BOOM Finance and Economics 13th October 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

MORE GOOD NEWS ON MONEY — NORWAY DEFENDS THE USE OF CASH

US DOLLAR STRENGTH OBVIOUS (AGAINST KRONE)

UNITED NATIONS PACT FOR THE FUTURE – ACTION 17 REFERS TO “OUR STATE” — WHICH STATE?

THE FUTURE PREPARED BY GERMANY AND NAMIBIA?

TESLA SHARES FALL ALMOST 13 % OVER THE WEEK

TESLA AND BYD COMPARED

THE DREAM CAR?

MORE GOOD NEWS ON MONEY

NORWAY DEFENDS THE USE OF CASH

This week, BOOM can report more good news on money. Norway has taken a stand on physical cash and, from 1st October, merchants there must accept physical cash if a customer wishes to pay with it. This applies to all transactions below 20,000 Swedish Krone which is currently equivalent to about US$ 1,800.

Increasing numbers of shops, restaurants, cinemas and other retailers in Norway have increasingly refused to accept cash over the last few years. However, that’s actually a violation of Norwegian law covering financial transactions.

Automated teller machines (ATMs or minibanks as they’re called in Norwegian) have also been in decline. And recently, in Oslo, the machines have imposed a fee for service of 10 Krone per transaction. Bank branches have also become reluctant to offer physical cash withdrawals for customers.

The Norwegian government has acted to stop this trend away from the acceptance of physical cash. There are some exceptions including medical practices and public transport. Justice Minister Emilie Enger Mehl recently said that cash remains important in the event of cyber attacks, massive power failures or other breakdowns in electronic payment systems. Norway’s guidelines for national preparedness urge Norwegians to have cash on hand in various denominations, to pay for essential items if or when electronic pay terminals break down.

“Relying entirely on digital payment systems increases vulnerability, and in some situations can harm important public functions,” said Mehl. “If no one pays with cash and no one accepts cash, our cash will no longer be part of preparedness in a crisis.”

Research has shown that 10 % of Norway’s citizens do not use electronic payment solutions deliberately. With the World Economic Forum and some deluded central banks have pushed for a cashless agenda, Norway is going the opposite way. It is important to have cash. Because in a cashless society, it would be very easy for a tyrannical government to control who can buy and sell, monitoring every transaction.

Two weeks ago, BOOM wrote about the Bank of Canada (the central bank) abandoning its plan to launch a CBDC – a Central Bank Digital Currency. This was an excellent decision as BOOM is of the firm opinion that CBDC’s are an intellectually bankrupt idea. Electronic cash sounds like a “good idea” but that view overlooks the many advantages of having a strong circulation of physical cash acting as a natural buffer to money created as credit.

BOOM looks forward to all central banks abandoning all research or plans for CBDC’s.

Readers who missed BOOM’s editorial on that subject can go to the BOOM Substack archives and find the BOOM edition dated 29th September 2024. In that article, BOOM explains two very important subjects.

What is good about Physical Cash?

And ….. What is bad about CBDC’s?

Sept 29th Edition:

https://boomfinanceandeconomics.substack.com/p/boom-finance-and-economics-29th-september

US DOLLAR STRENGTH OBVIOUS

Note that, over the last 10 years, the Norwegian Krone has depreciated by around 38.7 % against the strong US Dollar. Commentators who say “the US Dollar is collapsing” or “is going to collapse” should study the chart which shows the steady decline of the Krone.

