BOOM Finance and Economics 4th February 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available at LinkedIn and at Wordpress https://boomfinanceandeconomics.wordpress.com/

ABSOLUTE ZERO – UTOPIAN DREAMS, DELUSIONS AND MAGICAL THINKING

THE CHINA STOCK MARKET MAY BE CLOSE TO A REBOUND

GENERAL MOTORS MOVES TO HYBRIDS

TESLA MOMENT OF TRUTH?

VOLVO ABANDONS POLESTAR ELECTRIC

ABSOLUTE ZERO – UTOPIAN DREAMS, DELUSIONS AND MAGICAL THINKING

Mix false assumptions, false conclusions, moral panic, delusion, anxiety, catastrophism, lack of critical thinking, lack of consultation, dreams of Utopia, academic group think and magical thinking and you will get ……. Absolute Zero.

Absolute Zero is a report produced by the UK FIRES group, dated 29th November 2019. FIRES stands for Future Industrial Strategy Resource Efficiency. Why they called it the FIRES Group instead of the FISRE Group is a mystery.

The Absolute Zero Report reveals alarming plans to change British society rapidly and dramatically so that “climate change” can be avoided. However, it does not set a target temperature for the planet or for anywhere on the planet. There is no plan to monitor or audit outcomes or to measure success. This is a one way trip to climate Utopia from a group of University academics ensconced in their ivory towers high above any industrial activity.

In the Executive Summary, the first sentence states -- “We have to cut our greenhouse gas emissions to zero by 2050: that’s what climate scientists tell us”. There is no rationale presented for this statement. It is simply presented as an ultimatum or perhaps an article of faith.

BOOM searched for the word “target” in the document. It does mention “zero emissions”, net zero”, a “legal target”, “target challenges”, “Reaching Absolute Zero requires a collaboration between individuals, government and businesses. None of them can act unilaterally, so reaching the target will be a process”, “annual global emissions from human activities must be reduced rapidly and should be eliminated by 2050 – in thirty years’ time”, the target of Absolute Zero”.

Human beings emit Carbon Dioxide which has been labelled a “greenhouse gas”. So -- will all human beings be required to stop breathing by 2050 in order to meet the Absolute Zero Emissions Target?

The report hides behind a legal imperative to justify its existence. It states -- “In her last significant act as Prime Minister, Theresa May changed the UK’s Climate Change Act to commit us to eliminating all greenhouse gas emissions in the UK by 2050.” Note ALL Greenhouse Emissions.

The report rightfully explains that current “solutions” to the “problem” are not going to make enough difference.

Quote: “We’re concerned that most plans for dealing with climate change depend on breakthrough technologies - so won’t deliver in time.”

The authors state rather flippantly “ …. we’ll only have to cut our use of energy to 60% of today’s levels.”

The word “only” is the alarm bell. BOOM interprets this into economic and social outcomes. Perhaps a more honest and more thorough statement should have been made? For example –

“You will have to make dramatic, drastic changes in how you live by reducing your energy use by 40% from today’s levels, leaving no room for any significant economic growth. This will lead to economic stagnation at best and possible dramatic economic contraction at worst with huge increases in unemployment, bankruptcies and possible starvation. All of this can only be achieved via Totalitarian Government controls. Massive social unrest will therefore be inevitable.”

But they appear uninterested in the possible economic consequences. They move on to state “…. we’ll all stop using aeroplanes.” That statement concentrates the mind of any reader. Perhaps it should have been followed by the admonition “You will do as we say, or else”.

Does that mean all of us? Perhaps the elite alone will be allowed to travel using aircraft?

And “we must stop eating Beef and Lamb”. Again, what (exactly) do they mean by “we”? Do they really mean YOU?

Correctly, they realise that cement is a major issue. BOOM has previously read that cement is responsible for 10 % of all global CO2 emissions.

“However the most difficult problem is cement: making cement releases emissions regardless of how it’s powered, there are currently no alternative options available at scale”

The Report is produced by a group of academics from the following UK educational institutions with litle input from industry, consumers or financial experts. Tellingly, the report states “the authors of this report are funded by the government”.

