Trump's "Liberation Day Tariffs" may Backfire - Inflation in the USA with Dis-Inflation Everywhere Else - Covid Vaccine Stocks and CRISPR Stocks Collapsing - Russia Dumps Crypto

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive Further long term archives are available at LinkedIn and Wordpress https://boomfinanceandeconomics.wordpress.com

TRUMP’S “LIBERATION DAY” TARIFFS – INFLATION IN THE USA AND DIS-INFLATION EVERYWHERE ELSE - IS THIS ECONOMIC AND GEO-POLITICAL SUICIDE FOR THE USA?

Last Wednesday, on so-called “Liberation Day”, Donald Trump declared a Trade War against the rest of the world (mostly). This will not endear him to his citizens who will be hit with higher prices for many goods. This will also not endear him to many nations that export goods to the USA. If they can, they will abandon that market and rapidly find more friendly customers elsewhere outside the USA. BOOM suspects that the phone calls have been made already.

The Net economic effect will result in generally higher CPI inflation inside the USA and lower CPI inflation in all other nations. China will flood the world outside America with cheap goods. And they will seek trade settlements in currencies other than the US Dollar. As a result, the US economy and US Dollar domination will be harmed. A falling US Dollar will also add to CPI inflation inside the USA.

In all of this, Trump paints the USA as some sort of “poor victim” by saying “they have taken advantage of us”. But no one will be listening. Nobody outside America sees the US as a victim.

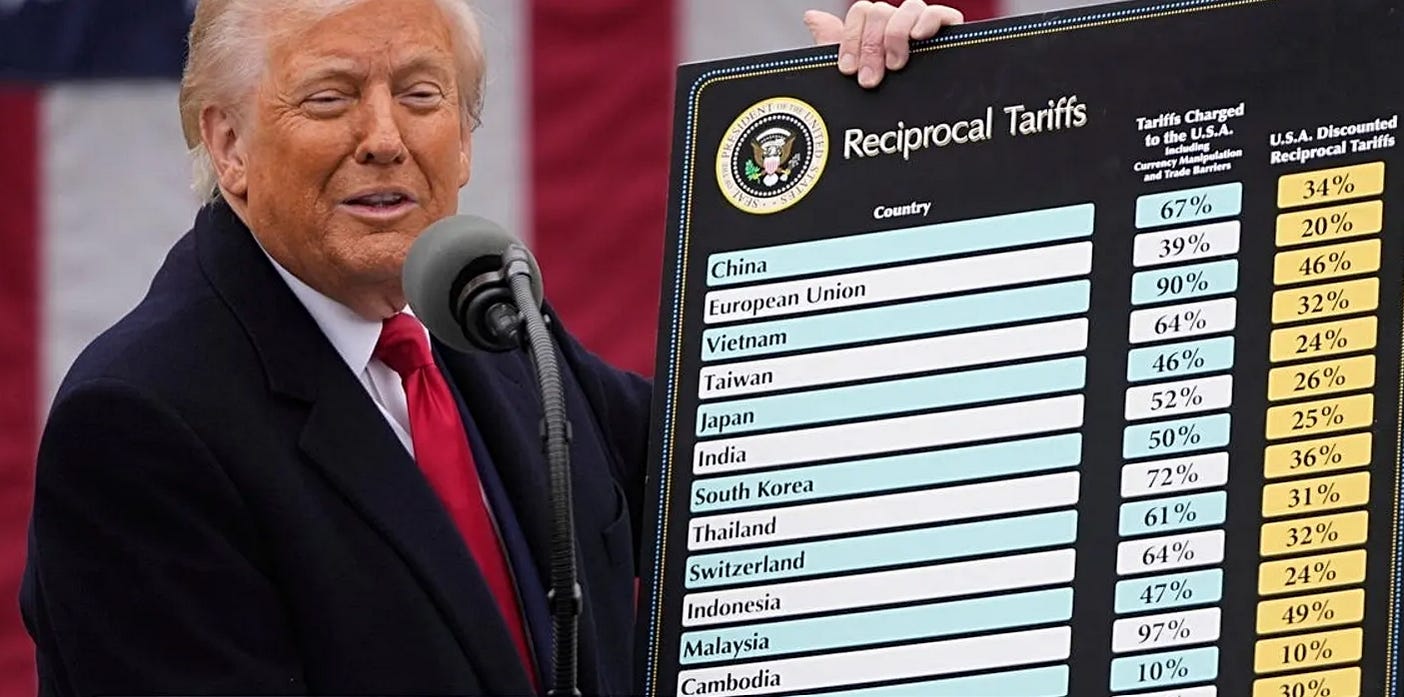

President Trump announced the so-called reciprocal tariffs on imports from about 60 nations, in addition to a 10% across-the-board tax applied to all imports to the US. The new tariffs will be additive, meaning that imports into America will face both the universal tariff of 10% plus the specific reciprocal import levies targeting each nation. The reciprocal rates will become effective at 12:01 am on April 9th. That's in addition to the baseline 10% tariff which goes into effect at 12:01 am on April 5th.

