BOOM Finance and Economics 27th August 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

SAUDI ARABIA TO JOIN BRICS

The BRICS Summit Meeting took place last week in South Africa. Representatives of the Founding Nations of the BRICS group attended -- Brazil, Russia, India, China and South Africa. Many other nations attended – Algeria, Bangladesh, Belarus, Bolivia, Cameroon, Central African Republic, Congo, Cuba, Djibouti, Egypt, Eritrea, Ghan, Indonesia, Iran, Malawi, Mozambique, Namibia, Nigeria, Saudi Arabia, Senegal, Tanzania, UAE (United Arab Emirates) and Zambia. Also in attendance was the Sahrawi Arab Democratic Republic which is a partially recognised state, recognised by 45 UN member states, which claims the non-self-governing territory of Western Sahara, but controls only the easternmost one-fifth of that territory.

Argentina, Ethiopia, Iran, Saudi Arabia, Egypt and the United Arab Emirates will be invited to become full members of the BRICS group of nations from January 1st, 2024. The most significant of this list are, of course, Iran, Saudi Arabia and Egypt. But that is not the end of this story.

As BOOM mentioned a few weeks ago -- “At the recent Russia-Africa Summit in Saint Petersburg, it was revealed that 19 other African countries have also applied for BRICS membership in the last 12 months. That is a staggering fact. If accepted along with new applicant Uruguay, these 19 nations would swell BRICS to 28 nations. And there are rumours of another 20 nations lining up to join. 48 nations would be a formidable bloc.”

But the addition of Saudi Arabia is the bombshell announcement. There appears to be some doubt about this because an official announcement has not yet come from Saudi Arabia. However, the Foreign Minister of Saudi Arabia, Prince Faisal bin Farhan, attended the meeting and was reported by Reuters as saying -- "We look forward to develop this cooperation to create new developmental and economic opportunities and elevate our relationship to the aspired level."

Such a development does not surprise BOOM as previous editorials have outlined the increasing economic ties between Saudi Arabia, China and Russia. These three nations are actually natural partners. Why? Because Russia and Saudi Arabia are the two biggest exporters of energy in the world and China is the biggest importer of energy. So, in the game of global energy, China holds most of the cards because it can determine the volume purchased and the price it will pay for its requirements. And it can also determine the currencies of settlement.

At present, these transactions are being settled with a mix of currencies including the US Dollar, the Chinese Yuan, the Russian Ruble and the Dirham – the currency of the United Arab Emirates. Of course, nobody really knows the actual mix of percentages in each contract because that is a well kept secret. However, suffice to say that there is slow progression towards lower percentages of US Dollars involved.

THE END OF THE PETRODOLLAR? THE END OF US DOLLAR DOMINANCE?

Some excited commentators have therefore announced that this is “The End of the Petrodollar (!!)”. However, that is not the case. The fact remains that China still earns a great deal of its foreign export revenues in US Dollars as do many other nations. Thus, its cache of US Dollars earned in trade is easily converted into energy via contracts with Saudi Arabia. And US Dollars are still, by far, the most readily available and most convenient currency of settlement. These convenient dollar volumes reside on the balance sheets of many global banks and are created not by the US government but by those banks making loans denominated in US Dollars to willing borrowers. None of this requires the permission of the US government which is content to see such expansion of its offshore currency volumes.

Offshore US Dollars are still, by far, the largest volume of offshore currency in the world. These are called Eurodollars and the US has no control over their creation or use by corporations and nation states as a means of making trade and capital settlements.

So, what happened to the US Dollar Index last week? It rose by 0.83%. In fact, it has been in strong short term uptrend since mid July. The first chart (over the last 6 months) shows that clearly.

And the longer term chart over 3 years shows steady and increasing demand for US Dollars over time.

This reality of global demand for US Dollars is counter to the Doom and Gloom merchants who write endless articles about the coming “collapse of the US Dollar, the resultant Hyperinflation and return of the Gold standard”. They call this “the return to sound money or gold backed money”.

BOOM has been reading such articles for 30 years. They are never an accurate reflection of current reality or of any possible future reality. Scenarios of US Dollar collapse are simply pipe dreams, financial fairy tales. We live in a US Dollar dominant empire and it ain’t about to “collapse” soon. Maybe a slow steady decline of usage over 50 – 100 years will happen. But “collapse” is Armageddon talk. BOOM cannot see any scenario whereby that would happen.

