BOOM Finance and Economics 24th March 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available at LinkedIn and at Wordpress https://boomfinanceandeconomics.wordpress.com/

GERMANY RUNNING OUT OF MONEY – GERMAN ECONOMY STALLING – – DUMB AND DUMBER LEADERSHIP

MOST NATIONS ARE NOT “MASSIVELY INDEBTED TO THE IMF” – THE FACTS MATTER

IMF DEBTS ARE SMALL

PERSPECTIVE IS IMPORTANT – SOVEREIGN BOND DEFAULTS

SPECULATIVE FRENZY NOW PEAKED? BITCOIN – ETHEREUM -- URANIUM

IF THE BANKERS DON’T CONTROL OUR WORLD – WHO DOES?

GERMANY RUNNING OUT OF MONEY – GERMAN ECONOMY STALLING – REAL WAGES FALLING – IMMIGRATION CRISIS UNRESOLVED – DUMB AND DUMBER

BOOM has repeatedly commented on the poor leadership that prevails in almost all Western European nations, the USA and in the United Kingdom. Germany is perhaps the centrepiece of political and economic stupidity.

A German “think tank”, Forum for a New Economy, released a report last week that discussed the worrying decline in Germany’s economic output. They compared it to the financial crisis of 2008 and the economic contraction that occurred during the Covid-19 Panic-demic in 2020. They called the current crisis "the worst economic downturn in the country since World War II." And they reported that surging energy prices have reduced real wages which fell more in 2022 than in any year since 1950.

The German central bank, the Bundesbank, also announced their expectation that the economy would continue to contract for the first quarter of the year and that it is not expected to recover for the rest of 2024. Their report was titled “German economy’s recovery is stalling”.

“The German economy continues to experience headwinds from various directions. Domestic and foreign demand for German industrial products went down further. Bundesbank economists believe that economic policy uncertainty about the future direction of transformation and climate policy is also likely to have weighed on economic activity.”

“Industrial output contracted across all sectors in January 2024. Production of motor vehicles saw a particularly significant fall”. It also reported that industrial enterprises were complaining about “the growing burden of bureaucracy and regulation”.

The finance minister of Germany, Christian Lindner, also warned last week that his nation is facing a major problem with financing its budget deficit in the long term. His solution, not surprisingly, is to slow or cut government spending. However his own government obviously has no appetite for that because it will harm their re-election prospects. It just gets Dumb and Dumber.

Lindner’s “Sustainability Report” which should have been titled the “Not Sustainable Report” stated -- “In an unfavorable scenario, the increasing financing deficits lead to an increase in debt in relation to economic output to around 345 percent in the long term”. And “In a favorable scenario, the rate will rise to around 140 percent of gross domestic product by 2070.”

Under EU law, Germany has limited its debt levels to 60 percent of economic output, which obviously requires dramatic savings.

A huge factor is Germany’s rapidly ageing population, with a government debt explosion likely as more and more citizens head into retirement while tax revenues shrink and the social welfare system grows — in part due to the country’s exploding immigrant population. Foreign investors and domestic investors will have to fund forthcoming massive deficits. In February, a German Professor of Public Finances, Bernd Raffelhuschen, said that mass immigration may cost Germany up to 19.2 Trillion Euros, and has already cost the country 5.8 Trillion Euros. He also showed that it would simply be cheaper to close the border entirely.

The “good news” is that the CPI inflation rate is falling (probably because of the poor economy). The EU-harmonized index of consumer prices in Germany rose 2.7% year-on-year in February 2024, after a 3.1% gain in the previous month, pointing to the lowest reading in three months.

The continued support of Ukraine by the German government and their belligerence to Russia does not help matters. Higher energy costs long term are expected to continue as a result.

For a nation highly dependent upon energy and labour to fuel its industrialised economy, it all amounts to a historical turning point of monumental proportions. Many citizens of Germany must be asking themselves – “is there an alternative for Deutschland”?

