BOOM Finance and Economics 9th July 2023

WEEKLY REVIEW -- Sunday -- All previous Editorials are available at LinkedIn and at https://boomfinanceandeconomics.wordpress.com/

This week in BOOM

China Denied Rare Earths to the US

Declaration from the Shanghai Cooperation Organisation

Argentina Pays IMF Loan with Chinese Yuan

Change in Producer Price Inflation Collapsing

CHINA DENIES RARE EARTHS TO USA

Two weeks ago, BOOM wrote “The US must import Rare Earths to meet its needs. And the only place where such supply can be guaranteed is China”. Then Joe Biden unilaterally decided to insult Xi Jinping by calling him a “dictator”, undoing all the careful work of the State Department to rebuild the fragile and tenuous US relations with China.

Subsequently, last week, on Tuesday, we learned that China has now decided to slow the supply of Rare Earths to the US. They announced new export controls on two rare earth metals, Gallium and Germanium, starting on August 1, in order to “to safeguard national security and interests".

The Chinese Ministry of Commerce said that Gallium-related items and germanium-related items are to be prohibited from export unless a license is obtained:

"Export operators should go through export licensing procedures in accordance with relevant regulations, submit an application to the Ministry of Commerce through the provincial commerce department, fill out the application form for export of dual-use items and technologies and submit the following documents."

So, on Friday, the US Department of Defense announced that it is invoking the Defense Production Act to boost the domestic mining and processing capacity of Gallium and Germanium, critical for high-tech chip-making for the US defense industry. It also announced that it had a stockpile of Germanium but no reserves of Gallium.

Germanium is used in high-speed computer chips, plastics and in many military applications. Gallium is used in radar and radio communication devices, satellites and computer screens. These Rare Earths are also used in electric vehicles and in fibre optics.

Rare Earth metals are, in fact, not rare. They are found relatively easily. However, they are difficult to refine and the process creates a huge local environmental problem. So, it is easy to find the metals but not so easy to increase production of the refined end products. The US will now have to find refining capacity to replace China’s reduced exports. That cannot happen overnight.

DECLARATION FROM THE SHANGHAI COOPERATION ORGANISATION

The Shanghai Cooperation Organisation nations met last week in an online conference, hosted by India. Iran was accepted as a full member. The other full members are China, India, Russia, Pakistan, Kazakhstan, Kirghizstan, Tajikistan and Uzbekistan.

Observer States include Afghanistan, Belarus and Mongolia. Dialogue Partners include Sri Lanka, Turkey, Cambodia, Azerbaijan, Nepal, Armenia, Egypt, Qatar, Saudi Arabia, Kuwait, Maldives, Myanmar and United Arab Emirates. Bahrain is an “upcoming” Dialogue Partner. The group of nations, founded in 1996, now comprise almost 50 % of Earth’s population.

They issued a Joint Declaration. The key elements along with BOOM’s comments were as follows --

“Based on the proximity of assessments of the current regional and international agenda, the Member States confirm their commitment to formation of a more representative, democratic, just and multipolar world order based on the universally recognized principles of international law, multilateralism, equal, joint, indivisible, comprehensive and sustainable security, cultural and civilizational diversity, mutually beneficial and equal cooperation of states with a central coordinating role of the UN”

Most of that was entirely predictable. However, the last phrase “with a central coordinating role of the UN” is clearly an attempt to not rock the political boat too much. After all, the first section boldly reveals the true agenda – to form “a more representative, democratic, just and multipolar world order”.

They go on to say -- “The Member States reaffirm that the SCO is not directed against other states and international organizations”. Again, another re-affirmation of the desire to not rock the boat.

However, then the declaration kicks a few shins by declaring a desire “to promote cooperation in building a new-type of international relations in the spirit of mutual respect, justice, equality and mutually beneficial cooperation, as well as formation of a common vision of the idea of creating a community of the common destiny of humanity”.

This clearly shows a divergence away from the power politics so often on full display in the United Nations where the US dominates.

They hammer the point home by stating “The Member States advocate respect for the right of peoples to an independent and democratic choice of the paths of their political and socio-economic development, emphasise that the principles of mutual respect for sovereignty, independence, territorial integrity of states, equality, mutual benefit, non-interference in internal affairs and non-use of force or threats to use force, are the basis of sustainable development of international relations. They reaffirm their commitment to peaceful settlement of disagreements and disputes between countries through dialogue and consultations.”

