BOOM Finance and Economics 24th September 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

THE FED WILL NOW JAWBONE

BOOM was asked last week if this was the end of the financial world as we know it. The question was a serious one, coming from a citizen who was (quite rightly) concerned about sharply rising interest rates.

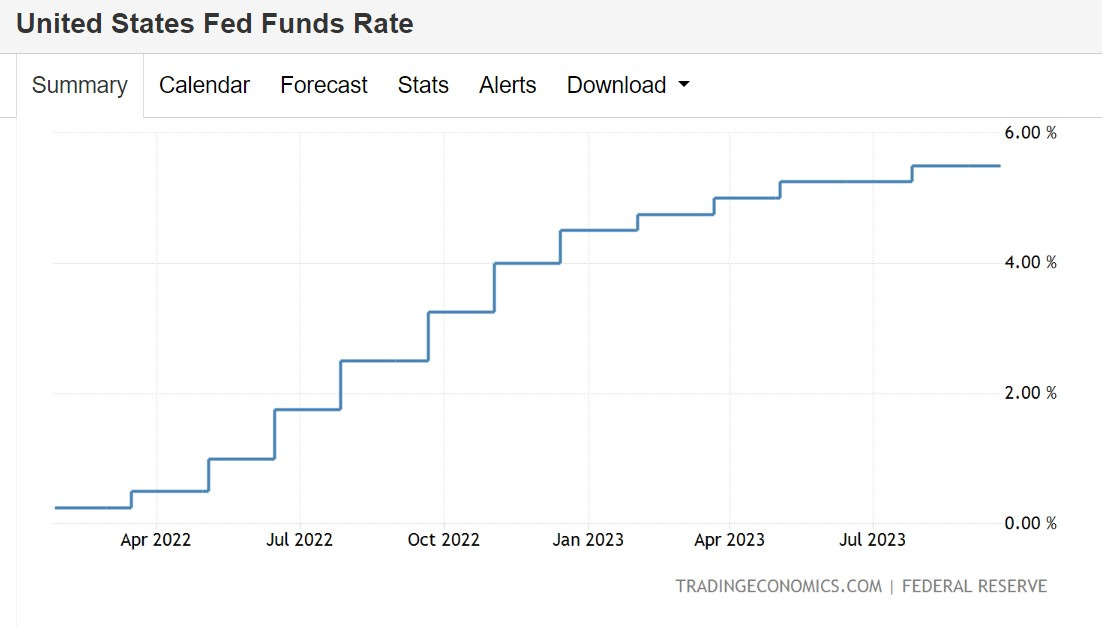

The Federal Reserve is the central bank of the United States. 18 months ago, they started raising their key interest rate from a base of 0.5% and, since then, they have done so 11 times. The so-called Fed Funds Rate is now at 5.5 %. This is the highest interest rate setting in 22 years. That sounds dramatic. It certainly has some citizens deeply worried. But let’s look back at history.

This graph shows what has happened to the US Fed Funds Rate since early last year. A steep rise in rates is evident.