MOST NATIONS ARE NOT “MASSIVELY INDEBTED TO THE IMF” – THE FACTS MATTER

BOOM was recently challenged with the statement that “most nations are massively indebted to the IMF” – the International Monetary Fund. The implication was that those nations are therefore controlled by the IMF, presumably because of those debts. Sounds feasible? Many people would fall for such a statement especially if they are ignorant of how the banking system operates. And especially if they have been pre-programmed to think that “they”, “the bankers” are somehow “running the world” to their own (presumably evil) agenda and advantage.

This narrative is commonly held and is full of illogical and inconsistent observations fuelled by commentators who write articles explaining that this is the only way to understand the world we live in. Here is the common narrative presented to ignorant readers -- “The bankers” are running the world and are planning to destroy our economies to their own benefit”. The hypothesis appears inconsistent in its internal logic, to say the least.

At this juncture, BOOM invariably tries to explain that bankers are actually (in general) not that Machiavellian or that clever. The true psychopaths and sociopaths of the world are not attracted to the dull, boring world of balanced banking ledgers. They are driven by dreams of power and control. How their quest for power is funded is just a detail to them and, to solve this problem, they employ the bankers. BOOM doubts that Adolph Hitler ever sat with his central banker, Hjalmar Horace Greeley Schacht, for long, sober discussions on how to establish a MEFO Bill system in their economy or how to (perhaps) borrow as a Sovereign nation from a controlled bank in Amsterdam, a separate jurisdiction to Germany.

However, in regard to the current operations of the IMF, which was established in July 1944 at Bretton Woods, the facts are important. BOOM prefers to look at the facts of any matter.