Then the following terms are repeated frequently and appear in a long section principally dealing with how to manage terrorism and drug trafficking -- “cooperation, coordination, constructive dialogue, joint coordinated efforts, common principles and approach, equal rights, responsible behaviour, equitable, mutually beneficial cooperation”. BOOM does not need to comment on that.

They then deal with Chemical Weapons pointedly in a section specifically dedicated to that important matter and directed at the United States.

“The Member States call for full compliance with the Convention on the Prohibition of the Development, Production, Stockpiling and Use of Chemical Weapons and on Their Destruction (CWC) as an effective instrument in disarmament and non-proliferation. They emphasize the significance of early destruction of all declared stockpiles of chemical weapons. The Member States reaffirm their support for Organization for the Prohibition of Chemical Weapons (OPCW) and advocate for concerted decisions to bridge divisions within the Organization, ensure its integrity and operate effectively under the Convention.”

They then make a clear statement on the Iranian nuclear program --

“The Member States consider sustainable implementation of the Joint Comprehensive Action Plan on the Iranian nuclear program to be important and, in accordance with Resolution 2231 of the UN Security Council, urge all the participants to strictly fulfil their obligations for comprehensive and effective implementation of the document.”

In regard to the World Trade Organisation, they avoid strong criticism but strongly state the need for reform by stating the need to “emphasise …. for early implementation of an inclusive reform of the organization”. This is a strong hint that larger nations are dominating smaller ones in trade negotiations.

Then, well down the document, the core message is delivered against the United States’ unilateral application of economic and financial sanctions against Russia --

They stressed “that unilateral application of economic sanctions other than those approved by the UN Security Council are incompatible with the principles of international law and have a negative impact on third countries and international economic relations”.

Then, US Dollar Dominance is addressed. The declaration clearly states a preference for currency multi-polarity. “The Roadmap” is supported ..… “for (the) gradual increase in the share of national currencies in mutual settlements by the interested Member States”.

The rest of the document mentions the word “cooperation” frequently but does not say much of great note. The declaration boils down to an opposition to unilateral economic sanctions (as practised by the US) and strong support for currency multi-polarity in international trade and capital settlements.

ARGENTINA PAYS LOAN WITH CHINESE YUAN

Last September 2022, Argentina applied for formal inclusion into the BRICS group of nations, comprising Brazil, Russia, India, China and South Africa. Thus, if accepted, the acronym will become ABRICS or, more likely, BRICSA.

At the time, the ArgentinIan Ambassador to China, Sabino Vaca Narvaja, said "For us, the group is an excellent alternative for cooperation in the face of a world order that has proven to be created by and for the benefit of a few". Thus, the purpose was clearly to reduce the South American country's dependence on Washington and the International Monetary Fund (IMF).

Argentina has a loan of US$ 44 Billion outstanding to the IMF. Notably, its latest payment on that loan was not made with US Dollars. It was made using some of its stock of Special Drawing Rights (SDRs) at the IMF and Chinese Yuan. SDRs are an asset within the IMF created to supplement countries’ official reserves. And the Chinese Yuan used to help pay back the loan came from a currency swap between the central bank of Argentina and the PBOC (People’s Bank of China). Thus, the Argentinian central bank’s foreign currency reserves were not touched.

It was reported that the country used $1 billion in Yuan from the currency swap line with China and $1.7 billion of SDRs to make the total payment equivalent to US$ 2.7 Billion.

Three months ago, the Economy Minister of Argentina, Sergio Massa, announced that Argentina will now aim to pay for the bulk of its monthly imports from China by using Yuan rather than US dollars. China is currently Argentina’s second largest trade partner after Brazil, and the second biggest destination for Argentinian exports.

The balance of trade, however, is in China’s favour. In US Dollar terms, last year during 2022, Argentina’s imports from China amounted to US$ 17.5 Billion while its exports to China amounted to just US$ 8 Billion. Thus, there was a trade deficit of US$ 9.5 Billion. This is a big increase as over the 7 previous years the trade deficit has been around US$ 5 Billion annually.

