BOOM Finance and Economics 31st March 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available at LinkedIn and at Wordpress https://boomfinanceandeconomics.wordpress.com/

THE BELT AND ROAD TO PROSPERITY

GLOBAL SHIPPING CONNECTIONS

CHANGES IN GLOBAL SHIPPING MOVEMENTS

CHANGING ENERGY CONSUMPTION PATTERNS

THE PROGRESSION OF CO2 EMISSIONS

CHINA TRADE IS BOOMING AGAIN

$ 275 TRILLION FOR NET ZERO — WHERE IS THIS CAPITAL COMING FROM?

THE BELT AND ROAD TO PROSPERITY — 150 NATIONS

China’s Belt and Road Initiative (BRI), is officially known as the “Silk Road Economic Belt and the 21st Century Maritime Silk Road” and is also known as the One Belt One Road (OBOR) strategy. Confused?

It is a trans-national economic network proposed and spearheaded by China. The idea of building the inter-continental economic network was first promoted by President Xi Jinping in 2013.

The official (glowing) narrative states that the objectives of the OBOR strategy are “to promote economic prosperity of the countries along the belt and road and regional economic cooperation, to strengthen exchanges and mutual learning between different civilisations, and to promote world peace and development.” High ideals indeed.

Nations West of China will especially benefit. Some call this the “Greater China Strategy”. The strategy underlines the Chinese government's push to export China's technologies and production capacity in industries such as building materials (steel and cement), electronics, infrastructure (highways and high-speed trains), and logistics (ports and airports).

Energy cooperation between nations is a key aspect while bilateral cooperation and multilateral cooperation are both emphasised.

BELT AND ROAD MAP – LAND AND SEA ROUTES

In his state visit to Kazakhstan in September 2013, President Xi delivered a speech in Nazarbayev University that encouraged worldwide cooperation on the development of the Silk Road Economic Belt. A month later, President Xi addressed the Indonesian Parliament, expressing China’s intention to build the 21st Century Maritime Silk Road with ASEAN countries.

By December 2023, more than 150 countries had joined the Belt and Road Initiative (BRI) by signing a Memorandum of Understanding (MoU) with China. However, due to some uncertainties over some MoU’s, it can be more accurately said that 146 to 151 countries (including China) are now members of the BRI. This is a staggering fact, inconvenient to the politicians of the Western advanced economies who prefer to pretend that all of this is not happening.

The countries of the Belt and Road Initiative (BRI) are spread across all continents

44 countries are in Sub-Saharan Africa

34 countries are in Europe & Central Asia

25 countries are in East Asia & Pacific (including China)

22 countries are in Latin America & Caribbean

19 countries in Middle East & North Africa

6 countries are in South East Asia

This also includes

17 countries of the European Union (EU), and

8 countries of the G20 Nations.

More official, ambitious narrative -- “With an intention to build an open, resilient and mutually beneficial network that connects Asia, Europe and Africa by land and sea, the new Silk Road initiative intends to establish collaborative partnerships among the sovereign states along the economic corridor and, ultimately, create a trans-national community united by shared responsibilities, shared interests and shared values.”

And yet more -- “The Belt and Road scheme imposes no territorial restraints, and, in compliance with the principles of openness and inclusiveness, welcomes every country and regional organisation. The proposed “five areas of connectivity” – policy co-ordination, facilities connectivity, unimpeded trade, financial integration and people-to-people bond – are the essential features for establishing a mutually beneficial partnership and reciprocal collaboration between states.”

We can clearly see the central role of China to the BRI and we can see the intentions of the project from these statements made by China. None of that is secret. But that is not enough to build the dream. Energy, transportation connectivity and finance will be required.

It is quite natural for China to promote its finance model which has successfully built modern China so rapidly over the last 3 decades. It is a combination of capitalist endeavour based upon commercial bank credit creation teamed with a disciplined, central oversight and control of the money supply. All of this is managed by a strong national central bank. Nations who seek to learn will be guided onto that pathway.

The other, critical part of the Belt and Road Initiative lies in regard to its energy requirements and consumption. An examination of that aspect will reveal what has already happened over the last 10 years and what is likely to happen in regard to CO2 Emissions being generated by the BRI nations as their economies grow into the future.

Why is all of this important to understand?

BOOM is of the opinion that poorly led, Western advanced economies are not advancing along a road to Prosperity but to a future of less reliable money supply and unreliable energy sources. And that is a formula for poor economic performance which cannot possibly exceed the Belt and Road strategy over the long term.

GLOBAL SHIPPING CONNECTIONS

To begin to understand the BRI strategy in depth, it is essential to look at global shipping movements to see what is happening to the maritime transportation of goods. The first thing to be discovered is the dominance of China.

