BOOM Finance and Economics 18th February 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available at LinkedIn and at Wordpress https://boomfinanceandeconomics.wordpress.com/

JP MORGAN & STATE STREET PULL $ 14 TRILLION OUT OF CLIMATE ACTION GROUP

THE CHINESE PEOPLE MUST BECOME CAPITALISTS – CHINA CAN BECOME THE GREATEST COMMUNIST NATION AND THE GREATEST CAPITALIST NATION ON EARTH SIMULTANEOUSLY - - A CITIZEN’S OWNED NATION?

CLIMATE ALARM IN THE WHITE HOUSE

US DEPARTMENT OF DEFENSE – THE WAR AGAINST CLIMATE CHANGE

THE BRICS EXPANSION -- DILMA ROUSSEFF

CHINA AND THE BALKAN PENINSULA – RESOURCES, CONSUMERS AND LABOUR

JP MORGAN & STATE STREET PULL $ 14 TRILLION OUT OF CLIMATE ACTION GROUP

In last week’s editorial, BOOM outlined the lack of wisdom displayed by America’s largest banks in joining the (UN organised) Net-Zero Banking Alliance (NZBA). The list of banks included the Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

BOOM described how those 6 banks have decided to abide by the oversight and agenda of a United Nations organisation (NZBA) rather than the US Government. This is akin to corporate treason. BOOM pointed out that it may be unlawful as well. The by-line for NZBA gives the game away. In propagandistic style it says “Industry-led, UN convened”. It should read UN led - UN Convened.

“In BOOM’s view, this is a repudiation of the US Government by these companies, a slap in the face to Congress and the Senate. This may be unlawful. The CEO’s have decided that they will be answerable not to their shareholders and not to their National government but to a group of unelected officials who meet at UN Headquarters.”

“BOOM assumes that this means the banks will (somehow) separate their Greenhouse Gas intensive and emitting customers from their non GHG emitting customers? On what basis will this be done to stay within applicable US Laws?

Surely customers who are discriminated against on this basis can take legal action to defend themselves? Have the various CEOs’ generated a contingent liability here?”

BOOM’s editorial on the matter was a hard hitting denouncement of the banks’ actions in regard to the NZBA and was titled: HAVE THE MAJOR US BANKS UNLAWFULLY ABANDONED THE US GOVERNMENT, THEIR SHAREHOLDERS AND SOME OF THEIR MAJOR CUSTOMERS?

As the week progressed, BOOM was not surprised to read that the JP Morgan and State Street Bank funds management divisions had decided to leave a UN inspired group called the Climate Action 100 + Group. Blackrock has apparently also decided to reduce its connections to the group. Perhaps they all read BOOM?

Reuters reported: “The decisions together remove nearly $14 trillion of total assets from efforts to coordinate Wall Street action on tackling climate change and came after the coalition, known as Climate Action 100+, or CA100+, asked signatories to take stronger action over laggards.”

And: “Financial firms have faced growing pressure from Republican politicians over their membership of such groups, amid accusations that committing to shared action could be a breach of antitrust law or fiduciary duty.”

THAT is exactly what BOOM wrote about in last week’s editorial. Bankers and Fund managers should all take note.

The Climate Action 100 + website does not reveal who is behind it, who is the organising force. That seems rather suspicious to BOOM. It describes itself as an “investor-led initiative” with a “global steering committee”.

This is reminiscent of the slogan “Industry-led. UN-convened”.

Its funding is sourced from four “philanthropic” groups including the Climate Works Foundation.

Climate Works Foundation is a Billionaires club. It is funded via “foundations” which are funded by billionaires Jeff Bezos (Amazon), Bill Gates (Microsoft), Michael Bloomberg (Bloomberg), Mark Zuckerberg (Facebook), Jeremy Grantham, Julian Robertson, Bill Hewlett, David Packard (Hewlett Packard), Henry Ford (Ford Motor Company), Gordon Moore (Intel), the Brenninkmeijer family (C & A), Ingvar Kamprad (IKEA), Dustin Moskovitz (Facebook). “ClimateWorks also has several funders that prefer to remain anonymous.”

