Warning - Decline and Fall of the UK Economy - Norway and CASH -- Argentina Review - The Vultures Circle - Nazi Bombshell Revelations - Nazis Lived in Argentina - The Sad Economic History of Argentina

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive Further long term archives are available at LinkedIn and Wordpress https://boomfinanceandeconomics.wordpress.com

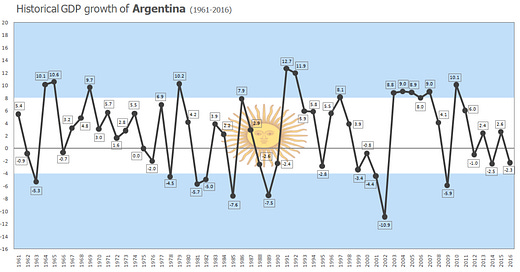

ARGENTINA HISTORICAL GDP GROWTH

THE DECLINE AND FALL OF THE UK ECONOMY --

ARGENTINA REVIEW – DON’T GO DOWN THIS ROAD

NORWAY AND CASH

THE VULTURES CIRCLE

NAZI BOMBSHELL -- NAZIS IN ARGENTINA – DYNAMITE REVELATIONS

THE (QUICK) DISASTROUS ECONOMIC HISTORY OF ARGENTINA

================================================================

THE BRITISH BULLDOG IS NO LONGER ……

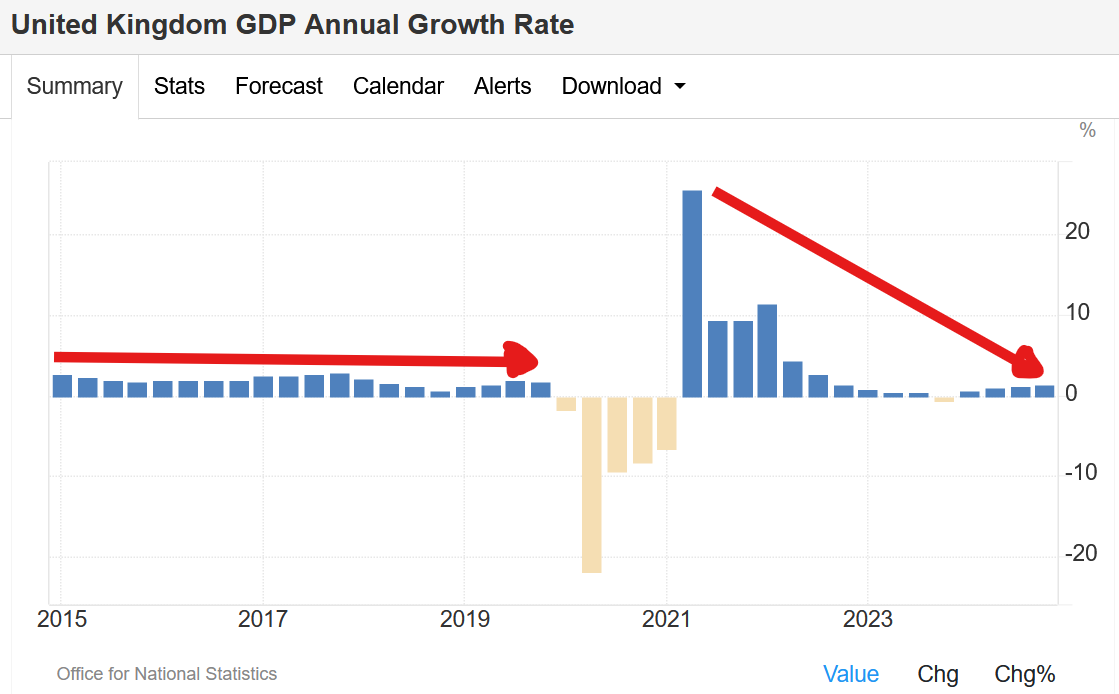

BOOM has warned previously of the precarious position of the UK economy.