18 MONTH CHART

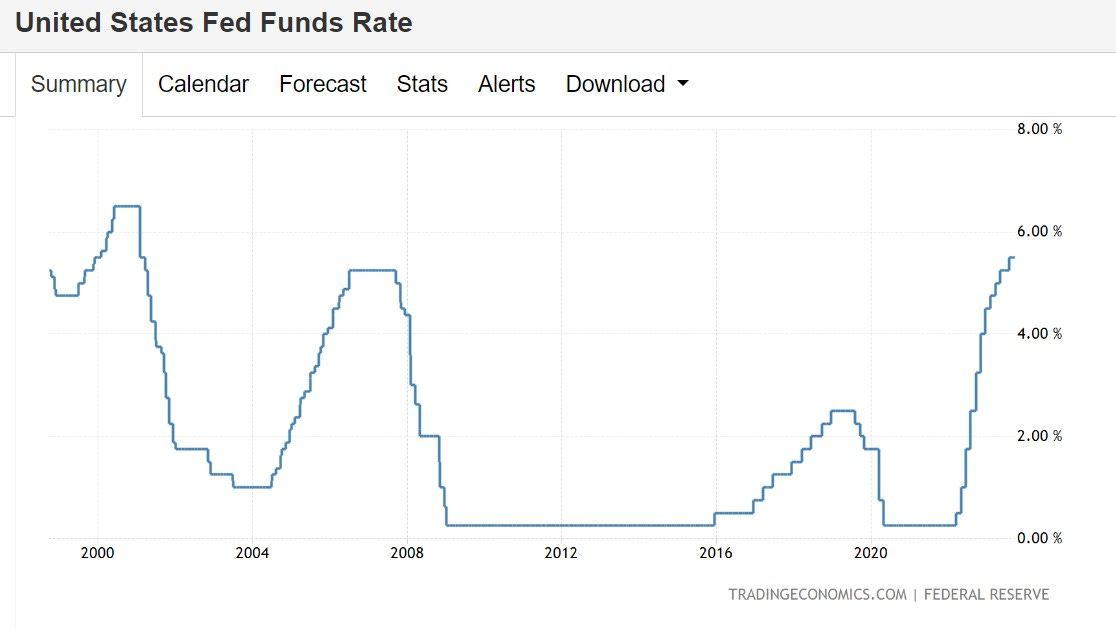

This graph shows the 25 year picture.

25 YEAR CHART

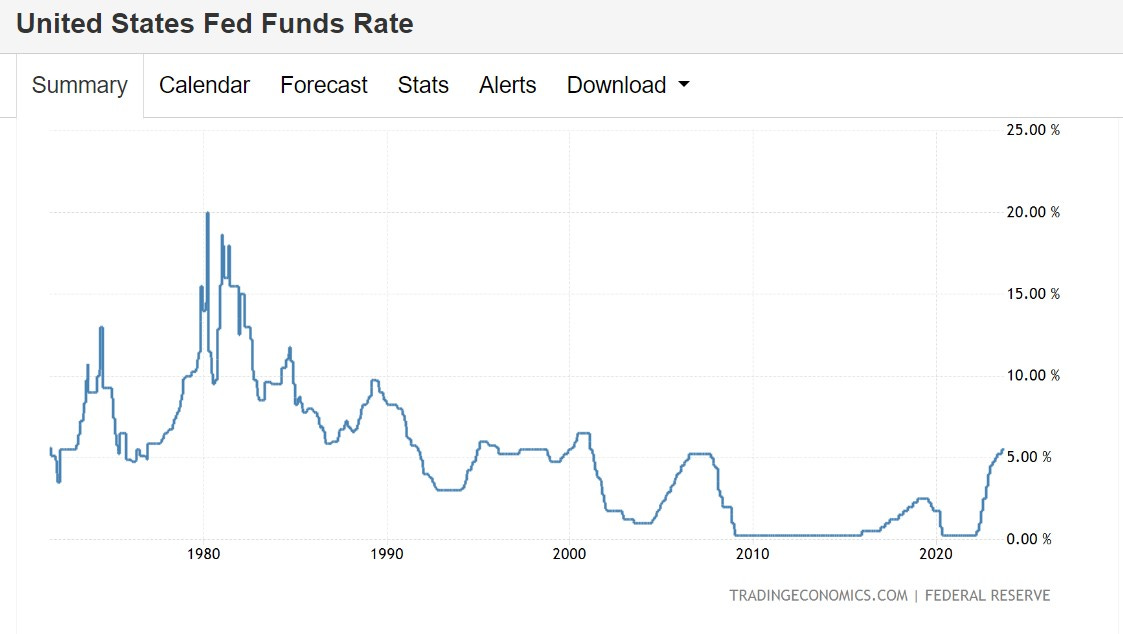

However, it is worth looking at the very long term chart over 45 years which puts current interest rates settings into better perspective. The “end of the financial world as we know it” is not here in 2023. It happened in 1981.

This chart shows the Fed Funds Rate peak in 1981 at 20 %. Yes – 20 %.

Now that is what BOOM calls a high interest rate. Paul Volcker was the Chairman of the Fed at the time.

45 YEAR CHART

The Fed raised rates to that seemingly outrageous number of 20 % because of high CPI inflation. The inflation rate was 15% in the United States at the time.

Inflation had surged to such a high level due to rapid increases in the cost of oil and profligate levels of credit creation (loans) by commercial banks.

