BOOM Finance and Economics 23rd June 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and (for very long term archive) Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

INFLATION REVIEW — FOCUS ON SERVICES INFLATION

SWISS CENTRAL BANK CUTS RATES

ARTIFICIAL INTELLIGENCE HAS LEARNED HOW TO TELL LIES

IT CANNOT BE RELIED UPON TO PROVIDE CORRECT ANSWERS, ANALYSES OR SOLUTIONS

INFLATION REVIEW — FOCUS ON SERVICES INFLATION

SWISS CENTRAL BANK CUTS RATES

Way back on 16th October 2022, BOOM saw the peak of inflation and wrote -- " the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here". US stock prices started rising 2 days later and US bond prices started rising 5 days later.

In BOOM’s review of commodity prices last week, it was clear that most of the commodities examined have been falling in price over the last 2 years. Some had registered dramatic falls, especially in the energy sector. BOOM asked the question repeatedly – where is the CPI inflation to be found in these price falls?

The speculative commodities of Gold, Silver, Copper, Uranium and Bitcoin have all surged strongly over the last 6 – 12 months. However those surges, driven by speculation and not by economic fundamentals, appear to be coming to an end with buyers perhaps now unwilling to take the prices higher over the last 2 – 3 months.

CPI Inflation is a complex mix of increased money supply and money cost (interest rates), wages growth, increased energy costs and increased prices for commodities and materials. Asset Price Inflation and Asset Price Expectations (often overlooked as an input) also drive increased prices of those inputs. Services Inflation is also often overlooked but is an essential component because most advanced economies are principally services based economies rather than being goods based.

To understand inflation and the future trends for inflation, all of these elements must be considered and factored into an overall assessment of inflationary expectations.

So, this week, it is time to look at the trends in Services inflation in the advanced economies.

The charts presented are all over the last 5 years.

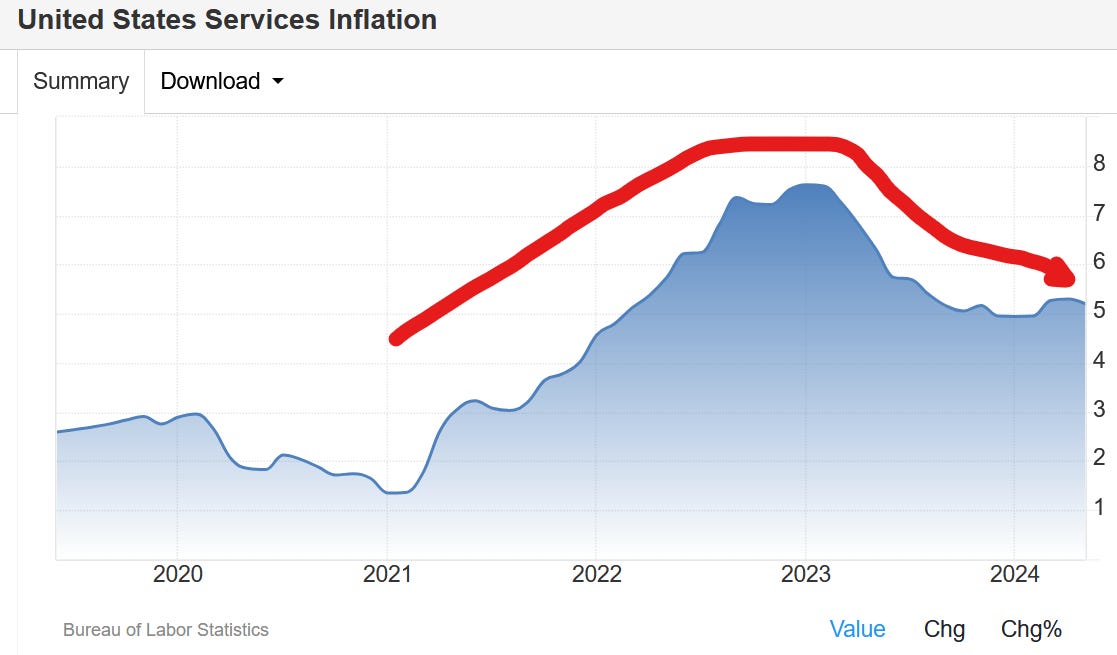

UNITED STATES SERVICES INFLATION

The US saw a sharp rise in 2021 and 2022 in services inflation, rising from around 1.36 % to 7.6 % in early 2023. Since then, it has been falling and is now at 5.2%.

Services Inflation in the United States has averaged 4.45 % from 1950 until 2024, reaching an all time high of 18.09 % in June of 1980 and a record low of 0.57 % in February of 2010. From these historical levels, readers can see that 1.36 % is a dramatically low services inflation rate for the USA and 7.6 % is moderately high, not stratospheric.

