BOOM Finance and Economics 5th November 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

EATING POLITICIANS – A LESSON FROM THE PAST — HUNG, DRAWN, TORN APART AND EATEN BY THE PEOPLE

YET ANOTHER MASSIVE CRYPTO CRIME

US YIELD CURVE DYNAMICS -- A FLAT CURVE – OUTLOOK POSITIVE FOR US ECONOMY AND ASSET PRICES?

BULL MARKETS COMING IN US FINANCIAL ASSETS?

PFIZER REPORTS LOSS AND CLOSES DOWN MANUFACTURING PLANTS AS COSTS MOUNT

QUANTITATIVE BOOSTING EXPLAINED

TESTIMONY FROM A READER

"Boom’s finance and economics views are based on experience and wisdom, both of which are sadly lacking in today’s narrow-analysis focused commentary."

EATING POLITICIANS – A LESSON FROM THE PAST — THE DE WITT BROTHERS – HUNG, DRAWN, TORN APART AND EATEN BY THE PEOPLE

In 1672, two leaders, including the Prime Minister, of an “advanced” European nation were attacked, torn apart and eaten by the people. This rage was driven by the prospect of hunger and enslavement from two invading armies. Yes – this happened – and it happened in the nation we now call The Netherlands.

The leaders were the de Witt brothers, Johan and Cornelius. Johan de Witt was well educated with great ability in mathematics. He wrote one of the first textbooks in analytic geometry. At the age of 28 years, he became Grand Pensionary — the Prime Minister — of the United Provinces of the Dutch Republic in 1653. That was 17 years after Tulip-mania hit Holland. At the peak of tulip mania, in February 1637, single tulip bulbs sold for more than 10 times the annual income of a skilled artisan. So Johan De Witt would have witnessed the madness and insanity of the Tulip-mania price debacle at the age of 12 years.

When he came to power, he used his mathematical skills to manage Holland’s financial and budgetary problems. The Dutch Golden Age followed and he was re-elected in 1658, 1663, and 1668. However, he was in direct opposition to the monarchists and in 1672, he failed to defend the nation and secure peace when both England and France attacked and were able to effortlessly invade the Dutch Republic. He resigned his position. But the people, driven into a rage by monarchist propaganda were angry, very angry. In Dutch history, the year 1672 is referred to as the Rampjaar -- the Disaster Year.

A French historian, Alexander Dumas, described the fate of Jacob and his brother Cornelius.

There is a lesson here today for all politicians in Government, unelected bankers and unelected officials in globalist NGOs (Non Government Organisations) who seek great power. Always consider and respect The People. Or else.

“After having mangled, and torn, and completely stripped the two brothers, the mob dragged their naked and bloody bodies to an extemporised gibbet, where amateur executioners hung them up by the feet.

Then came the most dastardly scoundrels of all, who not having dared to strike the living flesh, cut the dead in pieces, and then went about the town selling small slices of the bodies of John and Cornelius at ten sous a piece.”

BANKMAN-FRIED GUILTY OF FRAUD AND CONSPIRACY

Yet another massive Crypto crime has been more fully revealed. On Friday in New York, Sam Bankman-Fried of FTX Crypto-exchange fame, was found guilty by a jury of two counts of fraud and five counts of conspiracy. He was accused of stealing US$ 8 Billion from his customers. His testimony in the court will go down in history as rare truth revealed.

"We thought that we might be able to build the best product on the market"

"It turned out basically the opposite of that."

Over the last 14 years, since 2008, there has been a litany of Billion Dollar financial crimes in the Crypto markets. This is just the latest. Many investors have lost significant sums of money to fraudsters. But still the Crypto market persists and has a $ 1.3 Trillion market capitalisation. Bitcoin is 52.4 % of that and there are now more than 2 million other “Cryptos” available to buy on 671 Crypto exchanges. The madness of crowds continues, 250 years after Tulip mania hit Holland.

US YIELD CURVE DYNAMICS -- A FLAT CURVE – OUTLOOK POSITIVE FOR US ECONOMY AND ASSET PRICES?

The US Treasury Yield Curve from 3 months to 30 years is now essentially flat with a slight inversion overall. This is a much more comfortable curve than what has prevailed for the last 12 months. As a result, most well informed investors are much less anxious and willing to take on risk again.

The Fed’s overnight rate is set at 5.5 %.