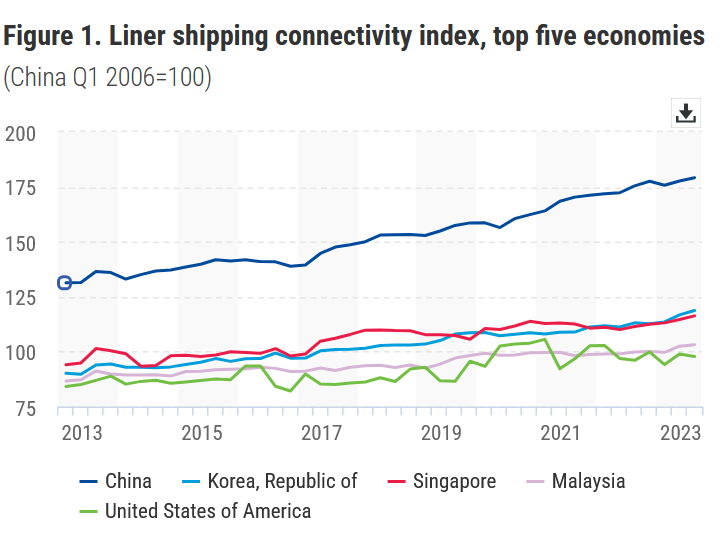

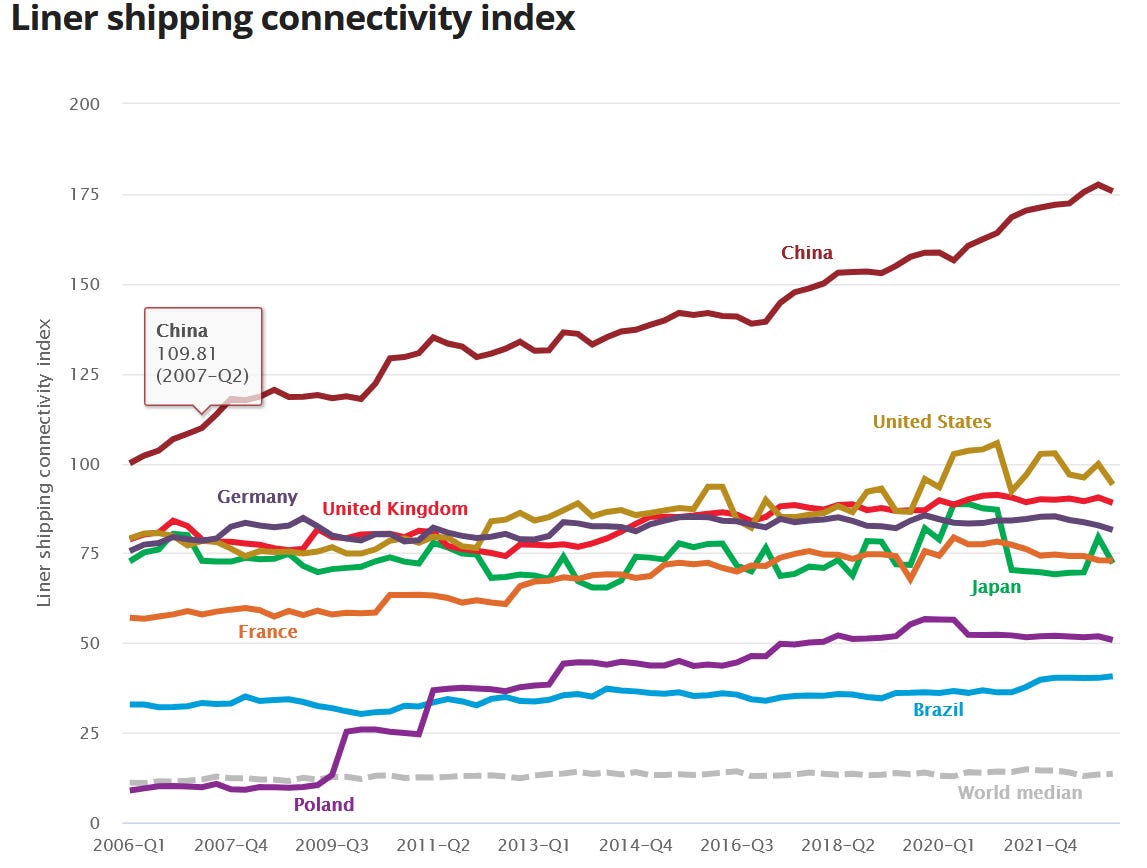

The Liner Shipping Connectivity Index (LSCI) aims at capturing a country’s level of integration into global liner shipping networks, since the access of a country to international markets will depend largely on its transport connectivity (specifically, in the services of exports and imports of the shipping lines). The LSCI was created by UNCTAD, the United Nations Conference on Trade and Development.

In the third quarter of 2023, China was the economy best connected to the global liner shipping network, as measured by the LSCI. The Republic of Korea, Singapore, Malaysia and the United States of America followed next in the rankings. Three of the top five best-connected ports are in China, namely Shanghai, Ningbo and Quindao, together with Pusan in the Republic of Korea and the port of Singapore. This chart compares the Top 5 nations between 2013 and 2023.

LINER SHIPPING CONNECTIVITY INDEX

The second chart is over a longer time frame from 2006 to 2022 and compares China with Germany, France, Brazil, United States, Japan, Brazil, Poland. Again China is the leader from way back in 2006. China’s dominance is not a new phenomenon.