University of Cambridge

University of Bath

University of Nottingham

University of Strathclyde

University of Oxford

Imperial College

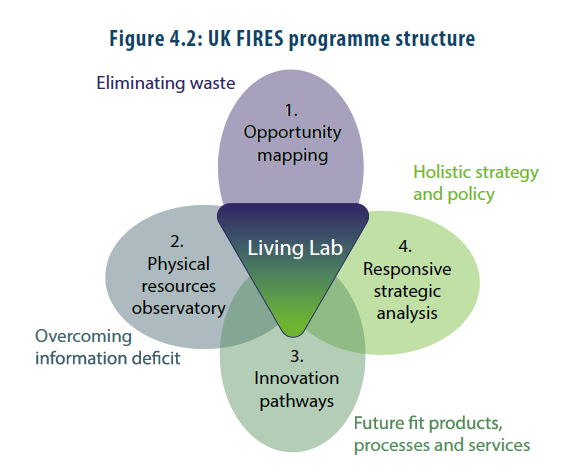

To demonstrate that some consultation has taken place, the report states “The UK government has invested £5m in the UK FIRES research programme, bringing together the academics from six universities who have written this report with businesses across the supply-chain in a ‘Living Lab’.” BOOM is not sure what a “Living Lab” is but apparently it is costly to construct. They show a cute diagram to explain this one sentence that deals with the consultation process. Five Million Pounds is equivalent to 6.3 Million US Dollars and almost 10 Million Australian Dollars.

UK FIRES

The real world of economic activity where goods and services are produced and funded by the financial sector appears to have been essentially ignored. Most of the references provided appear to be from academic or government publications.

Quote: “The fossil fuel, cement, shipping and aviation industries face rapid contraction, while construction and many manufacturing sectors can continue at today’s scales, with appropriate transformations.”

Here are its most disturbing proposals including the end of aviation (for most people), massive airport closures and no new roads.

Travelling

1. Stop using aeroplanes

2. Take the train not the car when possible.

3. Use all the seats in the car or get a smaller one

4. Choose an electric car next time, if possible, which will become easier as prices fall and charging infrastructure expands.

5. Lobby for more trains, no new roads, airport closureand more renewable electricity.

The authors’ Utopian vision for the future clearly includes an idle populace, left with no meaningful employment. That is revealed under a heading of -- Leisure, sports, creative arts and voluntary work. The report states “These sectors can expand greatly”.

They want the Mining and Materials industries to contract dramatically, as if by some kind of magic. BOOM is acutely aware of magical thinking throughout the document.

They have done some sums/math and reached this conclusion on electric cars -- “by 2050 (we) will have only 60% of the electricity required to power a fleet equivalent to that in use today. Therefore we will either use 40% fewer cars or they will be 60% the size.” More magic, as if everyone will be happy to discard their individual freedom of movement to happily jump on publicly provided electric trains, taxis and buses for every trip. However, they are concerned about the car batteries -- “The rapid expansion of lithium battery production may hit short-term supply constraints and create environmental concerns…”. Mmmmm ……. environmental concerns?

On Aviation: Quote: “There are no options for zero-emissions flight in the time available for action, so the industry faces a rapid contraction. Developments in electric flight may be relevant beyond 2050.”

On Energy: Quote: “All coal, gas, and oil-fuel supply from extraction through the supply chain to retail must close within 30 years”.