In the November 17th 2024 edition, BOOM revealed that the Private Debt to GDP ratio of the United Kingdom reached a peak in 2008 and has suffered a persistent decline ever since. Such a 17 year decline in the creation of private credit can only lead to economic stagnation and the persistent threat of recession. In such a situation, BOOM would expect economic activity to slowly decline and, eventually, real asset price dis-inflation and deflation to occur. When that becomes ingrained, it is a slippery, inevitable slope towards increased, persistent unemployment and a discouraged workforce.

From the BOOM editorial dated November 17, 2024 – under the heading THE UK ECONOMY IS MORIBUND --

Quote: “In response to the Covid event, the UK economy collapsed and contracted dramatically. In the second Quarter of 2020, the Annual GDP Growth contracted by 22 %. This was a remarkable drop in economic activity. Since then, the GDP rebounded dramatically in early 2021 but since then it has fallen and not really recovered. UK GDP Growth has barely escaped a recession. Such an outcome is to be expected in an economy where private credit growth has been poor for such a long time.”

Last week, BOOM saw this comment after an article concerning the United Kingdom. It was striking and appears to be genuine. BOOM does not know who wrote it as the author was clearly anonymous. But it rings true ……

Quote: “The UK is collapsing. When you live there you can see it in front of your eyes. There is no more community. There are no more jobs. Manufacturing has left. Pubs have closed. Nothing has taken their place. The UK hit a really important point. More than 50% of household income is now state handouts. Think about that. That is pure unsustainable death spiral cataclysmic stuff.

These people will vote for anyone keeping them on the hand outs. So the economy is destined to fail because the UK population want to sit at home, watch tv, drink beer and get their handouts. They are now a won’t work, don’t want to work culture. The regulatory environment has killed the UK. It's the silent killer of everything. Can't hire, can't fire, can't evict, can't do anything. It's a real shame because the UK used to be great pre 2000. Post 2000 the death spiral has never been more evident. It freaked me out so much I had to leave.”

If this description is a true estimate of the social and economic position of the United Kingdom, then crisis is not far off. BOOM is consistently critical of the political class in all western, advanced economies. They are Comfortably Numb. As a whole, they do not understand the basic true facts about their monetary system.

To dumb the message down, BOOM often uses the garden analogy. If you starve a garden of fresh new water, it will begin to stagnate and, eventually, it will die. This sentence can be translated to understand the importance of fresh new money creation in any economy.

If you starve an economy of fresh new money (cash or credit), it will begin to stagnate and, eventually, it will die.

NORWAY NOW ENCOURAGING THE USE OF CASH

For some time, Norway was “leading the way” towards a cashless society. This was seen as being ultra progressive, super trendy. Some Norwegians (and Swedes), usually young and gullible, even went to the extreme position of rejecting all cash transactions and having a small computerised chip put under the skin in their hand or wrist. They displayed themselves in videos waving their hands across a payment terminal to effect settlement of a transaction, usually proudly (and smugly) smiling to the camera. According to some reports, up to 6,000 people in Sweden have already been microchipped.

That was then. This is now.

The Government of Norway has recently decided to encourage cash transactions. Merchants who refuse to accept cash as settlement are now subject to severe fines.

From the 1st of May, shops that refuse to accept physical cash as payment risk massive fines, up to 4% of their revenue or up to $ 2.4 Million.

The reason for this is to ensure that the economy can still function in case of special situations, as we just saw happen in Spain with massive electrical blackouts or in storms or warfare (cyber or kinetic).

If all power is lost for a significant amount of time, an economy dependent upon electronic transaction settlements could grind to a complete halt.

Hungary has also gone against the cashless agenda. The Hungarian parliament recently passed a constitutional amendment. It ensures that paying with physical cash is a fundamental right. This means that Hungary cannot become a cashless society.

However, the EU has adopted new rules that will ban anonymous cash payments over € 10,000 which will take effect in 2027. Why? This is an infringement of human rights, plain and simple and a huge monetary mistake.

BOOM hopes that this is reversed soon. If the entire EU discourages cash settlement, then the economy will eventually suffer because physical cash is an essential element of the fresh new money supply and supply must always be increased upon increased demand from the populace. That demand supply dynamic is critical to the monetary system in the long run.