Treasury Yields are 5.56 % for 1 month, 5.57 % for 2 months and 5.59 % for 3 months.

The 1 Year Yield is at 5.44 %.

The 5 Year Yield is 4.82 %.

The 10 Year Yield is 4.88 %.

The 20 Year Yield is 5.2 %.

The 30 Year Yield is 5.04 %.

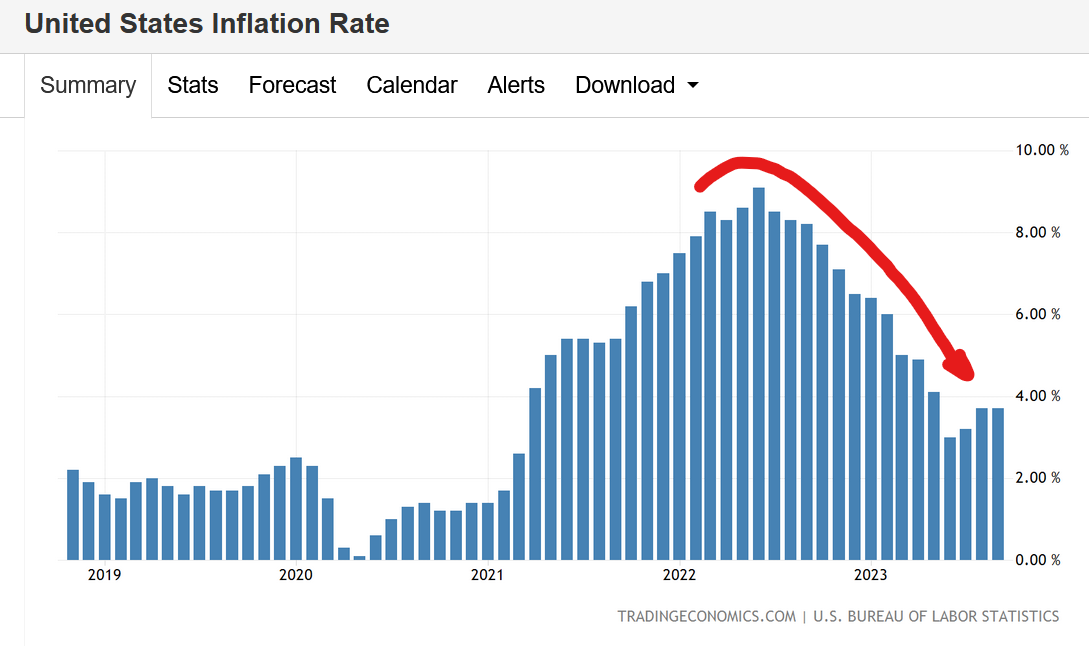

We await the next data points for US CPI inflation on 14th November. CPI inflation in the United States has been falling since May last year.

Since June, the US Dollar Index has shown good strength having appreciated by 8.3 % since mid January. US currency strength has a dis-inflationary impact inside the US. That is a positive for investor sentiment and the US economy as well with import costs falling.

However, wages growth in the US is running at around 4 – 5 % annualised over the last year in the various labour sectors. This is a little too high for comfort and the Federal Reserve will be watching the trend in wages closely before making their next interest rate decision.