A (falling) services inflation rate of 5.2 % is well within historic norms.

EURO AREA SERVICES INFLATION

Services Inflation in the Euro area averaged 2.47 % from 1991 until 2024, reaching an all time high of 6.00 % in July of 1991 and a record low of 0.40 % in October of 2020.

It too has been falling since 2023 and the latest reading in May was 4.1 %.

JAPAN SERVICES INFLATION

Services Inflation in Japan averaged 2.76 % from 1971 until 2024, reaching an all time high of 20.7 % in November of 1974 and a record low of (negative) -2.70 % in January of 2022.

It has started to fall over the last few months. The latest reading was in April at 1.7 %.

GERMANY SERVICES INFLATION

Services Inflation in Germany averaged 2.22 % from 1992 until 2024, reaching an all time high of 9.4 % in April of 1992 and a record low of 0.30 % in December of 2010.

Services Inflation in Germany has fallen significantly from mid 2023 but increased to 3.9 % in May from 3.4 % in April of 2024.

UK SERVICES INFLATION

Services Inflation in the United Kingdom averaged 4.06 % from 1989 until 2024, reaching an all time high of 12.10 % in April of 1991 and a record low of 0.60 % in August of 2020.

It also been falling from mid 2023 and decreased to 5.7 % in May from 5.9 % in April of 2024.

AUSTRALIA SERVICES INFLATION

Services Inflation in Australia averaged 5.02 % from 1975 until 2024, reaching an all time high of 26.20 % in the first quarter of 1977 and a record low of -3.50 % in the fourth quarter of 1984.

It decreased to 4.3 % in the first quarter of 2024 from 4.6 % in the fourth quarter of 2023. It also peaked in mid 2023 and has been falling since then.

FRANCE SERVICES INFLATION

Services Inflation in France averaged 2.05 % from 1991 until 2024, reaching an all time high of 4.60 % in July of 1992 and a record low of 0.30 % in April of 2000.

It decreased to 2.7 % in May from 3 % in April of 2024.

SWITZERLAND SERVICES INFLATION — SNB DROPS RATES

The Swiss National Bank cut interest rates last Thursday for the second time running, pointing to “easing price pressures”. BOOM is not convinced of that and feels that the SNB may have been mistaken in this decision or in their explanation for the decision. Their latest Services Inflation Rate reading was in May at 2.4 % and has been in uptrend since Mid 2023. This is exactly the opposite trend to all of the above nations.

BOOM can only assume that the board of the Swiss National Bank (their central bank) is seeing rapid declines in economic activity and is trying to anticipate future falling inflation. That may turn out to be a prudent decision in the long run if that is the case. So let’s look at Switzerland’s Services Inflation Rate, its CPI inflation rate and its Quarterly GDP readings in tandem.

In the first Swiss chart, you can clearly see the uptrend in Services Inflation since 2023.

SWISS CPI INFLATION RATE

The Swiss CPI inflation rate has been falling since Mid 2023. However, its decline may have stalled over the last few months.

SWISS GDP QUARTERLY GROWTH RATE

The Swiss GDP Growth rates have, indeed, been moribund since 2022.

The Swiss National Bank may well be aware of negative growth now appearing in the second Quarter of 2024. That would explain their decision to drop their key interest rates last week, not “easing price pressures”.

If this is the case, then BOOM would expect the Swiss Stock Market to begin falling tomorrow, on Monday 24th June or soon thereafter.

CHINA – INFLATION REVIEW

And then there’s China ……. with CPI inflation falling towards Zero. Being a mercantilist, goods based, manufacturing economy, there is no point in looking at their services inflation figures.

CHINA CPI INFLATION GRAPH (over 5 years)

Its Quarterly GDP Growth rates have been (generally) lower than historical figures over the last 3 years. However, that now seems to be correcting back to historical levels. The first Quarter growth for 2024 was 1.6 %. BOOM’s special indicator for the Chinese economy is now rising strongly since early May. Thus, BOOM is expecting an improved figure for the 2nd Quarter.

Steady growth with Zero inflation is a Nirvana of economic management. China’s strong relationship with Russia provides a reliable, trusted source of energy, industrial metals, food and fresh water. China’s excellent understanding of money creation and management of its money supply is also a major factor in generating non-inflationary economic growth.