Let’s repeat the message. BOOM is consistently critical of the political class in all western, advanced economies. They are Comfortably Numb. As a whole, they do not understand the basic true facts about their monetary system.

However, thankfully, there is some hope erupting in Norway and Hungary.

ARGENTINA REVIEW – DON’T GO DOWN THIS ROAD – ECONOMIC DISASTER AWAITS – THE VULTURES CIRCLE

On 25th February 2024, BOOM stated --

Quote: “Today, BOOM is turning the spotlight onto the economies of Israel, Argentina, Japan and the United Kingdom. All four are showing signs of economic and societal breakdown which could easily accelerate into an unstoppable cascade of failure. If this were to happen, the consequences could rapidly become unimaginable for their comfortably numb populations. Poverty is a hard pathway to wisdom.”

Time to review the situation in Argentina, free of any propaganda concerning the new President Javier Milei. Remember, Milei is an academic economist, not someone who has previously created jobs or put his personal capital at risk. The term “head in the clouds” appears relevant here.

We must be sceptical of glowing media reports which paint a “remarkable” turnaround in the Argentina economy when over 50 % of the people are still living in poverty and children are presenting to school suffering from Scurvy.

Milei has reduced real public spending by 30% and dismissed 36,000 public employees since November 2023, according to the Wall Street Journal. This is aggressive policy, akin to grabbing the wheel of the Titanic and forcing it hard to turn. It might avoid the iceberg, it may not.

The stock market (the Merval Stock Index), which has been in a stupendous uptrend since 2022, now looks precarious and is in an established downtrend since January 1st 2025. There was some buyer support evident in April but this will be tested very soon. Any fall in the Merval index below 1.9 Million will be ominous and will puncture morale. If that happens, BOOM expects investors to bail out hard which will see the index possibly collapse. Without fresh equity capital, Argentinian companies cannot move forward towards profit and prosperity. Debt finance cannot help them because of the high risk premium and extra high interest rates attached.

Argentina’s central bank lowered its benchmark interest rate by 300bps to 29% on January 31, 2025. Sounds promising. However, that interest rate setting is still a staggering hurdle for corporations inside Argentina to pay for debt finance.

Without robust private corporations borrowing and confident home buyers borrowing, Argentina’s money supply will continue to shrink and cause major problems. Remember, fresh new money supply is like water for the economic garden. It is the Sine Qua Non of new economic activity. Propaganda supporting Milei’s radical economic management will not help. You cannot finance productive economic activity with propaganda. And it cannot be used as food or fuel. Without a critical mass of fresh new, domestic money creation (either as credit or as physical cash) put into circulation, an economy cannot recover. It is as simple as that. Such a plan is simply one of hopes and dreams.

BOOM advises readers to be wary of Milei propaganda which predicts a quick, bright economic turnaround for the moribund Argentinian economy. This massive, radical socialist economic mess was created over 100 years of steady and increasing adherence to the Marxist cult and will not be turned easily. Much of the Milei promoting propaganda comes from foreign vulture capitalists salivating over the prospect of buying cheap assets and resources. However, those assets and resources could become even cheaper over time, especially if the fundamentals of money supply are not understood. Therefore, the vultures will circle and wait while the people below will continue to suffer and descend into more and more poverty mixed with a steadily increasing crime rate.

This is all reminiscent of the situation in Russia after the fall of the massive socialist/pure communist monetary experiment known as the USSR. And in Chile under The Chicago Boys when Pinochet came to power. In both cases the western vulture capitalists were circling, waiting while the Chicago Boys prepared the feast.

The Chicago Boys were a group of Chilean economists prominent around the 1970s and 1980s, the majority of whom were educated at the Department of Economics of the University of Chicago under Larry Sjaastad, Milton Friedman, and Arnold Harberger, or at its affiliate in the economics department at the Pontifical Catholic University of Chile.