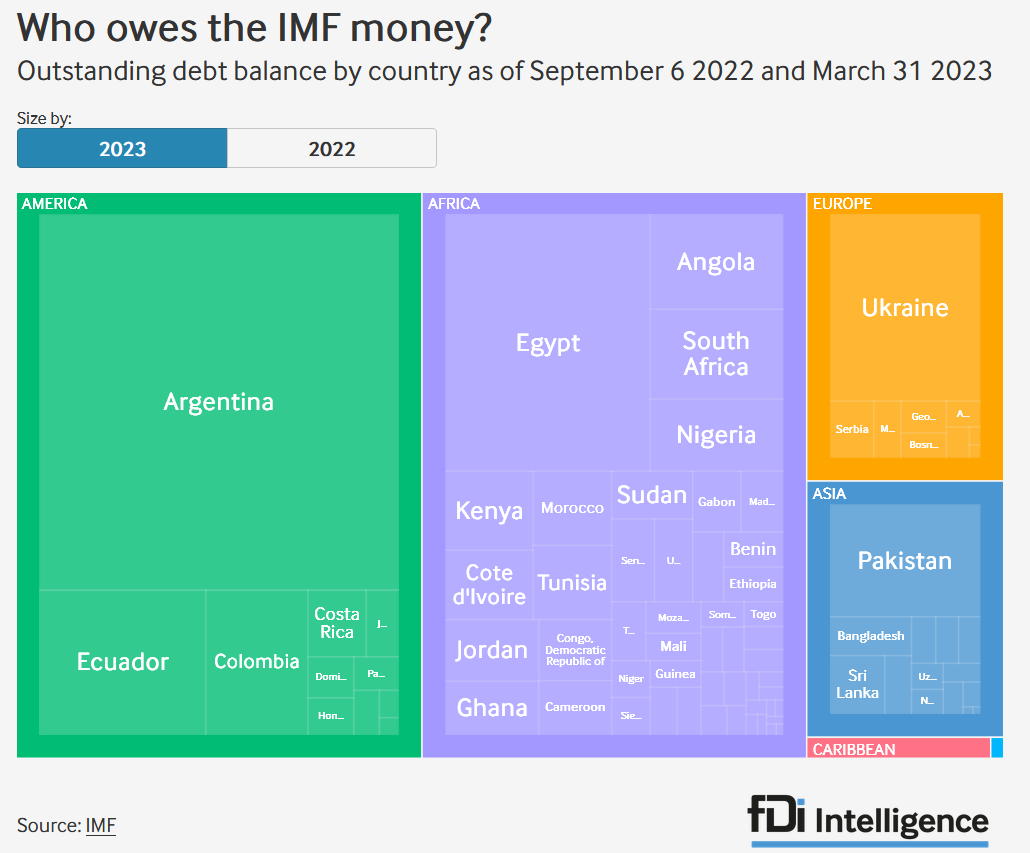

The IMF is essentially a Supra-national bank which can loan funds to any nation in financial distress. Those nations are usually developing economies with poor political leadership. On March 31st, 2023 the total global outstanding debt owed to the IMF stood at US $155 Billion and 93 nations in total were in some debt to the IMF. That was equivalent at the time to 115.2 Billion Special Drawing Rights (SDRs) with the value of an SDR on March 31st 2023, being US$ 1.345. Most of the nations who are in debt owe sums which are very small when examined in a Global context.

When such small numbers are in play, there is absolutely no way that the IMF can be seen as some sort of evil controller of the planet. BOOM can assure readers that the answer to that particular conundrum is far more complex.

IMF DEBTS ARE SMALL

As at March 23rd, 2023, despite there being a total of 93 countries owing it money (out of 190 Member nations in total), the IMF’s top 10 debtors accounted for 71.7% of the outstanding balance.

Argentina was the biggest debtor to the IMF, with a total outstanding debt of $ 46 Billion (again as at March 23rd 2023). As BOOM has explained in previous editorials, Argentina has had a long and troubled relationship with the IMF, with a history of spectacular fall-outs and bail-outs. At the turn of the century, in the year 2000, the IMF made $ 88.3 Billion available to bail out the country’s ailing economy. Please note that the then president, Néstor Kirchner, repaid the entire debt in 2006. His eventual successor, Mauricio Macri, went to the IMF for a $ 50 Billion bailout in 2018 — the biggest rescue in the IMF’s history. However, the country soon found itself in dire straits again, and returned to the IMF in 2022 for another $ 44 Billion loan.

Egypt was the second-largest debtor by amount on the balance date of March 23rd, 2023, with an outstanding balance of $ 18 Billion.

Ukraine was the third largest debtor with a total outstanding debt of $12.2 Billion. In March 2023, the IMF dispersed $2.7 Billion to Ukraine as part of a $ 15.6 Billion loan to support the country’s economy since the war with Russia began there over the disputed Russian speaking regions of Eastern Ukraine. Please note that this was the first time that the IMF has extended major conventional financing to a country involved in a full-scale war.

Ecuador was the fourth-largest debtor of the IMF, with a total outstanding debt of $ 8.2 Billion.

And Pakistan had the fifth-biggest outstanding debt, standing at $7.4 Billion.

WHAT IS A SPECIAL DRAWING RIGHT? AN SDR?

The SDR is a unit of account USED by the IMF. Thus, it is a ledger entry. It is calculated by using a basket of 5 major international currencies and is used as a unit of account by the IMF to assess the financial support it provides to struggling economies (damaged by their irresponsible and often corrupt politicians).

The IMF created the SDR as a supplementary international reserve asset in 1969, when currencies were tied to the price of gold and the US Dollar was the most commonly used international reserve asset. The IMF then defined the SDR as equivalent to a fractional amount of gold that was equivalent to one US dollar.

However, in 1973, after fixed exchange rates ended due to Nixon’s abandonment of the Gold standard, the IMF redefined the SDR as equivalent to the value of a basket of world currencies. The SDR itself is not a currency but an asset that holders can exchange for currency when needed.

The value of an SDR is determined daily by the IMF based on the exchange rate between the major currencies – US Dollar, Japanese Yen, British Pound, the Euro and Chinese Yuan – which are included in the SDR basket.

SDRs can only be held by member countries of the IMF and certain designated official entities known as "prescribed holders". As of April 28 2023, the IMF had allocated a total of SDR 660.7 Billion (equivalent to about $935.7 Billion) to its member nations.