The world's second largest funds manager, Vanguard, has never joined CA 100 + and, in late 2022, dropped out of another well-known climate group, called the Net Zero Asset Managers (NZAM) initiative. Vanguard cited independence concerns, as did a number of large insurance companies who have left an associated organisation.

Last March, a group of Republican attorneys general led by Montana's Austin Knudsen questioned most of the largest US asset managers about their membership in such industry groups and described what it called "potential unlawful coordination" within CA 100+.

Knudsen was reported on Thursday as saying that the moves by the three companies to leave CA100 + was "great news". He also said, "We need every asset management firm to follow suit."

THE CHINESE PEOPLE MUST BECOME CAPITALISTS – CHINA CAN BECOME THE GREATEST COMMUNIST NATION AND THE GREATEST CAPITALIST NATION ON EARTH SIMULTANEOUSLY - A CITIZEN’S OWNED NATION?

China’s government is communist. However, they must now encourage all of their citizens to become buyers of shares in Chinese companies. If they don’t, the Chinese stock markets will be at risk of progressive slow melt down with no end. And if that were to happen, the ownership of corporate China will become locked into fewer and fewer hands, creating an elite class of citizens who own the productive assets of China. This elite class would become the robber barons of China by default, capable of exerting great influence. China’s communist ideals could then become corrupted by the financial power of an organised group of oligarchs.

None of that is compatible with communist ideology. Therefore, the best way forward is for the central government of China to encourage its citizens to start buying shares as soon as possible.

BOOM is expecting such a direction from the Chinese government soon. It is actually inevitable because the consequences of not doing this are too great to ignore.

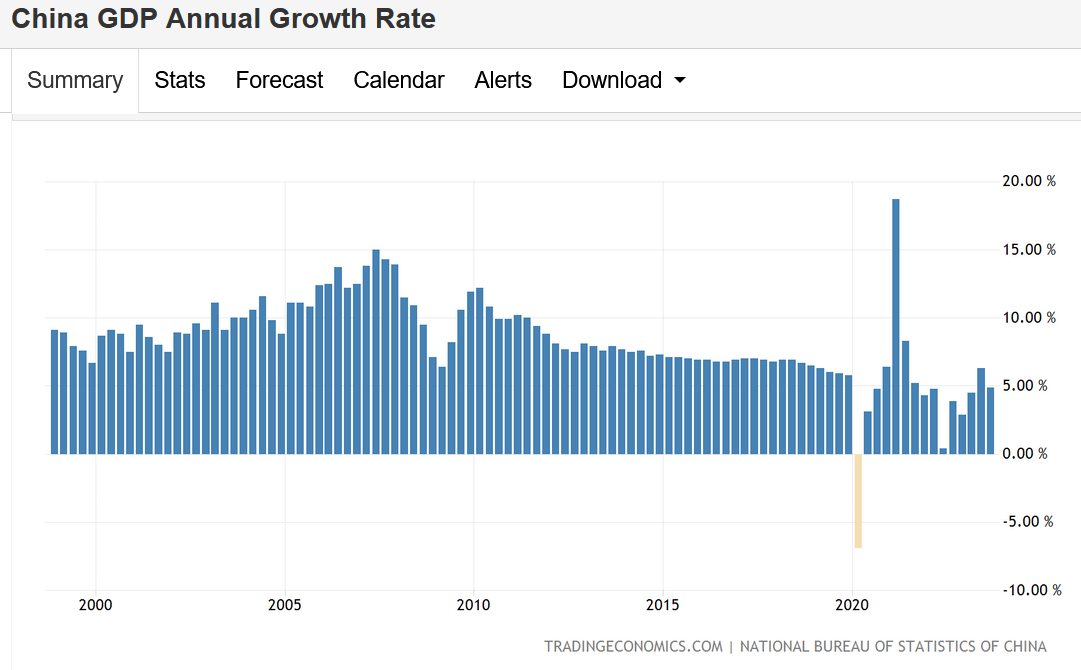

According to CEIC Data, China’s total stock market capitalisation in December 2023 was equal to US$ 10,889 Billion ($ 10.9 Trillion). The market capitalisation reached an all-time high of US$ 14,375 Billion in Dec 2021 ($ 14 Trillion).

