BOOM Finance and Economics 21st July 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and (for very long term archive) Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

INTEREST RATE CUTS COMING

US LISTED PROPERTY INVESTMENTS SURGING

FOCUS ON UKRAINE DEBT

IS THE HYDROGEN DREAM OVER ALREADY?

THE END OF THE NICKEL INDUSTRY IN AUSTRALIA?

THE HINDENBURG AIRSHIP WAS FILLED WITH HYDROGEN IN 1937

IT CRASHED SPECTACULARLY

INTEREST RATE CUTS -- US LISTED PROPERTY INVESTMENTS SURGE

Interest rate cuts are expected in both the United States and in Western Europe in the coming months as CPI inflation rates continue to fall.

On June 6th, the European Central Bank lowered its key interest rates by 25 basis points and made the following announcement --

“The Governing Council today decided to lower the three key ECB interest rates by 25 basis points. Based on an updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission, it is now appropriate to moderate the degree of monetary policy restriction after nine months of holding rates steady. Since the Governing Council meeting in September 2023, inflation has fallen by more than 2.5 percentage points and the inflation outlook has improved markedly.”

The European Central Bank (ECB) announced on Thursday last week that it left key rates unchanged following the July policy meeting, as expected. The key interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility are now set at 4.25%, 4.5% and 3.75%, respectively.

BOOM feels that these interest rate levels are far too high for the economic predicament that Western Europe now finds itself in with the major threat not being inflation but falling economic growth or stagnation.

There are firm expectations in the financial markets that both the ECB and the US Federal Reserve will cut rates again in September.

The US Bond markets are showing a clear pattern which reveals what investors think. The major Bond ETFs in the US are all surging higher. For those who don’t know, Bond prices surging higher indicate an environment of falling interest rates. Time to examine a few charts.

Bear in mind what BOOM wrote way back on 16th October 2022 when BOOM saw the peak of CPI inflation and wrote -- " the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here". US stock prices started rising 2 days later and US bond prices started rising 5 days later.

The US Bond markets as reflected in a range of ETFs -- Over 3 Years

JNK – High Yield Bonds ETF (sometimes called “Junk Bonds” although that is often a misnomer)

CORP – Investment Grade Corporate Bonds

MUNI – Municipal Bonds

BND – Total Bond Market ETF

TLT – 20 Year Plus US Treasury Bonds ETF

Treasury Yields below 12 months are beginning to show a consistent pattern of flat to falling yields. The yields began to flatten around October 2022 when BOOM made the above statement. Now, they appear to have begun the journey South. BOOM expects this trend to gain strength over the next 6 months.

$UST1Y — One Year US Treasury Yield

$UST6M — Six Month US Treasury Yield

US YIELD CURVE — US TREASURIES

The inversion of the US Yield Curve is slowly correcting back to a more positive shape. BOOM expects the short end to fall steadily now so that the curve can attain a more normal stance. That will be a strong positive for the health of the US financial system.

US PROPERTY INVESTMENTS SURGING

In response to the expectations of lower interest rates, investors have begun increasing their exposure to listed US Property investments. For very large investment funds, this will involve a steady increase in weighting to property versus bond and equity holdings as 2024 unfolds.

Here are some charts of a selection of the largest US Property ETF’s, based upon Assets Under Management (AUM). All of these ETF’s are in the Top 10 for size based on AUM. The move towards increased property exposure began in October 2023.

CHARTS – OVER 5 YEARS. All listed on the New York Stock Exchange. All of these ETF’s are seeking higher valuations since October 2023.

