BOOM Finance and Economics 29th October 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

US MASS MEDIA AUDIENCE COLLAPSED

AUDIENCE DECLINE OVER 30 YEARS

UNITED NATIONS REPORT ON INTERNATIONAL FINANCIAL ARCHITECTURE

GLOBAL GOVERNANCE AND CLIMATE CHANGE

UTOPIAN DREAMS OF CONTROL

US MASS MEDIA AUDIENCE COLLAPSED

The mainstream media audience has collapsed in America. CNN has just announced the closure of its “World News Headquarters” in Atlanta amid reports that its audience is now less than that generated by just one man in the alternative media, Joe Rogan. Other reports list Tucker Carlson’s audience for his first show on Twitter at over 100 million views. Who needs mainstream news?

On Friday, CNN reporter Kate Bolduan said -- “Before we go today, we are marking an important moment today in CNN’s history. Today’s show will be the final broadcast from the CNN Center in Atlanta”.

The people have lost faith and trust in what conventional newspapers, magazines, radio and TV stations offer as news.

Perhaps we should all now bracket the word “news” with inverted commas?

Why? Because it is now clear to most that the mass media “news” is, in fact, an endless diet of propaganda that ensures a twisted view of national and world events. There is no attempt at balanced reporting. No debate is tolerated. Free speech is censored. It is all fearful sensation aimed at political persuasion and intended to create endless mass anxiety.

Fear begets alpha brain wave states which boost suggestibility. So the remnant, robotic audience still watching and reading the mainstream western media will do just about anything suggested by the mainstream. They will even believe that the fifth, sixth or seventh Covid “vaccine” jab is necessary and “safe and effective”.

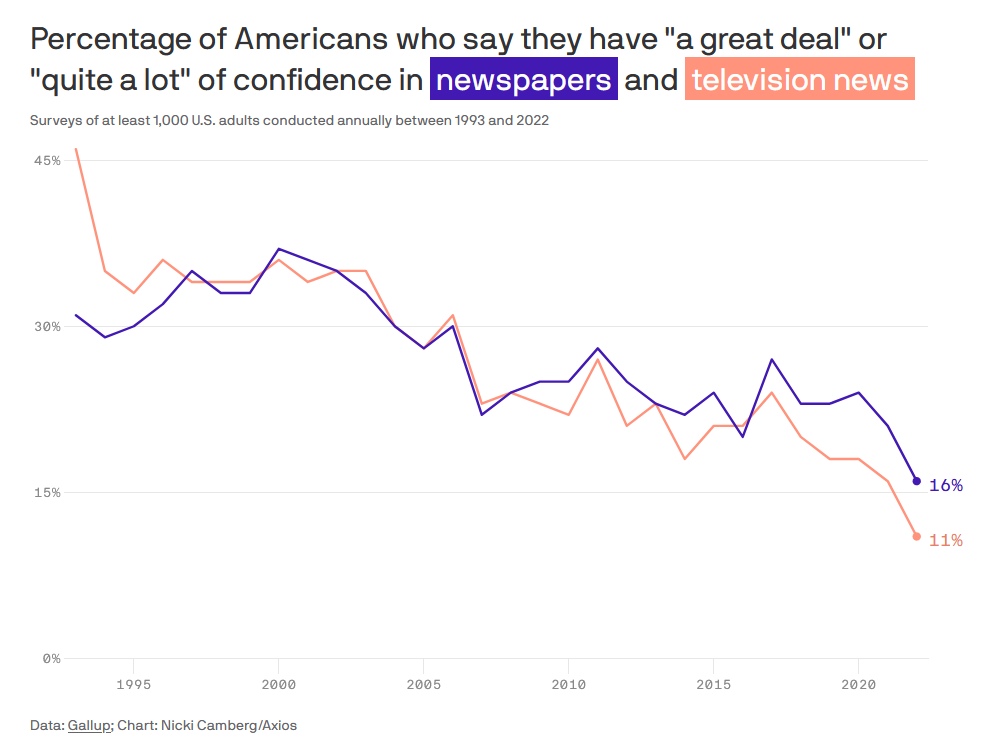

An article in AXIOS recently showed that only 16 % of Americans have strong confidence in their newspapers. That is a staggeringly low number. However, for television news, the number is 11 %.