The nations most affected by reciprocal tariffs are – in order of effect --

Laos 48 %

Madagascar 47 %

Vietnam 46 %

Sri Lanka 44%

Myanmar 44 %

Bangladesh 37 %

Serbia 37 %

Botswana 37 %

Thailand 36 %

China 34 %

Taiwan 32 %

Indonesia 32 %

Switzerland 31 %

South African 30%

Pakistan 29 %

Tunisia 28 %

Kazakhstan 27 %

India 26 %

South Korea 25 %

Japan 24 %

Malaysia 24 %

Cote d’Ivoire 21 %

European Union 20 %

Jordan 20 %

Nicaragua 18 %

Israel 17 %

Philippines 17 %

All other nations will see a 10 % reciprocal increase in Tariffs while some will see no increase e.g. Russia.

Note that China (34 %), Taiwan (32 %), South Korea (25 %), Japan (24 %), India ( 26 %) and the European Union (20 %) are the major economies affected outside the USA. This is clearly an attack on those economies. Trust in the US as a reliable trading partner is now damaged and will be hard to repair.

On February 16th, Boom had a lot to say about Donald’s economic policies in TRUMP’S PLAN FOR AMERICA. Here are some excerpts worth reviewing --

“BOOM does not think it will work as planned for obvious reasons. It is essentially a magical thinking “solution”, a glorious dream, to America’s terrible economic, social and cultural problems which are deeply embedded after many, many decades of poor economic management, adversarial thinking, endless warfare and the malevolent influence of what many call the “Deep State”. And it focuses too much on a manufacturing resurgence and a much lower price of energy. It also sees the rest of the world as “the enemy”/”adversaries” which have to be subdued. There is no acceptance of multipolarity as a viable future. This is a Roman, Imperial viewpoint."

“They (Trump and Bessent) are missing the fact that the US economy is overwhelmingly dominated by the provision of services and not manufactured goods. And they are missing the reality of the aspirational policies of the BRICS nations to create a Multipolar world for 7.5 billion people who do not live in the USA. Glorious economic isolation with a dominant global currency is ultimately a Pipe Dream, devoid of consideration for other nations.”

Is this just a Trump Negotiating Tactic?

Of course, there is the possibility of this Trump Tariff announcement being just an opening gambit by Trump, the first step in negotiating new “trade deals” with each nation (or group of nations). We will soon know if that is the case. However, such a strategy is fraught with the risk of damaging America’s international reputation. After all, these are not business deals we are discussing here. They are part of the delicate Geopolitical mix, part of the global conversation and not something to be treated lightly. Diplomats do not step on each others feet at meetings.

Trump was also reported as saying about US car prices that he “couldn’t care less” if automakers raised their prices due to increased Tariffs. If that is true, then it would appear that he is content to insult his citizens just as easily as he insults trading partners. That is bad karma, surely.

Since the US Reciprocal Tariffs announcement last Wednesday, the following effects have been seen in US financial markets —

US Dollar – Falling sharply

US Stocks – Crashing – the worst daily declines since 2020

US Bond Yields – Flat or Down as funds seek safe havens from stocks

In regard to the US Dollar, BOOM wrote this on February 2nd --

“Since Trump’s win in the election, the US Dollar initially strengthened from early November to 20th December. However, since then, it has weakened significantly against other currencies but not dramatically. This weakening can be clearly seen in the chart for UUP – the US Dollar Index – the Invesco US Dollar Bullish Fund. BOOM will watch closely from here for ongoing US Dollar weakness.”

CHART US DOLLAR — UUP over 6 months — Note the Plunge after the Trump Tariff Announcements

In regard to US stocks, BOOM wrote this on 22nd December, just before Christmas:

“BOOM is becoming increasingly concerned that we are witnessing what may be the beginning of a Sell Off. ….. BOOM’s analysis shows that the Post Trump election exuberance in US Stock prices ……… may be coming to an end. Honeymoons don’t last forever.”

US STOCKS — $SPX — S and P 500 Index — over 6 months — Note the Plunge after the Trump Tariff Announcements — DOWN 18 % since Mid Feb (!)

In regard to US Bonds, BOOM wrote on 1st December --

“US Bond prices may be starting to rise again. That is a signal that investors and analysts should be watching for, especially if it occurs right across the various Bond sectors.”