VNQ – Vanguard Real Estate ETF

RWR – Dow Jones REIT SPDR ETF

SCHH – Schwab US REIT ETF

XLRE – Real Estate Select Sector SPDR Fund

IYR – iShares US Real Estate ETF

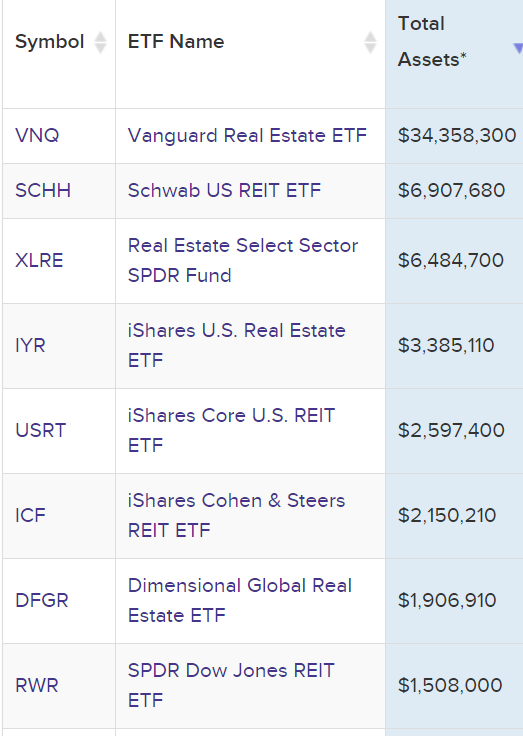

Here is a list of the largest Top 10 US Real Estate ETF’s. It shows the sum total of Assets Under Management (AUM)

LIST – US REAL ESTATE ETFs — Top 8 on AUM (Assets in Thousands of USDs) —

Source — e.g. VNQ = $ 34.358 Billion AUM

https://etfdb.com/etfdb-category/real-estate/

FOCUS ON UKRAINE DEBT — UKRAINE’S DEBT SITUATION – SOLVED (?)

The Ukrainian government announced in mid June that it had failed to reach an agreement with a group of foreign bondholders on restructuring Ukraine’s $20 Billion in Eurobonds. Those bond holders included US financial giants Black Rock and Pimco.

In February 2022, the bondholders had granted Ukraine a two-year debt freeze in view of the conflict with Russia. But that agreement will end in August, and the bondholders were anxious for Kiev to begin paying interest on its debt again. Ukraine could end up in default if it failed to make those interest payments and such a failure would damage the country’s credit rating dramatically, thereby reducing its ability to borrow in the future.

Hey Presto (!) – Problem Solved (?) -- But Russia Unhappy

A report came in on Friday last week stating that Euroclear will transfer 1.55 Billion Euros to Ukraine in July. Those funds are derived from the interest income generated from frozen Russian assets. Euroclear's total interest earnings from those assets reached 4 Billion Euros in January-July 2024.

These funds will allow Ukraine to meet its interest payments in August and into the future.

“In July 2024, Euroclear will make a first payment of €1.55 billion to the European Fund for Ukraine following the recent implementation of the EU regulation on the windfall contribution,” Euroclear said in a statement.

This decision follows months of deliberations among EU and G7 nations about how to use US$ 300 Billion of assets belonging to Russia’s central bank that were immobilised as part of Ukraine-related sanctions.

Since the start of the conflict, the World Bank and IMF have provided more than $85 Billion in state budget financing to Kiev, according to Reuters. And Ukraine has also become by far and away the top recipient of US Government foreign aid. Since the war began, the US Congress has voted through five bills that have provided Ukraine funds. The most recent one was in April 2024. The total budget authority under those bills is US$ 175 Billion.

The total value of Australia's overall support to Ukraine has been $1.3 Billion. And the European Union (EU) will contribute up to 50 Billion Euros in grants and loans for the period 2024-2027 under the Ukraine Facility.

So, with the support of these Western nations, Ukraine will avoid default on its sovereign Bonds and the Bond holders will remain content.

Russia is, of course, unhappy with the confiscation of its interest payments by Euroclear. Some G7 members, such as the US and the UK, have been pushing for the outright seizure of Russian assets. But concerns over the legality of such a move has led to a decision to use the interest generated by the funds instead.

Russia has repeatedly said that any actions taken against its assets would amount to “theft,” insisting that seizing the funds or similar moves would violate international law and lead to retaliation. Kremlin spokesman Dmitry Peskov warned recently that “illegal attempts to rob the Russian Federation” would cause huge damage to the international financial system.

