Climate Change Strategies have Failed over 35 Years - The Transition to Renewables is increasing Demand for Coal, Oil, Gas and Boosting CO2 Emissions - And Global GDP has Tripled - All part of a Plan?

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

The Energy Transition Strategy is Failing — A Long Term Review of Global Energy Reveals the Ugly Truth

THE CLIMATE CHANGE NARRATIVE AND THE TRANSITION TO RENEWABLES HAVE CREATED INCREASED DEMAND FOR OIL, GAS, and COAL — CO2 EMISSIONS ARE RISING — GLOBAL GDP CONTINUES TO GROW UNABATED

A REVIEW OF GLOBAL ENERGY SINCE 1988

Over the last 35 years,

Global consumption of Coal and Gas has DOUBLED

Global consumption of Oil has increased by 60 %

CO2 Emissions have also DOUBLED while …

Global GDP has TRIPLED in size.

These facts are indisputable. The Oil, Coal and Gas industries have benefited greatly from the climate change narrative and especially from the so-called transition to alternative energy sources. These facts beg questions.

IS IT ALL PART OF A PLAN?

The obvious questions are these —

Did the energy industry plan all of this to boost demand for coal, oil and gas?

Did they decide to construct a parallel electricity generation system that they knew would require increased fossil fuel consumption?

Did they know all along that parallel system would be intermittent and thus the backup conventional fossil fuel system would have to be expanded?

Did they know that all the energy supply chains would be permanently boosted?

Did they convince the media and the political class to promote their Plan?

ALL OF THIS CERTAINLY LOOKS FEASIBLE when a review of the last 35 years is taken into consideration.

At the outset, BOOM must declare an agnostic position in regard to the Climate Change debate. As with all hypotheses, BOOM awaits either conclusive proof or partial proof on a strong balance of probabilities. In regard to the issue of atmospheric carbon dioxide and its possible causative link to global temperatures, we seem no closer to any convincing proof after 35 years of debate. There is much conjecture, “models” and fear. However, BOOM is naturally sceptical that a single variable can be the sole cause of change in such a complex matter as our Planet’s climate.

BOOM prefers to look at what has actually happened rather than to engage in a hypothetical debate. Let’s look at the key facts over time. Those key facts are (1) the Global Consumption of Oil, Gas and Coal (2) Global CO2 Emissions (3) Global economic activity as measured by GDP calculations and (4) the Profits of Oil, Gas and Coal companies.

GLOBAL FOSSIL FUEL CONSUMPTION – DOUBLED -- SINCE 1988

GLOBAL ANNUAL CARBON DIOXIDE EMISSIONS – DOUBLED -- SINCE 1988

GLOBAL GDP HAS TRIPLED IN SIZE — SINCE 1988

Over the last 35 years, Global GDP has TRIPLED IN SIZE – from US $ 30 Trillion in 1986 to $ 90 Trillion in 2022. In 2023, it reached $ 105 Trillion.

THE HISTORY OF GLOBAL WARMING, CLIMATE CHANGE AND GLOBAL BOILING

The Global Warming narrative originated with the theories of Joseph Fourier in France in the 1820’s – 200 years ago. In 1859, John Tyndall – an Irish physicist – found that water vapour and carbon dioxide were present in the atmosphere. Then in 1896, in Sweden, a physicist and physical chemist, Svante Arrhenius was the first to theorize that perhaps changes in atmospheric carbon dioxide may be responsible for the Earth's surface temperature.

The term greenhouse was first applied to this phenomenon in 1901 by another Swede, Nils Gustaf Ekholm. But the so called “Greenhouse Effect” didn’t grab the public’s attention until 1987 when a paper was published by NASA titled “1987: Evidence for future warming: How large and when? The Greenhouse Effect, Climate Change, and U.S. Forests.” The Abstract made some bold predictions about the future of “rapidly rising temperatures” — all based upon “models” of the Earth’s extremely complex climate.