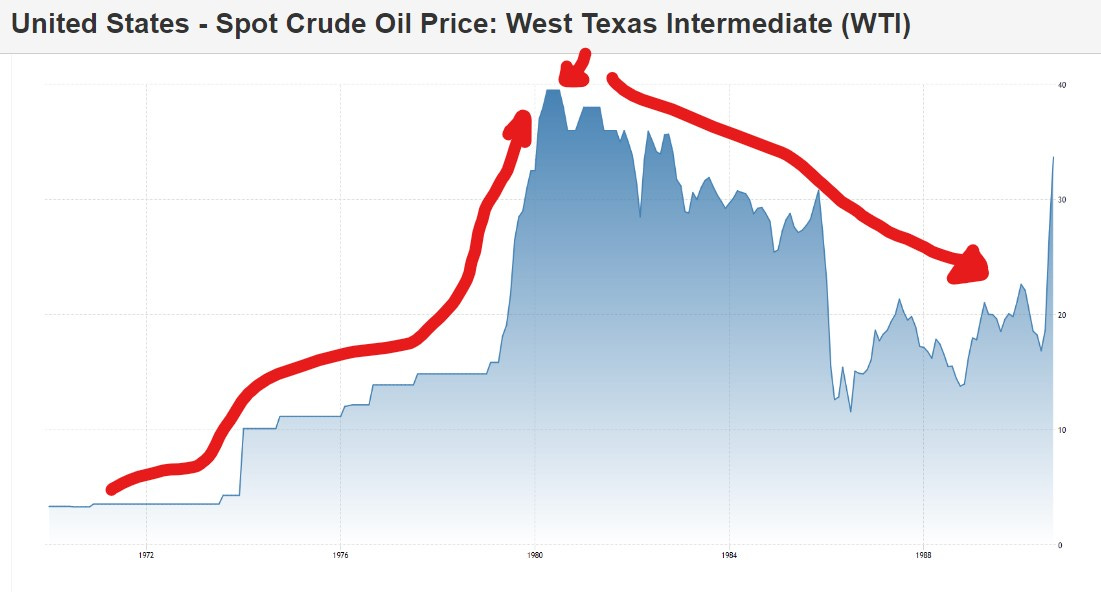

Here is a chart of the Spot Crude Oil Price from 1971 – 1990, showing the oil price surge from 1970 which contributed to the peak of CPI inflation in 1981.

In fact, from 1971 to 1981, the oil price went from US$ 4 per barrel to almost $ 40 -- a TEN FOLD increase.

