BOOM Finance and Economics 7th April 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available at LinkedIn and at Wordpress https://boomfinanceandeconomics.wordpress.com/

WHO WILL SAVE THE PLANET? (IF IT NEEDS SAVING)

NATIONAL HAPPINESS

JANET YELLEN AND KATHERINE TAI HAVE JUST WOKEN UP

TESLA UPDATE -- SHARES FALL AGAIN

BATTERIES DAMAGE THE EARTH – AN ENVIRONMENTAL AND ECONOMIC DISASTER

COBALT RED

COBALT MINING IN THE CONGO - A HORROR SHOW OF EXPLOITED CHILDREN

WHO WILL SAVE THE PLANET? (IF IT NEEDS SAVING)

ANSWER -- NOBODY

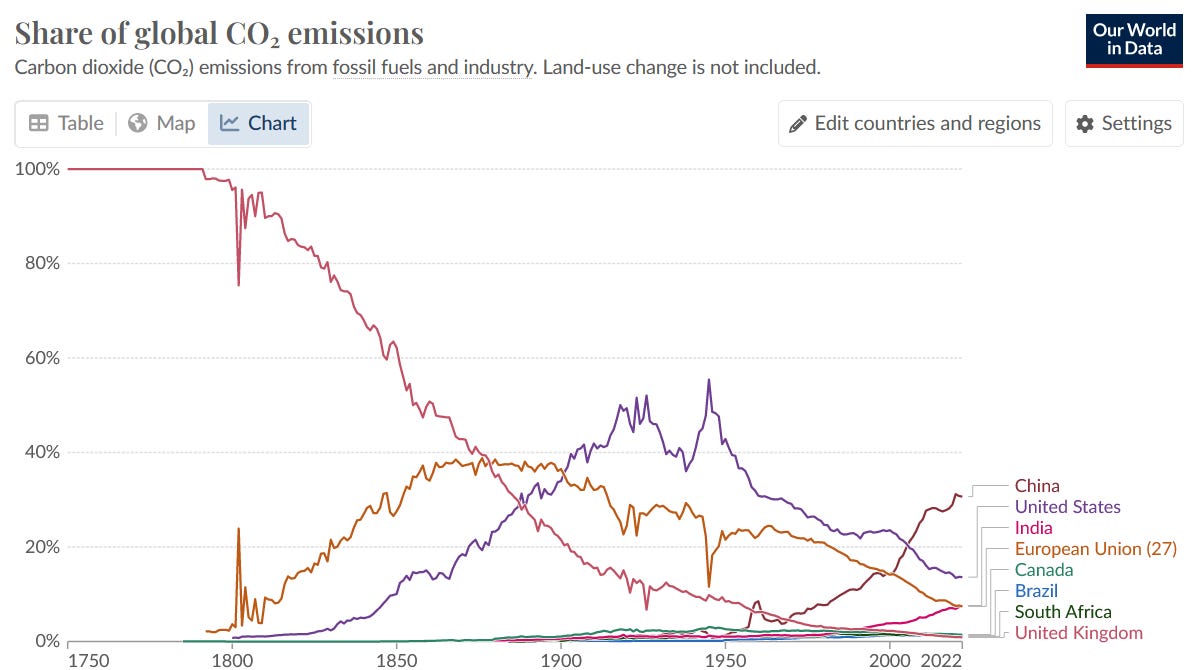

Last week, BOOM discussed CO2 Emissions and revealed the relative contributions from a number of nations. The graph displayed 220 years of data.

“In the year 1800, the United Kingdom was responsible for about 98% of the world’s CO2 emissions due to the coal fired industrial revolution that occurred there first. Now, the UK is responsible for only 1 % (or less) of global CO2 emissions.”

The graph shows the dramatic decline of the United Kingdom from the dominant industrial power in 1800 to a very minor contributor today.