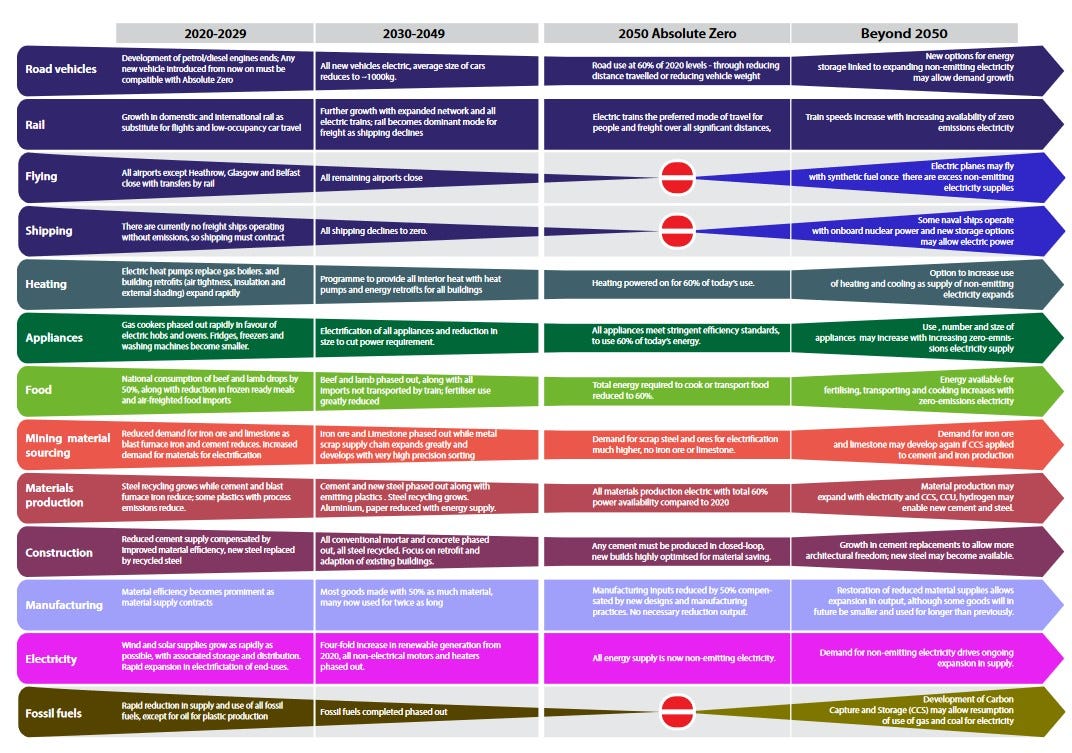

The Report provides a Summary Image (above). It shows that within just 5 years, by the end of 2029 --

Only 3 airports will be in operation in the UK. They will include Heathrow, Glasgow and Belfast. ALL OTHER AIRPORTS WILL BE CLOSED.

And by 2049, those three major airports will also be closed. THE END OF AVIATION.

And “all shipping will decline to zero”. THE END OF SHIPPING.

By 2029, in the next 5 years, Beef and Lamb consumption is planned to drop by 50 %. By 2049, there will be no Beef or Lamb production and all imported foods (not transported by electric train) will be banned.

Quote: “... the best estimates of science today predict that annual global emissions from human activities must be reduced rapidly and should be eliminated by 2050 – in thirty years’ time. This target, which requires extraordinarily rapid change, is now law in the UK, and several other countries. However, despite the science and the laws, global emissions are still rising.”

Quote: “The two renewable technologies now being deployed widely are wind-turbines and solar-cells. These critical forms of electricity generation are essential, and should be deployed as fast as possible, but Fig. 1.3 shows that, they combined with nuclear power and hydro-electricity, still contribute only a small fraction of total global energy demand.”

The real truth finally emerges in this sentence -- “the only solutions available in the time remaining require some change of lifestyle”. The authors request a “discussion” to resolve this roadblock. “This report therefore aims to trigger that critical discussion.”

MMMmmmm. Some “change of lifestyle” will be required. Some “specific restraint in our lifestyles.” And all we need to do is have a “discussion” to settle the matter?

To BOOM, that sounds like an ultimatum from a crime boss or perhaps from the leader of a Boy Scout group. In this discussion, do they plan to make us an offer we can’t refuse? Or do they want us to all hold hands and joyfully sing Kumbayah?

For those who don’t know, Kum ba yah ("Come by here") is an African American spiritual song known to be sung in the Gullah culture of the islands off South Carolina and Georgia, with ties to enslaved Central Africans. Note the enslaved aspect of the song. Enslavement seems to be part of the plan.

