BOOM Finance and Economics 19th November 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

CHINA GROWTH CONTINUES TO SLOW – A POSITIVE SIGN FOR STOCKS AND BONDS

HYDROGEN THE FUEL OF THE FUTURE?

HYDROGEN COMPANIES AND ETFs

CLEAN ENERGY – EXCHANGE TRADED FUNDS

CLEAN ENERGY SUPERPOWERS? — ARE THEY INSANE?

IN SPITE OF ALL THE WARNINGS — FOSSIL FUEL PRODUCTION JUST KEEPS RISING

GOVERNMENTS TO THE RESCUE?

DO FOSSIL FUELS EXIST? METHANE ON SATURN’S MOON?

TESTIMONY FROM A READER

"Boom’s finance and economics views are based on experience and wisdom, both of which are sadly lacking in today’s narrow-analysis focused commentary."

CHINA GROWTH CONTINUES TO SLOW – A POSITIVE SIGN FOR US STOCKS AND BONDS

BOOM often refers to a special (unrevealed) indicator which has proven reliability in predicting the progress of the Chinese economy. That indicator has been falling for 12 months now. There was a positive reaction phase that lasted from March to June. BOOM mentioned this to readers at the time. However, during the last 4 months, the indicator has again been heading South in a determined fashion. This means that China’s economic growth is definitely slowing. The economy is still growing but at lower rates than has been the case over the last two decades. And, ominously, this slowing of growth appears to be from lack of demand from its Western client economies.

China’s GDP growth has averaged between 5 – 10 % annually since the turn of the century, a stellar performance. However, BOOM is expecting 4th quarter growth to be below 5 % and perhaps well below that figure.

CHINA GDP GROWTH THIS CENTURY

All of this suggests that US and European economic growth is slowing even faster than China. The recent, persistent falls in the price of West Texas Crude Oil over the last MONTH also suggests a significant fall in economic demand.

WEST TEXAS CRUDE OIL — OVER 3 YEARS

If growth is slowing fast, then CPI inflation should continue to fall in the West. If so, in the coming months, the Federal Reserve should hold their rates steady and asset prices should increase as per BOOM’s expectations outlined two weeks ago on 5th November --

“In summary, BOOM is expecting US investors to become more aggressive here in buying all financial assets. If so, a new Bull market especially in stocks but also in bonds will be confirmed if (and when) the S & P 500 stock Index rises above 4,600.”

S & P 500 STOCK INDEX — OVER 3 YEARS

Since BOOM published that forecast, the US stock and bond markets have been on fire with buyers anxious to buy at current prices. Real property REITs have also responded. US Bond market strength has been particularly noteworthy right across the board in treasuries, municipals, investment grade corporate and junk bond sectors. The market is screaming at us that US Yield Curve correction is coming which means that short term interest rates must fall to fulfil those expectations.

Long term BOOM readers will recall that 12 months ago, when doom and gloom analysts reigned supreme, BOOM made this forecast on October 15th 2022 --

“So, overall, the inflation statistics and retail sales figures were a good result, offering some firm evidence that the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here”

HYDROGEN THE FUEL OF THE FUTURE?

After last week’s analysis of the alternative energy and electric car industries, readers asked BOOM to look at Hydrogen as the promised “energy of the future”. The result was not dissimilar to what BOOM outlined last week. Investors are fleeing from companies that specialise in developing Hydrogen as an energy alternative. They are voting with their wallets. Thus, Hydrogen companies will struggle to raise capital in future. The energy “revolution” may already be over, failed from lack of sufficient funding. BOOM is not surprised, having seen BMW’s first Hydrogen powered car in mothballs over 10 years ago at the BMW factory and museum in Munich.

PLUG POWER – THE LEADER IN HYDROGEN

Plug Power calls itself “the leader in building an end-to-end green hydrogen ecosystem to “decarbonize” the economy”.

In a filing to the U.S. Securities and Exchange Commission on November 9th, the company said its existing cash “will not be sufficient to fund its operations through the next twelve months.”

Plug Power also warned that lack of funding creates a "substantial doubt about the company's ability to continue as a going concern." Supply chain disruptions and the cash burn rate are obviously problematic.

The company website explains that it produces carbon-free “green” hydrogen using renewable electricity and water. It has deployed 60,000 fuel cell systems, over 180 fueling stations (more than anyone else in the world) and is the largest buyer of liquid hydrogen. Its fuel cell technology is used in more than 40,000 vehicles worldwide. Plug (reportedly) operates a state-of-the-art “Gigafactory” (whatever that is) to produce electrolyzers and fuel cells, and is commissioning multiple green hydrogen production plants that will yield 500 tons of liquid green hydrogen daily by year end 2025. It expects to produce 2,000 tonnes of green hydrogen per day by 2030.