And the trend in confidence has been in steady decline since 1990. Thirty years of decline in confidence is a disaster, surely. It makes one wonder who the 11 % group is that still implicitly trusts their TV news broadcasts each evening and their morning newspaper. Are they the brain dead? The idiots of the Idiocracy?

US MEDIA AUDIENCE DECLINE OVER 30 YEARS

Leaving the mesmerised 11 % to their plight, let’s see what other Americans are thinking. A Gallup survey from September 1st to 23rd revealed the following.

A record-high 39% of US adults have "no trust at all" in the media. That is the highest level on record. And 29% have "not very much" trust in the media.

So, in summary, 11 – 16 % of adult Americans still believe what they are being told by the mainstream media but almost 70 % of the adults in the nation have either no trust or not very much trust in the mainstream media news. These results are the worst ever recorded in Gallup's history.

US mainstream media ownership is dominated by just 5 or 6 companies. Here are the stock charts of three media conglomerates -- over the last 5 years

AT & T

COMCAST

DISNEY

UNITED NATIONS REPORT -- GLOBAL GOVERNANCE AND CLIMATE CHANGE – UTOPIAN DREAMS OF CONTROL

The United Nations released a report in May this year titled “Our Common Agenda. Policy Brief 6. Reforms to the International Financial Architecture”. It outlines how the pathway to authoritarian, non democratic, centralised global governance is paved by the words climate, change, crisis, pandemic preparedness and sustainable.

The very first sentence in the introductory “Chapeau” contains a major assertion that is self serving. It would be challenged by independent observers if such independent observation had ever been allowed to review the document prior to publication. The sentence reads --

“The challenges that we are facing can be addressed only through stronger international cooperation”.

Easy to agree? The word “only” is the problem here. It suggests the exclusion of local solutions. Thus, the rest of the document is destined to refer only to globalist solutions. The next sentence attempts to hide the intention of the document by referring to “multi-lateral solutions”. However, note the reference to “strengthening global governance” at the very core. Again, local solutions are excluded from the outset. Global governance is the goal. The one and only goal of the document.

“The Summit of the Future, to be held in 2024, is an opportunity to agree on multi-lateral solutions for a better tomorrow, strengthening global governance for both present and future generations (General Assembly resolution 76/307).

The author of the “Chapeau” introduction – the UN Secretary General – seems sublimely ignorant of the fact that the term “global governance” is offensive to many millions, if not billions, of people on planet Earth. After all, he is an un-elected official, appointed and answerable to no one in particular. He does not represent any electorate. He assumes authority over people who have not played any part in granting him authority. This lack of real democratic process is a major problem for the United Nations and its many satellite Non Government Organisations.

But there is worse to come, much worse. The next biggest problem that BOOM has with the document as a whole is the constant references to climate change, climate crisis and the word sustainable. This assumes that climate change is somehow a financial problem. After all, the document is (supposedly) about reform of the global financial architecture.

Here is a typical sentence illustrating BOOM’s point – Quote: “…. international financial architecture (is) entirely unfit for purpose in a world characterized by unrelenting climate change, increasing systemic risks, extreme inequality, entrenched gender bias, ………..”

And more “The existing architecture has been unable to support the mobilization of stable and long-term financing at scale for investments needed to combat the climate crisis and achieve the Sustainable Development Goals for the 8 billion people in the world today …….. Dramatic under investment in global public goods, including pandemic preparedness and climate action”.

BOOM must ask – what the hell has climate to do with reform of the International Financial Architecture? Is this a Report on Climate? On gender bias? On pandemic preparedness? On sustainability? Or a Report on Finance?

Then there is the tendency for over-reach. “We must craft a new set of rules and institutions that support convergence for the twenty-first century and enable all countries to achieve sustainable, inclusive and just transformations.”

Who (exactly) is “we”? What is “convergence” for the twenty-first century? What “new institutions” will support it? And what is a “just” transformation?

The international financial architecture should be structured to proactively support the implementation of the Sustainable Development Goals and the realization of human rights.

What is meant by “proactive support”? And why is “the realisation of human rights” a separate matter from “sustainable development goals”?

Then that troublesome word “only” appears again, assuming a centralised (global) authority to act. And reference to global governance appears yet again. “The only way to facilitate such a structure is through ambitious reform, starting with more inclusive, representative and, ultimately, more effective global economic governance.”

The words “inclusive” and “representative” appear as if the author felt that they should somehow be thrown into the word salad, presumably to give the appearance of democracy when the whole thrust of the document is opposed to it.