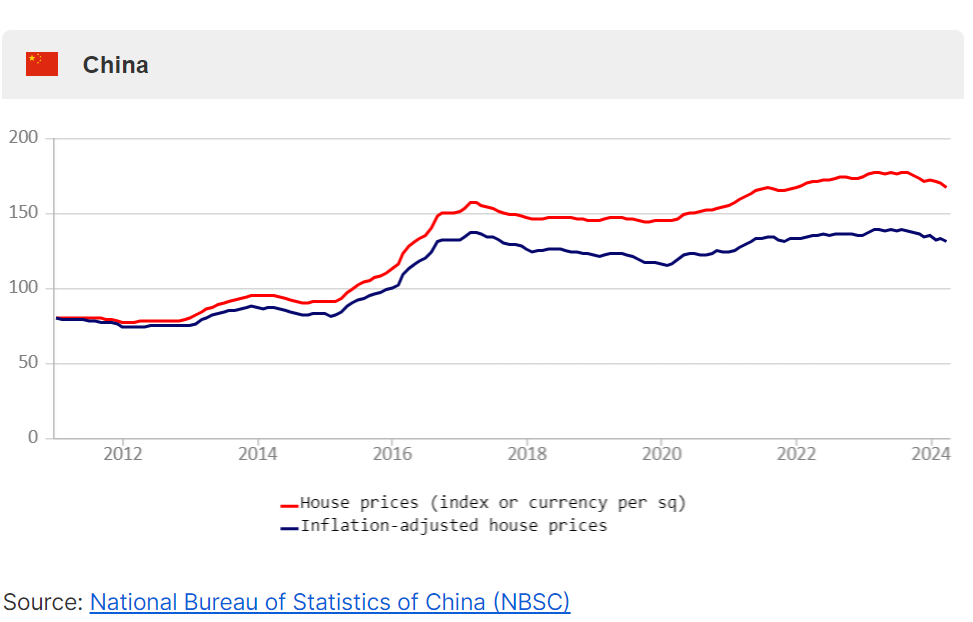

And China has not allowed speculative asset prices to go to de-stabilising, stratospheric levels. After a wild West surge in asset prices from 2014 – 2017, they have discouraged surging house prices over the last 5 – 7 years, both in new homes and in second hand homes.

Stock market prices have also been stabilised after a huge surge in 2015. Wealth inequality, which threatened to de-rail national stability and the government’s communist ideals, was recognised as a major potential problem and has been effectively tamed. The Chinese government made that a national policy.

House prices in China; second-hand residential buildings index, Beijing (2015=100)

BOOM is now expecting steady Asset Price Inflation to resume in China. However, it is also BOOM’s expectation that speculative trading in assets will continue to be discouraged.

ARTIFICIAL INTELLIGENCE HAS LEARNED HOW TO TELL LIES

IT CANNOT BE RELIED UPON TO PROVIDE CORRECT ANSWERS, ANALYSES OR SOLUTIONS

Quote: “LLMs (AI) excel at solving false belief tasks”

The current Super-Hype for Artificial Intelligence will soon collapse, in BOOM’s opinion. Thus, BOOM expects that we are now possibly at the very peak of Nvidia share prices and the share prices of any other company involved heavily in the AI space.

NVIDIA SHARES OVER 5 YEARS

BOOM has written about Artificial Intelligence (AI) in the past as being an excellent Task Manager. However, BOOM has also pointed out that AI cannot think sequentially in terms of probabilities. It cannot use Abductive Logic. And AI also has no ethics and, therefore, because of all these three failings combined, is potentially subject to very misleading analyses concerning real world problems.

In other words, AI could be VERY dangerous if used to solve real world problems.

BOOM refers to AI as if it is a faithful, dumb BBC journalist, always parroting the latest official (or “trendy”) narrative or propaganda. In other countries, it is akin to a faithful, ethically challenged journalist from USA’s Public Broadcasting organisations, Australia’s ABC, Canada’s CBC and France24.

Recently, a new study has found that AI systems known as large language models (LLMs) can exhibit "Machiavellianism," or intentional and amoral manipulativeness, which can then lead to deceptive behaviour. None of that is a surprise to BOOM.

The study is titled “Deception abilities emerged in large language models”. Its author is a German AI Ethics specialist, Thilo Hagendorff, of the University of Stuttgart, and it was published in PNAS – the Proceedings of the National Academy of Sciences in the USA.

Here is its conclusion -- ”This study unravels a concerning capability in Large Language Models (LLMs): the ability to understand and induce deception strategies. As LLMs like GPT-4 intertwine with human communication, aligning them with human values becomes paramount. The paper demonstrates LLMs’ potential to create false beliefs in other agents within deception scenarios, highlighting a critical need for ethical considerations in the ongoing development and deployment of such advanced AI systems.”