Abstract: “A wide range of evidence confirms a general understanding of the "greenhouse" mechanism. Climate models and empirical evidence from past climate changes suggest a climate sensitivity for doubled atmospheric carbon dioxide (CO2) that agrees with the estimate of 3±1.6°C (5.4±2.7°F) by committees of the National Academy of Sciences. Recent rapid increases of atmospheric trace gases also have accelerated the greenhouse forcing of the climate system. An experiment using a three-dimensional global climate model in which CO2 and other trace gases increase at the rate observed !rom 1958 to 1984 and at similar rates into the future, shows global temperatures inching above the level of natural variability by about 1990, followed by a trend of rapidly rising temperatures.”

So – since 1987/88, we have now had over 35 years of Global Warming fear narratives which somehow changed to “Climate Change” along the way and now we are being told that the era of “Global Boiling” has arrived.

THE SOLUTION

The solution proposed by our political class and our “expert” class is to transition away from Coal, Oil and Gas, reduce CO2 emissions and move to Net Zero by switching to alternative sources of energy. Those alternative energy sources are variously described as “renewable” but BOOM cannot understand why.

The charts presented above show that the global consumption of Coal, Oil and Gas have all steadily increased since 1987. In fact, the consumption of Coal and Gas have both doubled. Oil consumption has increased by 60 %. CO2 Emissions have doubled and Global GDP has more than tripled.

Those are the cold, hard facts of the matter.

THE OUTCOMES OF THE ENERGY TRANSITION — THE WINNERS ARE IN OIL, GAS AND COAL PRODUCTION

The outcomes of the energy transition policies are now observable and undeniable. The winners are the energy producers. Unquestionably, all of this effort has generated increased demand for Oil, Gas and Coal.

During the 1970’s and 1980’s, there was (clearly) no new global industry which would provide goods and services that could be imagined and promoted and which would boost the use of oil, gas a nd coal. Perhaps a parallel, intermittent, unreliable, electricity generation system could be built that had to be “renewed” every 15 - 25 years? A bold plan? A self-fulfilling prophecy?

If that was the Plan all along, it has been executed very skilfully indeed and it has been certainly successful in boosting the revenues and profits of the companies involved in production of so-called “Fossil Fuels”.

BOOMING OIL AND GAS PROFITS - $ 4 TRILLION

The global oil and gas industry's profits in 2022 jumped to some $4 Trillion from an average of $ 1.5 Trillion in recent years, according to the head of the International Energy Agency (IEA), Fatih Birol.

Chevron, ConocoPhillips, Exxon and Shell all reported record profits in 2022.

Exxon, the largest U.S. oil producer, reported an epic $ 55 Billion in profits for 2022. Shell reported nearly $40 Billion of profit for 2022. That's more than double the prior year's results and the most money Shell has ever made in its 115 years of existence. Chevron, the second-largest oil company in the US, posted record earnings of $ 36.5 Billion, while refiner ConocoPhillips doubled its profits to $18.7 Billion.

And their share prices have boomed as well. It has been a Bonanza for investors.

CHEVRON SHARE PRICE SINCE 1988

EXXON MOBIL SHARE PRICE SINCE 1988

CONOCO PHILLIPS SHARE PRICE SINCE 1988

The oil and gas industry has delivered US$ 2.8 Billion a day in pure profit for the last 50 years, according to a recent analysis from Professor Aviel Verbruggen. He is Emeritus Professor of Energy and Environmental Economics at the University of Antwerp.

According to Verbruggen, the vast total captured by both the petrostates and the fossil fuel companies since 1970 is US$ 52 Trillion ($ 52,000 Billion), providing the power to “buy every politician, every system”.

His analysis, based on World Bank data, assessed the “rent” secured by global oil and gas sales, which is the economic term for the profit produced after the total cost of production has been deducted.

COAL SALES BOOMING — PROFITS TRIPLED IN 2022

As BOOM pointed out last week, Coal consumption is now at record levels and prices are at record highs. The world’s largest coal mining companies tripled their profits in 2022 to reach a total of more than $ 97 Billion, according to a recent Financial Times article. As global demand for coal rose to record levels, total earnings from coal operations at the world’s 20 largest coal miners reached $ 97.7 Billion compared with $28.2bn during the same period a year earlier.