Individuals and private entities cannot hold SDRs. IMF members – and the IMF itself – can hold SDRs and the IMF has the authority to approve other holders. Remember, an SDR is an international reserve asset. It is not a currency itself and is not trade-able outside the banking system.

The Articles of Agreement allow the IMF to allocate SDRs to members – but not prescribed holders – under certain conditions. There have been four general allocations, most recently in 2021, when the IMF’s Board of Governors approved a general allocation of about SDR 456 Billion, equivalent to US$650 Billion, to boost global liquidity.

That distribution – the largest SDR allocation in the history of the IMF – helped countries respond to the COVID-19 pandemic. In 2009, the was a general allocation of about SDR 161 Billion, equivalent to US$ 250 Billion. Its aim then was to boost liquidity in response to the global financial crisis the (GFC) that began in 2008. That crisis was, in fact, a bank solvency crisis precipitated by fraud in the banking sector (but especially in regard to the United States).

A general allocation of SDRs requires broad support from the IMF’s members. The IMF distributes a general allocation to member countries in proportion to their quota shares at the IMF. In other words, a general allocation is equivalent to a Quantitative Easing Program for the entire planet.

Most observers do not understand this and did not see the impact of that decision which became effective on 23rd August 2021. BOOM has written about this in a previous editorial. Dedicated readers will know this. You can read about it here (later – after reading BOOM):

https://www.imf.org/en/Topics/special-drawing-right/2021-SDR-Allocation

PERSPECTIVE IS IMPORTANT

Let’s put the matter into perspective. The biggest IMF loan in history was for US $ 50 Billion to Argentina in 2018. That may sound like a very large number to some people. However, the Gross Domestic Product (GDP) of Argentina in 2022 was worth US$ 631.13 Billion US dollars, according to official data from the World Bank. Thus the Loan to GDP ratio was approximately 8 %.

Now, the annual GDP value of Argentina represents only 0.27 % of the world economy.

So the biggest IMF loan in history was equivalent to 8 % of 0.27 % of global annual GDP.

That is a very small number indeed. BOOM won’t lose any sleep over it tonight and suggests that readers should also sleep well.

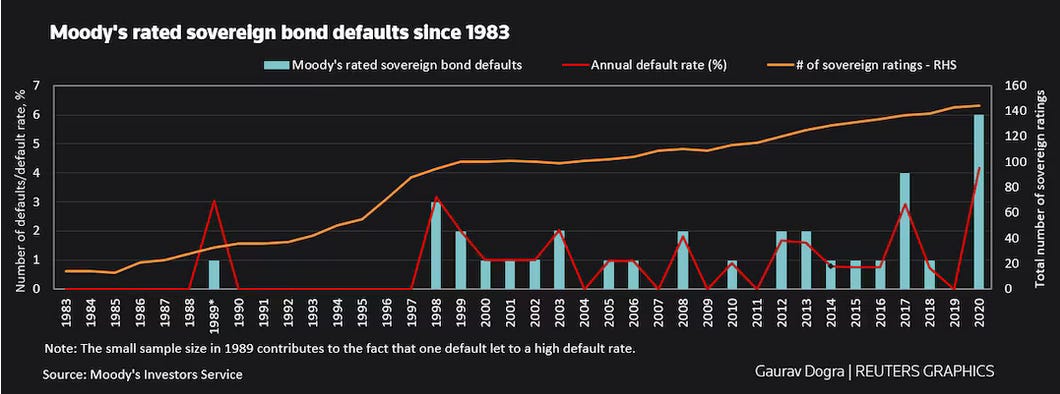

The lesson to learn is this. Nations don’t often default on their bonds (their debt issuance). And, if they do, the amounts are also not great when looked at in a global context.

SOVEREIGN BOND DEFAULTS

This chart shows that the average default rate on Sovereign Bonds has been below 4 % of total global Bond issuance until the Global Financial Crisis (GFC) in 2009. Since then, there has been an increase in the average to 6 % but this is still a small number compared to global GDP and mostly involves developing economies.