NORWAY KRONE OVER 10 YEARS – Source: XE.com Currency Converter

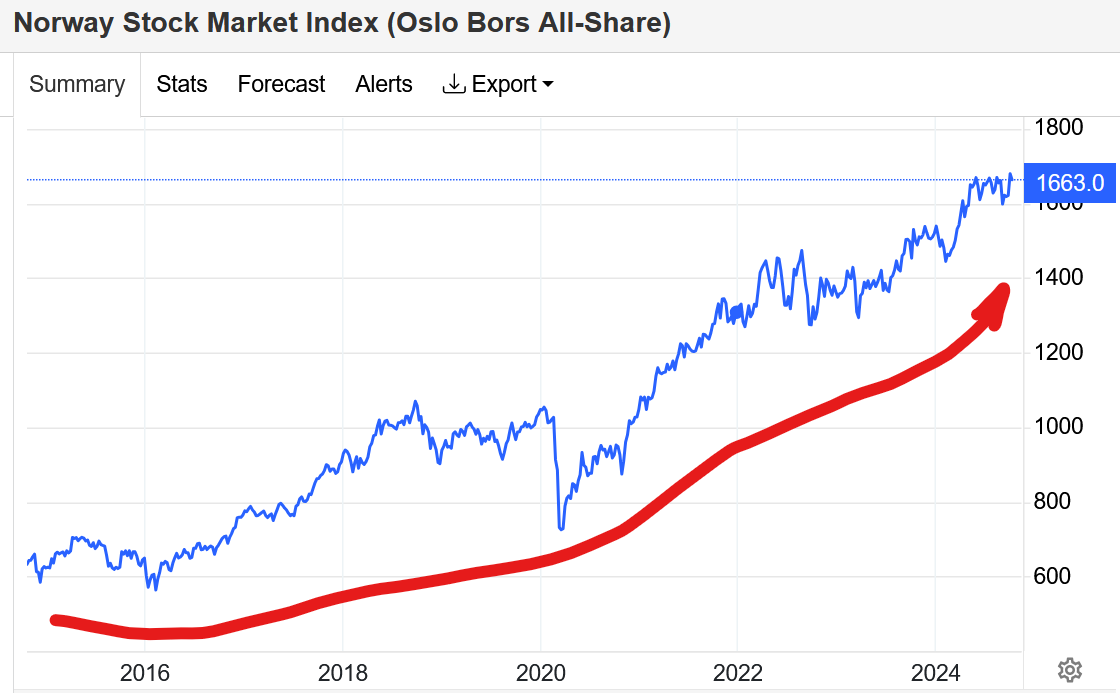

While this has happened, Norway’s stock market index, the Oslo Bors, has appreciated from around 600 to 1660. Domestic stock investors have been well rewarded. Many foreign investors, especially US based, have not done so well especially if they sold out and repatriated their funds back to their home currency.