REVIEW OF WORLD ENERGY 2024

Last week, BOOM summarised the Coal Report for 2024 from the International Energy Agency (IEA). It showed that coal is certainly not in decline. In fact, in 2024, global consumption of coal was at record highs and coal prices were also at historically high levels.

This week, BOOM will look at the 2024 Review of World Energy report produced by the Energy Institute (EI). The Energy Institute is a UK Charitable organisation, incorporated by Royal Charter in 2003.

After reading the Review, BOOM could only reach one conclusion – the Climate Change “Transition” strategy to move away from fossil fuels and towards a world of Net Zero while maintaining and improving living standards AND growing the global economy is a complete failure and has been so for over 30 years now. However, that conclusion which is obvious to BOOM is simply too inconvenient for many people to even contemplate, let alone accept.

Before we look at the Report, we can all imagine a speech from any one of our political “leaders” in the Western world in the pursuit of virtue --

PROSPECTIVE CLIMATE CHANGE SPEECH BY ANY POLITICAL LEADER IN THE WESTERN WORLD

“Ladies and Gentlemen and All Others of Any Other Gender,

There are too many people on Earth. Thomas Malthus decided that over 200 years ago when the global population was just 1.6 Billion. Therefore, 8 Billion MUST (surely) be too many. There is no time to waste.

In fact, the Planet is now boiling according to the United Nations Secretary-General Antonio Guterres. Yes … it is dying and we are obviously the cause. (Pause for emphasis). We are now in the Era of Global Boiling. (Pause again)

So we must continue to do what we have done for the last 30 years ….. We must spread panic and fear. We must continue to abandon hydrocarbon fuels and replace them with “renewables”. And we must continue to ignore the fact that those renewables have to be renewed by China every 15 – 20 years. Net Zero is our goal (!)

Meanwhile, we must ignore all the other inconvenient facts of global energy production and consumption. We must continue to eat, to construct, to heat our buildings in winter and to use all forms of transportation using hydrocarbon fuels that are all derived from the oil, gas and coal industries. And, of course, we must (always) grow the global economy.

Then – if all of those endeavours fail to lower energy consumption and CO2 emissions (which appears to be the case already), then it is time to discuss the Ultimate Malthusian Solution … (Pause for emphasis) ……

Yes, People of the Earth. We must kill off the bulk of the population especially the elderly, the disabled and other Useless Eaters. And we must stop the Young from reproducing as well. Only then can we be safe and see the Planet recover to a lower level of the deadly pollutant, Carbon Dioxide.

Thank you for your patience. However, I cannot take questions because my private jet is fuelled up and ready to take me to the next COP Conference 5 Star Resort.”

COP CONFERENCES

For those who don’t know, COP Conferences are the supreme decision-making body of the UN Framework Convention on Climate Change (UNFCCC). They meet every year (usually in very comfortable locations) to review “the implementation of the Convention and take decisions to promote its effective implementation”.

NOTE: To review and promote the Convention.

Not to correct our various courses of action if they are proving to be ineffective.

Hundreds of private jets and thousands of staff are required, of course. Not to mention the 5 Star hotels and resorts. The last one was in mid-November 2024 in Baku, Azerbaijan, otherwise known for being one of the birthplaces of the oil industry. Annually, Baku produces about 33 million tonnes of oil and 35 billion cubic meters of gas.

MOVING BACK TO THE ENERGY INSTITUTE’S GLOBAL ENERGY REVIEW

The Energy Institute is very much a British institution with a strong climate change and political emphasis, working with (among others) the Pledge to Net Zero, the Race to Zero, Aiming for Zero (Methane Emissions Initiative), the Department of Energy Security and Net Zero, Methane Guiding Principles, Professional Bodies Climate Action Charter, Terra Carta Sustainable Markets Initiative, Society for the Environment, the Environment Agency, PRIDE in Energy and POWERful WOMEN.

According to the biographies provided on the Institute’s website, the President of the Institute’s Council, previously “enjoyed” a 35-year international career with Royal Dutch Shell in seven countries. The Vice President is ex-BP. Another member was appointed as the UK Government’s Offshore Wind Champion (whatever that means) in May 2022. The Honorary Secretary is President of the UK’s largest electricity distribution network and is “a strong advocate for innovative solutions to a decarbonised energy market, believing clean technology solutions and new demand response initiatives can help to deliver Government targets for net zero”. Mmmmmm …….