However, some of them earned degrees at Harvard University or MIT. They advocated widespread radical (and sudden) deregulation, privatisation, and other free market policies for closely controlled economies. The Chicago Boys first rose to prominence as leaders of the early reforms initiated in Chile during General Augusto Pinochet's dictatorship. Then, in 1990, they moved into Russia, after the collapse of the USSR. Jeffrey Sachs was a prominent member of the cult. He was part of the so-called Harvard Wunderkinder (the Harvard branch of the Chicago Boys).

The initial training program was the result of the "Chile Project" organised in the 1950s by the US State Department, through the Point Four program, the first US program for global economic development. It was funded by the Ford Foundation and the Rockefeller Foundation aimed at influencing Chilean economic thinking. The rest is history, including the terrible societal consequences that followed in the collapse of the USSR.

Switching from one incorrect, radical economic theory containing a very poor understanding of money and money supply management to another incorrect, radical economic theory combined with a very poor understanding of money and money supply management will simply result in poverty, chaos and crime, and especially so if it is introduced rapidly by an elite who have no connection to the suffering of the common people.

UNEMPLOYMENT – CONSUMER DEMAND -- EXPORTS

Unemployment in Argentina in the last quarter of 2024 rose to 6.4 % according to the National Institute of Statistics and Census (Indec), in a report released last Thursday. 72.5% of the unemployed have been jobless for less than a year, and 27.6% for more than a year. Nationwide, an estimated 1.47 million people are unemployed. That is 180,000 more than a year ago. BOOM expects that number to climb toward 2 million unemployed in the next 2 years.

The government is currently seeking another IMF loan to support some economic activity through budgetary spending. This is called the begging bowl strategy of economic management. But such government spending is ultimately unproductive in a situation where productive investment is almost impossible. It is life support and that is all it is.

Supermarket sales in Argentina have dropped by 8% while wholesale sales have plummeted by 22% under President Javier Milei, a report from the University of Buenos Aires showed last Tuesday. Industrial production also fell by about 5% in 2024, with textiles and basic metals hit hardest, though food and beverage production rose slightly.

Despite some economic growth in early 2025, mass consumption continues to decline, with a 5.4% year-on-year drop in March and an 8.6% fall in the first Quarter of 2025. Consumer demand cannot be created by propaganda or by magic words emanating from the Casa Rosada – the so-called “pink palace” of the President in Buenos Aires, cut off from the people by high steel fences and gates.

Argentine beef exports dropped significantly in the first quarter of 2025 compared to the first quarter of 2024, with a 28% decrease in volume (142,500 tons) and a 7.5% decrease in value (US$694.4 million). This is an awful result.

Argentina's trade surplus fell to US$ 323 million in March 2025 compared to US$ 2,160 million in the same month last year.

In early April, the US Secretary of Agriculture Brooke Rollins announced that they would no longer be buying meat from Argentina. With friends like that ….. who needs enemies?

BRICS ….. please, please can you buy some of our meat?

Argentina rejected a membership of the BRICS Group of nations as soon as Milei took the Presidency in November 2023. That is a fatal and foolish economic mistake.

NAZI BOMBSHELL -- NAZIS IN ARGENTINA – DYNAMITE REVELATIONS

Argentina has released a huge trove of declassified Nazi and dictatorship documents

Last week, the Argentine government’s National Archives made available a series of declassified documents, including information on Nazi criminals in Argentina. Secret and classified presidential decrees have also been published.

From the Buenos Aires Herald. Quote:

“Previously unseen documentation of Nazi criminals in Argentina have been released to the general public by the government. Presidential decrees that were also classified are now available for all to read.

On Monday evening of April 29, the National Archives (AGN) produced 1850 documents, organized into 7 files detailing various pieces of information of various prominent Nazi criminals who escaped to Argentina following World War II, including Adolf Eichmann, Erich Priebke and Josef Mengele.

Previously unseen Presidential decrees ranging from 1957 to 2005, including from dictatorship-era de facto governments, are also documented.