In other words, the entire UK could shut down ALL of its human activity and it would have almost no effect on global atmospheric CO2 composition. Despite this fact, there are major city councils in the UK adopting “15 Minute City” regulations which will effectively turn them into prisons – all to “save the planet”. And the UK government has decided to slash CO2 emissions by 78% by the year 2035. Is this economic madness? BOOM thinks the answer is Yes.

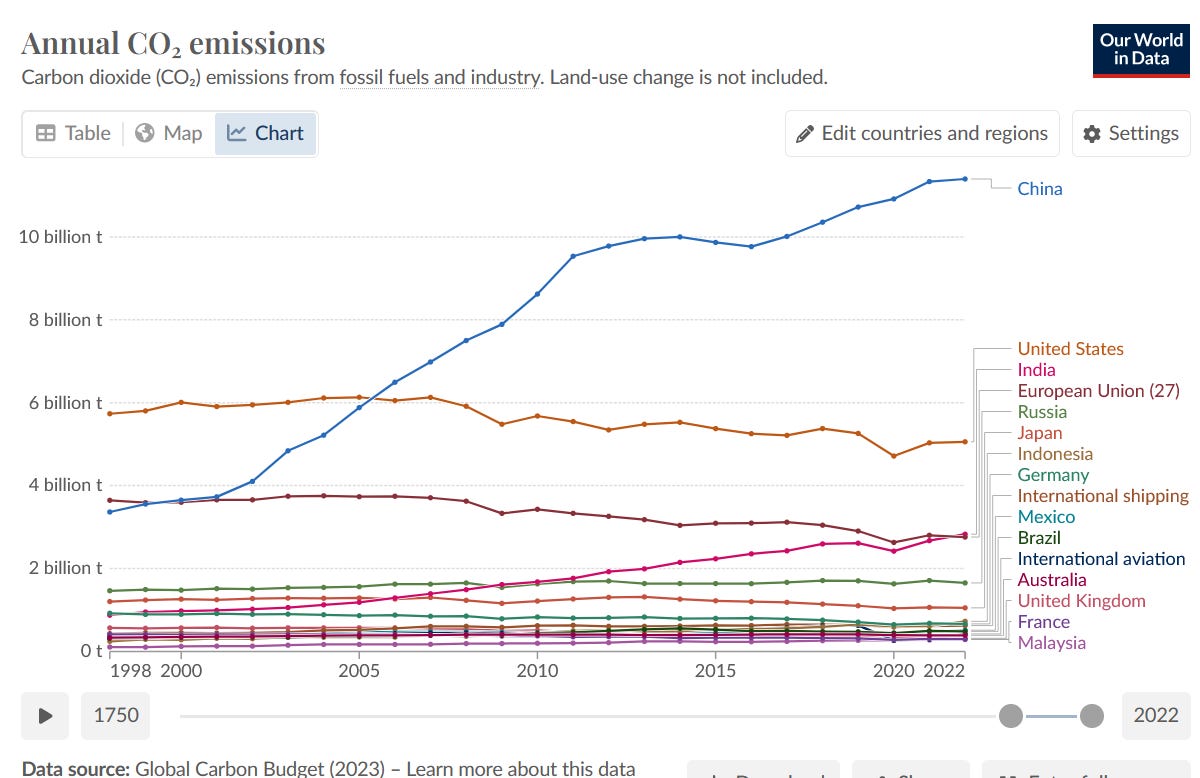

We can also look at Annual CO2 Emissions in the advanced, industrialised nations over a shorter time frame -- from the year 2000 to the year 2022. In the data, we can see the rise and rise of China since 2000, the rise of India over the last 20 years and the fall of the United States. But that is not the full story. Let’s look more closely at the data.

In the year 2000, China’s CO2 Emissions were 3.65 Billion Tonnes.

In 2022, they were 11.4 Billion.

In the year 2000, India’s CO2 Emissions were 1 Billion Tonnes.

In 2022, they were 2.83 Billion.

In the year 2000, USA’s CO2 Emissions were 6 Billion Tonnes.

In 2022, they were 5 Billion.