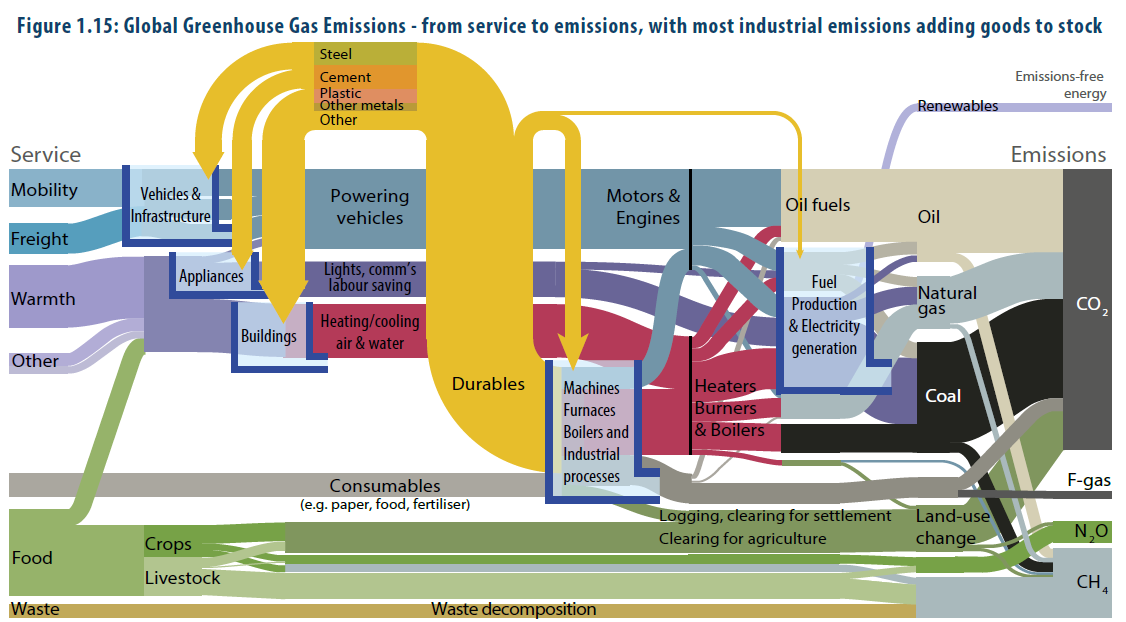

On and on the report goes for 54 pages with dense images such as this one which seeks to explain Global Greenhouse Gas Emissions.

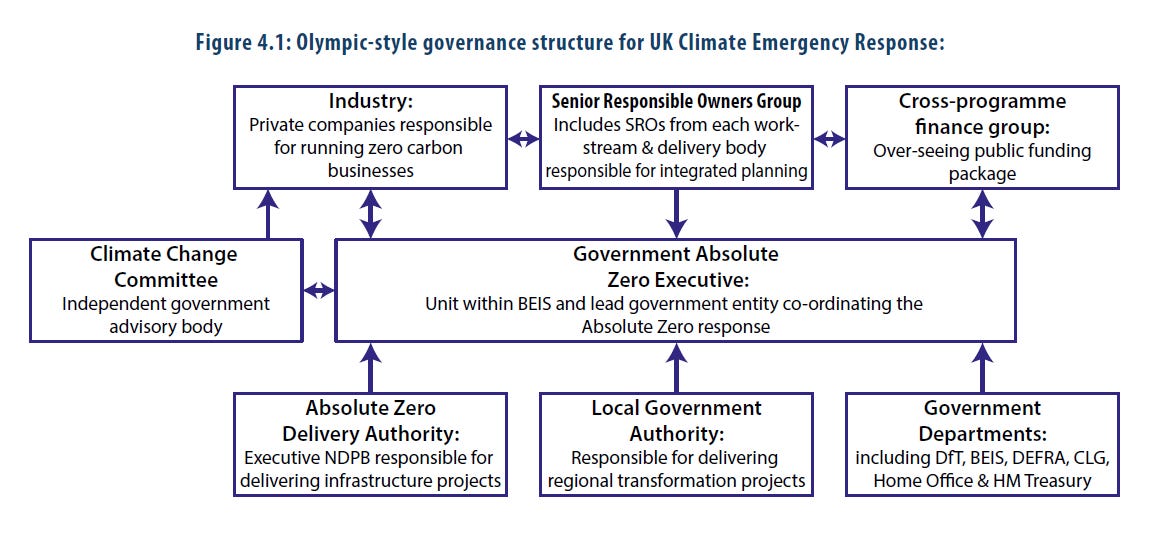

And this one on “Opportunity in Governance” shows the “Governance Structure” that will be required – replete with “groups”, “advisory committees”, “programmes”, “executives”, “authorities” and (many) government departments.