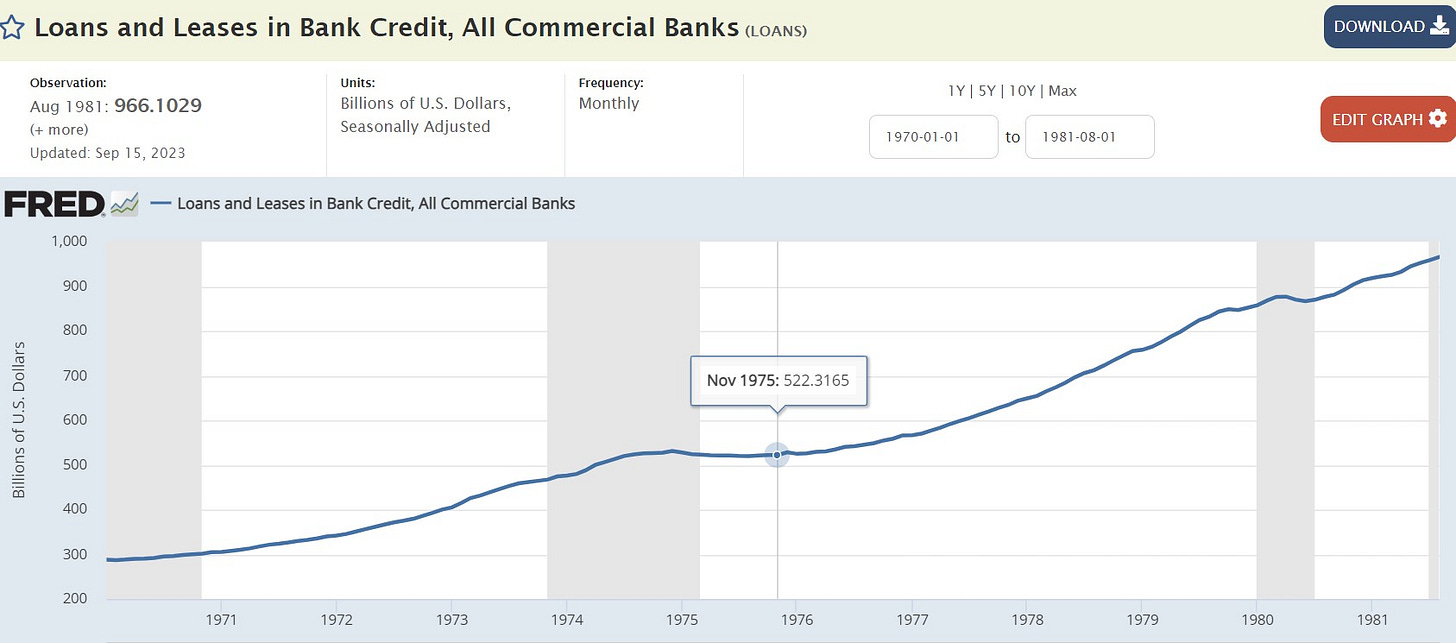

Meanwhile, again from 1971 to 1981, Total Loans and Leases from All Commercial Banks in the US increased dramatically from $ 300 Billion to $ 980 Billion.

They TRIPLED in volume.

As a result, the CPI inflation rate in the US rose to 15 % in 1981. It clearly occurred due to the excessively large increase in credit money creation as the banks lent wildly after the US Dollar to Gold peg was broken by Nixon in 1971. Plus the massive increase in the oil price occurred when the US economy was very much an energy dependent one compared to today’s services based economy.

Now, let’s compare 1981 to today’s situation. If we look at the Total Loans and Leases for the last 10 years in the US, 2013 – 2023, we see an increase from $ 7,000 Billion to $ 12,000 Billion. That is only a 70 % increase over 10 years – a far cry from a tripling in total credit money volume that occurred in the 1970’s.

And the price of West Texas Crude Oil over the last 10 years has traded mostly down rather than up to arrive at its current price which is now just slightly above its average price over that period.

So the circumstances of 1981 are simply not here today for us to see any further strong increase in CPI inflation in the United States. And that outlook applies to most of the advanced economies (with the possible exception of the UK).

For further persistent rapid surges in CPI inflation to occur in our advanced services dominated economies, excess wages growth would have to be the prime trigger for inflation. And that is not happening at present.

Thus, the Fed is done as far as BOOM can see. They will not rush to any further interest rate increases. They will jawbone threats of more rate rises just to keep things on an even keel and to appear hawkish.

And that is exactly what Jerome Powell, the head of the Fed, did last week. He said “We are in a position of proceeding carefully”. In other words, they will raise rates again if the data indicates a need to do so but caution is now the primary approach.

COVID VACCINES ARE CONTAMINATED

PFIZER AND MODERNA SHARES CONTINUE TO FALL

mRNA technology has fallen under yet another very dark cloud this week with more revelations concerning Covid vaccine contamination with foreign DNA. Some months ago, a renowned molecular biologist and super expert in gene sequencing, Dr Kevin McKernan, discovered large amounts of foreign DNA in Plasmid form in vials of Covid vaccines.

Last week, similar revelations were delivered by two more senior Molecular Biologists at a Senate hearing in South Carolina — to be precise, the South Carolina Senate Medical Affairs Ad-Hoc Committee on DHEC.

Professor Phillip Buckhaults and Dr Janci Lindsay ripped the band aid off the horrible, semi-secret, suppurating wound of genetic tampering which they explained is inevitable when large amounts of DNA are present in these so-called RNA vaccines.

On the DNA contamination in the products, Dr Buckhaults said

“ … it's basically packaged in a synthetic virus able to dump its contents into a cell”

“ … they just didn't think about the hazard for genome modification”

“… I would not have given it to my daughters …. and I feel like my consent was not as informed as it should have been”

And the other horrible truth, the presence of SV40 Promoters was also discussed in front of the stunned Senators. SV 40 promoters enhance the uptake of genetic material into the nucleus of cells in the body and thus the transcription (combination) of that material into the DNA contained within the nucleus of each cell. Why were the Senators stunned? Because large volumes of foreign DNA and SV 40 Promoters simply should not be present in such products and are a precursor to possible alterations in the Human Genome which will probably lead to a significant increase in many cancers (and other illnesses).