CHART US BONDS — BND - over 6 months — US Total Bond Market ETF — Note the rush into safe haven Bonds as prices rise

CHART -- BITCOIN — GBTC — over 6 months —

BOOM’s forecast on 22nd December — “BOOM’s analysis shows that the Post Trump election exuberance ……. in Bitcoin/Crypto may be coming to an end. Honeymoons don’t last forever.”

COVID VACCINE STOCKS HEADED TOWARDS COLLAPSE

In the past, BOOM has written extensively about the lack of commercial and medical viability of MRNA technology (Covid Vaccines). Almost 2 years ago, on 23rd April 2023, BOOM wrote --

“Messenger RNA technology (mRNA), used in the Moderna and Pfizer Covid vaccines, is increasingly a topic of great concern and discussion in scientific and medical circles. The financial world is also starting to pay attention.”

“The possible links between the Covid mRNA vaccines and subsequent infertility plus sudden, unexpected, excess death numbers in healthy adults are especially worrying. Also, the genetic vaccines now apparently lack efficacy in preventing transmission of the Covid virus which is increasingly a major concern. But there is more, much more to consider.”

“The reports of extraneous, unexpected DNA being found in significant quantities are from a highly qualified, independent genetic sequencing expert, Dr Kevin McKernan. They must be given serious consideration.”

On 9th February, this year, BOOM wrote -- Covid MRNA Technology a Global Disaster --

“Covid MRNA “vaccines” are not anything like conventional vaccines. They are better described by the term “Genetic Therapies”. They do not protect users from being infected by the Covid virus and they do not stop transmission of the virus. In fact, neither of those parameters was tested in the limited trials conducted.

Their use is fraught with potential risks. Adverse effects are their Achilles heel and are arguably frequent in the short term, including sudden unexpected death. And we have no idea of the medium to long term adverse event risks.”

This paper was published last week in the Journal: Neuroscience

Expression of SARS-CoV-2 spike protein in cerebral Arteries: Implications for hemorrhagic stroke Post-mRNA vaccination

“Spike protein expression was detected in 43.8 % of vaccinated patients, predominantly localized to the intima of cerebral arteries, even up to 17 months post-vaccination.

This study demonstrated prolonged presence of SARS-CoV-2 spike protein in the cerebral arteries following mRNA vaccination. Additionally, some inflammatory cell infiltration was observed in spike-positive vessels. These findings raise significant concerns regarding the biodistribution of lipid nanoparticle-based vaccines and their long-term safety.

Source: The Journal of Clinical Neuroscience https://www.sciencedirect.com/science/article/pii/S096758682500195X

Neuroscience is the official journal of the Neurosurgical Society of Australasia, the Australian and New Zealand Society for Neuropathology, the Taiwan Neurosurgical Society, and the Asian Australasian Society of Neurological Surgeons

Time to look (yet again) at the alarming Charts for companies involved in MRNA technology — Covid Vaccines (!)

MRNA — MODERNA — over 5 years — DOWN over 19.3 % last week (!!)

NOVAVAX — NVAX — over 5 years — DOWN over 10 % last week (!!)

BNTX — Biontech — Over 5 years — Falling, falling, falling —

PFIZER — PFE — Over 5 Years — Down 8.9 % last week

If these charts are looking like a great buying opportunity, readers should read this paper just released —

European Immunologist Urges Reclassification of mRNA COVID-19 Vaccines, Calls for Research and Support for the Vaccine-Injured

Quote: “A sweeping peer-reviewed review by Dr. Janos Szebeni affiliated with Semmelweis University, SeroScience and Sungkyunkwan University calls for a critical reevaluation of mRNA-LNP COVID-19 vaccines, citing a dramatically expanded profile of adverse events (AEs), underreporting in official statistics, and systemic biological risks inherent to the vaccine platform. The review, which appears in Pharmaceutics, challenges both the prevailing regulatory definitions and the assumption that mRNA vaccines pose only minimal safety concerns in healthy populations.

“The prominent Hungary-based physician-investigator’s hypothesis: adverse events (AEs) linked to mRNA-based COVID-19 vaccines are more frequent and severe than initially reported, and these vaccines may require reclassification as gene therapies.”

CRISPR TECHNOLOGY FAILURE

Another Biotechnology sector that, in BOOM’s opinion, has no medical or commercial viability is in CRISPR technology, a means for the “editing” of genes. Wikipedia has this to say – (note the last sentence)

Quote: “The technique is considered highly significant in biotechnology and medicine as it enables editing genomes in vivo and is precise, cost-effective, and efficient. It can be used in the creation of new medicines, agricultural products, and genetically modified organisms, or as a means of controlling pathogens and pests. It also offers potential in the treatment of inherited genetic diseases as well as diseases arising from somatic mutations such as cancer. However, its use in human germline genetic modification is highly controversial.”