In March, the Herald reported that Argentina’s president Javier Milei had ordered for the documents to be declassified, following a request from U.S. Jewish human rights organization, the Simon Wiesenthal Center. Milei was given a letter from Charles Grassley, chairman of the U.S. Senate Judiciary Committee and a copy was also sent to President Donald Trump. The letter requested the Argentine president’s “assistance and support with the Committee’s ongoing investigation into previously undisclosed and unknown Nazi assets at Credit Suisse and its predecessor banks.”

Readers may be interested to see the progress of the Credit Suisse share price from 2007 onwards to its inevitable terminal phase in March 2023, when it was taken over by UBS under orders from the Swiss government and central bank. The bank was 167 years old.

An article on the demise of Credit Suisse published in the Financial Times on March 24th, 2023, referred to “accounts linked to Nazi Party Officials”.

However, returning to last week’s revelations in Argentina --

“The National Archives are operated by the Secretariat of the Interior who report to the government. Much of the information related to Nazi criminals released today had already been made available in 1992 under a presidential decree from then-President Carlos Menem, but was only available for viewing in a specially designated room on location at the AGN. Now, anyone around the world can review the documents digitally.

Likewise, the AGN also made available on its website the secret and confidential presidential decrees issued between 1957 and 2005. These nearly 1,300 documentary pieces address diverse topics, including the purchase and sale of weapons, budget modifications, the organization of the Argentine intelligence service, among others.

All of the AGN’s documents can be found in Spanish here.”

The Buenos Aires Times also added -- Quote: “They include records of banking operations, secret intelligence files and previously confidential Defence Ministry reports.”

And --- “Some of the most striking revelations concern Josef Mengele, the so-called "Angel of Death" who conducted cruel experiments on prisoners at the notorious Auschwitz-Birkenau concentration camp.

Intelligence records show that after arriving in Argentina in 1949, Mengele initially lived openly, using his real name. It was only later that he adopted a false identity, "Gregor Helmut" and claimed to be from the Italian region of Trent”.

These revelations reveal the awful truth. Nazi war criminals escaped after World War Two and lived freely in Argentina. But the bigger questions are these – “How many escaped Germany”, “Where else did they escape to?” and “Did they also escape to Chile? To Paraguay? To the USA? To the UK? To Australia? And, if they stayed in Germany, what roles did they play in post war Europe?

But the biggest question of all in modern history is this –

Did they continue to work with each other in a common global purpose and under a centralised command? And how did they support themselves? How were they funded?

The files confirm that a number of other Nazi fugitives also lived in Argentina with the knowledge of the authorities – among them, Adolf Eichmann, one of the main organisers of the Holocaust.

Eichmann, who oversaw the deportation of millions of people to concentration camps, settled in Lanús to the south of the capital, using the alias “Ricardo Klement.” He lived undisturbed with his family until 1960, when he was famously captured by Mossad agents.

Another prominent figure was Erich Priebke, a former SS officer responsible for the 1944 Ardeatine Caves massacre in Italy, a mass killing in which more than 300 people were killed.

Priebke arrived in Argentina in 1948 and lived for decades in Bariloche.