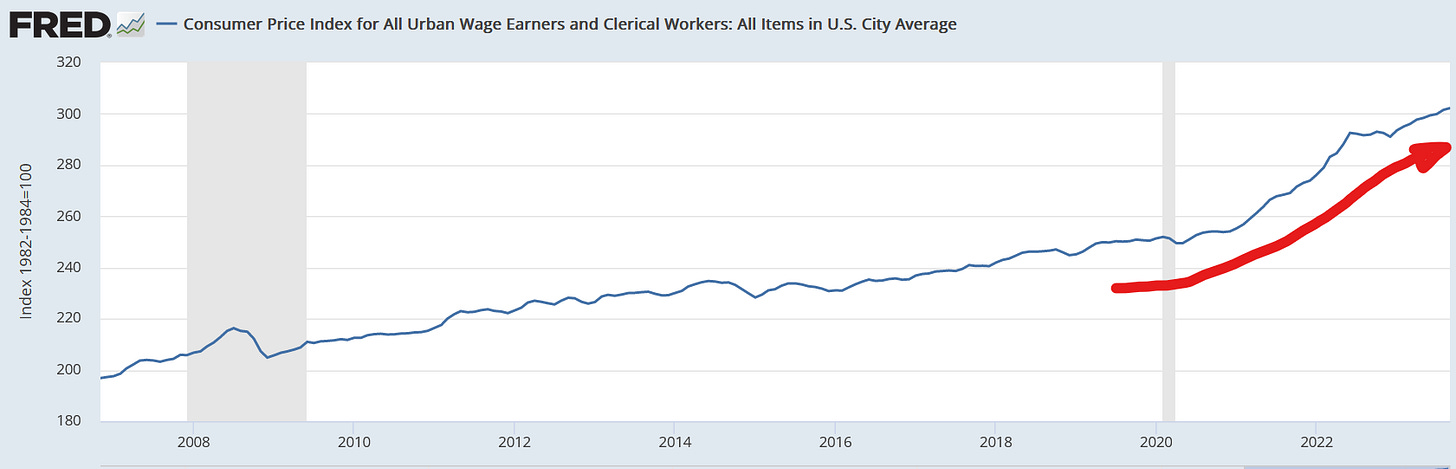

If we look at the Consumer Price Index for All US Urban Wage Earners and Clerical Workers over the last 100 years, we can see the steady long term growth pattern and the recent acceleration in wages.

If we look at the last 15 years in particular, we can see the acceleration that occurred since the Covid Panic-Demic began in early 2020. That accelerated trend (clearly) cannot go on forever. BOOM is expecting a slowing of wages growth from here onwards in the next 6 – 12 months which will quell CPI inflationary tendencies further in the US and globally.

There has been much concern by some analysts about increased energy costs associated with the uncertain situation in the Middle East. However, the Middle East has very little impact on prices for energy inside the US. The US does not import significant amounts of energy from that region. In fact, US energy imports from all regions have been falling significantly since 2006 and the US now exports more energy than it imports. Contrary to popular opinion, the United States imports very little energy from Saudi Arabia. Its major sources of imported energy are Canada and Mexico.

The current Continuous Contract Price for West Texas Crude Oil at the CME (Chicago Mercantile Exchange) is roughly at the same level as it was in January – around US$ 80 per barrel. The current Continuous Contract Price for Natural Gas at the CME is also at the same level as it was in January. So energy costs are not a major worry for the US economy at present.

The Federal Reserve (the US central bank) held rates steady last week as expected (as did the Bank of England). BOOM expects the Federal Reserve to keep their interest rate settings on hold for the next 3 months. BOOM also expects US Bond prices to stabilise around current levels and then to start rising if CPI inflation remains steady or continues to fall over the next 3 – 6 months.

The formation of a clear, unambiguous bottom in Bond prices will improve investors confidence greatly and should create significant buyer interest in US stocks from this point forward.

BULL MARKETS COMING IN US FINANCIAL ASSETS?

Last October 2022, BOOM forecast that we were past the Peak of CPI inflation in the US. BOOM also forecast a corresponding bottom in stock and bond prices. That forecast has proved accurate. Stock prices have risen strongly since then.

Bond prices have also risen from October 2022 through to April 2023. However, they have weakened over the past 6 months. BOOM is expecting the end of that weakness to become manifest very soon.

In summary, BOOM is expecting US investors to become more aggressive here in buying all financial assets. If so, a new Bull market especially in stocks but also in bonds will be confirmed if (and when) the S & P 500 stock Index rises above 4,600. It is currently around the 4,350 level.

US HOME PRICES CONTINUE TO RISE

BOOM forecast, 16th April 2023 -- “This suggests that US house prices may soon begin to rise in price”.

As per BOOM’s forecast in April, US annual home price growth has accelerated again. The price of homes rose for a third straight month in August according to data released by the Federal Housing Finance Agency (FHFA). Home prices rose 5.6% on a year-over-year basis in August, up from a 4.6% increase in the prior month. This is very reassuring for the US economy especially in regard to a recovery in money supply.

PFIZER REPORTS LOSS AND CLOSES DOWN MANUFACTURING PLANTS AS COSTS MOUNT

Pfizer has reported a loss of $ 2.4 Billion for their latest quarter of operations. Sales of their Covid vaccine have collapsed with only 2 – 3 % of Americans prepared to take their latest booster jab. The general public have woken up. Pfizer’s revenue fell by 42 % and they had to report a $ 5.6 Billion write down on unused inventory. To make matters worse, there are reports of hundreds of job losses as the company attempts to save $ 3.5 Billion in costs. Two manufacturing plants are being closed in North Carolina.