Sir Humphrey Appleby from the famous British “Yes Minister” television series would be glowing with pride and enthusiasm if he ever saw such a plan involving multiple layers of bureaucracy and endless meetings.

GOVERNANCE

SIR HUMPHREY APPLEBY

Another Sir Humphrey Appleby Quote:

“Civil servants have an extraordinary genius for wrapping up a simple idea to make it sound extremely complicated.” ― Jonathan Lynn, The Complete Yes Minister

You can Download the 54 page Absolute Zero Report from -- https://ukfires.org/impact/publications/reports/absolute-zero/

Hit the Download Button, then go to the PDF link under the Heading “Files”. That will Download a PDF Version to your Download Folder.

Please Note: The Population of the UK is 67.8 Million. But only 37,400 people have viewed the Download page and there have only been 153,000 Downloads of the Report (according to the statistics provided).

In other words, very, very few people of the UK have actually seen this 5 Million Pound Absolute Zero Report that strongly supports dramatic, draconian changes to life in Britain. Social, financial and economic reality is missing.

BOOM suggests the Absolute Zero Report be given a score of Absolute Zero.

THE CHINA STOCK MARKET MAY BE CLOSE TO A REBOUND

On 21st January, two short weeks ago, BOOM wrote “BOOM’s China trade indicator has turned upwards in the last 2 months and is gaining strength. This is a reliable sign of increased Chinese trade which usually precedes a resurgence of the domestic economy.”

And ….

“… if the upswing in external trade continues, then we should soon see a rebound in the Chinese economy and a subsequent rebound in stock prices.”

Over the last 2 weeks, BOOM’s China trade indicator has continued to show a sharp recovery. In fact, the indicator has increased by 20 % in that time frame. That is a significant change in direction. It suggests strength in both the Global economy and the Chinese economy.

And, since BOOM made that forecast, investors have poured US$ 12 Billion into the Chinese stock market as reported by Reuters. This is the largest inflow of funds in 8 years and is the second largest on record. Perhaps BOOM’s Japanese readers are influential?

Technically, the Chinese stock market indices have not yet shown a base formation. However, with huge investment inflows and a recovering trade picture, there is potential here for a significant turnaround soon in stock market valuations.

The Shanghai Composite ndex Total Market Capitalisation is around US$ 6 Trillion. In comparison, the S and P 500 stock index in the US is valued at around US$ 42 Trillion. The total market cap is calculated by summing the market capitalisation of every company in the index.

The long term charts are certainly interesting. The Shanghai Composite Stock Index has been falling since 2015. This 25 year chart reveals two sharp peaks in price in November 2007 and in June 2015. Since 2015, there has not been any joy for investors. A turnaround would appear to be long overdue.

CHINA SHANGHAI COMPOSITE INDEX (over 25 years)

The Hong Kong Hang Seng Stock Index shows 4 sharp peaks in price including the peak in 2007. However, the market has been in steady decline since February 2021.

HONG KONG HANG SENG INDEX (over 25 years)

In that 25 year period under consideration, the Annual GDP of China, measured in US Dollars, has grown from US$ 1 Trillion to $ US 18 Trillion. But China’s GDP measured in PPP (Purchasing Power Parity) is now above US$ 30 Trillion which is considerably higher than the United States.

The Chinese New Year begins next week, on Saturday February 10th and this year, 2024, it is the year of the Dragon. In Chinese mythology, the Dragon is powerful, endlessly energetic and full of vitality, goal-oriented yet idealistic and romantic, and a visionary leader. Sounds perfect for a stock market turnaround? The Chinese communist government will have to encourage its people to become investors in the share market for this to happen. But that is capitalism, is it not?