The Human Genome is a mystery to most people. But so is the piano keyboard. Most people have no understanding of a keyboard and no use for it. However, in the hands of a musical genius, a piano can be used to write great pieces of music. If someone were to suddenly vary each sound produced by each key on the keyboard, it would not necessarily create better pieces of music. For that, a human musical genius would still be required.

That is a simplistic analogy but it is useful in understanding why CRISPR technology may not have any long term medical or commercial viability.

So, let’s look at the commercial world of CRISPR technology. BOOM has created this summary from a number of reputable news sources.

Spotlight Therapeutics, a startup with a bold vision for delivering CRISPR therapies into the body without the need for viral vectors or lipid nanoparticles, has shut down. The San Francisco-based company had more than 40 employees at its peak and raised $66.5 million in two rounds of funding since its debut in 2020. A prominent investor was GV, formerly known as Google Ventures. In a statement, the company acknowledged that the technical hurdles were more significant than anticipated. This shutdown highlights ongoing struggles within the CRISPR biotech sector, which continues to grapple with the gap between the potential of gene editing and investor expectations. Despite the promise of CRISPR to transform medicine, including applications in lowering cholesterol and addressing heart disease, many companies in this field are facing difficulties. This situation reflects a broader trend in the industry, as experts discuss the need for improved delivery mechanisms and alternative approaches to gene editing. Spotlight was co-founded in 2018 by local scientists Alex Marson, of UC San Francisco, Patrick Hsu, of UC Berkeley, and Jacob Corn, who taught at Berkeley but then moved to ETH Zürich. The company’s series A funding round, in 2020, was led by GV and brought in $30 million. A year and a half later, Spotlight raised another $36.5 million.

Other companies in the CRISPR sector are worthy of inspection. Let’s look at their share price performance over the last 5 years. Readers may note some similarity of outcome for investors.

CHART FOR EDIT - Editas Medicine, Inc - Down 17.6 % last week (!)

CHART FOR CRSP — CRISPR Therapeutics

CHART FOR NTLA — Intellia Therapeutics, Inc — DOWN 17.84 % LAST WEEK

CHART FOR BEAM — Beam Therapeutics, Inc — DOWN 31.25 % LAST WEEK

CHART FOR PRME — Prime Medicine, Inc

$NBI — And here is the chart for the Nasdaq Biotechnology Index. Any takers?

RUSSIAN CENTRAL BANK POURS COLD WATER ON CRYPTO

Elvira Nabiullina is an economist and current governor of the Central Bank of Russia. She was Vladimir Putin's economic adviser from May 2012 to June 2013. Prior to that post, she was the Minister of Economic Development from September 2007 to May 2012. And, before that, between 2003 and September 2007, she chaired the Centre for Strategic Development. In 2013, Nabiullina was appointed head of the Central Bank of Russia. In 2015, Euromoney magazine named her their Central Bank Governor of the Year. And in 2017, the British magazine The Banker chose Nabiullina as "Central Banker of the Year, Europe"

Nabiullina was born in Ufa, Bashkir in 1963 into an ethnic Tatar family. She does not come from a privileged background in Moscow. Her father was a driver, while her mother was a factory manager. Bashkortostan or Bashkiria, officially the Republic of Bashkortostan, is a republic of Russia between the Volga river and the Ural Mountains in Eastern Europe. The capital city, Ufa, is much closer to Kazakhstan than to Moscow. There are over 13,000 rivers in the republic. Many rivers are part of the deep-water transportation system of European Russia; they provide access to ports of the Baltic and Black seas.

Last week, Nabiullina called for settlements in Crypto ”currencies” to be banned in Russia. Russia currently allows Crypto mining and experimental foreign-trade settlements in Crypto. However, speaking at a press conference on Friday, she stated that Cryptos are still “very volatile [financial] instruments often used for shady operations” and that they should not be allowed to serve as a means of payment. Last year, in August 2024, Nabiullina said the Bank of Russia would conduct the first cross-border Crypto payments as part of an experiment. On Friday, she said that any transactions in Crypto outside of this special experiment should be banned and those found in violation of the regulations should face legal penalties.

ETHEREUM TRUST — Over 5 Years

This is a very strong position for any Central Bank to take and underlines the importance of using sovereign, national currencies to settle trade and capital movements.

However, it has been reported that she has expressed support for allowing Cryptos to serve as an investment tool for certain qualified investors. Such a position underlines her opinion that Cryptos are investable assets and not currencies. Clear thinking.

In August 2024, Russia enacted a law prohibiting the advertising of Crypto assets to the general public and the promotion of Cryptos to settle transactions in goods or services. The legislation also banned advertising Cryptos and services such as crypto exchanges or wallets.

==========================================================

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.

reciprocal

Flip flopping Trump , Trump 2 = Obama 2.

https://grubstreetinexile.substack.com/p/flip-flop-to-the-golden-turd?r=l1oox