Long term BOOM readers are familiar with the risks to solvency for all companies involved in manufacturing the so-called “vaccines” for Covid. The problems are compounding. It is now common knowledge that the mRNA injectables are contaminated with DNA and SV40 Promoters and don’t stop transmission of the virus. Enterotoxins have also been identified in some vials. Repeated doses may even increase your risk of becoming infected. That is called negative efficacy. So the claims of “95 % effective” (Relative Risk Reduction) have become questionable and were possibly misleading or fraudulent. Absolute (Population) Risk Reduction for these products is in the range 0.7 – 1.3 %. So statements of “95 % effective” without qualifications stating absolute risk reduction numbers may be seen as deliberately designed to mislead.

Then there is the side effect profile. Experts have reported that these products have more reported adverse events in the VAERS data (Vaccine Adverse Events Reporting System) than all other previous vaccines in history combined.

BOOM has documented the precarious situation of these companies and the loss of faith from their investors as evidenced by the collapse in their share prices over the last 2 years. The first time BOOM warned of this was over 2 years ago, in June 2021. MRNA technology is now under a very dark cloud and may have no future. Legal challenges are now in their thousands and large class actions are amongst them. Large investor institutions with large financial losses mounting may soon join the party and start legal actions based upon fraudulent mis-representation. Wall Street is stirring. Billions or perhaps Trillions of Dollars could be at stake. No company could survive class action damages being awarded in the Trillions.

KILLER JAB? 24 % OF AMERICANS IN RASMUSSEN POLL SAY THEY KNOW SOMEONE WHO DIED FROM THE COVID-19 “VACCINE” – 42% READY TO JOIN A CLASS ACTION LAWSUIT

In a recent Rasmussen Poll of Americans, 24% said they knew someone who had died from COVID-19 vaccine side effects.

Also from the Rasmussen website, article dated 2nd November -- Killer Jab? 24% Say Someone They Know Died From COVID-19 Vaccine

“Forty-two percent (42%) say that, if there was a major class-action lawsuit against pharmaceutical companies for vaccine side effects, they would be likely to join the lawsuit, including 24% who say it’s Very Likely they’d join such a lawsuit.”

PFIZER SHARES OVER 3 YEARS – THE ROLLERCOASTER

THE FUTURE OF MONEY – CONFUSION FROM THE BANK FOR INTERNATIONAL SETTLEMENTS

Long term readers will know what BOOM has stated many times. Money is always a contract. The history of money reveals this. Paper money was first used in China during the Tang dynasty 500 years prior to it catching on in Europe. During his visit to China in the 13th century, Marco Polo was amazed to find that people traded paper money for goods rather than coins made of silver or gold. He wrote extensively about how the Great Kaan used a part of the Mulberry Tree to create the paper money as well as the process with which a seal was used to impress on the paper to authenticate it.

So Cash money obviously has an implied contract. It is a solemn promise from the Sovereign to the people and, originally, it was expended (issued) into the real economy by the Sovereign to build castles, fortresses, infrastructure, to fund armies and to facilitate trade inside the local economy. Cash can always be recalled and cancelled by the issuer. That is an implied term of the contract. However, cash must always be issued by the Sovereign upon increased demand from the economy/people. In a modern economy, the banking system acts as both distributor and agent of recall.

Credit money (created when a bank makes a loan) also and always has contractual elements. That is obvious. No secret there. The dumbest borrower understands that he/she is entering into a contract.

Hyun Song Shin, Economic Adviser and Head of Research at the Bank for International Settlements made a speech in Basel on 25th June this year. The occasion was the Bank’s Annual General Meeting and the speech was titled “A blueprint for the future monetary system”.

Sounds promising, new, innovative. The speech was certainly grand, full of new technological terms and concepts. But BOOM asks the most important question.

What problem (exactly) was he trying to solve?

Shin said “This year’s special chapter (in the Annual Report) argues that the monetary system could be on the cusp of another major technological leap in the form of tokenisation. Tokenisation is the process of representing claims digitally on a programmable platform. It can be seen as the next logical step in the long evolutionary arc of record keeping and asset transfer.”