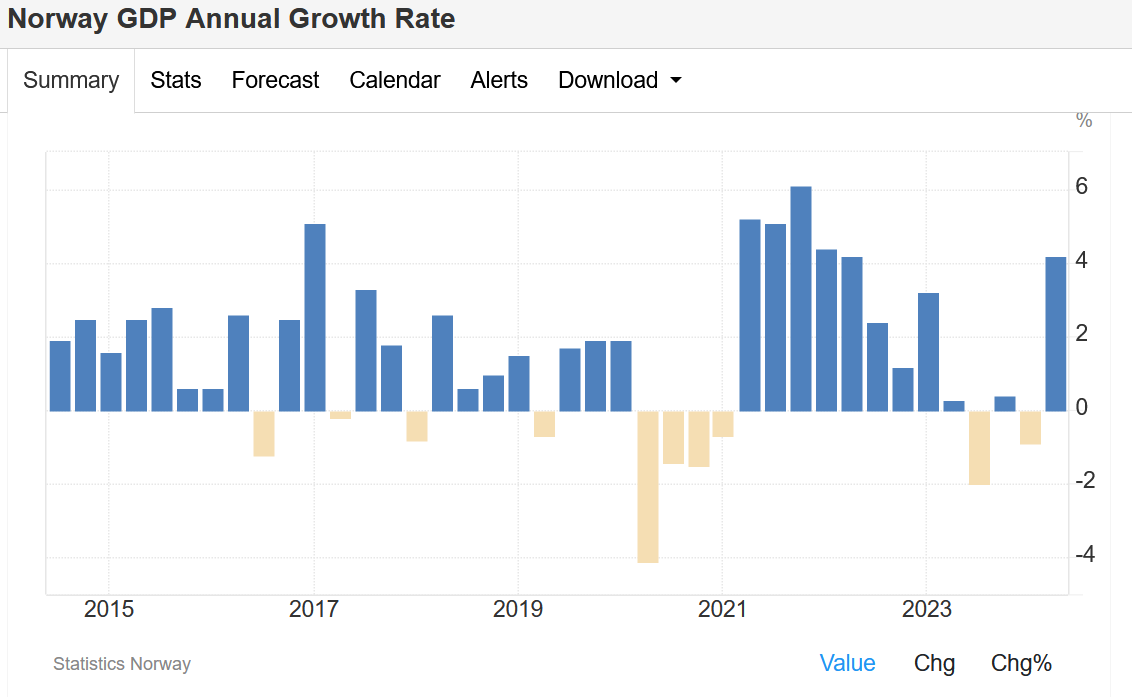

Norway’s GDP has averaged around 2 - 3 % annual growth in that 10 year period.

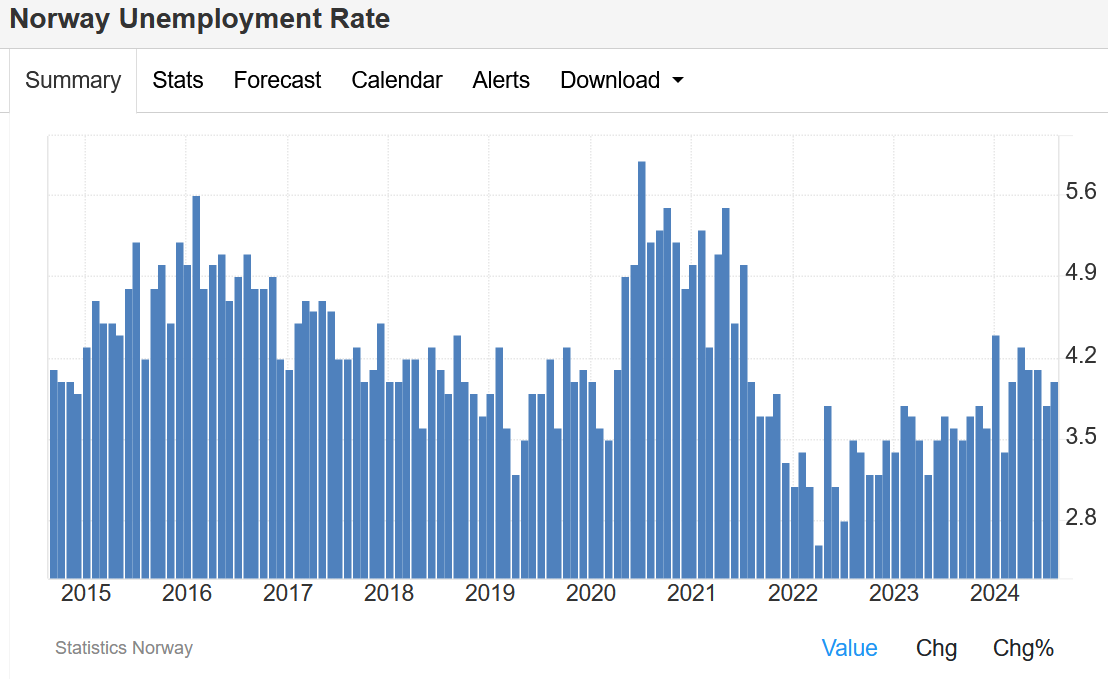

The average unemployment rate has been stable – around 4 % -- and has fallen since the Covid Panic of 2020.