CHINA CUTS INTEREST RATES -- GENTLY

While the Western, advanced economies are worrying themselves sick about possible further interest rate rises to combat CPI inflation, China has a different problem. Falling prices and falling interest rates are the reality there. The mainstream media in the West has decided or has been told to promote the idea that “the China economy is therefore perilously close to collapse”. Such stories are repeated ad nauseam as the Western propaganda machine gains momentum in service to the official, State run narrative. BOOM disagrees, of course. The Chinese changes over the last 2 weeks are not a sign of any great economic crisis.

Last week, the PBOC – People’s Bank of China – (China’s central bank) reduced its one-year loan prime rate, a benchmark commonly used for household and business loans, by 0.10 % from 3.55% to 3.45%. BOOM sees that as an extremely minor change of policy. Meanwhile, the PBOC left the five-year loan prime, which is used to price mortgages, at the existing rate of 4.2%. Last week, the PBOC decreased the rate on its short and medium-term lending facility, the interest rate to banks, by 0.15%. Again, a non significant reduction in the scheme of things economic.

BOOM advises readers to ignore the “China collapse” stories and the “US Dollar collapse” stories. This will leave much time to read more accurate analyses.

THE NETHERLANDS IN RECESSION – ALL OF WESTERN EUROPE TO FOLLOW

The Netherlands is now officially in an economic recession, a contraction of GDP for two consecutive quarters. The economy shrank 0.3% between April and June, after a 0.4% contraction in the first three months of the year. It is the Eurozone’s fifth largest economy. Germany’s economy is also in recession and looking stagnant.

Meanwhile, the latest CPI annual inflation rate for The Netherlands in July is 4.2 % and the number in Germany was 6.2%.

The entire Eurozone economy grew by 0.6 percent year-on-year in the second quarter of 2023, easing from a 1.1 percent expansion in the previous quarter. With Germany and The Netherlands now in official recession, BOOM cannot see how all of Western Europe can avoid the same fate.

Foolish leadership is to blame. The people are only slowly beginning to understand this. However, the reality will set in as each new quarter shows no recovery in economic activity as prices continue to rise due to energy costs that simply cannot fall without Russia’s help. It is time to reign in the war hawks of NATO who wish to sacrifice hundreds of thousands of young Ukrainian men’s lives while simultaneously killing the economies of Western Europe. Jens Stoltenberg, the blood lust leader of NATO, must be brought to his senses before he destroys civil society in all of Western Europe.

NOVAVAX AND BIONTECH SHARES COLLAPSE

In the Covid vaccine space, Pfizer and Moderna get all the attention. However, there is another company, Novavax, that produces a vaccine using a different technology. Theoretically, it appears to be an arguably safer technology because it does not involve the injection of synthetic, man made genetic material into human bodies. And this means that the dosage of Covid Spike protein can be delivered much more accurately. However, the Novavax product, despite these advantages, is not being accepted as readily as the products from Pfizer and Moderna in the government marketplace. Does this indicate the smell of corruption in government agencies?

So – let’s look at the share price history of Novavax. Over 3 years. It has fallen from a High of $ 325 to its current price below $ 10. That is some fall. Some would call it spectacular.

Then there is the other company involved in the Covid vaccine debacle, Biontech. It is Pfizer’s partner in manufacturing their joint Jab. Biontech’s share price has fallen from a High above $ 450 to its current price around $ 117.

Investors appear to have made up their mind about these companies. They think they are too risky to hold over the long term. They think that the promise of new vaccine technologies is a false promise. BOOM agrees. Readers will not be surprised. The hype is way beyond the reality. In fact, these vaccine technologies may turn out to have caused injuries and deaths well above acceptable levels. In that case, the companies involved may arguably have negative equity if large class actions are launched in the United States.

ARE THE COVID VACCINES CONTAMINATED?