In her testimony, Dr Lindsay said –

“I think that this is the most dangerous platform that has ever been released on mankind”

“it goes to your brain … it goes to your bone marrow”

“the risks were not told to people”

“there are sequences within these plasmids ....I personally feel that this is intentional. I believe that there is nefarious intent .… I'm going to tell you why”

“there are sv40 sequences within the plasmids that were not disclosed to the Regulators”

“they're dangerous …. we're injecting these in our kids ... we don't inject contaminated medical products in our kids”

Moderna shares finished the week in New York at around $ 100 -- down 12.74 % on last Friday’s close. Two years ago, they traded at $ 500.

And Pfizer shares finished down by 4.05 % on the week at $ 32.71. At the end of 2021, they peaked just above $ 57.00.

Relentless long term downtrends also continue to plague the other Covid vaccine stocks. Novavax fell another 7.52 % during the week. Biontech shares also fell by 7.45 %.

After these Bombshell revelations in the South Carolina Senate last week, BOOM cannot see how these downtrends can be easily reversed. Armageddon has arrived for mRNA technology and the battle for its future just turned decidedly ugly for the companies involved. We may be witnessing a fight to the death.

References:

and

BLACK SEA SECURITY ACT – DANGEROUS MEDDLING – WHY?

The planet is undergoing rapid Geopolitical change with the move towards currency multi-polarity being driven by the BRICS Group of nations and with the Ukraine war steadily moving towards its second year of conflict. The Covid “pandemic” is also contributory to increased global uncertainty.

Washington DC is not content with that state of affairs. They have achieved their expressed goal of massively increased defence spending from their Western European NATO allies (settled in US Dollars, of course) and now appear willing to destabilise things even more with the United States being on the verge of adopting the Black Sea Security Act of 2023.

In Sec 2 of the Act, the following statement almost appears to be almost a declaration of war from the United States. please note that the word “almost” is important here as the posture is defensive and not offensive.

“the United States and its allies should robustly counter Russia’s illegitimate territorial claims on the Crimean Peninsula, along Ukraine's territorial waters in the Black Sea and the Sea of Azov, in the Black Sea's international waters, and in the territories it is illegally occupying in Ukraine; “

The bill is an addition to the National Defense Authorization Act (NDAA), which defines US spending on national defence. However, if adopted, the Black Sea Security Act will increase the US economic and military footprint in the Black Sea region. It represents a further NATO expansion Eastwards and thus yet closer to Russia’s borders. In other words, when the bear is irritated and striking out, you prod it again with a sharp stick. Makes sense?

Many readers ask BOOM why the US continually appears to destabilise the Geopolitical landscape. Of course, BOOM always points out that the US is not the only nation involved in such destabilisation. Other nations play a role in the patchwork quilt of foreign interference. However, the US involvement in all of this is the question most often asked and the answer is not so obvious. Many Geopolitical analysts say that it does so in order to strengthen the dominance of the US Dollar as the primary currency of settlement for international trade and capital movements. In times of global uncertainty, the US Dollar will then remain as a safe haven for investors. This supports the US currency relative to other currencies but it also supports the US bond markets (especially for Treasuries), the US stock markets and the US real estate markets in the minds of foreign investors.

And looking back over recent history, this appears to have been the chief driver of US foreign policy ever since the end of World War Two in 1945. US Dollar dominance was established 12 months earlier in July 1944 at the historic Bretton Woods Meeting in New Hampshire. At that meeting, the unelected, non-democratic NGOs (Non Government Organisations) which now plague the world and appear hell bent on Supra-national control, were also either established immediately or were prepared for launch at a later date – the United Nations, the International Monetary fund (IMF), the International Bank for Reconstruction and Development, the World Bank, the World Health Organisation.

The chief agents of global destabilisation were also established around that time in many nations – borne of the distrust that was triggered by the horrors of World War 2. These agents of destabilisation are the so-called “intelligence” organisations of the world’s nations. In the Western alliance of nations, the “Five Eyes” nations are the backbone of this but other allies scattered around Western Europe and in Asia are connected. Some (rather unkindly) call those nations vassal states.

The “Five Eyes” is an intelligence alliance comprising Australia, Canada, New Zealand, the United Kingdom, and the United States. These countries are parties to the multilateral UK-USA Agreement, a treaty for joint cooperation in signals intelligence. Informally, Five Eyes can also refer to the group of intelligence agencies of those countries.

All of this is well known public knowledge but what is the economic importance of it all? Economically, it ensures the dominance of the US Dollar globally. And, theoretically, that currency dominance is supposed to contribute to increased economic and financial stability of the global economy.