“Tokens both define assets and specify what can be done with them”

All of that sounds “gee whiz” but reveals nothing new. BOOM would not describe it as “a major technological leap”. A good old fashioned printed share certificate is a Token that represents (or “defines”) an asset. And it specifies the right to ownership to a company and the right to receive dividends from net profits (if there are any) from that company. And it can be traded on an open market. The only difference is that the modern “Token”, which Shin is referring to, is in the form of digital code, held on an electronic ledger. But nothing new there; we have had electronic ledgers run by computers in banks and large companies since the 1960s.

The “programmable platform” Shin refers to implies “programmability” which is also nothing new. All contracts contain “programs”. They are legally called the terms of the contract.

Mr Shin goes on to say “Tokenisation introduces two important capabilities. First, it enables the contingent performance of actions through smart contracts. And second, it provides greater scope for composability, whereby several actions are bundled into one executable package.”

BOOM cannot see how this differs from any contract – the elements of contingent performance and composability are certainly nothing new. There is no innovative step there. He goes on to describe what “atomic settlement” is. (BOOM’s words in brackets)

“Tokenisation (can) combine messaging, reconciliation and settlement in one step. Smart contracts and composability enable so-called atomic settlement, the instant exchange of two assets, such that the transfer of each one occurs only upon transfer of the other one. Such functionalities can increase efficiency and reduce risks”.

Sounds impressive. However, it is no different from any transaction for goods and services where cash is accepted as settlement. We are all familiar with these transactions. “Atomic settlement” happens at any market stall when one person hands over the bread and cheese or promises to deliver future bread and cheese and the recipient hands over the cash. Instant settlement is achieved. It is “atomic” in the new, gee whiz language of settlement.

Shin goes on to say “Tokenisation can improve efficiency and mitigate risks in payments”. Why? Because “Tokenisation enables the combination of messaging, reconciliation and settlement”

Mmmmmmm. Yes, possibly. It may be a small step towards increased efficiency and decreased time/number of steps. However, in BOOM’s opinion, it does not deliver much more than that. A hugely complex machine of events has to be constructed first based upon computer software, notorious for “bugs”.

Shin says that it decreases settlement risk because it (may) speed the transaction. Mmmmm. BOOM is not so sure that is true.

Shin goes on to say “A tokenised environment allows contingent performance of actions”

Yes – but so does any current use of money to settle a transaction. After all, money is a token by definition. It is a representation of value.

He skips forward to deal with supply chain efficiency, trade settlement and trade finance. And, certainly, he describes magical scenarios supporting increased speed, increased efficiency and decreased potential for fraud which can be imagined rather easily in such a “tokenised environment”.

It is akin to explaining (magically) to a novice in transport that “a Ferrari is obviously better than a horse and cart”. But, it depends ………. on the task at hand. A horse and cart can do some things much more efficiently, safely and more cheaply than a Ferrari can.

Shin seems to realise that the advantages of technology are not so obvious in all circumstances so he quickly moves on to say “Tokenisation efforts are already happening. Crypto and decentralised finance offered a glimpse of tokenisation’s promise. But recent scandals have made it clear that crypto is a flawed system that cannot take on the mantle of the future monetary system”.

Here, he is referring to the many scandals revealed by the FTX fiasco and many others. Last Friday, as previously stated, the FTX founder Sam Bankman-Fried was found guilty by a jury in New York of defrauding the customers of his bankrupt cryptocurrency exchange in one of the biggest financial frauds in history.

“Away from crypto, efforts by commercial banks and other private sector groups have explored the capabilities of tokenisation for real-world use cases. But these efforts have been hampered by the silos erected by each project and the resulting disconnect from other parts of the financial system. In particular, they lack the ability to settle with finality, which depends on central bank money.”

They lack the ability to settle with finality. That is the killer phrase which defines the role of a central bank.

MAGICAL THINKING TO THE RESCUE

So Shin then seeks to resurrect the entire argument for tokenisation with a solution to the problem of finality, something he calls “central bank money”. However, central bank money already exists and is not a new concept. It is called “reserves” in the world of central banking. Reserves are all digital and they are banking assets.

But now he wants to introduce what sounds like a magical solution. He describes it as a whole new concept called a CBDC – a central bank digital currency – which can be made available to the public in the real economy and which can be “the solution” that will provide finality for settlement in an environment of tokenisation. Hey presto.

“What these projects lack is integration with a tokenised version of the settlement asset in the form of a wholesale central bank digital currency (CBDC). The foundation of trust provided by CBDC and its capacity to knit together the various elements of the financial system derive from the central bank’s role at the core of the monetary system”.