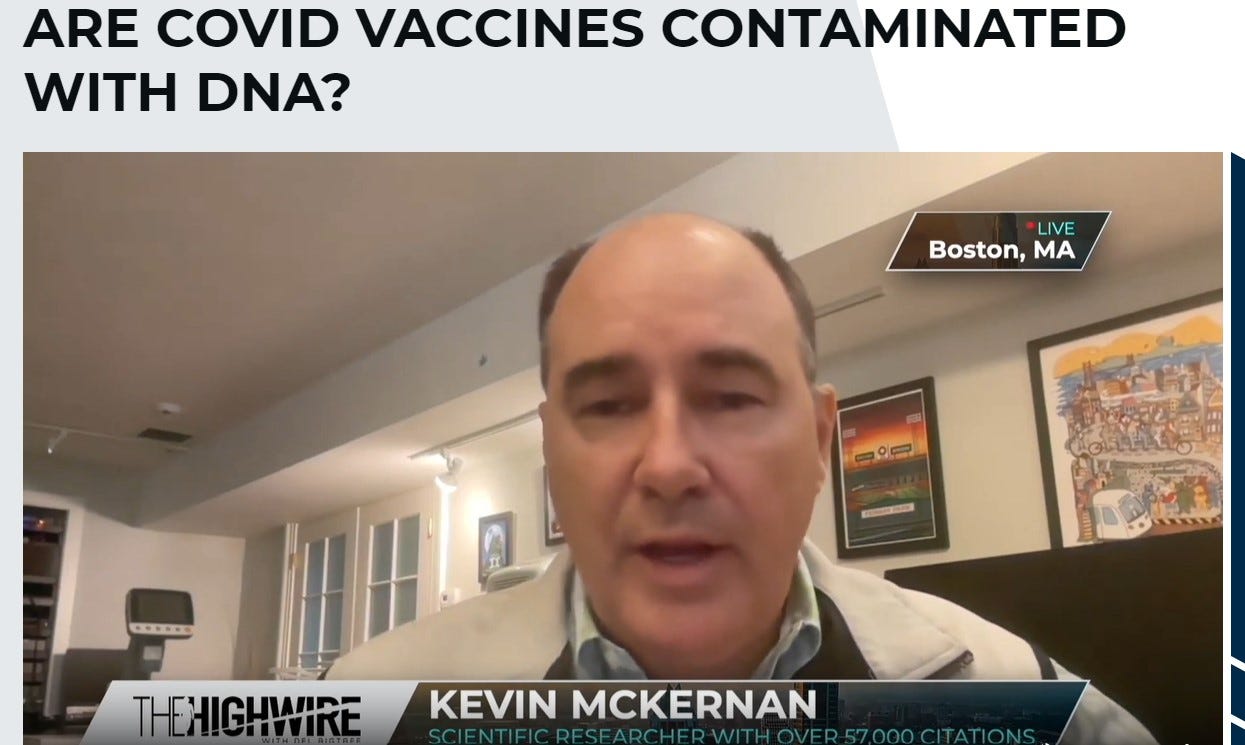

One major doubt about the Covid vaccines concerns the foreign DNA contaminations that have been found in some vials. This is an extremely serious matter and deserves close inspection. Watch this interview with Dr Kevin McKernan, a world class expert in Genomics and Gene sequencing and make up your own mind. Investors should especially watch closely.

https://thehighwire.com/ark-videos/are-covid-vaccines-contaminated-with-dna/

JAB INJURIES GLOBAL

A website that collects testimonials from Covid vaccine injured people is sobering. It is available at

https://jabinjuriesglobal.com/

NEITHER SAFE NOR EFFECTIVE

And a book has been recently published — by Dr Colleen Huber — Neither Safe Nor Effective 2nd Edition: The Evidence Against the COVID Vaccines.

This is a section from the introduction —

“Dr. Peter McCullough, an American cardiologist, called the COVID vaccines, ‘the worst pharmaceutical development idea in the history of mankind.’”

“It often comes as a surprise to people that mRNA-type medical interventions and coronavirus vaccines had plenty of red flags through their history prior to December 2020. The ingredients used were already known to be toxic: Cationic lipids injure the nervous system, lungs and liver, as well as cell membranes throughout the body. Polyethylene glycol was never used for injections, due to safety concerns. mRNA had already been shown to change DNA. Previous attempts at coronavirus vaccines had all failed and killed the test animals. So inflicting the world’s population with a new, mostly untested vaccine for which its components already had so many safety warnings was the most widespread reckless experiment in human history.”

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS EDITORIALS AVAILABLE AT —

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry

Over 6 years on a number of platforms, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.