The total market capitalisation of the US stock market is currently US $50,781 Billion ($50.8 Trillion) as at Jan 1st, 2024 – five times greater than China. The market value is the total market cap of all US based public companies listed in the New York Stock Exchange, the Nasdaq Stock Market and the OTCQX US Market (the OTC market).

Let’s look at that another way, taking into account the population of each nation (on a per capita basis).

China’s market capitalisation is equal to approximately US $ 8,000 per person.

The US market capitalisation is equal to approximately US $ 170,000 per person.

In other words, China’s productive assets per person are valued at less than 5 % of the US valuation for its productive assets. China’s valuation also seems grossly undervalued if you compare the GDP of both nations.

On a PPP (purchasing power parity basis), the Chinese annual GDP is considerably larger than that of the United States.

Its citizens already have a higher total purchasing power than US citizens. This is a remarkable achievement. But the purchasing power on a per person basis is lower in China compared to the US.

The Nominal GDP of China (in USD on a PPP basis) is estimated to be US $ 35 Trillion. The Nominal GDP of United States (in USD on a PPP basis) is estimated to be US $ 28 Trillion.

Looked at on a per person basis --

The Nominal GDP of China (on a PPP basis) is estimated to be US $ 25,000 per person.

The Nominal GDP of United States (on a PPP basis) is estimated to be US $ 90,000 per person.

The forward Price Earnings Ratio of Chinese stocks is now below 10. The forward Price Earnings Ratio of US stocks (as measured S & P Index) is now above 20.

The forward Price Earnings Ratio of the US Dow Index is now above 25.

The forward Price Earnings Ratio of the US Nasdaq Index is now above 30.

And, by the way, the forward Price Earnings Ratio of Russia’s Stock Index is now below 4.

(Source: Siblis Research)

The P/E ratio of the S&P 500 US stock market index going back to 1927 had a low of 5.9 in mid-1949 and a high of 122.4 in mid-2009. The long-term average P/E for the S&P 500 is about 17.6.

The timing is perfect for the people of China to begin their journey to share ownership. The P/E ratio is very favourable and China’s GDP could feasibly triple in size from current levels.

The One Nation Two Systems dream of Deng Xiaoping applied to Hong Kong’s relationship to Mainland China. However, it may well be about to come true in a different sense.

China has the potential to become the greatest communist nation and the greatest capitalist nation on Earth simultaneously.

CLIMATE ALARM IN THE WHITE HOUSE

On October 8th 2021, President Biden signed Executive Order 14057 which states the “US Government Will Lead by Example to Leverage Scale and Procurement Power to Drive Clean, Healthy, and Resilient Operations”. The stated aim is to lead by example in tackling the “climate crisis”.

Readers should note that Carbon Dioxide is the only variable being considered here. Sub-oceanic volcanic activity, oceanic temperature variations, rainfall, cloud formation, magnetic pole shift, the impact of reduced solar activity and Cosmic Ray proton waves from Super-nova explosions are not being considered. These phenomena are all ignored by climate scientists. For them, there is only one variable. Perhaps there is some obtuse logic in that stance. After all, human beings cannot have any influence on those huge astronomical and geological events. BOOM calls this the Single Variable method of analysing complex phenomena.

The White House Brief in Order 14057 hopefully states: “The executive order will reduce emissions across federal operations, invest in American clean energy industries and manufacturing, and create clean, healthy, and resilient communities. The President is building on his whole-of-government effort to tackle the climate crisis in a way that creates well-paying jobs, grows industries, and makes the country more economically competitive.”

This statement is not coherent in regard to basic physics and the economics of supply and demand. In other words, how can economic growth continue without hydrocarbon energy to fuel transport, cement production, steel, heating and fertilizers for food production?

Nevertheless, the Executive Order states the following five ambitious goals:

BOOM comments are in bold.

100 percent carbon pollution-free electricity (CFE) by 2030 (just 6 short years away), at least half of which will be locally supplied clean energy to meet 24/7 demand; (and where will the other half come from?)