Yet another member is Co-Chairman of Scotland’s 2020 Climate Group. Another is a leader in the Energy practice at Bain & Company. She is “dedicated to the energy transition” and was previously a member of the UK Department for Transport’s Net Zero Transport Board.

The CEO is ex BP, having spent nearly 22 years there in a variety of roles. He is also a Board Member of POWERful WOMEN. Perhaps they couldn’t find a woman to take that position?

Did BOOM mention that the Energy Institute has a strong climate change and political emphasis?

BOOM’S REVIEW OF THE ENERGY INSTITUTE’S 2024 REVIEW OF WORLD ENERGY

The review is 76 pages long. BOOM has read it for you and summarises the key facts. However, there is something curious to consider first. Although the Report is titled 2024, all of the information contained within is for the Calendar Year 2023.

Of course, it begins with a plea to the political world of climate change and global warming. For over 30 years now, the narrative hasn’t changed in the advanced Western economies. That narrative proposes that Global CO2 emissions can and will be reduced significantly if we transition from fossil fuels to “renewable” energy. This requires an almost religious belief in the power of renewables to effect such momentous change.

However, soon enough, any review of Global energy trends, including this one, has to deal with the ugly facts of the matter. And here they are – a harsh reality. Some key Headlines in the report tell the story.

RECORD CONSUMPTION OF FOSSIL FUELS AND RECORD EMISSIONS

“In this 2024 Statistical Review, ….. we report on another year of highs in our energy hungry world. Record consumption of fossil fuels and record emissions from energy.”

“THE PROGRESS OF THE TRANSITION IS SLOW” … MMMMmmmmmm ….

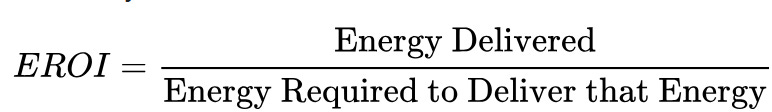

After reading those alarming headlines, BOOM immediately searched the document (all 76 pages) for the terms EROI and ERoEI. But the search was fruitless. It’s as if the Energy Institute has no interest in this key energy subject. Perhaps because to do so would cause much embarrassment at the facts of the matter?

EROI is Energy Return on Investment (EROI). But more accurately, it is called Energy Returned on Energy Invested (EroEI), This is the ratio of the amount of usable energy (the exergy) delivered from a particular energy resource to the amount of exergy used to obtain that energy resource.

This is an important matter as huge materials supply chains have to be maintained to build the so called “alternative, renewable” energy technologies that promise so much. And those huge supply chains are dependent upon industries that use a lot of fossil fuels – mining in remote locations, shipping, refinement, ground transportation and construction.

And then, Renewable energy systems have to be RENEWED (replaced) at the end of their serviceable life and that may be anywhere from 15 – 25 years.

So EroEI calculations must be watched closely to see if the energy “transition” is actually a feasible plan to reduce CO2 emissions and arrest the assumed changes in the climate. Simply assuming that it is feasible runs the risk of relying upon a false assumption. And we all know that false assumptions result in False Conclusions.

EROI FOR MAJOR ENERGY SOURCES -- BREAK EVEN POINT = 7

Source: https://corporatefinanceinstitute.com/resources/accounting/energy-return-on-investment-eroi/

SHOCK HORROR – IT SURELY CAN’T BE SO?

The EROI comparisons suggest strongly that a combination of Nuclear Energy, Hydro and Renewables is the answer if we are to ultimately eliminate Coal, Oil and Gas.

However, nuclear power stations take many years to plan, construct and commission. Then there is the Fukishima disaster to consider. And Hydro power is not applicable in most heavily populated regions of the Planet.

There is also the problem that we cannot fuel heavy transport such as ships, trucks and aircraft with electricity. And we cannot heat buildings efficiently in Northern Hemisphere winters with it either. Then there is the issue of fertiliser production and food production which are heavily reliant on Hydrocarbon energy sources.