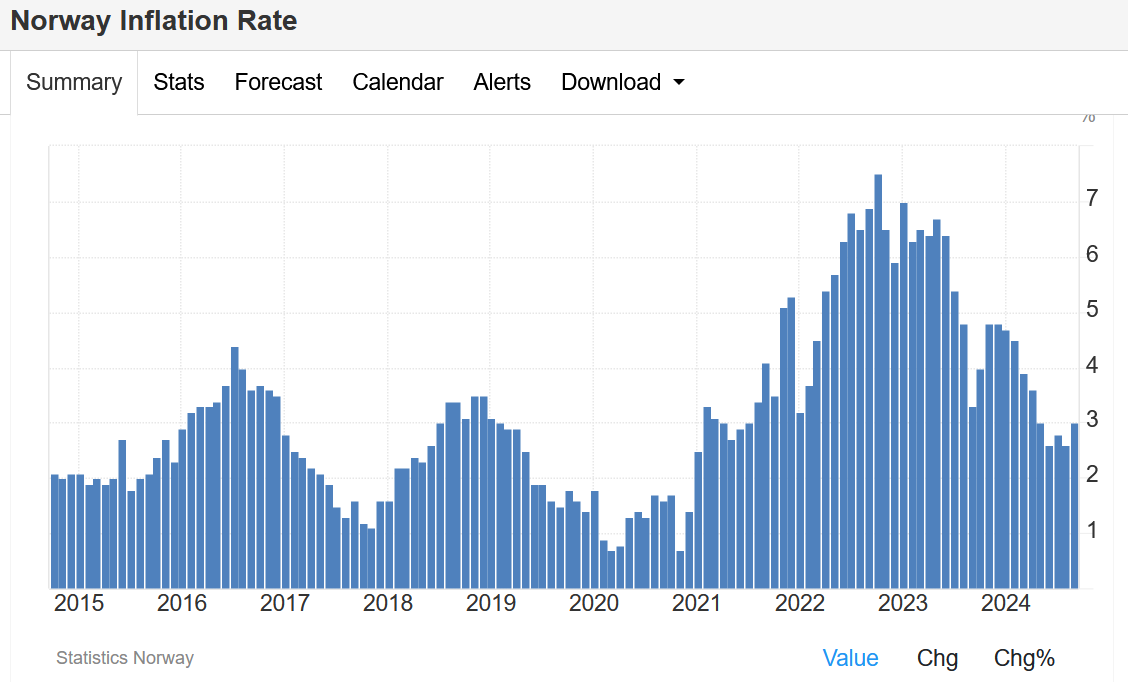

Its CPI inflation rate has averaged around 3 % and has fallen back towards more normal levels since the peak of Covid induced inflation occurred in 2022.

Norway has had a positive trade balance for the last 10 years except during the Covid Panic in 2020 when it ran a very small trade deficit. Its government has had a Budget surplus for almost all of that time (again, except during the Covid Panic when a small budget deficit was registered).

Oil and gas investments will rise to a record high in 2024. Norway is the top hydrocarbon producer in Western Europe. Norway expects its oil production to rise by 5.2% next year from 2024, while natural gas production is set to slightly drop by 1.6%, according to government estimates. Johan Castberg, a large field in the Barents Sea, has estimated recoverable volumes of between 450 and 650 million barrels. The field will produce for 30 years, and at its peak, Johan Castberg may produce 220,000 barrels per day. The Norwegian government expects oil and gas production to remain relatively stable until 2030.

Total investments in oil and gas activity in 2024, including pipeline transportation, are estimated at an all-time high of $24 billion (257 billion Norwegian crowns), Statistics Norway said on Thursday in its third-quarter survey of oil companies’ investment plans.

Norway’s corporate tax rate currently stands at 22 % and has been set at that level for the last 6 years.

BOOM would struggle to find a more stable economy on Earth. If the local currency were to start appreciating against the US Dollar, then Norway will become a very attractive place for global investors. Investors would rush into Norwegian bonds and stocks in such a scenario. BOOM is expecting lower interest rates globally. So strength in the Krone is certainly worth watching for closely.

UNITED NATIONS PACT FOR THE FUTURE – ACTION 17 REFERS TO “OUR STATE”

Last week, BOOM presented a comprehensive review of the UN’s Pact for the Future. The document asserts that nations “will end hunger and eliminate food security”, “address global financing and investment gaps, commit to a fair multilateral trading system, achieve gender equality, protect the environment and the climate, and protect people affected by humanitarian emergencies”. But it is silent on how the UN and its members will do this. The “how” of the plan is missing.