The author (or authors — who do not reveal their names) grandly sets out the “action orientated” recommendations for reforming the international financial architecture and tax architecture in six areas (somehow the reform of tax architecture has suddenly appeared).

1. Global economic governance (yet another reference to Global Governance)

2. Debt relief and the cost of sovereign borrowing (who can disagree with debt relief?)

3. International Public Finance

4. The Global Financial Safety Net

5. Policy and regulatory frameworks and

6. Global tax architecture for equitable and inclusive sustainable development.

There’s that word “Global” again mixed up with the words “inclusive, equitable and sustainable”.

Did an 8th grader write this document with the assistance of Chat GPT, the so-called artificial “intelligence”? BOOM wonders.

The document then tries to describe what the International Financial Architecture (IFA) actually is. However, it lists just 7 elements that make up the entire IFA. BOOM would suggest that there are a little more than seven. However, the 8th grader runs out of ideas at number 6 and then lists the 7th element as (why not?) the “United Nations as a norm-setter and implementer”.

BOOM is not sure what a “norm-setter” is in the International Financial Architecture but is certain that the United Nations has nothing to do with it. The same could be said of the word “implementer”. No matter how hard BOOM tries, the idea of the UN as being an “implementer” in the world of International Financial Architecture is mysterious. Perhaps BOOM should ask a 9th grader for assistance?

Then, there is finally something that BOOM might agree with (at last) although the “climate change” problem arises again, this time appearing as “climate action” …….. like a bad smell that just won’t go away.

This is the (hopeful) statement that the IFA “needs to be coherent with and complemented by rules governing trade, tax, financial integrity, technology, environmental sustainability and climate action, as well as other development issues.”

The next (rather large) Heading announces “Reform and strengthen global economic governance”. There’s that pesky reference (again) to global governance and we are only on Page 5. The document is well over 30 pages in length.

A diagram then proudly announces FIGURE 1 -- REFORMED INTERNATIONAL FINANCIAL ARCHITECTURE THAT IS FIT FOR PURPOSE FOR THE TWENTY-FIRST CENTURY –

An illustration under it looks like an old Greek or Roman Temple (not a 21st century structure) with three foundations:

A REPRESENTATIVE APEX BODY TO ENHANCE COHERENCE

An “Apex” body as a foundation? To enhance “Coherence”? Huh?

MORE DEMOCRATIC AND REPRESENTATIVE DECISION-MAKING RULES

Democracy mixed in with some representation and rules? Who can disagree with that?

REFORMED AND STRENGTHENED GLOBAL ECONOMIC GOVERNANCE

You can never have enough Global Governance, can you?

And at the top of each pillar in the Roman Temple lie the words --

COHERENT – LONG TERM – RESILIENT – SUSTAINABLE – EQUITABLE – INCLUSIVE – COORDINATED

Now who could argue with that?

Then, there are two “ACTIONS” listed as necessary to reform the International Financial Architecture and make it Fit For Purpose for the 21st Century. More centralised, non-democratic global governance.

ACTION 1: TRANSFORM THE GOVERNANCE OF INTERNATIONAL FINANCIAL INSTITUTIONS

ACTION 2: CREATE A REPRESENTATIVE APEX BODY TO SYSTEMATICALLY ENHANCE COHERENCE OF THE INTERNATIONAL SYSTEM

What (exactly) is “coherence” in regard to global finance? BOOM is mystified unless it is a synonym for central control. And do we need yet another un-elected, non-representative committee which is now called an “Apex Body”?

The next major Title in the document tends towards magical thinking and wish fulfilment --

Lower the cost of sovereign borrowing and create a lasting solution for countries facing debt distress

Yes – jolly good idea, 8th grader – why hasn’t someone thought of that previously?

Then a few more ACTIONS appear – more Jolly Good Ideas. Who could argue with these?

ACTION 3: REDUCE DEBT RISKS AND ENHANCE SOVEREIGN DEBT MARKETS TO SUPPORT SUSTAINABLE DEVELOPMENT GOALS

ACTION 4: ENHANCE DEBT CRISIS RESOLUTION THROUGH A TWO-STEP PROCESS: A DEBT WORKOUT MECHANISM TO SUPPORT THE COMMON FRAMEWORK AND, IN THE MEDIUM TERM, A SOVEREIGN DEBT AUTHORITY

A “Sovereign Debt Authority” – another central committee – or is it to be an Apex Body?