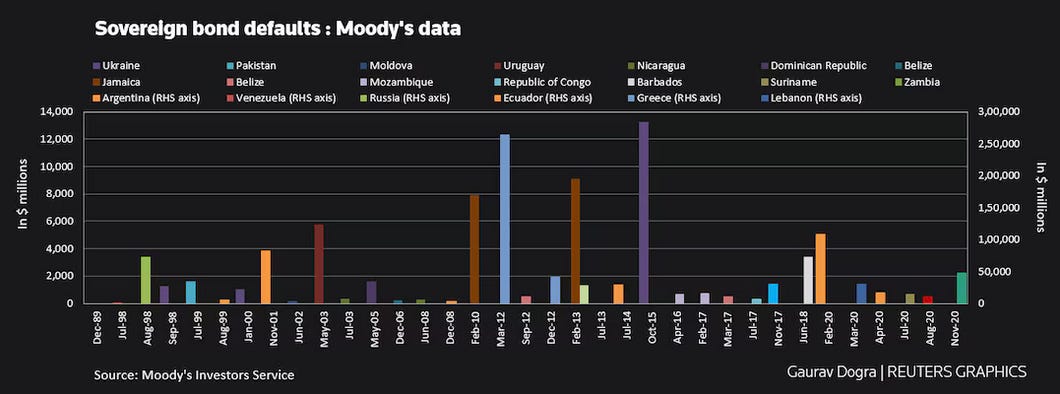

SOVEREIGN BOND DEFAULTS SINCE 1990

This second chart shows the nations that have defaulted since 1990. However, in a global perspective, the numbers are still relatively small.

Total Annual Global GDP is estimated now to be approximately US $ 130 Trillion ($ 130,000 Billion). The total Global GDP (cumulative) in that time frame since 1990 was approximately well in excess of US $ 2,500 Trillions.

In that time frame, the largest individual default was for $ 13 Billion. That is a drop in the ocean of cumulative Global GDP. In fact, the number is 0.00052 % of total cumulative global GDP in that time frame. Hardly a cause for any loss of sleep. Hardly a mechanism used to “control all the nations on Earth”.

ANNUAL REPORTS -- The Annual Reports of the IMF are readily available.

Reference: https://www.imf.org/external/pubs/ft/ar/2023/what-we-do/lending/#

Debts held by individual nations: https://www.imf.org/external/np/fin/tad/exfin1.aspx

SPECULATIVE FRENZY NOW PEAKED? BITCOIN – ETHEREUM -- URANIUM

The markets where speculative frenzies have dominated over the last year or so have been in Uranium and in Crypto assets. Have these markets peaked? Or are they just weakening before making further moves higher?

Bitcoin is the dominant “Proof of Work” electronic, immutable ledger with a current Market Capitalisation of US $ 1.25 Trillion. Ethereum is the major “Proof of Stake” Crypto with a current Market Capitalisation of just below US$ 400 Billion.

In the Crypto markets, the Bitcoin price started rising in late October 2023, just after BOOM accurately forecast a further rise in traditional asset market prices. Since then, it has risen from US $ 30,000 per Bitcoin to $ 73,777 on the 14th March. In the previous 10 months it had also doubled in price from around $ 16,000.

Numerologists may be interested to know that the price top on 14th March was very close to $ 6,666 points above $ 66,666. In other words, 66,666 plus 6,666 equals 73,332. The number 666 may (or may not) be significant to some observers. BOOM has no opinion to offer on that matter.

Thus, the Bitcoin price has doubled and then doubled again (to an all time High) since the beginning of 2023.

The Ethereum Price also began rising sharply in late October 2023. It has gone from just below $ 2,000 then to just above $ 4,000 in early March. By the way, to put this into historical context, Ethereum’s all time High price occurred at $ 4,868 in the first week of November 2021.

Over the last week, the Bitcoin price has fallen by 8.37 % and the Ethereum price has fallen by 11.45 % (as per prices available at Coinmarketcap on Saturday 23rd March).

Since early March, Bitcoin has fallen by about 17 % of its early March High to its March 20th Low.