Of course, the BRICS nations and the nations which are members of the Shanghai Cooperation Agreement will all be very concerned about this development.

The BRICS group of nations which began cooperation in 2006 includes:

Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates.

The Shanghai Cooperation Organisation Group of nations which is now 30 years old includes --

Membership

Belarus

China

India

Iran

Kazakhstan

Kyrgyzstan

Pakistan

Russia

Tajikistan

Uzbekistan

Observers:

Mongolia

Dialogue partners:

Armenia

Azerbaijan

Bahrain

Cambodia

Egypt

Kuwait

Maldives

Myanmar

Nepal

Qatar

Saudi Arabia

Sri Lanka

Turkey

United Arab Emirates

BOOM is of the view that the international piracy of financial assets can only be described as theft and that this will damage the future of the Western financial system in the long run. Trust is the glue of finance and trade. Without it, there can be no finance or trade.

This destruction of financial trust will (eventually) weaken US and Euro currency dominance in global trade and capital settlements. And it will allow nations to move between two camps – the West versus the BRICS/Shanghai Cooperation Group of nations.

IS THE HYDROGEN DREAM OVER ALREADY?

FORTESCUE SACKS 700 WORKERS

Andrew Forrest is a Billionaire, Australia’s richest man. His iron ore mining and production company, which contains the bulk of his wealth, Fortescue Limited has a current market capitalisation of $ 67.8 Billion. The company runs a successful iron ore business but has been planning to become a global leader in so-called Green Hydrogen energy. Forrest has been a staunch supporter and promoter of the “Green revolution” but especially in regard to Hydrogen where (apparently) further fortunes can be made. “The more you use Hydrogen the cheaper it becomes”. Forrest has been investing in massive solar farms to lay the groundwork for Fortescue Future Industries with the stated aim of producing 15-million tonnes of “green hydrogen” a year by 2030.

However, last week, the company announced plans to cut 700 staff and appears to be backing away from some of its claims concerning this new, alternative energy source. The job losses seem to be coming from the company’s Hydrogen division.

Fortescue has 4 major Hydrogen projects in Brazil, Norway, Australia and the USA. In regard to the job cuts, Forrest said that the company had to remain “lean and impactful”.

BOOM covered the Hydrogen energy sector in the BOOM editorial dated November 18th, last year – just 8 months ago. This is what BOOM had to say --

“After last week’s analysis of the alternative energy and electric car industries, readers asked BOOM to look at Hydrogen as the promised “energy of the future”. The result was not dissimilar to what BOOM outlined last week. Investors are fleeing from companies that specialise in developing Hydrogen as an energy alternative. They are voting with their wallets. Thus, Hydrogen companies will struggle to raise capital in future. The energy “revolution” may already be over, failed from lack of sufficient funding.”

At the time, BOOM looked at a number of specialist Hydrogen Energy companies listed on US, UK and Canadian stock exchanges. Here is the list.

Plug Power, FuelCell Energy, Bloom Energy, First Hydrogen, Charbone Energy, Power Tap Hydrogen, Hydrogen One, Global X Hydrogen, Direxion Hydrogen.

All of the share charts of those companies were showing dramatic downtrends in price in November. Long term readers will remember those dramatic charts.

Let’s see what has happened in just 8 short months since BOOM’s November review--

PLUGPOWER Shares – a 44 % fall in 8 months since November

The share price was $ 4.00 in November. It is now just above $ 2.50 representing a 37.5 % loss of capital for buyers who entered in November.

But just 2 weeks ago, the shares traded at $ 2.25. That represented a loss in price of approximately 44 % in just 8 months. A disastrous result for long suffering shareholders.

Here is the 5 year chart of Plug Power’s shares. It is not a pretty sight. You can see the decline since November 2023 in this chart. But the overall fall from a High of $ 75 to just $ 2.52 is dramatic. This looks like a one way trip.