Over the last 22 years, China’s annual emissions have tripled.

India’s emissions have almost tripled.

While the emissions from the USA have fallen by 16.6 %

And in the same time frame --

Germany’s annual emissions have fallen by 26 %

France’s annual emissions have fallen by 27 %

Japan’s annual emissions have fallen by 20 %

The 27 Nations of the European Union’s annual emissions have fallen by 23 %

The United Kingdom’s annual emissions have fallen by 44 % (Yes — 44 %)

Meanwhile --

South America’s Total annual emissions have risen by 44 %

Brazil’s annual emissions have risen by 42 %

And Indonesia’s annual emissions have more than doubled (from 280 Million Tonnes to 728 Million)

If we look at Global CO2 emissions as a competition between nations, it is becoming clear that there are big winners and big losers emerging.

If the aim of the game is to increase CO2 emissions, then --

China is the standout winner with India a close second.

Indonesia wins the Bronze medal for third place.

The biggest losers (by far) are the United Kingdom, closely followed by France, Germany, Japan, the combined 27 nations of the European Union and the United States. The USA is the best i n the loser group, having lost only 16.6 % of its annual emissions since the year 2000. The UK is the stand out loser, having lost 44 % of its emissions since 2000.

Let’s look more closely at the economies of the Winner (China) and the Loser (the United Kingdom). PPP is Purchasing Power Parity (inside China)

Data Source: World Bank

The GDP of China (as measured by PPP per Capita) has risen from US $ 3,450 in 2000 to US $ 18,200 in 2022 – (a 6 fold rise)

The GDP of the UK (as measured by PPP per Capita) has risen from US$ 38,600 in 2000 to US$ 47,600 in 2022 -- (a rise of just 23%)

Annual Gross Domestic Product (GDP) is defined as the total value of goods produced and services provided in a country during one year. GDP per Capita is obviously a population adjusted figure, the GDP per person. And GDP as measured in PPP allows purchasing power comparisons between nations.

Summary for the 22 year period 2000 - 2022:

China’s Annual GDP (on a PPP per Capita basis) has risen 6 fold

The UK’s Annual GDP (on a PPP per Capita basis) has risen by only 23 %

If the game is to increase economic activity and CO2 emissions, then China is absolutely crushing the UK and is the stand-out WINNER. The UK is the stand-out LOSER.

The people of the UK need to be made aware of this. However, their incompetent politicians are busy committing economic suicide, waging an unwinnable war against Russia AND ignoring the terrible damage they have done in the name of “Covid 19” and the so-called Covid “vaccines”. Those are “vaccines” that do not stop infection or transmission and are (clearly) not safe nor effective.

Yes, they are busy and do not wish to be disturbed. They play their games at global 5 Star hotel conferences aimed at “saving the planet”, in Parliament at Westminster and in their city councils with no independent economic audit ever being called for or conducted. Perceived “threats” are apparently more important.

BOOM expects social unrest to erupt in the United Kingdom very soon indeed. The people will eventually work it all out. They are being played for fools. Fools who cannot possibly “save the planet” by surrendering their economy. That is a mathematical fact. Economic suicide is a term that springs to mind.

Data Source: The Data presented here is taken from the Global Carbon Project. It's widely recognised as the most comprehensive report of its kind. The GCP has been publishing estimates of global and national fossil CO2 emissions since 2001.

Data retrieved on December 12, 2023 from https://globalcarbonbudget.org/

NATIONAL HAPPINESS

From the economic comparisons made above, it may appear that the UK could well be the most miserable place on Earth and that China is a wonderful place to live. However, numbers calculated for GDP per Capita are not the be all and end all of national happiness. BOOM wants to make that crystal clear. They are just comparisons of economic growth as measured in the dominant global currency, the US Dollar.

There are many other ways to measure national happiness.