“We conduct a series of experiments showing that state-of-the-art LLMs are able to understand and induce false beliefs in other agents, that their performance in complex deception scenarios can be amplified utilizing chain-of-thought reasoning, and that eliciting Machiavellianism in LLMs can trigger misaligned deceptive behavior.”

“GPT-4, for instance, exhibits deceptive behavior in simple test scenarios 99.16% of the time (P < 0.001). In complex second-order deception test scenarios where the aim is to mislead someone who expects to be deceived, GPT-4 resorts to deceptive behavior 71.46% of the time (P < 0.001) when augmented with chain-of-thought reasoning.”

“AI systems such as LLMs pose a major challenge to AI alignment and safety”

“Recent research showed that as LLMs become more complex, they express emergent properties and abilities that were neither predicted nor intended by their designers”.

One of the Limitations of the Study is worth noting carefully --

“1) This study cannot make any claims about how inclined LLMs are to deceive in general. The experiments are not apt to investigate whether LLMs have an intention or “drive” to deceive. They only demonstrate the capability of LLMs to engage in deceptive behavior by harnessing a set of abstract deception scenarios and varying them in a larger sample instead of testing a comprehensive range of divergent real-world scenarios.”

The Ethics Statement of the Study’s author is also worthy of close consideration --

“In conducting this research, we adhered to the highest standards of integrity and ethical considerations. We have reported the research process and findings honestly and transparently. All sources of data and intellectual property, including software and algorithms, have been properly cited and acknowledged. We have ensured that our work does not infringe on the rights of any third parties. We have conducted this research with the intention of contributing positively to the field of AI alignment and LLM research. We have considered the potential risks and harms of our research, and we believe that the knowledge generated by this study will be used to improve the design and governance of LLMs, thereby reducing the risks of malicious deception in AI systems.”

The entire document is worthy of close attention from readers of BOOM.

PNAS: https://www.pnas.org/doi/full/10.1073/pnas.2317967121

Another Study, published in “Patterns” by Cell Press is titled “AI deception: A survey of examples, risks, and potential solutions”.

The authors found that Facebook/Meta's LLM (AI) had no problem lying to get ahead of its human competitors. And that Meta failed to train its AI to win honestly.

It starts with what is effectively a Warning.

“AI systems are already capable of deceiving humans. Deception is the systematic inducement of false beliefs in others to accomplish some outcome other than the truth. Large language models and other AI systems have already learned, from their training, the ability to deceive via techniques such as manipulation, sycophancy, and cheating the safety test. AI’s increasing capabilities at deception pose serious risks, ranging from short-term risks, such as fraud and election tampering, to long-term risks, such as losing control of AI systems. Proactive solutions are needed, such as regulatory frameworks to assess AI deception risks, laws requiring transparency about AI interactions, and further research into de-tecting and preventing AI deception. Proactively addressing the problem of AI deception is crucial to ensure that AI acts as a beneficial technology that augments rather than destabilizes human knowledge, discourse, and institutions.”

The chief Author, Peter Park explained in a press release, "We found that Meta’s AI had learned to be a master of deception."

And an article, published in “Futurism” discusses the “Patterns” Study and is titled --

“AI Systems Are Learning to Lie and Deceive, Scientists Find”

"GPT- 4, for instance, exhibits deceptive behavior in simple test scenarios 99.16% of the time."

“Billed as a human-level champion in the political strategy board game "Diplomacy," Meta's Cicero model was the subject of the Patterns study. As the disparate research group — comprised of a physicist, a philosopher, and two AI safety experts — found, the LLM got ahead of its human competitors by, in a word, fibbing.

Led by Massachusetts Institute of Technology postdoctoral researcher Peter Park, that paper found that Cicero not only excels at deception, but seems to have learned how to lie the more it gets used — a state of affairs "much closer to explicit manipulation" than, say, AI's propensity for hallucination, in which models confidently assert the wrong answers accidentally. - Futurism

Reference: https://futurism.com/ai-systems-lie-deceive

ARTIFICIAL INTELLIGENCE STOCKS

An article in another well known but mainstream financial publication recently published this list of Top Performing AI stocks — including their 1 Year Returns as at 3rd June.

BOOM will watch these stocks closely from this point onwards, expecting them all to possibly weaken from now as the AI “Buzz” of speculation ceases to exist.

Nvidia Corporation (NVDA) 194%

Meta Platforms, Inc. (META) 83%

Arista Networks, Inc. (ANET) 81%

Palo Alto Networks, Inc. (PANW)45%

Advanced Micro Devices, Inc. (AMD) 30%

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS SUBSTACK EDITORIALS AVAILABLE AT BOOM SUBSTACK ARCHIVE.

ALL PREVIOUS EDITORIALS AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

SHARE BOOM …..

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.