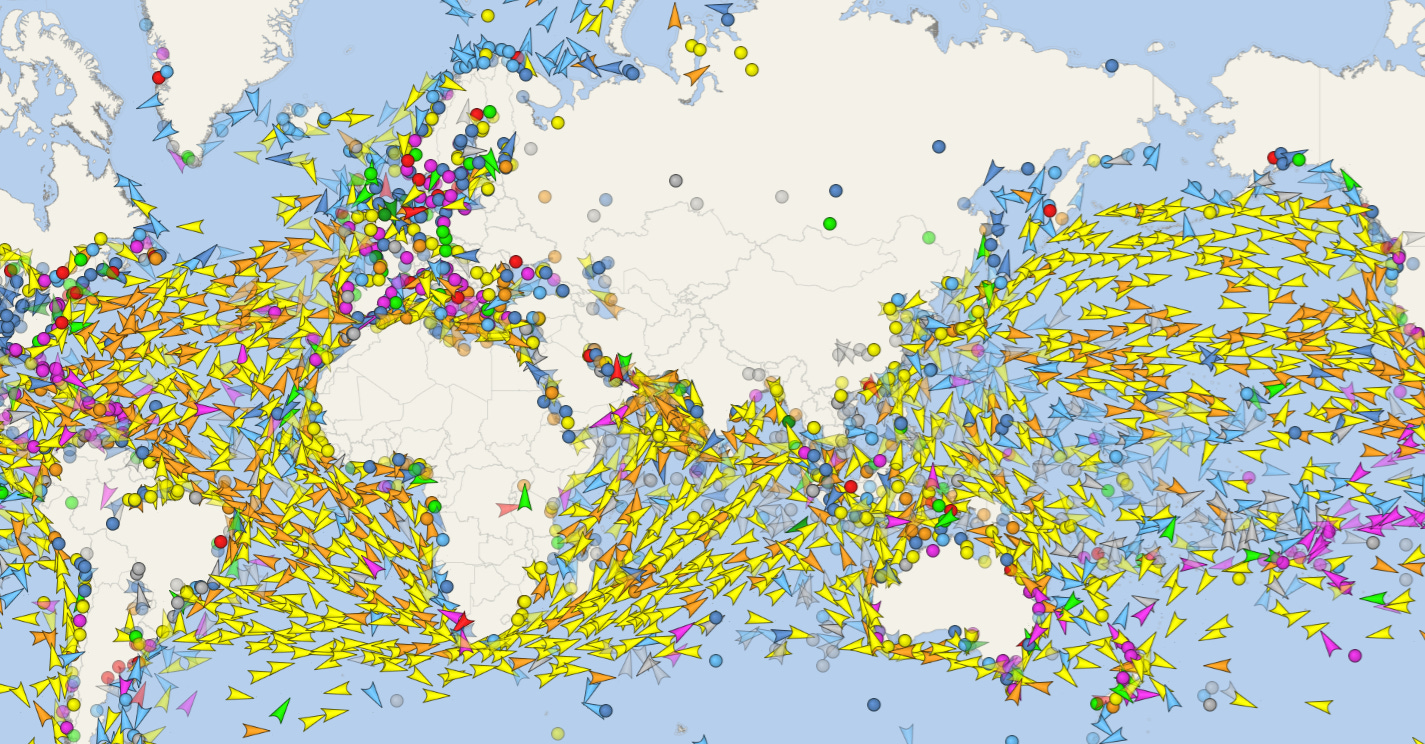

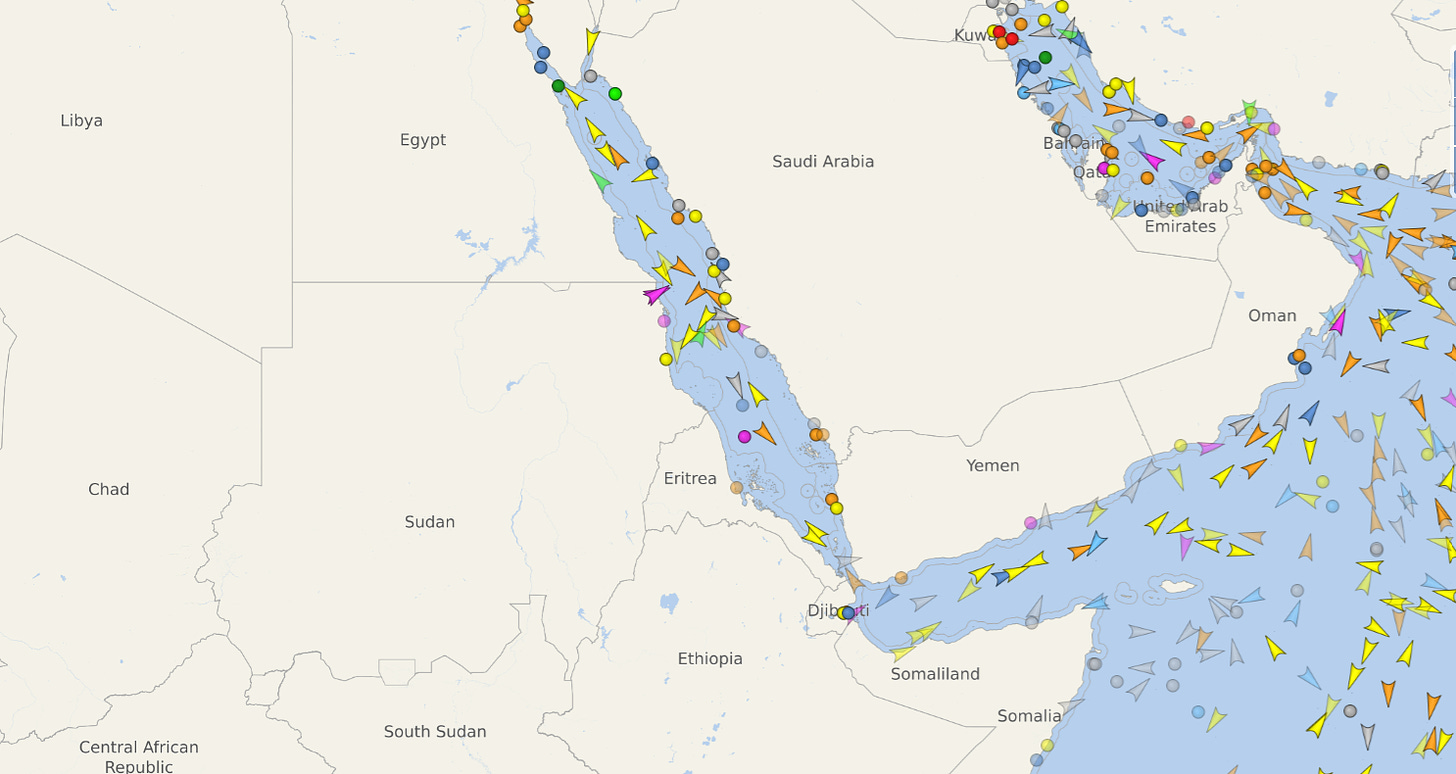

CHANGES IN GLOBAL SHIPPING MOVEMENTS

There are various services available where you can watch global shipping movements. BOOM watches one called “Shipping Vessel Finder”. The recent slow down in use of the Suez Canal has changed the pattern of movements dramatically. In January, UNCTAD reported that freight through the Suez Canal was down 45% since Houthi attacks began on ships near Yemen. The agency said 39% fewer ships than at the start of December transited the canal, leading to a 45% decline in freight tonnage. Container shipments through the canal were down 82% in mid January from early December.

UNCTAD's head of trade logistics said there were now three key global trade routes disrupted, including flows of grain and oils since Russia's invasion of Ukraine, and the Panama Canal, where low water levels from drought meant shipping last month was down 36% year-on-year and 62% from two years ago.

Dramatic slowdowns in traffic through the Suez Canal and the Panama Canal will cause increased shipping connectivity in all African ports (especially in South Africa) and in all South American ports (especially in Brazil and in nations bordering the Caribbean sea). That increased connectivity will boost economic growth in those regions.

Please take note: Africa’s total population is approximately 1.4 Billion people and South America’s is almost half a Billion.