Ethereum has fallen by about 25 % of its early March High to its 20th March Low

So, in the last few weeks the speculative frenzy in these two assets has weakened considerably. These Daily price charts for the last 6 months from Stockcharts.com reveal the sell off from early March and the weak close on Friday last week.

GBTC (The Grayscale Bitcoin Trust ETF traded on the American Stock Exchange)

ETHR.TO (An Ethereum ETF traded on the Toronto Stock Exchange)

The speculative frenzy in Uranium stocks also appears to have weakened considerably. The sell off began in early February.

Again, the price charts reveal what has happened. This time the Daily charts are over a 12 month time frame. Here are for two prominent Uranium producers Cameco corporation and Mega Uranium Limited.

CAMECO CORP (Listed on the New York Stock Exchange)

MEGA Uranium (listed on the Toronto Stock Exchange)

GOLD

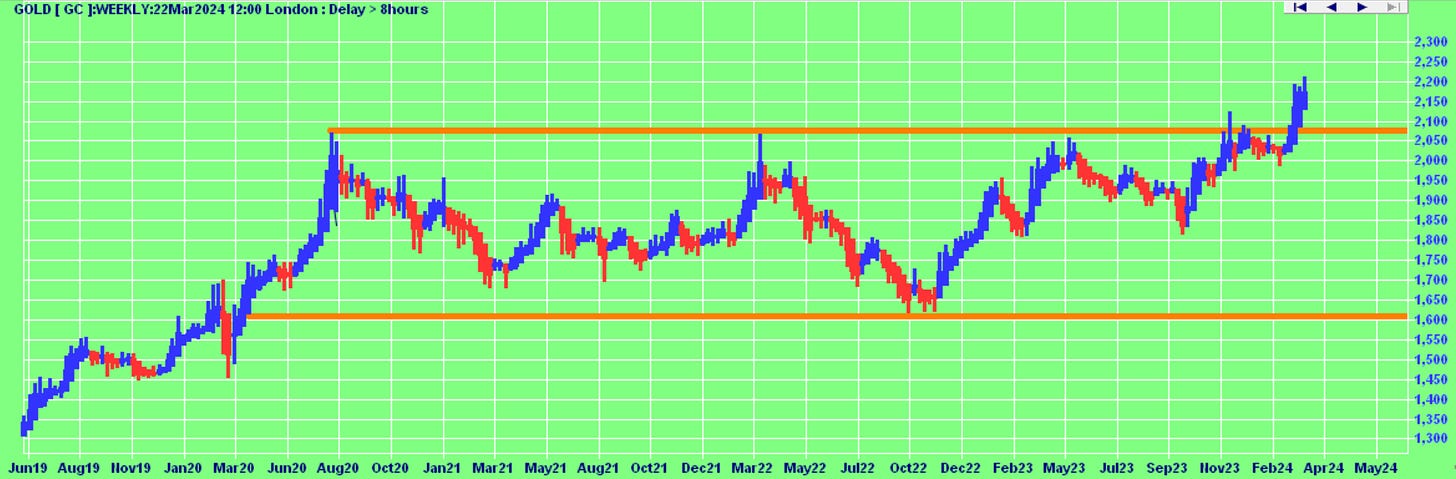

The US Dollar denominated Gold price has been in a trading range for the last 4 years. This year, the Gold Bugs have finally been rewarded for their patience. The price has popped above its US$ 2,100 price collar and risen to US$ 2,200. Buyers from Asia have pulled it higher. They are seeking a commodity that can be traded for any currency anywhere. Gold is liquid but does not pay a dividend. And there are commission costs to be paid when acquiring it and disposing of it. It must be protected while in possession which comes at a cost. Thus, it is a place for sophisticated investors to park excess funds while awaiting direction from the real currency market.

The Gold price in US Dollars over the last 5 years tells the story. Charts are sourced from Incredible Charts.com.

There are actually 2 possible scenarios displayed – Gold may be breaking out of its trading range established in August 2020 into a new, exciting Bull market. This is the hypothesis that is exciting the Gold Bugs worldwide.