GENERAL MOTORS MOVES TO HYBRIDS

General Motors, one of the “Big Three” US car manufacturers, has decided to move away from electric cars and towards Hybrids. They claim that this is only an interim measure as they move towards all electric.

The CEO said “Let me be clear, GM remains committed to eliminating tailpipe emissions from our light-duty vehicles by 2035, but, in the interim, deploying plug-in technology in strategic segments will deliver some of the environment or environmental benefits of EVs as the nation continues to build this charging infrastructure.”

However, in BOOM’s opinion, that is more a political statement rather than a true indication of their intentions. They currently make only one Hybrid car model for the US market so this is a big change of direction.

The announcement was made on Tuesday and investors responded rapidly. Improved earnings helped. GM shares rose sharply and finished the week up by 10.6 %.

By the way, Ford has recently announced a huge cut in electric vehicle (EV) production. It is losing $ 36,000 on each EV vehicle sold and around 50 % of its dealers have refused to take any EV cars in 2023. Its unsold EV inventory is 92,000 cars.

GM shares over 6 months

TESLA MOMENT OF TRUTH

US Shareholders have abandoned many electric car companies over the last 2 – 3 years. Investors have largely decided that electric vehicles are not commercially viable in the long run.

Tesla shareholders are the hold-out of true believers. However, Tesla shares have been falling since a peak in late 2021. Last week, after a mixed week of trading, they found some support (which appeared less than enthusiastic) above $ 180 to close at $ 187.91. If the tenuous $ 180 support level is broken, the market will almost certainly move lower from there towards $ 150 and $ 100 levels. We shall watch closely. This could well be the moment of truth for Tesla shares.

BOOM has previously documented the share price collapses in almost all other companies in the sector. The share price falls have been dramatic and some are arguably the greatest collapses in history.

Mullen Automotive shares, for example, have fallen from $ 451,000 per share on August 5th, 2020 to $ 7.00 per share last Friday. That represents three years of terror for any Mullen investors who have held on.

MULLEN SPORT CROSSOVER – LOOKS GOOD?

VOLVO ABANDONS POLESTAR ELECTRIC

In this bizarre world of electric cars, there was another notable event last week. The Swedish brand Volvo, listed as Volvo Cars (Volcar) on the Swedish stock market and which is now principally owned by the Chinese company, Geely, announced that it would no longer provide financial support to the all electric Polestar company -- which it founded with the Geely Chairman, Eric Li. And Volvo Car is apparently aiming to sell its remaining holding in the company to Geely.

Polestar was an IPO in mid 2021 and began its life as a publicly listed company with a share price of US$ 10.00. Those shares are now trading at $ 1.79. As with all electric car companies, it has a fabulous website. GeeWhiz, in fact. However, its financial reports are far from stellar. For the three months ended September 2023, its un-audited financial statements show a Revenue of US$ 613 Million. Its Gross profit was $ 6.3 Million (around 1 % of Revenue). However, Operating Costs resulted in an Operating Loss of $ 260 Million. The company’s Cash Balance fell by $ 22.8 Million from the previous accounting period. In financial terms, this is called “spinning your wheels”. There is a lot of activity going on but no profit is emerging.

POLESTAR SHARES

Volvo Car shares (VOLCAR-B.ST) are listed in Stockholm. The leadership of the company appears devoted to becoming All Electric. As a result, the shares are also showing the typical decline of electric car companies, despite the fact that only 16 % of its sales are currently electric. The leadership’s devotion to an all-electric future has not inspired its shareholders, quite the opposite. The share price chart over the last 2 years reveals what investors are thinking.

Volvo AB, the parent company, sold off its Volvo car division to Ford in 1999. Ford subsequently sold Volvo Cars off to Geely in 2010.

In contrast to Polestar and Volvo Car, Volvo AB shares have performed well over the last 5 years. Volvo AB makes trucks, buses and construction equipment. It also supplies marine and industrial drive systems and financial services.

VOLVO AB SHARES

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Thanks for reading BOOM Finance and Economics Substack.

Subscribe for FREE to receive new posts and support my work.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers and academics.