At its peak in 2021, the company had a market cap of US$35 Billion. Now it's at just over US$2 Billion. The company had announced it expects $1.2 Billion in revenue this year. It also expects revenue to grow to $6 Billion in 2027 and $20 Billion by 2030.

However, Plug Power posted weaker-than-expected third quarter sales of US $199 Million. It described "unprecedented hydrogen supply challenges" in the north American hydrogen market.

The company has now announced its intention to raise debt or to issue new shares to raise equity finance. "The Company’s plan includes various financing solutions from third parties with a particular focus on corporate level debt solutions, investment tax credit related project financing and loan guarantee programs, and/or large scale hydrogen generation infrastructure project financing".

RELUCTANT INVESTORS

Investors appear reluctant to hold shares in Hydrogen companies. Here are example share price charts of companies that specialise in Hydrogen (excluding large conglomerates such as Linde, Air Products and Siemens Energy that have Hydrogen divisions amongst many others).

All charts are over a 5 year period from Stockcharts.com The red lines are drawn by BOOM.

Plug Power leads the way. BOOM has included each company’s description from their website in italics.

PLUG POWER STOCK CHARTS

Plug, the leader in building an end-to-end green hydrogen ecosystem that addresses every step of operations, is proud to offer its customers cost-effective green hydrogen, which is quickly becoming the molecule of choice for customers both large and small.

FCEL – FUEL CELL ENERGY

At FuelCell Energy, we're helping deliver a more sustainable future by decarbonizing power and producing hydrogen around the world. Our platforms can help businesses and communities with power generation, carbon capture, hydrogen production, and energy storage.

BE – BLOOM ENERGY

When power is resilient, sustainable, and predictable, there’s no limit to what you can do. See how Bloom Energy is helping power a better future for all. Powering our planet with resilient, sustainable, and predictable energy is the defining challenge of our time. Bloom empowers businesses and communities to take charge of their future with abundant, clean energy without compromises.

FHYD.V – FIRST HYDROGEN

First Hydrogen is a unique opportunity to invest in a ground-up, closed loop, green hydrogen solution, targeting both (hydrogen) supply & (zero emissions vehicles) demand. First Hydrogen is removing adoption barriers for zero emission fleets with its fully integrated, green hydrogen centric solution. We are creating scalable and replicable eco-systems for rapid expansion in attractive markets primed for high growth.

CH.V – CHARBONE HYDROGEN

CHARBONE is a company that develops and produces hydrogen-powered vehicles and solutions for various applications. Learn how hydrogen can be a clean and affordable energy source for the future of transportation, industry and heating. Faced with climate change and the energy transition, using proven and bankable technologies, CHARBONE considers that the adoption of technological solutions using green hydrogen, supported by renewable energies, is one of the best ways to counter these changes. The group is fully committed to the energy transition planned until 2030 and the decarbonization of our planet.

MOVE.NE – Power Tap Hydrogen Capitalisation

Aiming to Build an Extensive Network of Hydrogen Fueling Stations Hydrogen. Made right at the pump. No distribution infrastructure, no expensive off-site production plant, just convenient, low cost hydrogen– on demand. The PowerTap fuelling station is a proven technology with 14 of the previous generation’s units (PowerTap does not own nor have any financial interest in these units) installed across the US.

HGEN.L -- HydrogenOne Capital Growth

HydrogenOne’s investment objective is to deliver an attractive level of capital growth by investing, directly or indirectly, in a diversified portfolio of hydrogen and complementary hydrogen focused assets whilst contributing to climate change mitigation by integrating core ESG principles into its decision making and ownership process.

HYDR – GLOBAL X HYDROGEN ETF

HJEN --- Direxion Hydrogen ETF

HDRO – Defiance Next Gen H2 ETF

CLEAN ENERGY – EXCHANGE TRADED FUNDS

“Clean Energy” ETF’s (Exchange Traded Funds) also show similar share price patterns --sobering, to say the least. They are often invested in many companies across all alternative energy sectors. However, some specialise in solar or wind, for example.