PLUG fell over 18 % in last week’s trading

From Plug Power’s website -- “Plug’s customer demand for hydrogen has grown by 10 times in five years — nearly a 200% annual growth rate. And now, in the face of extraordinary global regulatory tailwinds, more industrial users believe that green hydrogen is a solution to their toughest climate and operational challenges”.

Sounds promising? Investors appear to have taken another view of the future for Hydrogen.

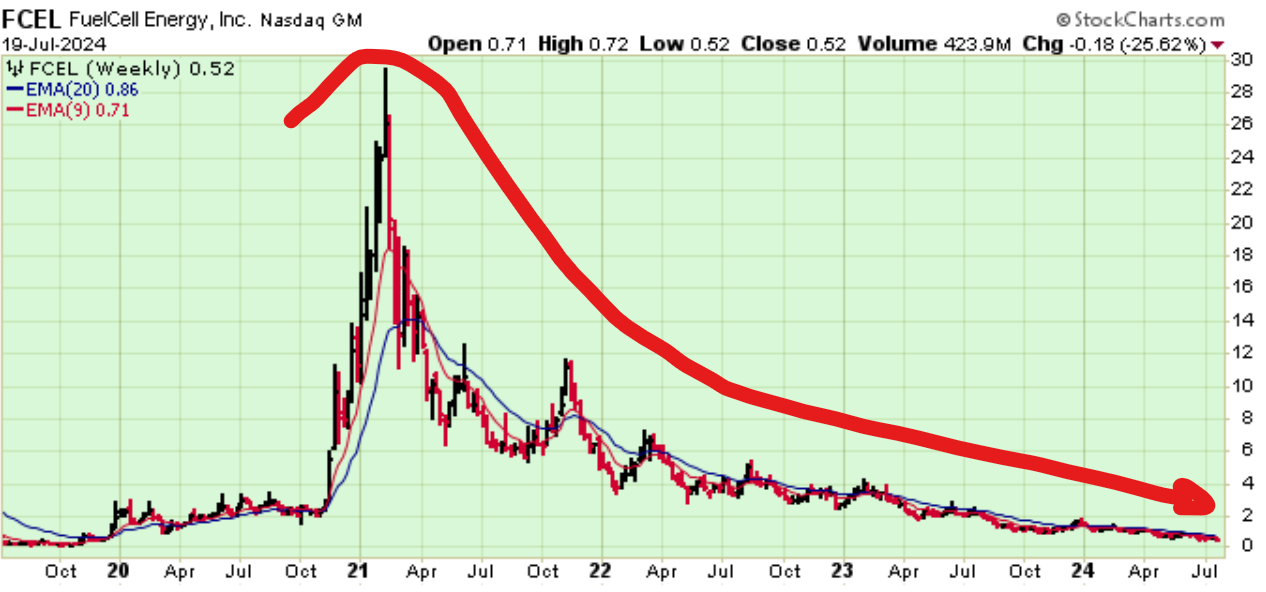

FUEL CELL ENERGY Shares – a 68.75 % fall in 2024

– the share price was $ 1.22 when BOOM last looked in November.

Fuel Cell Energy shares fell by a staggering 25.62 % in last week’s trading. It is now trading at around 50 cents. The collapse in price in just 8 months amounts to around 60 %. A horrendous performance.

But for investors who took the plunge at the start of 2024, the result is worse. Back then, the shares had risen from November to $ 1.60. So, the plunge to the current price of 50 cents represents a fall of 68.75 %. A staggering collapse in just 8 months

From Fuel Cell Energy’s website -- “We believe in a world where everyone can benefit from low to zero-carbon power. Our platforms can provide flexible paths to net zero in realistic and achievable ways. What will you decarbonize?”

Sounds promising? However, investors appear to have taken another view of the future for Hydrogen.

BLOOM ENERGY Shares – BE – Shares are now trading around $ 15. In November, they were trading at $ 12.50. This makes Bloom Energy a stand-out performer in the hydrogen sector.

FIRST HYDROGEN Corporation – In November, First Hydrogen shares were trading at $ 1.64. They are now trading around 54 cents. This represents a fall of 67 %.