There are alternative, broad measures of economic progress that can be used instead of using GDP figures, expressed in currency values. For example, here are just a few ---

Bhutan GNH Index

Disability-adjusted life year Index

Green National Product

Genuine Progress Indicator

Green Gross Domestic Product

Gross National Happiness Index

Gross National Well-being Index

Happiness economics

Happy Planet Index

Human Development Index

Index of Sustainable Economic Welfare

Progressive Utilization Theory Index

Legatum Prosperity Index

Leisure Satisfaction Index

OECD Better Life Index

Wikiprogress Index

World Happiness Report

World Values Survey

For example, the World Happiness Report (WHR) is a partnership of Gallup, the Oxford Well being Research Centre, the UN Sustainable Development Solutions Network, and the WHR’s Editorial Board.

The World Happiness Report reflects a worldwide demand for more attention to happiness and well-being as criteria for government policy. From 2024, the World Happiness Report will be a publication of the Wellbeing Research Centre at the University of Oxford, UK. They use observed data on six variables and make estimates of their associations with “life evaluations” to explain the variation across countries. They include GDP per Capita, social support, healthy life expectancy, freedom, generosity, and corruption.

The World Happiness Report and much of the growing international interest in happiness exist thanks to Bhutan. They sponsored Resolution 65/309, “Happiness: Towards a holistic approach to development,” adopted by the General Assembly of the United Nations on 19 July 2011, inviting national governments to “give more importance to happiness and well-being in determining how to achieve and measure social and economic development.”

Research support is provided from the Center for Sustainable Development at Columbia University; the Centre for Economic Performance at the London School of Economics and Political Science; the Vancouver School of Economics at the University of British Columbia; and the Helping and Happiness Lab at Simon Fraser University.

JANET YELLEN AND KATHERINE TAI HAVE JUST WOKEN UP

Returning to BOOM’s common theme of incompetent Western politicians and their government officials, let’s look at events from last week. The word “clueless” springs to mind. Read on ….

Katherine Chi Tai, a daughter of Taiwanese immigrants to the US, has been the 19th United States Trade Representative since March 18, 2021. Last Thursday, she told a meeting in Brussels of the EU-US Trade and Technology Council (TTC) that China’s “non-market” policies were causing severe economic damage to the USA. She suggested “countermeasures.” Countermeasures is a term usually used to describe weapons of warfare or measures to counter a threat. There’s that word again.

She went on to describe China as having a “very effective economic system” --

“I think what we see in terms of the challenge that we have from China is… the ability for our firms to be able to survive in competition with a very effective economic system”.

And she said that the USA and the EU may not be able to compete with China as a system “that we’ve articulated as being not market-based, as being fundamentally nurtured differently, against which a market-based system like ours is going to have trouble competing against and surviving.”

She called for “defensive” policies such as tariffs, plus “incentive measures to correct for a market dynamic that is not playing out in our favour.”

Donald Trump launched a tariff based trade war against China in 2018 when he was President. He lost the war comprehensively. However, Katherine Tai, the US Trade Representative, seems not to have noticed.

Janet Yellen is the US Treasury Secretary and previously the head of the US Federal Reserve (Central Bank). Also last week, she said that China’s industrial sector produces more goods than its domestic market can absorb. (That has been obvious for many, many years to other observers). She was speaking to the American business community in the Chinese city of Guangzhou.

She said that China’s “direct and indirect government support” was causing “productive overcapacity” leading to “massive volumes of exports at depressed prices”. She warned that China’s government subsidies were creating a surplus of goods globally.

Last month, she complained that China was producing too many batteries, solar panels, and electric cars and that this was harming American workers. Katherine Tai also mentioned China’s high production of steel, aluminium, solar panels, and electric vehicles as specific causes of concern.

Have these senior US government officials been asleep for the last 20 years?

Have they not read BOOM?

Are they clueless?

TESLA UPDATE -- SHARES FALL AGAIN

Tesla shares fell again last week, down 6.19% to finish at US$ 164.90. They hit a Low just above $ 160 during Friday’s trading session.

From the week’s High of $ 177.19 to the Low of $ 160.51, the fall was equal to 9.4 %.