Chinese manufactured goods are flooding into Argentina. If those goods are of a productive capacity, then they will help Argentina in boosting its exports. If not, then the debts to China will inevitably grow. Currency Swaps can be an effective methodology to boost trade between two nations in the short to medium term while building the productive capacity of Argentina. However, eventually, Argentina will clearly have to boost its exports to China to reach a better trade balance. BOOM expects China to be patient in the interim. Why? Because Argentina is an excellent source of food, minerals and other raw materials. China’s top exports are in cereals, animal fodder, animal fats, meat and oil seeds.

However, the ultimate prize is in energy. Argentina possesses the world’s fourth-largest shale oil reserves and second-largest shale gas reserves. And China is the world’s largest importer of energy. BOOM expects Argentina to boost energy production with China’s help over the next decade. That will close the trade gap to the benefit of both nations. China has done its homework.

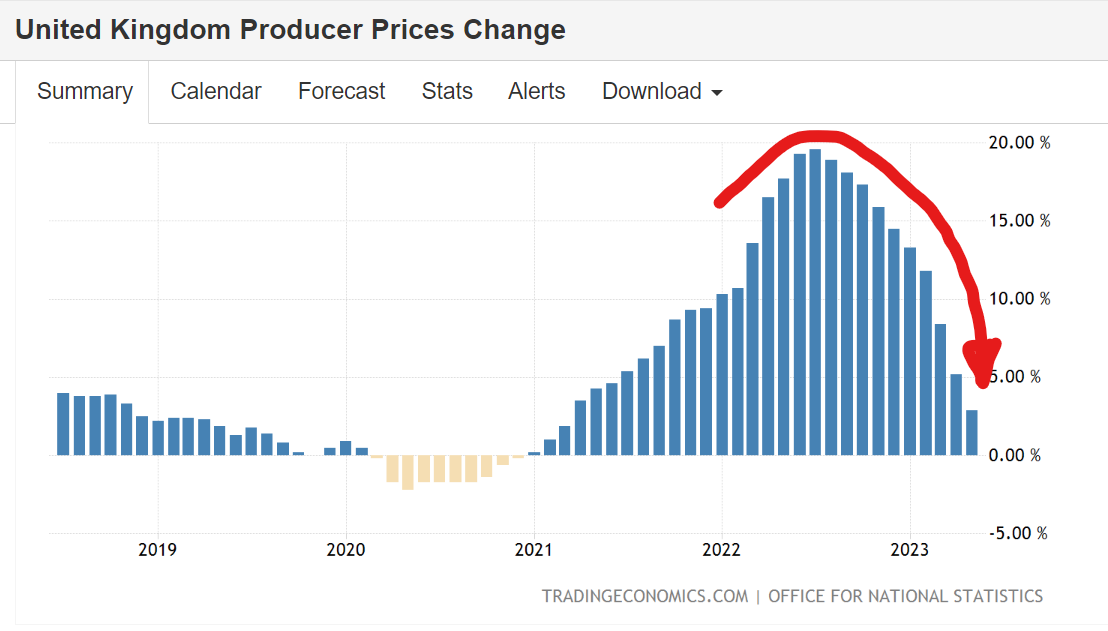

EURO AREA PPI CHANGE COLLAPSES

BOOM correctly predicted the peak of CPI inflation and the bottom for stock markets for most advanced nations in October 2022. No other analyst made that forecast. Since then, it has become apparent that BOOM’s forecast was spot-on and inflationary pressures have eased globally.

Producer Price Inflation is not Consumer Price Inflation. However, if it falls very quickly, it can be a leading indicator for CPI inflation because it indicates a rapid decline in consumer demand. In other words, the wallets are slamming shut. The price of services must follow for CPI inflation to be finally defeated. Why? Because, advanced economies are predominantly services based (not goods based). For the price of services to fall, the demand for them must fall because services generally do not get over-produced in an economy.

In summary, BOOM expects Producer Price Inflation to fall first and then the prices of services should fall as an economy contracts. The degree and speed of change in each nation will, of course, be different. These steps can happen slowly or quickly. But BOOM is now expecting a rapid transition to low CPI inflation rates in most advanced economies.

If you look at a graph of change in PPI in the United Kingdom, Western Europe, the US, China and India it is obvious that wallets have now been slammed shut.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

BOOM — ALL PREVIOUS EDITORIALS AVAILABLE AT —

https://boomfinanceandeconomics.wordpress.com/

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

By Dr Gerry

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.