BOOM Finance and Economics 1st October 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

THE BIG THREE — POTENTIALLY FALSE NARRATIVES OF THE FUTURE

Over the last few weeks BOOM has examined investors apparent and observable enthusiasm for selling shares in alternative energy companies and in pharmaceutical companies that produce mRNA Technology (Covid “vaccines”). Today, we look at the promise of Artificial Intelligence and the shares and ETF’s involved in that arena.

These are the big three “industries” of the future which are promoted endlessly by the mainstream media and the political class in unison. They appear to be mesmerised by the promises made for these three prospective technologies and insist that our lives will be hugely influenced by them.

mRNA Technology is supposedly going to revolutionise the world of healthcare and pharmaceuticals.

Alternative energy companies are supposedly going to revolutionise the way we create energy to power our complex societies.

Artificial Intelligence is supposedly going to revolutionise everything.

However, BOOM smells a rat. After initially being attracted to the three Wunderkind technologies, investors in all three have decided to sell out and the downtrends in prices are obvious to anyone who cares to take note. The future appears not to be what the mainstream media and the politicians are promising. BOOM suspects that all three technologies will be found wanting in the fullness of time. The term over-hyped springs to mind.

ALTERNATIVE ENERGY – THE FUTURE?

In the BOOM editorial a few weeks ago, dated 10th September, we displayed the share price graphs for a selection of large renewable energy companies. Almost all of them were in steady downtrends that began about two and a half years ago. Most were down over 50 % from their peak share prices when those downtrends began. The clear message is that investors are selling out, persistently. They do not believe the promises for alternative energy.

That seems strikingly opposite to what we are being told by our politicians and by the mainstream media. They scream at us in almost every speech and in every news bulletin -- “The future is in alternative energy” (!). “Net Zero is our goal”. “We must save the planet from global warming”. “It is a climate crisis, a climate emergency”. And there is not just global warming to worry about (according to them). We are apparently now at “global boiling” point, according to the unelected officials at the United Nations.

Saving the world from catastrophe has become one of the three Wunderkind obsessions.

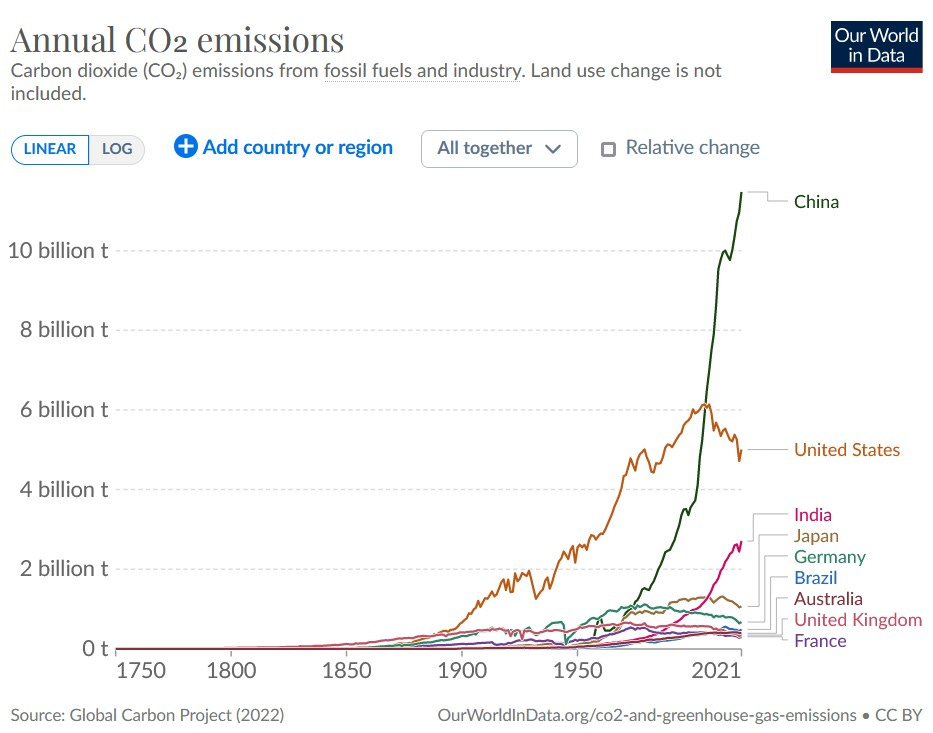

If we compare nations based upon their CO2 Emissions from fossil fuels and industry since industrialisation began over the last 200 years, we can see that China produces much more CO2 than any other nation. Most advanced Western economies are way lower.