He goes on -- “Wholesale CBDCs would serve a similar role as reserves in the current system”.

Yes – BOOM can see that — so why have them?

What problem (exactly) do CBDCs solve in the real economy where goods and services are transacted for commonly agreed purposes?

He dresses up CBDC’s by describing them as having “functionalities enabled by tokenisation, such as the composability and contingent performance of the actions.”

And …… “While the form of the settlement asset – CBDCs – in a tokenised environment is clear, there is greater room for debate concerning the appropriate form of private tokenised money that complements CBDCs. There are currently two main candidates: asset-backed stablecoins and tokenised deposits. Both represent liabilities of the issuer, but they differ in how they are transferred and in their role in the financial system”.

At this point, it begins to feel as if he has fallen in love with the Ferrari without considering what transport problem he is trying to solve.

In fact, he has not just fallen in love with the technology, the power, the sound and complexity of the Ferrari, he has donned a mechanic’s overalls and climbed deep into the engine bay with a feverish passion for the beast he is trying to subdue.

“Central banks are uniquely positioned to knit together the system as a whole”.

It all begins to sound like a comedy. He is mesmerised by the shiny new “innovations” of digitalisation (which is actually 70 years old) and tokenisation (which has been with us for thousands of years – ever since money was invented).

He has become dazzled by the size and power of computerisation while overlooking its inherent fragility and its limits. The Ferrari has dazzled him when all he needed was a horse and cart – or perhaps a modern Volkswagen.

None of this is any solution to The Big Problem which all advanced economies actually currently face.

Reference: BIS Speech by Hyun Song Shin, the Economic Adviser and Head of Research at the Bank for International Settlements. Basel June 25th -- https://www.bis.org/speeches/sp230625b.pdf

So what is that Big Problem (exactly)?

THE PROBLEM OF INADEQUATE BORROWERS

The Problem which all advanced economies are confronted with is the problem of inadequate and declining banking reserves in nations where working age populations are in demographic decline. All continents are facing this problem with one exception – Africa.

The core of the problem is actually to be found in the persistent decline of working age populations (ageing) and the consequent fall in fresh new credit money creation (bank loan volumes) over time. Older age groups do not borrow as much as younger age groups. That is obvious.

Rather than charging forward into a world of deeper and deeper technological complexity dressed up as “efficiency”, “speed” and “innovation”, BOOM suggests a much simpler solution to our current monetary system problems. It will boost banking reserves and solve many other problems as well.

Central bankers are missing the most important ingredient in the monetary system that they have inherited. That ingredient is a form of money that can be issued in higher volumes upon demand from the real economy, is non-interest bearing, fungible, anonymous and can be recalled when reduction of its volume is required. BOOM is referring to physical CASH.

Rather than abandoning it, we need to look much harder at the essential, key role of physical cash money in our money system. In short, cash has huge potential to solve our problem of falling credit money creation.

Increased physical cash is an easy solution to the problem at hand. It can be issued by the Sovereign via expenditure into the real economy. The Government can pay many (most?) of its expenditures with cash. For example, it can pay its wages bill with cash for the army of public servants it employs. Such cash will increase commercial bank deposits instantly and thus automatically allows increased bank reserves at the central bank level. It also provides a natural buffer to excessive credit money creation and, thus, is not as inflationary as excessive credit money expansion.

Shin and the Bank for International Settlements fail the first test that should be asked of any business. What problem (exactly) are you trying to solve here?

THE NON CASH SOLUTION

Apart from increased physical cash, BOOM has another solution called Quantitative Boosting whereby banking reserves and commercial bank deposits can be increased over time in reverse and complementary fashion to the Cash solution. In Quantitative Boosting, however, there is a need for deep and complete, formal agreements of cooperation between our Governments, our central banks and our commercial banking sector. It involves Governments borrowing from the banking sector rather than using the Sovereign Bond market to raise funds sufficient to cover their budget deficits.

QUANTITATIVE BOOSTING EXPLAINED

https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/

If the central bankers and the current crop of incompetent politicians in the advanced economies get this all wrong, then they may well end up being torn apart and eaten by the angry mob. They should understand the lesson of the de Witt Brothers and their failure to understand what (exactly) was the problem being faced by their nation. Distraction is not an adequate excuse to an angry mob faced with hunger and enslavement.

In economics, things work until they don’t. Do your own research. Make your own conclusions.

BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.