Also worth noting: Africa’s Working Age Populations are forecast to grow over the next 100 years while the working age populations of most other regions around the world are forecast to fall.

SHIPPING VESSEL FINDER

This image shows a snapshot view of vessels travelling the globe on 26th March 2024.

Note the huge flow of vessels now travelling via South Africa to and from Asia and the Atlantic Ocean. Movements to Africa and South America are growing rapidly. Readers are reminded that South Africa is a prominent member of the BRICS group of nations – Brazil, Russia, India, China, South Africa.

SHIPPING VESSEL FINDER SUEZ CANAL 26th March 2024

This close up view, taken on 26th March, of the Red Sea entry and exit point near Djibouti and Yemen illustrates that few vessels are now travelling though the Suez Canal.

CHANGING ENERGY CONSUMPTION PATTERNS

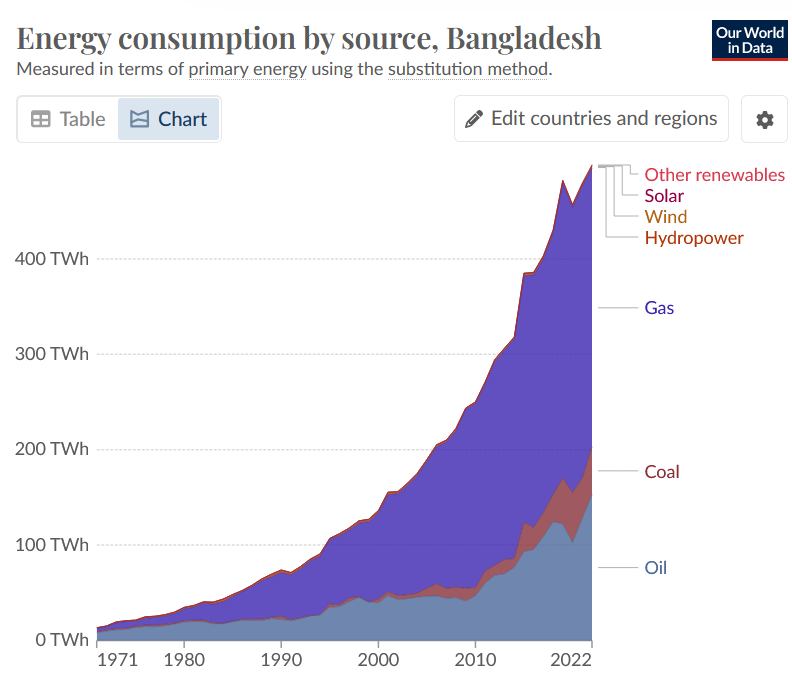

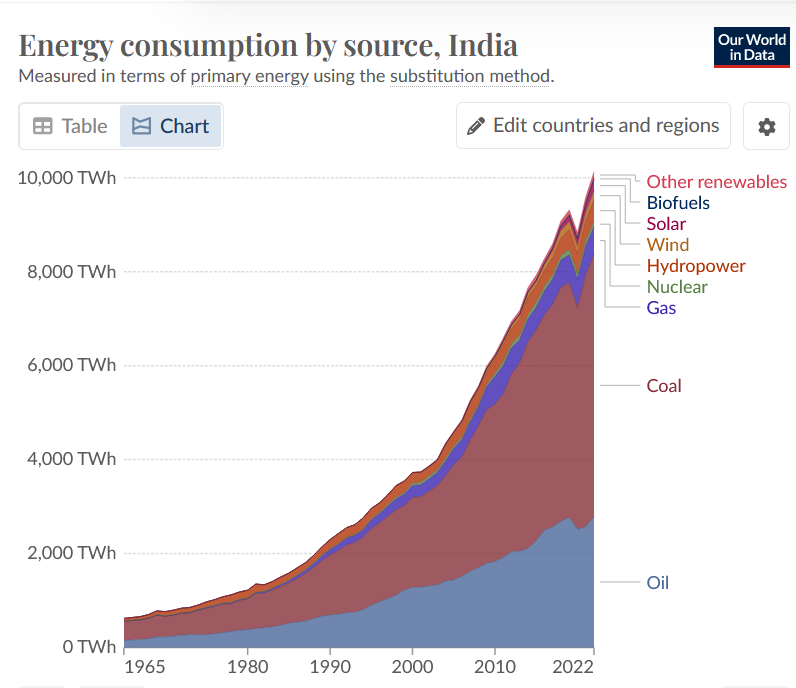

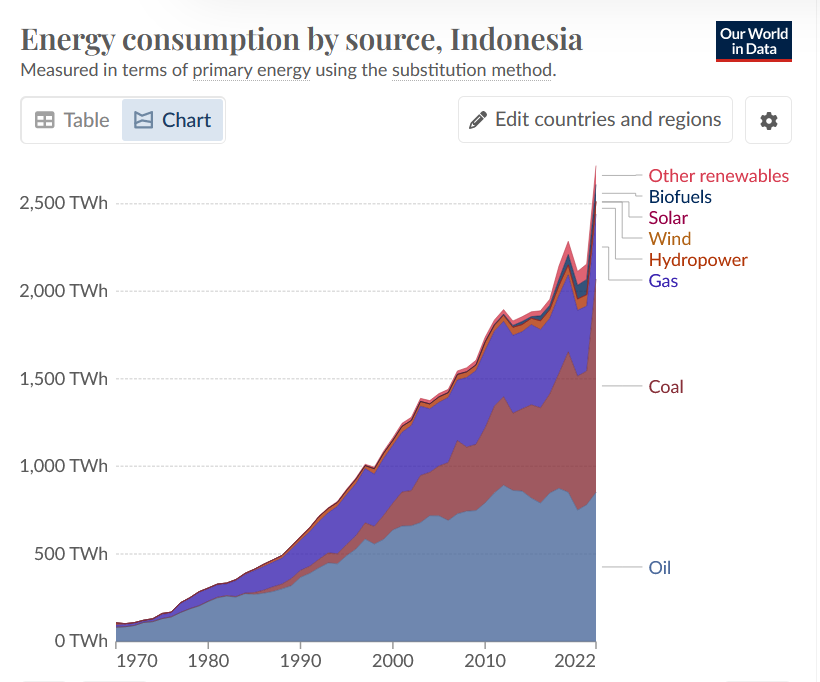

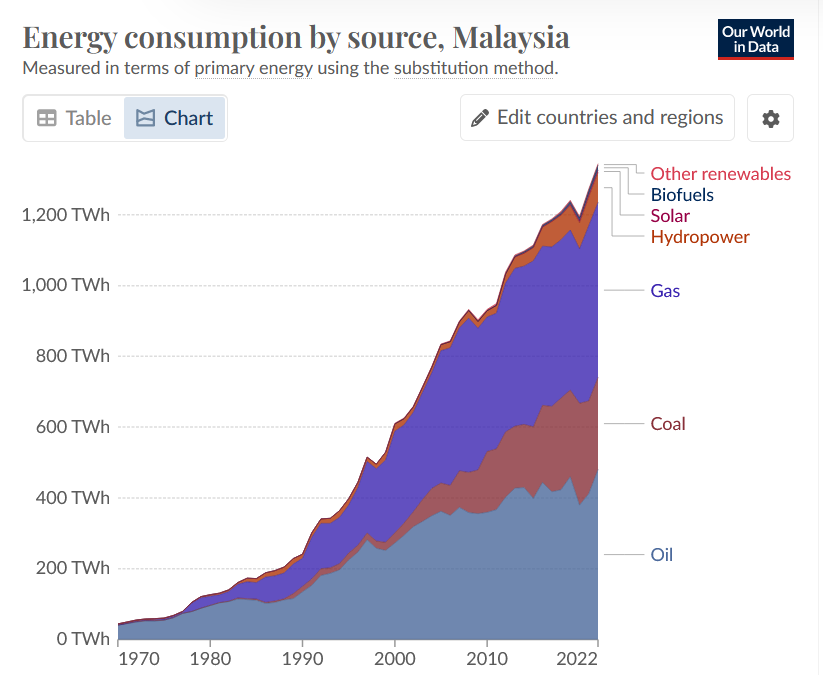

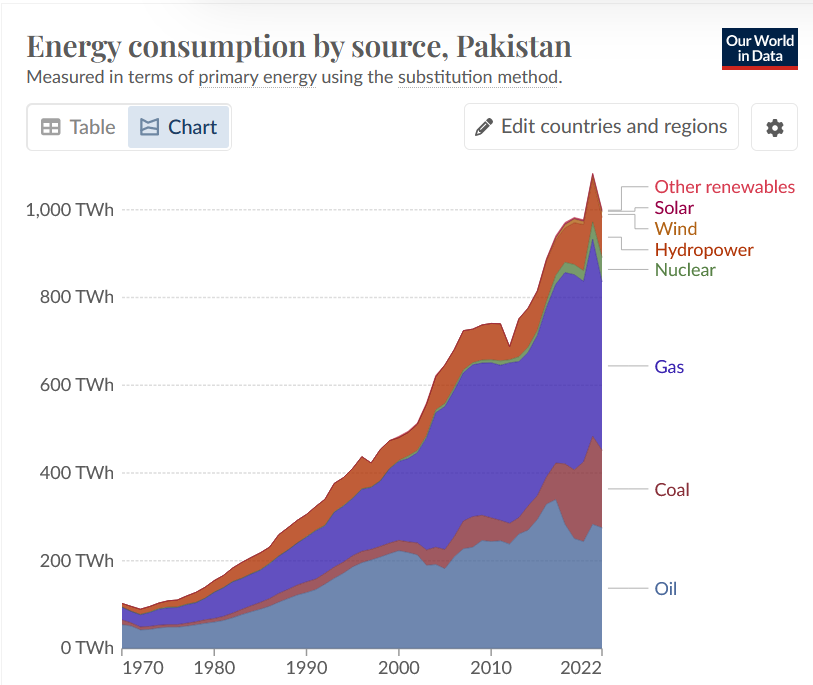

Here are some graphs showing typical increases in Energy Consumption since 1970 in a selection of Belt and Road nations. Readers please note that this is almost all driven by energy from Coal, Oil and Gas. The Belt and Road Initiative began in 2013.