100 percent zero-emission vehicle (ZEV) acquisitions by 2035, including 100 percent zero-emission light-duty vehicle acquisitions by 2027; (just 3 short years away)

Net-zero emissions from federal procurement no later than 2050, including a Buy Clean policy to promote use of construction materials with lower embodied emissions; (what will replace steel and cement?)

A net-zero emissions building portfolio by 2045 (no “emissions” from any buildings?), including a 50 percent emissions reduction by 2032; and

Net-zero emissions from overall federal operations by 2050, including a 65 percent emissions reduction by 2030. (just 6 short years away)

BOOM admires ambition. However, there is a thing called reality to consider here. The Executive Order looks to have been written by an enthusiastic Grade 8 high school student who has no understanding of how such a complex economy as the United States operates by using vast amounts of energy – mostly supplied from Hydrocarbon sources.

Shortly after the ambitious but unrealistic goals are listed, the White House statement devolves to using a propagandist slogan – Build Back Better -- “Today’s executive action is a part of the President’s broader commitment to increasing investments in America’s manufacturing industries and workers to build back our country better.”

The White House also released a detailed description of this plan (which is 68 pages long, if you care to read it): The Federal Sustainability Plan: Catalyzing America’s Clean Energy Industries and Creating Jobs Through Federal Sustainability

https://www.sustainability.gov/pdfs/federal-sustainability-plan.pdf

The White House release goes on to state: “Through this executive order, the federal government will transform its portfolio of 300,000 buildings, fleet of 600,000 cars and trucks, and annual purchasing power of $650 billion in goods and services.”

It’s that easy? Apparently all that is required is an executive order from Washington DC.

Lots of wishful, magical thinking continues until you reach the end of the document. One single sentence is sufficient to deal with the US Department of Defense which is a massive user of Hydrocarbon fuels: “DOD is integrating climate change considerations across its strategic guidance and planning documents, including the National Defense Strategy, which will be released in 2022.”

Presumably, that means a US Defense force with zero aircraft, zero missiles and zero space missions. Mmmmm … OK, if the executive order says so.

US STRATEGIC BOMBER FLEET — POWERED BY HOT AIR

The last paragraph from the White House reveals the document’s true colors when it discusses just 70 cars in the Department of Veteran’s Affairs in Boston. Yes – 70 cars. Did anyone of gravitas read this document before release?

How did this end up in an Executive Order from the President?

ZEV’s are (so called) Zero Emissions Vehicles. BOOM wonders if they will contain steel, aluminium, glass, silicon, rubber and plastics.

“In 2020, the Department of Veterans Affairs (VA) New England’s Boston Healthcare System partnered with National Grid on a plan to transition its 70-car fleet to ZEVs. Consistent with National Grid’s recommendations, VA is working with GSA to procure approximately 25 ZEVs in the 2022 acquisition cycle.”

BOOM is not so sure that this initiative involving just 70 cars will help swing the whole planet to a better carbon future. But, then again, BOOM is known for being a crusty old cynic.

US DEPARTMENT OF DEFENSE – THE WAR AGAINST CLIMATE CHANGE

Magical thinking is not confined to the White House in America. The Department of Defense has also adopted it as a key component of its planning.

In 2021, Richard Kidd, the Deputy Assistant Secretary of Defense for Environment and Energy Resilience made the following statements.

“By itself, the Department of Defense is the 55th largest producer of greenhouse gases.”

“The DOD's Climate Adaptation Plan charts the department's way forward. It's based on the premise that climate change is a national security risk that "affects our mission requirements, our installations, the welfare of our service members, and our equipment."

"It is a destabilizing force in the world, expanding our mission set and creating new missions where there were none before and impacting our operational environment."

"We know we are transitioning to a carbon-free future," Kidd said. "The country that gets there first wins. So, if China and Russia aren't working to get there, they're going to lose."

“We're going to pivot the entire department towards living in a climate, towards living and operating in a reality altered by climate change.”

CLIMATE FRIENDLY FIGHTER JET

In April 2023, the Department of Defense released its Plan to Reduce Greenhouse Gas Emissions. It includes statements that BOOM cannot understand. Perhaps readers can?