However, another possibility to consider is that it has just moved to a new High point of a slowly moving, and unexciting, upwards trend that began in August 2020. This is illustrated in the second chart which uses a Linear Regression Channel that shows a slowly moving and unexciting upwards direction over time.

GOLD PRICE OVER 5 YEARS – within the confines of the trading range shown since August 2020

GOLD PRICE OVER 5 YEARS – with Linear Regression Channel from August 2020

To try to resolve which one is the correct answer, we need to look at the US Dollar. Why? Because Gold is mostly traded in that currency and alternative, safer investments lie in the US Treasury markets and equity markets which both pay a dividend or a coupon payment. And those markets have much higher liquidity with very low transactional costs attached.

This chart shows the 5 year progress of the price for UUP – with two scenarios illustrated. UUP is the US Dollar Bullish Fund offered by Invesco at the Chicago Mutual Exchange. The black lines illustrate a Linear Regression Channel calculated from August 2020. The Red horizontal lines are all drawn by hand from that date in August 2020 through significant Highs and Lows since then.

US DOLLAR PRICE – as per the US Dollar Fund UUP traded on the CME (Chicago Mutual Exchange)

The chart begs the same question posited about the Gold price.

Is the US Dollar in a strong and long Bull run established in August 2020?

Or is it now trapped in a sideways trading range that started in October 2022?

If the US Dollar Index (as expressed in UUP) continues to rise from here and resumes its strong Bull run, then we can expect sophisticated investors to start swapping out of Gold holdings and back into US based yielding assets.

One way to possibly resolve this dilemma for foreign investors wanting to buy Gold (principally based in Asia), is to invest in the largest production Gold mining companies, listed on US stock exchanges. In such a case, they are riding both trains, the US Dollar and the Gold price, hopefully higher.

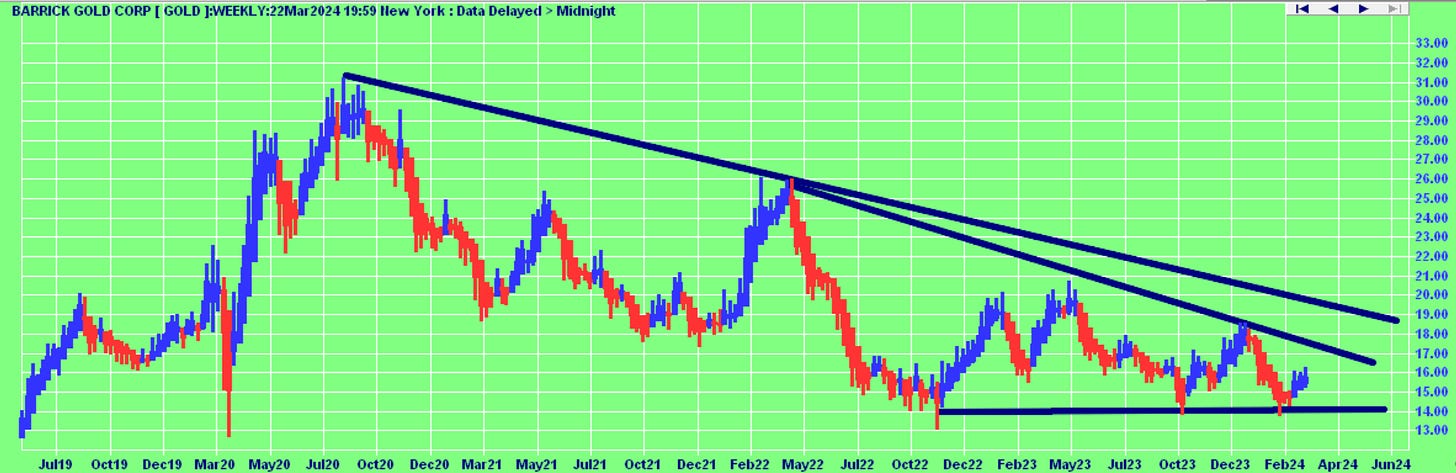

So – let’s look at the share price progression of those over time. The charts reveal that they have been a very ordinary investment for foreign investors since 2020. The strategy has not worked. The black lines here are simply drawn by hand from no particular starting point but the similarities in direction are easy to spot. Foreign investors have (generally) lost on the share prices and gained on their US Dollar exposure.