FIRST HYDROGEN — a Gee Whiz Website

Their website states – Zero Emissions. Total Solution. First Hydrogen is removing adoption barriers for zero emission fleets with its fully integrated, green hydrogen centric solution. We are creating scalable and replicable eco-systems for rapid expansion in attractive markets primed for high growth.

Wow – that sounds impressive. BOOM can’t quite understand it but it sure sounds good. Investors seem to have taken another view.

CHARBONE ENERGY – Its shares have traded from 4 cents per share to 7 cents recently. Investors have not lost capital in the 8 month timeframe. However, in May 2022, at public listing on the Toronto Stock Exchange, they were traded at 55 cents. Long term investors who have held on for the ride have lost about 90 % of their capital.

Last week’s trading resulted in a 13.33 % fall.

POWERTAP HYDROGEN CAPITAL – BOOM can no longer find a share chart for this company. And there is no mention of it on Yahoo Finance. Presumably, it has met its financial fate and gone to the (growing) graveyard of alternative energy companies. However, the website is still available for viewing and is very impressive indeed -

“Aiming To Build an Extensive Network Of Hydrogen Fueling Stations

PowerTap is leading the shift to a greener world by innovating in clean, cutting edge Hydrogen Fueling technology. With PowerTap’s proven technology and one of the smallest and efficient SMR platform in the world, the opportunity for PowerTap to grow in the Hydrogen Fueling industry has never been brighter.”

HYDROGEN ONE CAPITAL GROWTH – the shares have moved from 45 cents to 50 cents over the last 8 months, so true to its name, there has been some capital growth for investors who purchased the shares in November.

GLOBAL X HYDROGEN AND DIREXION HYDROGEN – the shares in both companies have traded sideways for the last 8 months. This is a triumphant performance in the Hydrogen sector.

NICKEL MINES SHUT DOWN IN AUSTRALIA – THE END OF THE INDUSTRY?

In last week’s Sunday editorial, BOOM wrote -- “The simple fact is this — the major economies of the West have major supply problems for Nickel, Lithium and Cobalt. China is well prepared with supply. So, where will all the batteries come from for the coming “energy transition”?

Mea Culpa — BOOM missed the announcement just 2 days previous on Friday 12th July by one of the largest mining companies in the world, BHP. The company announced the suspension of operations at its major Nickel West and West Musgrave mines in Australia.

Nickel West and West Musgrave suspension by October 2024

Shift to care and maintenance to cut ~3,000 jobs but approximately half will be redeployed to other projects

The closures will also affect the Kwinana nickel refinery in Perth and the Kalgoorlie smelter. Some analysts, reflecting on the announcement, were predicting the end of Australian nickel industry.

The government funded Australian Broadcasting Corporation, known as the ABC published an article with a disturbing headline.

BHP's Nickel West closure could mark end of Australian nickel industry – BHP Shuts Nickel Mines

The Australian mining analyst Tim Treadgold said he could not see the nickel industry recovering from such a big player bailing out. "This is very close to being the death knell," he said.

"It has a degree of inevitability to it ... and it's just such a shame for all those people are going to lose their jobs."

And on the price collapse of Nickel, he had this to say "We're talking about a metal, which as recently as two years ago, was just short of $50,000 a tonne," he said. "Now we're talking about a metal which is $17,000 a tonne. "I can't think of another commodity that moves at that pace, as far as it does."

BOOM asks the difficult questions --

What does this mean for the “Green energy revolution”?

Why has the price of Nickel collapsed when a massive increase in demand should be occurring?

Can it be explained by oversupply at such an early stage of the “revolution”?

None of this appears to be in sync with a coming boom in alternative energy solutions. Surely, there will be a huge, persistent, ongoing increase in the usage of battery storage solutions? Or surely not?

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS SUBSTACK EDITORIALS AVAILABLE AT BOOM SUBSTACK ARCHIVE.

ALL PREVIOUS EDITORIALS AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.