Some examples in italics: BOOM Comments in (Bold)

Initiatives that reduce GHG emissions can also create warfighting advantage. (How?)

For example, improving efficiency and deploying clean distributed generation and storage can strengthen the resilience of critical missions housed on military installations in the face of extreme weather, cyber attacks, and even kinetic attacks impacting electric grids. (How does this “strengthen resilience”?)

Rapid advancements in clean energy markets and technologies are creating opportunities for the Department to achieve its objectives—particularly on installations. At the same time, the Department is continually assessing those developments and market conditions to identify additional options for improving combat system GHG performance that align with capability and operational readiness. (What is meant by “combat system GHG (Greenhouse Gas) performance? And how does it “align with capability and operational readiness?)

In FY 2021, DoD Scope 1 and Scope 2 emissions totaled 51 million metric tons of carbon dioxide equivalent (MMTCO2e). Most emissions result from fossil fuel combustion, particularly jet fuel. In FY 2021, jet fuel combustion accounted for 80% of operational emissions and 50% of total DoD emissions. (So, with no solar powered, wind powered or battery powered aircraft, how does the DoD expect to defend America?)

DoD’s total Scope 1 and Scope 2 GHG emissions in 2021 are about 76% of total Federal Government emissions, equivalent to 1% of the total United States emissions in 2020.

(So, if the entire DoD was shut down, the US emissions would reduce by just 1 %?)

The Plan goes on and on for 25 pages of this language. Here is a classic example:

The Department’s approach includes the following: (OE is Operational Emissions)

• Reducing OE demand by increasing platform efficiency; exploring new operating concepts; and fielding new, more capable equipment;

• Substituting current fuels with sustainable liquid fuels, preferably produced in a distributed manner, and pursuing alternative power generation technologies;

• Pursuing technology innovation and adoption; and

• Leveraging GHG offsets and sequestration

Reducing demand for OE can bolster warfighting capability and energy resilience in contested operating environments. A Joint Force that reduces the energy (typically petroleum) to execute its missions can reduce the risks associated with deploying, employing, and sustaining Joint Forces in contested operating environments.

The ability to operate for extended periods, over long distances, with greater speed and payload, or in more locations directly increases our capability and reduces an adversary’s ability to disrupt the provision of energy for sustained operations.

New and scalable propulsion technologies can change the landscape of future operations and enhance warfighting capabilities while reducing energy needs.

The Department will continue to explore innovative propulsion options for the Navy’s surface fleet that reduce energy demand and increase the ability to support future upgrades and capability enhancements.

Here is a special example of magical thinking in action – “no changes required”. The word “potential” is used frequently in the document.

Sustainable Aviation Fuel (SAF) have the potential to provide operational flexibility and significantly reduce the department’s carbon footprint, while requiring no changes to military equipment or infrastructure.

Increasing the use of electricity to power land, sea (surface and subsurface), air, and dismounted soldier platforms has the potential to improve efficiency and could expand options for powering the force.

Potential …. could …. no changes required?

More (or less) hot air here – Methane reduction?

Non-CO2 gases such as methane (CH4), hydrofluorocarbons (HFCs), nitrous oxide (N2O), and others contribute significantly to global warming; methane alone contributes fully half of current net global warming of 1.0°C emissions.

Planting trees may help -- if only the military could adopt this as a core operational imperative?

In addition to seeking ways to embed carbon in construction, the Department will explore options to permanently sequester carbon through biosequestration. For example, tree planting is one method of offsetting emissions through sequestration of carbon and can also reduce urban heat island impacts and help reduce energy demand on installations.

Perhaps the DoD plan is to bury the enemy in meaningless words and language that make no sense whatsoever to a military defence strategy? Magical thinking to the rescue?

That is the only conclusion BOOM can reach after reading through these documents.

THE BRICS EXPANSION -- DILMA ROUSSEFF – NEW DEVELOPMENT BANK –

Dilma Rousseff, originally a socialist and Marxist but now conveniently describing herself as a “pragmatic capitalist” was the 36th president of Brazil, holding the position from 2011 until her impeachment and removal from office on 31 August 2016. In the impeachment, the Senate voted 61–20 to convict her, finding her guilty of breaking budgetary laws and she was removed from office. However, she is now President of the BRICS New Development Bank.