ICLN – Global Clean Energy ETF

TAN – Solar ETF

QCLN – Clean Edge Green Energy Fund

PBW – Wilderhill Clean Energy ETF

ACES – ALPS Clean Energy ETF

CNRG – Kensho Clean Power ETF

FAN – Global Wind Energy Index Fund

PBD – Invesco Global Clean Energy ETF

RNRG -- Global X YieldCo Index ETF

FRNW -- Fidelity Clean Energy ETF

RAYS – Global X Solar ETF

SOLR – Sustainable Energy ETF

CLEAN ENERGY SUPERPOWERS? -- ARE THEY INSANE?

Investors have clearly decided to leave these “opportunities” in Hydrogen and Clean Energy. That is the overwhelming conclusion.

Having considered all of this information, please read these quotes from prominent politicians and mainstream media journalists and ask yourself some pertinent questions.

The UK Prime Minister, Rishi Sunak, recently said: “We need to move further and faster to transition to renewable energy, and I will ensure the UK is at the forefront of this global movement as a clean energy superpower.”

And here’s a quote from the UK opposition – the Labour Party’s 2024 promises to Britain:“Labour’s fourth mission in Government will be to make Britain a clean energy superpower. We will make energy cheap and secure, so that the British public never again face spiralling bills; boost jobs and investment in every region and nation of the country; and grow our economy from the bottom up and the middle out.”

Australia’s Minister for Climate Change and Energy recently explained: “Our Government is laying out the road map for our nation to become a renewable energy superpower”.

And the Australian Treasury proudly announced: “The Albanese Government’s second Budget will help to unlock Australia’s potential as a renewable energy superpower with significant investments in clean energy industries and jobs.”

In April, the Economist magazine ran a headline “America’s chance to become a clean-energy superpower”. The article went on to describe the promise of Hydrogen and Plug Power. Nuff said. Another article in October last year asked “Will India become a Green Superpower?

The Financial Times in London recently ran a similar headline “The US plan to become the world’s cleantech superpower”.

Are these people miss-informed? Misled? Deluded? Naïve? Overly optimistic? Controlled? Do they think they have super powers like Superman and Superwoman?

Are they telling lies for political gain? Or, are they completely insane?

IN SPITE OF ALL THE WARNINGS — FOSSIL FUEL PRODUCTION JUST KEEPS RISING

For 30 years now, the idea of global warming has become a warning delivered by some politicians, journalists and some scientists. They warn that the globe is doomed unless we reduce our use of Hydrocarbons – the fossil fuels of oil, gas and coal. “Do as we say or else” is the essence of the message. However, despite all the warnings, it appears that this is having little effect. This diagram shows that the production of oil, gas and coal just keeps rising. That is the reality we all have to deal with. Why? Because fossil fuels are used in food production, heating, cooling and transport and the world’s population has steadily risen towards 8 Billion.

Fossil fuels are also used to produce most electricity which is used in manufacturing products and in providing services for those 8 Billion people.