Newmont (Production: 185.3 MT)

Barrick (Production: 128.8 MT)

Agnico Eagle Mines (Production: 97.5 MT)

Anglo Gold Ashanti (Production: 85.3 MT)

BOOM does not offer investment advice. And, by the way, BOOM pays no attention to traditionally drawn trendlines. The black lines here are for illustrative purposes only.

The future is always in the eye of the beholder and is beset with many biases, some of which may prove correct in the fullness of time and some of which may prove incorrect. Luck is an important ingredient for the feckless. However, an expert eye can resolve Trend directions in a heart beat, but that is a very rare skill, learned over many years of hard experience in the financial markets. It involves complex probability based analyses which generate a Risk Reward assessment of possible future scenarios. Some BOOM readers already possess those skills but they are few and far between. Others think they can discern trend probabilities accurately but they are mostly inexperienced, kidding themselves, living happily with the delusion that they can beat the rarely skilled opposition. They can win for a while with luck on their side and think they are a genius. But they will one day learn that they cannot always depend on luck to be on their side. Winning consistently in all investment markets needs a lot more than luck.

IF THE BANKERS DON’T CONTROL OUR WORLD – WHO DOES?

BOOM has written frequently about the poor political leadership in the Western, advanced economies. It appears obvious that all the individuals involved have been carefully selected at relatively young ages, groomed and promoted (often unknowingly) to positions of great power by an unelected global elite that also controls the unelected UN (United Nations), the WHO (World Health Organisation), the WEF (so-called World Economic Forum), the major Universities, the mainstream media, the major political parties and Big Pharma. The bankers are employed to fund the operations.

Their chosen and groomed national "leaders" are all out of their depth, slavishly following an internal consensus handed down to them by their controllers. As described in the first section in this editorial, the German leadership seems to be especially noteworthy. Switzerland and New York are also centrepieces of control, allowing their globalist organisations to thrive there. This all became obvious during the contrived “epidemic” of Covid 19 when all the national leaders used the exact same words and the exact same strategies to “manage” the “threat”.

The stupidity of the elite in control of the leaders knows no bounds. They appear to be psychopaths and sociopaths intent on only one thing – power and control. That does not require any great wisdom, quite the opposite. They are driven by major historical and philosophical themes which are cult-like in their effects.

Malthusianism (“there are too many people”, “we need to reduce our population”), launched by an incompetent economist, Thomas Malthus

Technocracy (“all our problems can be solved by technology and engineering”), co-launched by an incompetent engineer, King Hubbert, the inventor of “Peak Oil”

Transhumanism (“humans are just biological machines”, “we can merge humans with machines”, “we can defeat disease and achieve immortality” (for them). And last but not least.

Limits to Growth (“exponential economic and population growth with finite supply of resources will lead us to DOOM”). An incompetent assessment of future prospects commissioned by the infamous Club of Rome, first presented at international gatherings in Moscow and Rio de Janeiro in the summer of 1971.

Their aim appears to be to establish for themselves a heaven on Earth, with no God and no death (for them) but slavery or death for everyone else. Their current “guru” appears to be an Israeli academic, Yuval Noah Harari. BOOM readers are encouraged to do their own research on the matter.

A future of lower and lower populations, more and more technology, no religion and the dominance of trans-humans (half man/half woman/half machine) may (or may not) sound appealing. Readers can make up their own minds. But the word “bleak” springs to BOOM’s mind almost immediately.

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Thanks for reading BOOM Finance and Economics Substack.

Subscribe for Free to BOOM Finance and Economics

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years which includes many of the world’s most senior economists, central bankers, fund managers and academics.