Then, the next (predictable) section:-

Massively scale up development and climate financing

With -- more magical thinking --

ACTION 5: MASSIVELY INCREASE DEVELOPMENT LENDING AND IMPROVE TERMS OF LENDING

ACTION 6: CHANGE THE BUSINESS MODELS OF MULTILATERAL DEVELOPMENT BANKS AND OTHER PUBLIC DEVELOPMENT BANKS TO FOCUS ON SUSTAINABLE DEVELOPMENT GOAL IMPACT; AND MORE EFFECTIVELY LEVERAGE PRIVATE FINANCE FOR SUSTAINABLE DEVELOPMENT GOAL IMPACT

Then, it is back to climate change …… what else? ….. while ensuring “additionality” (whatever that is). And what, pray tell, is climate finance?

ACTION 7: MASSIVELY INCREASE CLIMATE FINANCE, WHILE ENSURING ADDITIONALITY

Then a plan to become more effective follows. Who could argue with that?

ACTION 8: MORE EFFECTIVELY USE THE SYSTEM OF DEVELOPMENT BANKS TO INCREASE LENDING AND SUSTAINABLE DEVELOPMENT GOAL IMPACT

And ……… Time to mention the poor? How did they forget to mention the poor?

ACTION 9: ENSURE THAT THE POOREST CAN CONTINUE TO BENEFIT FROM THE MULTILATERAL DEVELOPMENT BANK SYSTEM

Then it’s back to the “global safety net” (whatever that is) ….

Strengthen the global financial safety net and provide liquidity to countries in need

ACTION 10: STRENGTHEN LIQUIDITY PROVISION AND WIDEN THE FINANCIAL SAFETY NET

ACTION 11: ADDRESS CAPITAL MARKET VOLATILITY

Time to mention that magical word “sustainability” again.

Reset the rules for the financial system to promote stability with sustainability

ACTION 12: STRENGTHEN REGULATION AND SUPERVISION OF BANK AND NON-BANK FINANCIAL INSTITUTIONS TO BETTER MANAGE RISKS AND REIN IN EXCESSIVE LEVERAGE

ACTION 13: MAKE BUSINESSES MORE SUSTAINABLE AND REDUCE GREENWASHING

BOOM is not sure what “Greenwashing” is.

ACTION 14: STRENGTHEN GLOBAL FINANCIAL INTEGRITY STANDARDS

Redesign the global tax architecture for equitable and inclusive sustainable development

ACTION 15: STRENGTHEN GLOBAL TAX NORMS TO ADDRESS DIGITALIZATION AND GLOBALIZATION THROUGH AN INCLUSIVE PROCESS, IN WAYS THAT MEET THE NEEDS AND CAPACITIES OF DEVELOPING COUNTRIES AND OTHER STAKEHOLDERS

Ahh – the good old “inclusive process”. And, for good measure, mention it again in Action 16 just for added emphasis. Is this a pretence of consultation?

ACTION 16: IMPROVE PILLAR TWO OF THE PROPOSAL BY THE OECD/G20 INCLUSIVE FRAMEWORK ON BASE EROSION AND PROFIT SHIFTING TO REDUCE WASTEFUL TAX INCENTIVES, WHILE BETTER INCENTIVIZING TAXATION IN SOURCE COUNTRIES

ACTION 17: CREATE GLOBAL TAX TRANSPARENCY AND INFORMATION-SHARING FRAMEWORKS THAT BENEFIT ALL COUNTRIES

To a totalitarian globalist, Action 17 sounds like a good idea -- some good old surveillance and information sharing. The East German Stasi could perhaps be resurrected?

The word “climate” appears over 60 times in the document. There is no reference to “climate boiling”, thankfully. In the Conclusion, the word “sustainable” appears 5 times in just two short paragraphs. But, again thankfully, the words “climate change” do not appear.

However, the document leaves no doubt in BOOM’s mind. The pathway to authoritarian, non democratic, centralised global governance is paved by the words climate, change, crisis and sustainable.

Next week, BOOM will review a Report released by the Bank for International Settlements in June -- Blueprint for the future monetary system: improving the old, enabling the new. It is another 34 page document. Readers will be pleased and relieved to know (in advance) that the words climate and sustainable do not appear in it. However, there are no authors identified for it either.

In economics, things work until they don’t. Do your own research. Make your own conclusions.

BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.