A (QUICK) DISASTROUS ECONOMIC HISTORY OF ARGENTINA

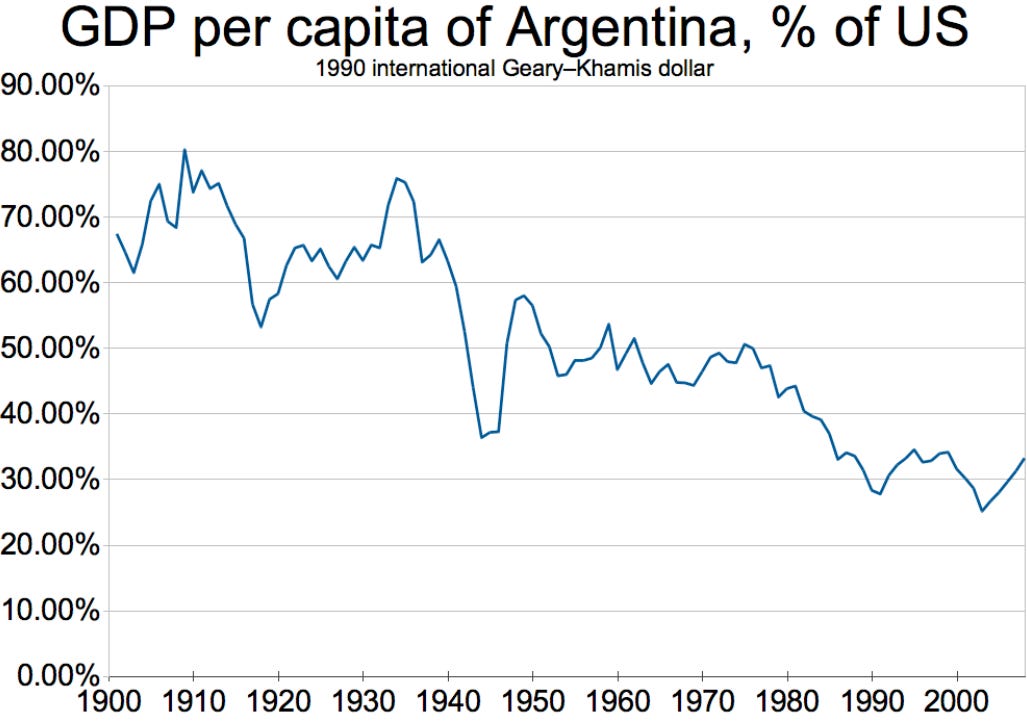

The economic history of Argentina is worthy of close study to see how a nation with such huge resources can be so badly managed. Since independence from Spain in 1816, the country has defaulted on its debt nine times. Inflation has often risen to the double digits, even as high as 5,000 %, resulting in several large currency devaluations. It has been an economic roller coaster ride.

During the first three decades of the 20th century, Argentina outgrew Canada and Australia in population, total income, and per capita income. By 1913, Argentina was among the world's top ten wealthiest states per capita. Beginning in the 1930s, the Argentine economy deteriorated notably during the great Global Depression/Financial crisis that began in the United States and spread globally. This trend has continued to present day, slowly but surely. Up until 1965, the nation was still performing reasonably well with solid GDP per capita. The rot really set in during the 1960’s and 1970’s.

A coup to overthrow the government occurred in June 1966, the so-called Argentine Revolution, which brought Juan Carlos Onganía to power. He introduced a very active role for the public sector in guiding the process of economic growth, calling for state control over the money supply, wages and prices, and control over bank credit to the private sector.

This was the straw that broke the camel’s back. Strict state control over the money supply and prices is effectively a Marxist monetary policy. CPI inflation came to town and stayed. A government, wherever it emerges, that does not understand money supply dynamics will always wreck havoc eventually.

Take note Donald Trump and Elon Musk (!).

Between 1975 and 1990, real per capita income fell by more than 20%, wiping out almost three decades of economic development. The extreme dependence on state support of the many protected industries exacerbated the sharp fall of industrial output. Productivity fell while CPI inflation accelerated sharply, reaching an average of more than 300% per year from 1975 to 1991, increasing prices 20 billion times.

In 1978 and 1979, the real exchange rate appreciated because inflation consistently outpaced the rate of depreciation. The overvaluation of the currency ultimately led to capital flight and a financial collapse. Growing government spending, large wage raises, and inefficient production created a chronic inflation that rose through the 1980s, when it briefly exceeded an annual rate of 1,000 %.

The Peronist, Carlos Menem, was elected president in May 1989. He immediately announced a new shock program, this time with reduced government spending. The rationale for this was a “huge” government deficit of 16% of GDP. (Please refer to last week’s editorial on mis-understandings about government debt).

In November 1989, agreement was reached on yet another support from the IMF, but again the arrangement ended prematurely, followed by another bout of hyper-inflation, which reached 12,000 % per year. Yes – 12,000 % per annum.

After the collapse of public enterprises during the late 1980s, privatisation became popular. Menem privatised almost everything the state owned, except for a couple of banks. But the decline in productivity continued.