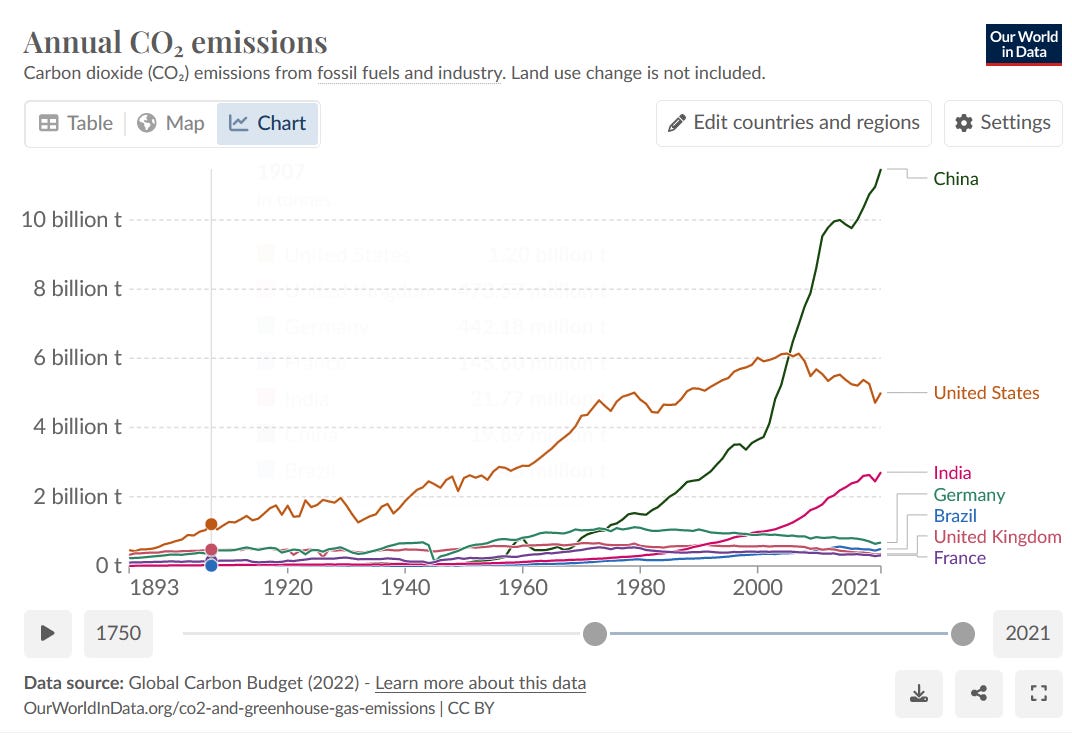

And Annual CO2 emissions keep rising in China and India – where most of the manufacturing takes place.

GLOBAL CO2 EMISSIONS

COAL PRODUCTION – GLOBAL

OIL PRODUCTION — GLOBAL

GAS PRODUCTION — GLOBAL

GOVERNMENTS TO THE RESCUE?

Over one thousand years ago, the ancient Greeks discussed climate change. Over 200 years ago, Joseph Fourier, a French mathematician proposed that the Earth’s atmosphere could (possibly) change the climate. Then, soon afterwards, Charles Fourier, another Frenchman, economist and founding father of utopian socialism warned that the Earth’s oceans would one day “become like lemonade”. And, way back in 1896, the Swedish scientist Svante Arrhenius became the first person to imagine that humanity could (possibly) change the climate on a global scale. The term “global warming” was born in the 1950’s and has become a commonplace theory since then, recently replaced by the term climate change.

However, this is all theory without deductive proof. Inevitably, we must deal with cold, hard economic reality. That reality may include the fact that the quest to find suitable, commercially viable, alternative energy sources (excluding nuclear power) to run the modern, comfortable world we live in may prove to be a bridge too far. Private enterprises in “renewable” energy may discover that there can be no profit at the end of that particular rainbow. Certainly, at present, they appear to be drowning in a sea of red ink and unable to raise sufficient risk capital, possibly proving that commercial viability is an impossible dream. In other words, economic viability at present living standards may be ultimately tied to fossil fuel use combined with a huge increase in nuclear power. BOOM has yet to see a solar powered jumbo jet or a battery powered blast furnace.

If commercial ventures fail, heavily indebted governments with massive budget deficits will then have to somehow fund their promises of energy transition from their empty coffers. (A coffer is a large, strong box in which money or valuable objects are kept.)

And the economies they are seeking to “save” may be unable to support such dreams. For without abundant energy dense fossil fuels and nuclear power, the advanced economies we enjoy will simply contract under their own weight.

That will be a hard lesson. Theory is one thing. Economic reality is another.

DO FOSSIL FUELS EXIST? METHANE ON SATURN’S MOON?

BOOM is certainly no expert in geology but is intrigued by the theories concerning the origin of so-called “fossil fuels”. It is controversial, believe it or not. If you don’t agree, look up the term “abiotic oil” and then “abiogenic oil”. Those theories originate from the idea that insufficient dinosaurs, trees and other biologicals sacrificed themselves aeons ago to provide the vast supply of energy dense hydrocarbons that we today call oil, coal and gas.

Hydrocarbons actually exist on extra-terrestrial bodies like Saturn's moon Titan. This indicates that hydrocarbons can be produced naturally by inorganic means (no dinosaurs required). Interestingly, Titan also has active weather, including possible cyclones and radar data from the Cassini spacecraft has also detected a number of “oceans” on Titan. Ligeia Mare, Titan's second-largest ocean, is made up of methane. Methane is a Hydrocarbon gas. Dead dinosaurs or plant fossils appear an unlikely cause in that distant location.

For readers interested in this theory, BOOM can suggest this extensive review of the subject in this Paper —

Deep-seated abiogenic origin of petroleum: From geological assessment to physical theory

It is available at Reviews of Geophysics — published in 2010

https://agupubs.onlinelibrary.wiley.com/doi/full/10.1029/2008RG000270

The authors include this note — “For the historical perspective on the debate surrounding the theory, we refer the interested reader to Glasby [2006]. Our review aims to support the theory of the abyssal abiogenic petroleum origin.”

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions.

BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.