In 2021 …

China produced 11.5 Billion Tonnes of CO2

United States produced 5 Billion Tonnes of CO2

India produced 2.7 Billion Tonnes of CO2

Germany produced 0.77 Billion Tonnes of CO2

Brazil produced 0.67 Billion Tonnes of CO2

Australia produced 0.4 Billion Tonnes of CO2

United Kingdom produced 0.336 Billion Tonnes of CO2

France produced 0.306 Billion Tonnes of CO2

In other words, in 2021, the advanced Western economies of the US, India, Germany, Brazil, Australia, the UK, and France COMBINED produced 10.2 Billion Tonnes of CO2 which was much less than what China produced alone.

If you add that other major industrialised nation, Japan (another 1 Billion Tonnes), the combined total is still not greater than China.

The total for the entire World is 37 Billion Tonnes. If all of the industrialised nations (excluding China and the USA), stopped all economic activity relating to CO2 emissions overnight, then the number would be reduced by 45 %. However, 5 Billion people would be crushed into poverty and starvation overnight. Not such a good outcome.

While this is all happening and is duly reported on by the mainstream media, investors continue to steadily sell out of companies that are going to (presumably) save the Earth and profit from all of this government and media hype. Investors have not swallowed the bait.

To see a selection of large alternative energy companies in long term share price decline, you can go back to BOOM’s editorial dated 10th September.

Here is one — which is typical of the sector —

Reference: https://boomfinanceandeconomics.substack.com/p/boom-finance-and-economics-10th-september

ARTIFICIAL NON INTELLIGENCE — THE FUTURE?

Let’s look at the other (presumed) major phenomenon of the future – Artificial Intelligence (AI). We are being told that it is wonderful; so clever that most jobs will be replaced by computerised robots that can run things much better than human beings.

On March 28th, the BBC – which is either a trusted news service or a major propaganda outlet (take your pick), announced in a headline “AI could replace equivalent of 300 million jobs ”.

The article referred to a report by the New York based investment bank, Goldman Sachs. Despite 300 million jobs lost, somehow, as if by magic, the forecast is that there will be increased economic growth. “It could eventually increase the total annual value of goods and services produced globally by 7% due to “higher-productivity work and cheaper-to-run services”.

There were some outbursts of honesty in the article. Here is someone being humble – a rare thing in the mainstream media -- "The only thing I am sure of is that there is no way of knowing how many jobs will be replaced by generative AI," said Carl Benedikt Frey, future of-work director at the Oxford Martin School, Oxford University.

However, if the hype is correct and the economic future is going to be boosted by Artificial Intelligence, then perhaps we should see a huge surge in investors’ interest in the AI sector? Let’s look at some of the companies and ETFs that are representative of that golden, profitable future.

The Share price patterns of all these companies and ETF’s over the last 5 years look strikingly similar. They all experienced strong buyer interest from 2020 to 2022. However, since January 2022, investors appear to be (generally) bailing out with sellers overwhelming buyers steadily over time.

There has been one ray of hope in the AI space – a company called NVIDIA. It makes the hardware and the software required for the anticipated huge increase in demand for AI. However, what if that “demand” does not eventuate in the future? If so, perhaps Nvidia is overvalued for a future that is just not coming?

ARTIFICIAL INTELLIGENCE -- JUST A TASK MANAGER

BOOM regards Artificial Intelligence as a dedicated Task Manager. In other words, given excellent instruction, it can perform tasks in minutes that would take a gifted, well trained human weeks or months to achieve. However, there is a sameness to what it produces and it is biased in favour of official government narratives. In other words, it is “woke”. Or perhaps “WOKE”.