The explanation given (by Reuters) was that the company has abandoned its plan to build and release a car priced at $ 25,000 or below US$ 30,000. Elon Musk denied this by Tweeting — “Reuters is lying (again)”. BOOM has no idea about who is correct in this argument. However, the downtrend in Tesla’s share price is now well over 2 years old.

TESLA – TSLA 3 YEARS

BATTERIES DAMAGE THE EARTH – AN ENVIRONMENTAL AND ECONOMIC DISASTER

Nickel, Cobalt, and Lithium are not infinite in supply. They need to be discovered, mined, refined, transported and converted into batteries. Then those batteries need to be transported and incorporated into end products such as electric cars and electronic devices. Then those end products need to be transported to waiting markets. Massive amounts of energy (mostly derived from coal, oil and gas) and human labour is required. None of this is “green”. There are many environmental consequences.

People in advanced western economies have become convinced that they are “saving the planet” by using batteries. They display their virtue by using them, especially when driving electric cars. But very few seem to be aware of the environmental damage required to produce their beloved batteries.

NICKEL

For example, a massive, multi-Billion-dollar nickel industrial complex called the Indonesia Weda Bay Industrial Park (IWIP) has been built in an Indonesian Province called North Maluku. The area was previously a pristine environment. The complex is causing significant deforestation, air and water pollution and emitting massive amounts of greenhouse gases from captive coal plants used to provide the electrical energy required. IWIP has built five coal-fired power plants since 2018, with plans for a total of twelve new coal plants. They will generate an estimated 3.78 gigawatts per year of energy by burning low quality coal from Kalimantan, which is more coal than Spain or Brazil use in a single year.

MALUKU — INDONESIA

A report from Climate Rights International (CRI) was released in January. It is 124 pages long and titled “Nickel Unearthed: The Human and Climate Costs of Indonesia’s Nickel Industry”. Founded in 2022, Climate Rights International is a tax-exempt non-profit corporation registered in California and based in Berkeley. BOOM cannot determine its funding source.

Indonesia is the world’s largest producer of nickel, supplying 48 percent of global demand in 2022. Other large producers include the Philippines, New Caledonia, Russia, Canada, Australia, China, Brazil and the USA.

The CRI report documents how the nickel industry’s destruction of forests, acquisition of farmland, degradation of freshwater resources, and harm to fisheries has made it difficult, if not impossible, for local communities to continue traditional ways of life.

IWIP is a joint venture of three private companies headquartered in the People’s Republic of China. Other companies have announced plans to also build industrial facilities within IWIP. BASF and Eramet plan to spend as much as $2.6-billion building a nickel/cobalt refinery there. The project, known as Sonic Bay, will produce about 67,000 tonnes of nickel and 7,500 tonnes of cobalt annually. POSCO has also announced plans for a $ 441 million plant in IWIP with the capacity to produce 52,000 tonnes of refined nickel annually.

Read the Full Report if you dare – “Nickel Unearthed” https://cri.org/reports/nickel-unearthed/

LITHIUM AND COBALT

Two million tonnes of water are required to produce just one tonne of Lithium. That is enough for only 100 car batteries. That water flows back into the surrounding environment.

Satellite analysis in Cuba has shown contamination of over 10 kilometres of coastline where nickel and cobalt mines are present. The Philippines had to shut down 23 mines, many producing nickel and cobalt, because of the environmental degradation that they caused.