BANGLADESH ENERGY CONSUMPTION

INDIA ENERGY CONSUMPTION

INDONESIA ENERGY CONSUMPTION

MALAYSIA ENERGY CONSUMPTION

PAKISTAN ENERGY CONSUMPTION

And last but not least –

CHINA ENERGY CONSUMPTION

Note: Well over 40,000 TerraWatt Hours of annual energy consumed and RISING

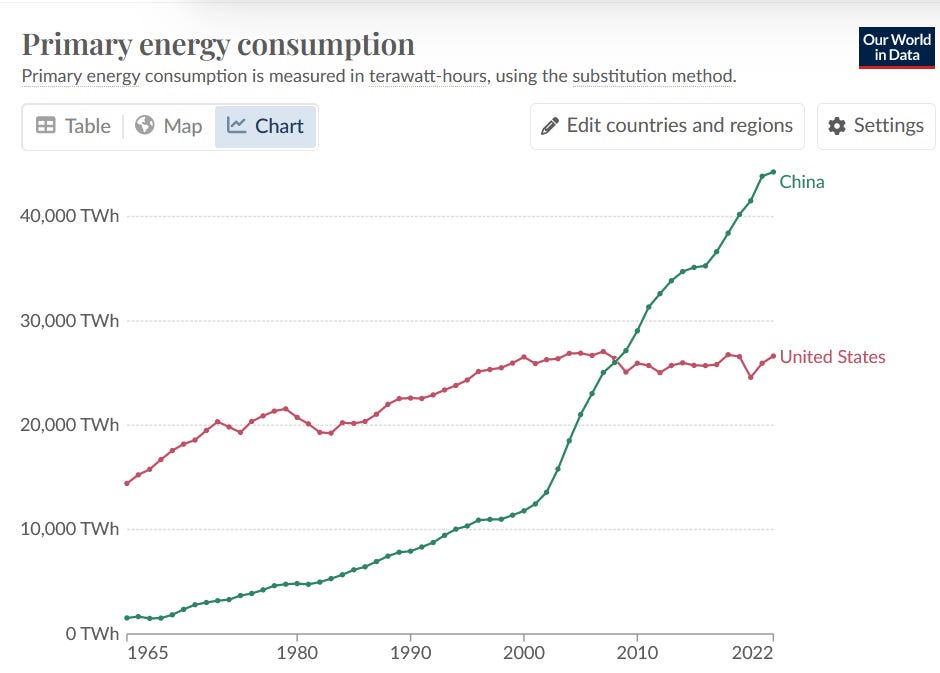

Let’s compare China’s Energy Consumption to the USA

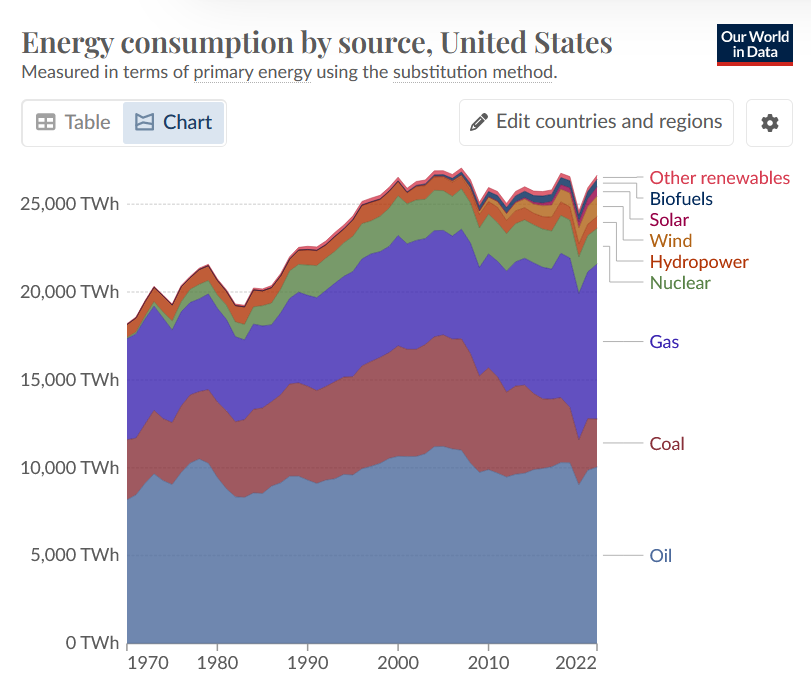

UNITED STATES ENERGY CONSUMPTION

Currently, the USA uses 25,000 TerraWatt Hours of annual energy consumption ….. and it is FALLING. There has been no increase this century, since the year 2000.

Note the bulk of the energy is provided (again) by Coal, Oil and Gas. Nuclear and “Renewables” make up approximately 20 %. And the supply from “Renewables” is only 10 % of the total. The remainder is from Coal, Oil and Gas.

The comparison over time between China and the United States reveals a great deal. Over the last 20 years, China’s total energy consumption has increased fourfold while America’s has remained static.