The New Development Bank (NDB) is a multilateral development bank established by Brazil, Russia, India, China and South Africa (the BRICS nations) with the purpose of mobilising resources for infrastructure and development projects in emerging markets and developing countries. It is essentially an alternative to the World Bank.

Speaking at the World Governments Summit in Dubai last week, Rousseff said that with the addition of new members, the group’s share in global economic output will rise from the current 35% to 40% by 2028, while that of the G7 group of developed nations will decline to 28 %.

The BRICS group of emerging economies, which previously comprised Brazil, Russia, India, China, and South Africa, recently underwent a major expansion after Iran, Ethiopia, Egypt, and the United Arab Emirates joined in January of this year. Saudi Arabia is also a possible contender for membership but has not yet officially joined.

If Saudi Arabia is included in the group, Rousseff stated that BRICS is poised to command more than 40% of global crude oil production, while its population will amount to almost half of the world’s total.

This is a formidable grouping of nations, unified now by the quest to form a multi polar world of currency exchange in capital and trade settlements. This is a direct challenge to the global dominance of the US Dollar that has existed since the Bretton Woods Agreement of 1944 which placed the US Dollar at the centre of currency exchange.

The BRICS multi polar currency world will eventually come but it won’t be a rapid transition in BOOM’s opinion. BOOM has often stated that US Dollar dominance will slowly decline but will persist for another 50 – 100 years. US Dollar dominance puts the USA in a strong position. They can demand that they pay for their imported goods and services with US Dollars and they can, likewise, demand payment in their currency for any goods and services that they export. This is a very powerful dominance which the US is unlikely to give up easily. Offshore, US Dollar denominated loans also contribute to dominance in currency volumes.

Here is a chart of the US Dollar Index over the last 5 years. There is no sign of weakness. In fact, the US Dollar has generally strengthened throughout this period.

US DOLLAR INDEX over 5 years

CHINA AND THE BALKAN PENINSULA – RESOURCES, CONSUMERS AND LABOUR

BOOM has written about China, Greece and the Balkan Peninsula previously.

On 7th March 2021, BOOM wrote -- “China has a demographic problem with insufficient labor now and in the future. This was caused by a big economic mistake that China made known as the One Child Policy which spanned 35 years from 1979 to 2015. This caused a labour shortage of about 30 - 50 Million over the next 2 decades. Maybe more.”

ONE CHILD POLICY

BOOM again from 2021: “This demographic policy mistake has resulted in a delayed labour shortage inside China and a gap in domestic consumer demand. The Chinese government is aiming to solve this problem by using labour forces in places like the Balkans. There are easily 30 to 50 million well educated, under employed people in the region but the unemployment in those areas is terrible. China’s relationship with Greece is the first big step. They own the port of Piraeus in Athens and they have established a commercial banking operation there with a banking license.”

The Balkans is a reference to the Balkan mountains and the Balkan peninsula. It includes Albania, Bosnia and Herzegovina, Bulgaria, Greece, Kosovo, Montenegro, North Macedonia, European Turkey, most of Serbia and large parts of Croatia. Sometimes the term also includes Romania and southern parts of Slovenia.

China’s expansion into the Balkans will give them millions of future consumers and an educated workforce close to Western Europe. But it is not just the labor force and the future consumption that China is interested in. The Western Balkans, in particular, is richly endowed with mineral resources such as copper, chromium, lead, zinc, gold, lithium, antimony, selenium and nickel. It boasts some of the largest deposits in Europe. There are a number of already existing mines producing copper, nickel, zinc and gold in the region which provide a useful footprint of mining activity. Infrastructure is relatively good, and the workforce is skilled and educated, especially compared with some other mining target regions. In Serbia, for example, there are no restrictions on foreign ownership or government participation or restrictions on flow of capital.

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Thanks for reading BOOM Finance and Economics Substack.

Subscribe for Free to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.