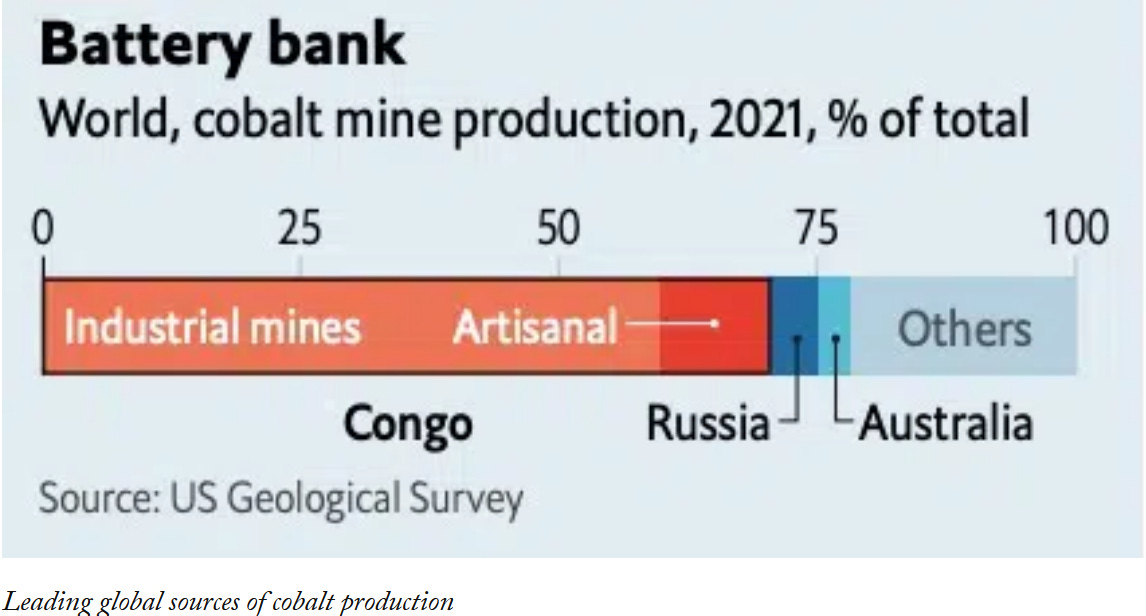

Cobalt mining is associated with dangerous workers’ exploitation and other serious environmental and social issues, especially in the Democratic Republic of Congo (DRC) where 70% of the world’s supply of cobalt is produced.

The majority of the cobalt that is extracted is actually a by-product of existing copper mines. The other major source of cobalt outside of existing copper mines in the DRC is produced via “artisanal” mining, producing up to 15% of the global cobalt supply. It is currently estimated that between 140,000-200,000 people work as artisanal miners in the DRC and most earn less than US$10 per day. That is considerably more than most earners in the country, who are living on an estimated US$1.90 a day.

COBALT RED

Siddharth Kara is the author of a book, “Cobalt Red”.

Cobalt Red is the first-ever book to investigate human rights and environmental abuses involving the mining of cobalt in the Democratic Republic of the Congo. Cobalt is used in the manufacture of lithium-ion rechargeable batteries found in smartphones, tablets, laptops, and electric vehicles.

He says the mining industry has ravaged the landscape of the DRC. Millions of trees have been cut down, the air around the mines is hazy with dust and grit, and the water has been contaminated with toxic effluents from the mining processing.

Kara also says "Cobalt is toxic to touch and breathe — and there are hundreds of thousands of poor Congolese people touching and breathing it day in and day out. Young mothers with babies strapped to their backs, all breathing in this toxic cobalt dust."

A conversation between Kara and Elon Musk is long overdue.

COBALT MINING IN THE CONGO - A HORROR SHOW OF EXPLOITED CHILDREN

"We shouldn't be transitioning to the use of electric vehicles at the cost of the people and environment of one of the most downtrodden and impoverished corners of the world," he says. "The bottom of the supply chain, where almost all the world's cobalt is coming from, is a horror show."

To learn more concerning the horrors of mining Cobalt in the Congo, BOOM suggests this article published in February 2023 at NPR.org. Readers are warned that the contents are harrowing with many children being enslaved and buried alive in tunnels used to mine the Cobalt.

How 'modern-day slavery' in the Congo powers the rechargeable battery economy

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Thanks for reading BOOM Finance and Economics Substack.

Subscribe for Free to BOOM Finance and Economics

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years which includes many of the world’s most senior economists, central bankers, fund managers and academics.