CHINA VERSUS USA ENERGY CONSUMPTION

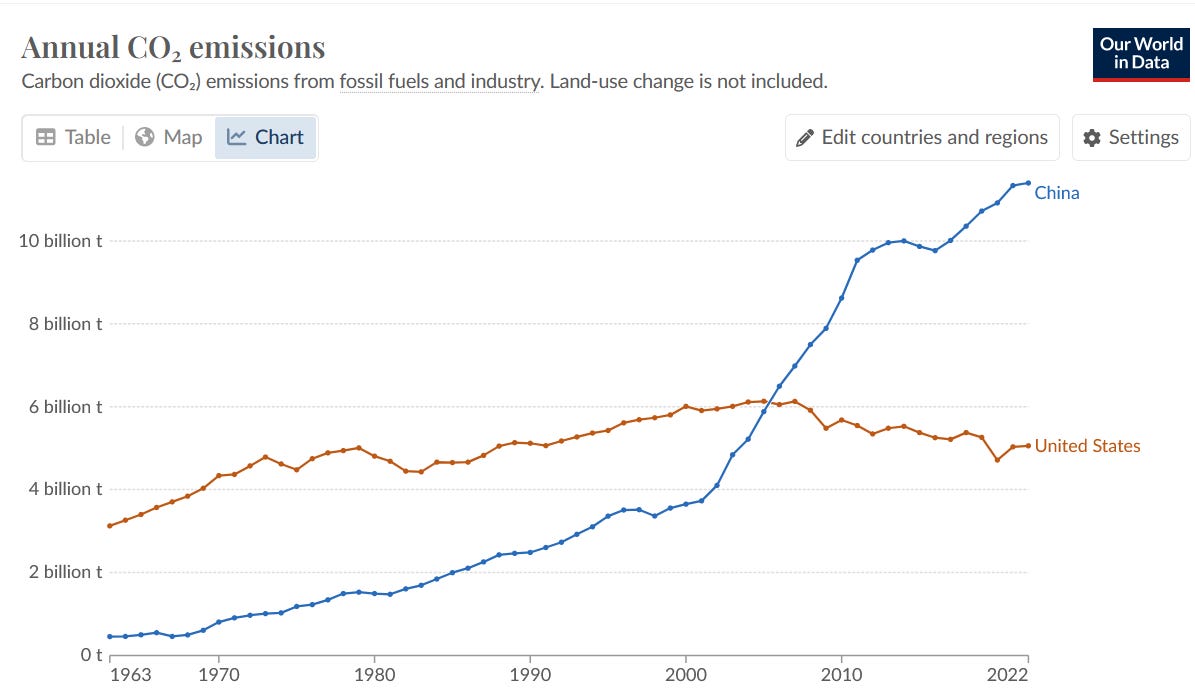

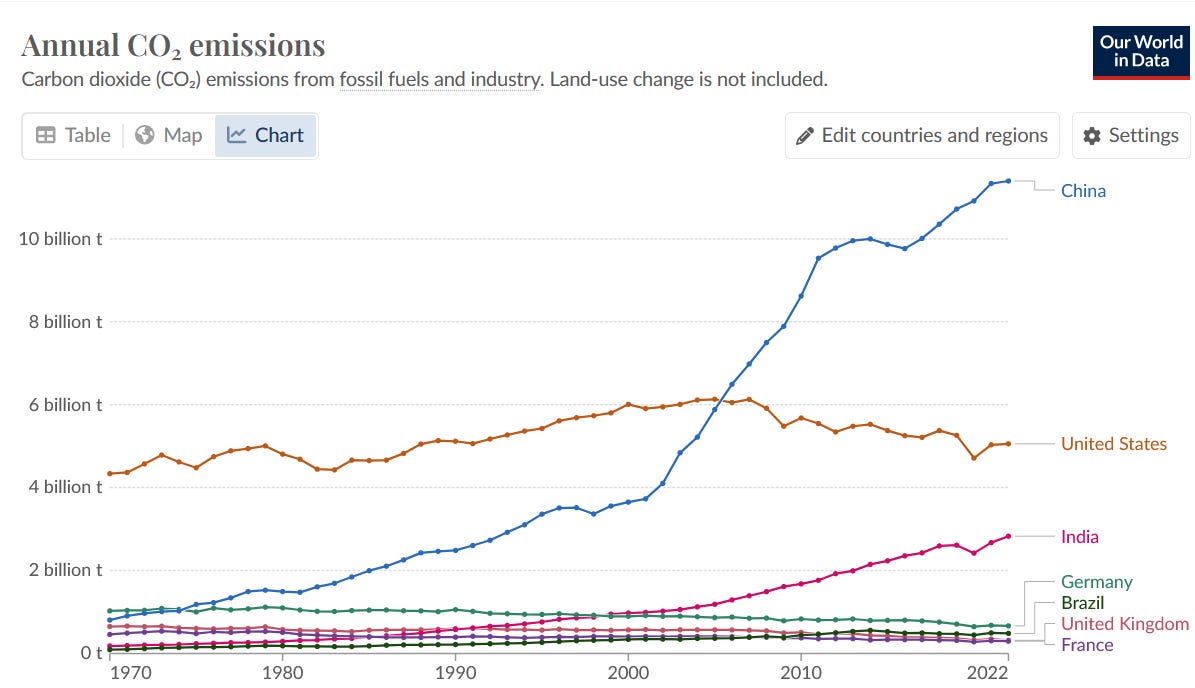

CO2 EMISSIONS

This energy consumption pattern is reflected in CO2 emissions. This chart for CO2 emissions is almost identical to the previous one comparing energy consumption.

ANNUAL CO2 EMISSIONS – COMPARISON OF CHINA TO THE UNITED STATES

We can also compare China and the USA to Brazil, Germany, France, the UK and India.

India’s growth in CO2 emissions is becoming increasingly obvious over the last 10 years.

The populations of China and India are roughly the same, about 1.4 Billion in each nation (give or take a few, billion). Thus, it is not unreasonable to expect India to perhaps grow its energy consumption and CO2 emissions fourfold over the next 10 years (?).

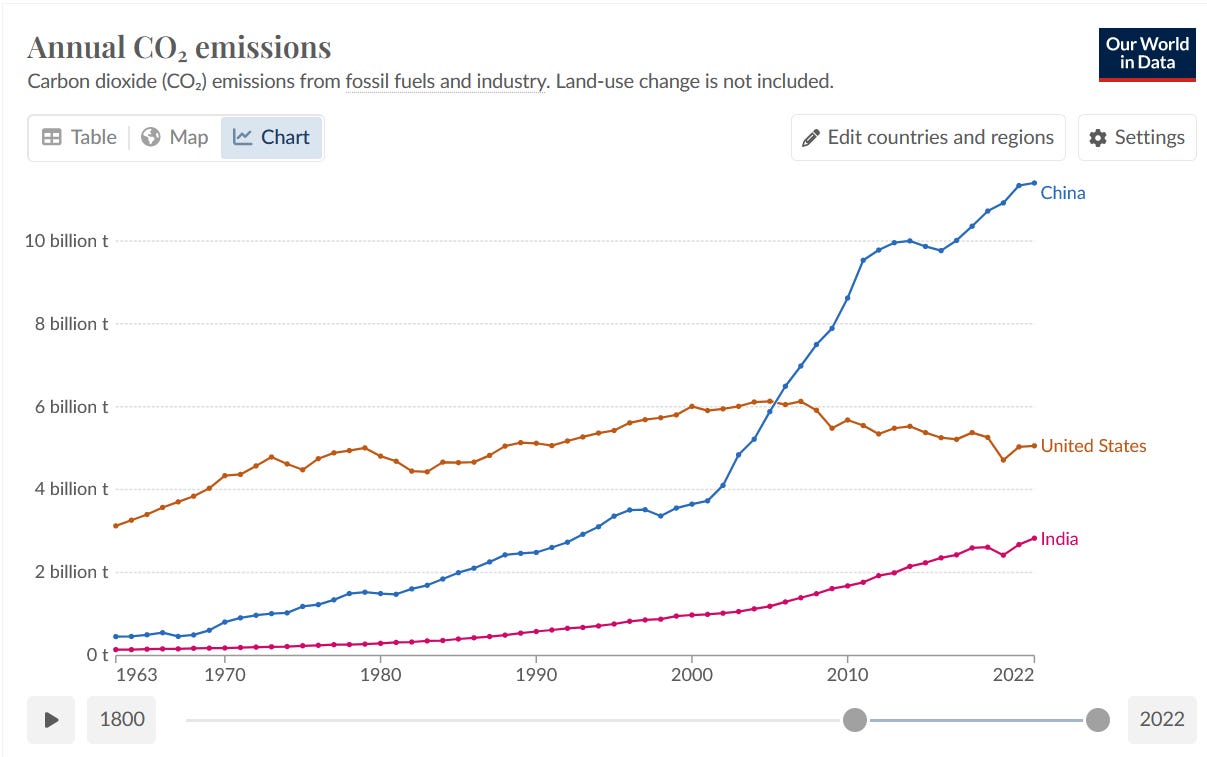

ANNUAL CO2 EMISSIONS – INDIA, CHINA, UNITED STATES

This next chart shows China and India compared to the USA.