In a world where most people want to keep warm, eat and move things (including themselves), we have to face stark reality.

Having looked at the EROI comparisons and considered those other confounding factors, it looks very unlikely, to say the least, that the renewable alternative sources of energy can deliver their promise over the long term. And, in fact, it appears very likely that their development simply INCREASES demand for conventional, Hydrocarbon energy sources.

And, if that is true, then the whole Hypothesis of Energy “Transition” cannot possibly be true.

If the entire “transition” strategy cannot and does not reduce CO2 Emissions, then it quite frankly becomes an extremely clever plan to INCREASE demand for Hydrocarbons.

Having considered all of those conundrums, let’s return to the Energy Institute’s REVIEW OF WORLD ENERGY 2024.

KEY EXCERPTS

Here are some key excerpts that are worthy of close consideration.

“Although demand for natural gas remained flat, consumption of crude oil broke through the 100 million barrels per day level for the first time ever and coal demand beat the previous year’s record level”.

“…. electricity demand grew 25% faster than total primary energy consumption”

“Greenhouse gas emissions from energy use, industrial processes, flaring and methane (in carbon dioxide equivalent terms) increased 2.1% to exceed the record level set in 2022.”

“Carbon dioxide emissions from flaring increased by 7% along with emissions from methane and industrial processes that also increased by over 5%”

“Global oil production increased by 2.1 million b/d to reach a record level of 96 million b/d in 2023. The US remained the largest producer seeing its output grow by over 8%. “

“China’s refining capacity (18,484 kb/d) exceeded the US (18,429 kb/d) for the first time ever making it the largest oil refining market by capacity.”

“The US remains the largest producer of gas delivering around a quarter of the world’s supply.”

“In 2023 LNG supply grew nearly 2% (10 bcm) to 549 bcm. The US overtook Qatar as the world’s largest exporter of LNG, seeing its supply increase nearly 10% versus a 2% drop from Qatar.”

“The global growth in LNG demand was triggered primarily by the Asia Pacific region with China, India, and other non-OECD Asia Pacific countries demand increasing”

“China regained its position as the world’s largest LNG importing country followed by Japan and South Korea. Together, they accounted for around 45% of global LNG trade.”

“Global coal production reached its highest ever level (179 EJ), beating the previous high set the year before. The Asia Pacific region accounted for nearly 80% of global output with activity concentrated in just four countries, Australia, China, India, and Indonesia.”

“Global coal consumption continued to increase and breached 164 EJ for the first time ever.”

“Whilst China is by far the largest consumer of coal (it beat its own record set in 2022 and now accounts for 56% of the world’s total consumption) ...”

“For fossil fuels, coal retained its position as the dominant fuel for power generation in 2023 with a stable share around 35%. Natural gas’ share of the generation fleet also remained stable at around 23%.”

“Renewables share of total power generation rose from 29% to 30%.”

‘Solar and wind capacity continued to grow rapidly in 2023 beating the previous year’s record of 276 GW by around 186 GW, a 67% increase.”

“Global biofuels’ production grew by over 8%”.

Global primary energy consumption reached a new record for the second consecutive year with non-OECD countries dominating both the share and annual growth rates.

CURRENT WORLD ENERGY CONSUMPTION

OIL = 32 % COAL = 26 % NATURAL GAS = 23 % NUCLEAR = 4 % HYDRO = 6 %

Then there are the alternative sources …….. RENEWABLES = 8 %

2023 saw a second consecutive record year for global primary energy consumption as it grew by 2%, reaching 620 EJ. Its growth rate was 0.6% above its ten-year average and over 5% above its 2019 pre-COVID level. Whilst a new record in the consumption of fossil fuels (in absolute terms) was recorded.

2023 global energy-related greenhouse gas emissions exceeded 40 gigatonnes for the first time ever

China commissioned the world’s first onshore demonstration of a small modular reactor (SMR)

Fossil fuels contributed 60% of total global electricity generated in 2023 and 81 % of global energy

Source: https://www.energyinst.org/statistical-review/home

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.