If AI is asked to solve a complex, evolving real world problem which is continually changing over time due to feedback loops, multiple variables and uncertainty of (and from) external inputs then it simply cannot do the task. Why? Because that involves (1) sequential probability analyses over time, (2) an operator who can entertain many possible outcomes all at once plus (3) the continual production of hypotheses and (4) an abductive logic approach using selected testing of those hypotheses to (5) re-arrange the probabilities of each conclusion – over and over again -- all in real time. Human beings can do this.

Think of a simple example – a malfunctioning car being driven through a violent and unpredictable storm on a poor road in very poor lighting conditions. Another example would be the well known bird strike that occurred in New York of both engines on take off where a (human) pilot was able to quickly calculate, in an instant, the most likely probability of survival and the sequence of required actions by landing on the Hudson River nearby. He made hundreds of decisions as the event unfolded. And, remember, all passengers and people on the ground in Manhattan that day survived that test. An AI computer pilot would have been hard stretched to perform such a miracle of flying as far as BOOM can tell. Captain Sully Sullenberger was the human being who performed that task.

COMPUTER MODELLING CAN BE GARBAGE IN GARBAGE OUT

Someone asked BOOM in an interview recently – “Which school of economic theory does BOOM follow? Keynesian or Austrian”? BOOM’s answer was “Neither – they are both intellectually bankrupt”.

Based upon these so-called “schools” of economic theory, economic modelling appears to work well in a classroom. However, once the door is opened and the real world is encountered, neither can explain the future course of events reliably.

The most famous recent example of computer modelling worth examining in detail occurred at the start of the Covid Non Pandemic in 2020. The American Institute for Economic Research published an article on this on April 22nd 2021, called “The Failure of Imperial College Modeling Is Far Worse than We Knew”. Some quotes are worthy of attention when considering the subject of computer modelling.

QUOTE: “Neil Ferguson, the physicist at Imperial College London who created the main epidemiology model behind the lockdowns …….. predicted catastrophic death tolls back on March 16, 2020 unless governments around the world adopted his preferred suite of nonpharmaceutical interventions (NPIs) to ward off the pandemic.”

“Ferguson’s team at Imperial would soon claim credit for saving millions of lives through these policies – a figure they arrived at through a ludicrously unscientific exercise where they purported to validate their model by using its own hypothetical projections as a counterfactual of what would happen without lockdowns.”

“Just over one year ago, the epidemiology modeling of Neil Ferguson and Imperial College played a preeminent role in shutting down most of the world. The exaggerated forecasts of this modeling team are now impossible to downplay or deny, and extend to almost every country on earth. Indeed, they may well constitute one of the greatest scientific failures in modern human history.”

Readers can make up their own mind if they read the whole article. BOOM disagrees with the final statement. There was certainly no science involved. Wild conjecture yes. False assumptions, yes. But scientific method, no. The article can be found here:

https://www.aier.org/article/the-failure-of-imperial-college-modeling-is-far-worse-than-we-knew/

GEOPOLITICAL EARTHQUAKE – CHINA SYRIA STRATEGIC PARTNERSHIP

Last week President Bashar Al-Assad of Syria visited China and was welcomed by the President Xi Jing Ping.

Xi announced -- "Today, we will jointly announce the establishment of the China-Syria strategic partnership, which will become an important milestone in the history of bilateral relations".

"Faced with an international situation full of instability and uncertainty, China is willing to continue to work together with Syria, firmly support each other, promote friendly cooperation, and jointly defend international fairness and justice".

Assad replied -- "This visit is important in its timing and circumstances, as a multipolar world is being formed that will restore balance and stability to the world".

Assad also made a pointed comment that China’s foreign policies were “ based on the independence of countries, respect for the will of the people, and rejection of terrorism."

Three cooperation agreements were signed in the fields of economic cooperation and development, as well as a Memorandum of Understanding (MoU) "on the common context of a cooperation plan within the framework of the Belt and Road Initiative (BRI)."

That is a Geo-political earthquake right there. A slap in the face to Imperial Washington DC. It is proof that the bulk of the Middle East has decidedly joined the BRICS group of nations — Iran, UAE, Syria, Saudi Arabia.

In economics, things work until they don’t. Do your own research. Make your own conclusions.

BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.