THE PROGRESSION OF CO2 EMISSIONS

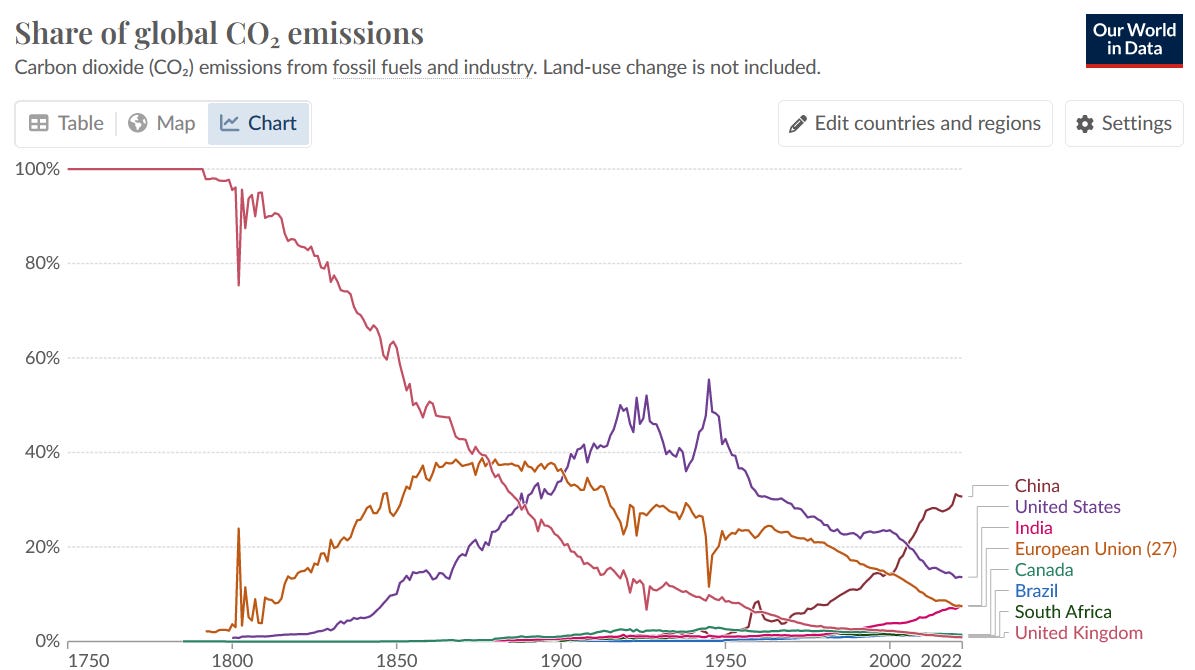

Now, we can also look at the progression of the share of Global CO2 emissions over the last 220 years, since the beginning of the 19th century and the industrial revolution that began in the UK.

In the year 1800, the United Kingdom was responsible for about 98% of the world’s CO2 emissions due to the coal fired industrial revolution that occurred there first. Now, the UK is responsible for only 1 % (or less) of global CO2 emissions.

China now accounts for 30.8 % while the US emits less than half that -- only 13.5 %. And India is over half that already at 7.6 % and rising, more than the 27 nations combined of the European Union. The world has changed and continues to do so but it is the rise and rise of China and India that cannot be ignored.

Together, they emit almost 38 % of global CO2 and they are on track to exceed 50 % very soon indeed.

CHINA TRADE IS BOOMING AGAIN

BOOM’s secret indicator for China trade performance continues to rise. It began rising in early January after falling for almost 2 years due to the contrived Covid Panic Demic. China is coming back.

The Chinese Shanghai Composite Stock Index has risen sharply since February as forecast by BOOM. BOOM is now expecting it to consolidate its 2024 gains and continue towards a longer run higher. We can watch its future progress throughout 2024. The people of China must be encouraged to invest in their corporate sector.

SHANGHAI COMPOSITE STOCK INDEX (over 3 years)

THE WESTERN ADVANCED NATIONS ARE DESTINED TO STRUGGLE ECONOMICALLY COMPARED TO THE BELT AND ROAD NATIONS

BOOM is of the firm opinion that China and the nations that join in the Belt and Road Initiative will continue to enjoy consistent economic growth for the next 10 years. The last ten years of growth since 2013 in shipping, energy production and energy consumption are already revealing the advantages of the BRI.

Western aligned nations which ignore this opportunity will suffer poorer economic growth and, possibly, long term contraction compared to nations in the BRI. The “Net Zero” policies being adopted by the West will economically damage nations that pursue such unwise policy settings.

$ 275 TRILLION FOR NET ZERO — WHERE IS THIS CAPITAL COMING FROM?

A January 2022, McKinsey analysis of the NGFS Net Zero 2050 scenario (Network of Central Banks and Supervisors for Greening the Financial System) was titled “The Economic Transition: What would change in the net-zero transition”. It forecast that $275 Trillion in cumulative spending on physical assets, or approximately $9.2 trillion per year, would be needed between 2021 and 2050 (to achieve “Net Zero”).

This ridiculous sum appears to be totally disconnected from financial reality as far as BOOM can see. It begs a very big question. Where is such risk capital to come from if there are insufficient returns or negative returns?

Over the last 6 months, BOOM has clearly demonstrated the reluctance of private investors to stay invested in renewable energy, electric cars and Hydrogen energy projects. Private investors have already sold out of many (?most) of these “renewable” projects and associated technologies.

At this early stage, in 2024, it is becoming crystal clear that sufficient private risk capital is not going to be available to achieve “Net Zero”. The gamble is simply too great. It is a pipe dream, a fantasy that will harm the advanced Western economies dramatically in the long run.

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

=============================================================

Much of the data on the Belt and Road Initiative here has been sourced from Fanhai International School of Finance (FISF) at Fudan University, Shanghai, China. And from https://greenfdc.org/countries-of-the-belt-and-road-initiative-bri/

Thanks for reading BOOM Finance and Economics Substack.

Subscribe for Free to BOOM Finance and Economics

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years which includes many of the world’s most senior economists, central bankers, fund managers and academics.