, and the highest value in mid-1946 was 100,000,000,000,000,000,000 Pengo. A special currency, the adópengő (or tax pengő) was created for tax and postal payments. The inflation was such that the value of the adópengő was adjusted each day by radio announcement. On 1 January 1946, one adópengő equaled one pengő, but by late July, one adópengő equaled 2,000,000,000,000,000,000,000 Pengo or 2×1021 Pengo (2 sextillion pengő).

When the pengő was replaced in August 1946 by the Forint, the total value of all Hungarian banknotes in circulation amounted to 1⁄1,000 of one US cent. Inflation had peaked at 1.3 × 1016% per month (i.e. prices doubled every 15.6 hours). On 18 August 1946, 400,000,000,000,000,000,000,000,000,000 Pengo (4×1029 pengő, four hundred quadrilliard on the long scale used in Hungary, or four hundred octillion on short scale) became 1 Forint.

Start and end date: August 1945 – July 1946

Peak month and rate of inflation: July 1946, 41.9×1015 % UNQUOTE

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.