Go figure – instability will cause stability. Only Washington DC could come up with such a plan although, to be fair, there are some doubts that the US Government is actually in charge of the plan. Supra-national bodies with their own agendas are suspected by some commentators of being the true controllers of such a diabolical policy stance.

Let’s look at the financial impact by charting the US Dollar Index over the last 5 years while the disruptions of Covid, BRICS and Ukraine have been the foci of Geopolitical uncertainty. The Index is made up of 6 currencies in a basket --

The US Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies. The Index goes up when the US dollar gains "strength" when compared to those other currencies. The index is designed, maintained, and published by ICE, with the name "U.S. Dollar Index" a registered trademark.

It is a weighted geometric mean of the dollar's value relative to following select currencies:

• Euro, 57.6% weight

• Japanese yen, 13.6% weight

• Pound sterling, 11.9% weight

• Canadian dollar, 9.1% weight

• Swedish krona, 4.2% weight

• Swiss franc, 3.6% weight

CHART OVER 5 YEARS – UUP – the US Dollar Index

The US Dollar Index has shown great strength over the last 5 years during all of this global Geopolitical turmoil. Is this proof of the pudding? It certainly looks like global instability is good for the dominance of the US Dollar.

GERMANY THE SICK MAN OF EUROPE

BOOM has written frequently about the inadequate leadership of Western Europe and especially so concerning the poor leadership of the European Union and of NATO. All of this has economic consequences for the people of Europe.

In regard to Germany, the Deutsche Bank CEO Christian Sewing said this last week at the Handelsblatt Banken Summit -- “We are not the ‘Sick Man of Europe” …... “but it is also true that there are structural weaknesses that hold back our economy and prevent it from developing its great potential.”

He went on to say -- “We will become the Sick Man of Europe if we do not address these structural issues now”.

He identified the key issues as high and unpredictable energy costs, slow internet connections, outdated rail networks, digitisation backlogs, a lack of skilled workers, excessive bureaucracy and long approval procedures. But, of course, the main problem that Germany faces is its increasingly high costs of energy. A manufacturing giant cannot prosper without reliable, cheap energy.

Goldman Sachs economist Peter Oppenheimer also chimed in when he said that Germany’s economy continues to grapple with challenges in its manufacturing sector as it suffers from higher energy costs. He said -- “It’s… not a deep recession but it’s obviously been more hit by obvious headwinds” and “going forward, any rise in geopolitical tensions or curtailment in world trade would hinder the German recovery”.

To make matters worse, Annalena Baerbock, the German Foreign Minister called the President of China, Xi Jinping, a “dictator” last weekend while visiting the US. The Chinese government responded by summoning the German ambassador in Beijing to lodge a formal protest. China said that it was "extremely dissatisfied" with Baerbock’s comments.

Yet, again, another European “leader” has been caught not hiding her idiocy under any semblance of intelligence or diplomatic language. The word foolish springs to mind.

THE UNITED KINGDOM IS THE OTHER “SICK MAN”

Last Tuesday, the OECD (Organisation for Economic Cooperation and Development) announced that the United Kingdom will experience one of the highest inflation rates of any major developed economy this year. In its latest Economic Outlook report, the OECD forecast that UK inflation will average 7.2 % this year. Compare that to China’s current Annual CPI inflation rate of 0.1 %, Russia’s at 5.2%, the Euro Area also at 5.2% and the USA at 3.7 %.

There is another threat looming for the British economy. This time, in the banking sector and in regard to the money supply. A growing number of British households are falling behind on their loan payments, with mortgage arrears jumping by 13% in the second quarter of the year to the highest level since 2016. This was revealed last week by the central bank, the Bank of England.

The value of home loans with late payments is up 29% on the previous year due to rising interest rates, unemployment and falling disposable incomes. Mortgage defaults will be next on the list of ailments if this trend worsens. Such defaults will inevitably lead to a decrease in the money supply if they occur in large enough volumes. When the real economy garden is starved of water (money supply) then it will start to die. It is as simple as that. The UK is in a dire economic situation indeed with little hope for the future as far as BOOM can see. Stagflation will rule there for many years and the people’s standard of living will progressively decline for year after year. Social unrest will soon erupt.

OECD SLASHES GLOBAL GROWTH FORECAST

To make matters worse for Germany, the United Kingdom and Western Europe, the OECD has reduced its forecast for global growth to 2.7 % for 2024.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.