Switching from one incorrect, radical economic theory containing a very poor understanding of money and money supply management to another incorrect, radical economic theory combined with a very poor understanding of money and money supply management will simply result in poverty, chaos and crime, and especially so if it is introduced rapidly by an elite who have no connection to the suffering of the common people.

On 1 January 1992, the government replaced the currency (the Austral) with the Peso at a rate of 10,000 Australs for 1 Peso. That is shock therapy writ large. The peso was fixed by law at par to the US Dollar, and the money supply was restricted to the level of hard-currency reserves. (Strangle the water supply to a garden and watch what happens). This was a risky policy which meant at a later stage Argentina could not devalue. That is akin to potential economic suicide for a nation exporting agricultural commodities.

CURRENCY COLLAPSE (cf US Dollar) FROM 1935 – 2005

Argentina fell into a deep recession in the second half of 1998, triggered and then compounded by a series of adverse external shocks, which included low prices for agricultural commodities, the appreciation of the US dollar, to which the Peso was pegged at par, the 1998 Russian financial crisis, the LTCM crisis and the devaluation of the Brazilian currency, the Real in January 1999.

ARGENTINE PESO 10 YEARS

The people lost faith in their banks. In December 2001, a series of deposit runs began to destabilise the banking system, leading the Argentine authorities to impose a partial withdrawal freeze. (More suicide). At the end of December, in a climate of severe political and social unrest, the country partially defaulted on its international obligations. In January 2002, it formally abandoned the currency convertibility regime (after ten years of madness).

The ensuing economic and political crisis was arguably the worst since the country's independence. By the end of 2002, the economy had contracted by 20% since 1998. Over the course of two years, output fell by more than 15%, the Argentine peso lost three-quarters of its value, and registered unemployment exceeded 25%. Income poverty in Argentina grew from 16.8% in October 1993, to an already high 25.9% in October 1998 (at the beginning of the recession), to 35.4% in October 2001, to a peak of 54.3% in October 2002.

In 2005, an attempt by the Kirchner administration to impose price controls failed, as many items went out of stock and the mandatory prices were often ignored. Various sectors of the economy were re-nationalised (let’s do what we did before that didn’t work), including the postal service (2003), the San Martín Railway line (2004), the water utility serving the Province of Buenos Aires (2006) and the airline, Aerolíneas Argentinas (2009).

In October 2008, President Fernández de Kirchner nationalised private pension funds worth almost $30 Billion, ostensibly to protect the pensions against falling stock prices around the world, although critics said the government simply wanted to add the money to its budget.

(This policy is called “stealing from the people”).

Rising inflation and capital flight caused a rapid depletion of the country's US dollar reserves, prompting the government to severely curtail access to US dollars in June 2012.

On 10 December 2023, Javier Milei, a right-wing libertarian, was sworn in as President. During the electoral campaign, inflation was at over 100 percent. At the time of Milei's inauguration, Argentina’s economy was suffering 143 percent annual inflation, the currency had plunged and four out of 10 Argentines were in poverty.

In January 2024, a study by the Catholic University of Argentina estimated that the country's poverty rate had reached 57.4%, the highest since 2004.

The saga continues. If Javier Milei wants to halt the slide, he can call BOOM.

ARGENTINA GDP PER CAPITA — 1900 - 2005

Argentina's GDP per capita (in 1990 international Geary–Khamis dollars) as a percentage of the US's, 1900–2008

==============================================================

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.

Off topic ...

I made comment under one of BOOM's previous posts, which was followed by a discussion about energy, including peak oil and other issues.

Here's a link to a very interesting presentation by a guy who obviously knows what he's talking about. Highly recommended. Apparently, rather an infinite oil, the Earth has virtually unlimited source of geothermal energy that is relatively easy to tap into, pretty much anywhere on the planet. Likewise, hydrogen can - contrary to widespread theories - be easily used as an energy carrier, in pretty much completely ecological manner. Electricity is a cul-de-sac, at least as far as mobile applications (batteries are too heavy).

https://www.youtube.com/watch?v=LZk8T1Q26M0