THE FUTURE PREPARED BY GERMANY AND NAMIBIA?

Some key facts were also missing in BOOM’s assessment that readers should pay attention to. The Pact was prepared by two member States of the UN – Germany and Namibia. Namibia has a population of only 3 million people and the size of its economy as measured by GDP expressed in US Dollars is a small number indeed in global terms, only US$ 12 Billion. By comparison, Germany’s population is 85 million and its GDP expressed in US Dollars is $ 4,456 Billion. BOOM suspects that Namibia did not have much say in the matter and was only there as a means to disguise the fact that The Pact for the Future is actually a German view of the future of the United Nations.

For those who don’t know, Namibia was a colony of Germany in the 19th century. Namibia became a German colony in 1884 and was known as German South West Africa (Deutsch-Südwestafrika).

From 1904 to 1907, the Herero and the Namaqua took up arms against the ruthless German settlers. In a calculated punitive action by the German government officials, ordered the extinction of the natives in what has been called the "first genocide of the 20th century", the Germans systematically killed 10,000 Nama (half the population) and approximately 65,000 Herero (about 80% of the population).

World War 1 and World War 2 followed and, for obvious reasons, Germany was not appointed to the Security Council of the United Nations when it was formed after the cessation of World War Two. The Pact for the Future appears to be an attempt to destroy the Security Council and its power of Veto. BOOM also sees the Pact for the Future as essentially an attempt to re-write the Charter of the United Nations (established, Post World War 2, in October 1945) by blatantly “transforming global governance”.

There are 56 “Actions” included in the Pact. They are full of good intentions and platitudes. For example, here is Action Number 56 -- “We will strengthen international cooperation for the exploration and use of outer space for peaceful purposes and for the benefit of all humanity”.

But the Action of most interest to BOOM was Action 17 which appeared to reveal the intentions of the Authors a little too well -- “We will fulfil our obligation to comply with the decisions and uphold the mandate of the International Court of Justice in any case to which our State is a party.”

“Our State”? -- The wording here seems to indicate that the Pact for the Future is actually being prepared for a single member State of the UN – are the authors referring to Our State of Germany?

Russia’s Deputy Foreign Minister Sergey Vershinin had something to say about this. He said that those who coordinated the text over many months – Germany and Namibia – only included “what was dictated to them mainly by Western countries and ignored Russia’s repeated requests for intergovernmental negotiations on the text. He described this approach as “despotism”. BOOM can guess that Namibia was not the senior party, the despot, in the drafting of the document.

Seven nations voted against the Motion to put the Resolution to the meeting of the General Assembly. They were Argentina, Belarus, Iran, Nicaragua, North Korea, Russia and Syria. 15 nations abstained from voting including -- Afghanistan, Azerbaijan, Brunei, Burkina Faso, the Central African Republic, Chad, Equatorial Guinea, Eritrea, Eswatini, and Kyrgyzstan. The motion recorded a vote of 143 in favour to 7 against.

However, acceptance of the Resolution itself was not put to an open vote. It was “adopted by consensus”. That is a telling fact.

On Twitter, the First Deputy Permanent Representative of Russia to the UN, Dmitry Polyanskiy, had this to say – note that he referred to the Pact of the Future and not the Pact for the Future.

Quote: “Unfortunately there is nothing to celebrate with the adoption of the Pact of the Future by the UN today. The UN trampled on its own principles to please a group of delegations from the “beautiful garden” that usurped negotiations from the outset. And the majority from the “jungle” like a herd simply didn’t have the guts to protest and stand for their rights. And it will be the one which will bear the consequences. As a result there was no inclusive negotiation process in normal meaning of this term. The new PGA tried to save the situation but it was too late. The pact is unbalanced and contains very dangerous provisions which will backfire and undermine multilateralism and intergovernmental nature of the UN upheld by the UN Charter. It’s a huge blow to the organisation as a whole.”

Argentina was not happy with what had transpired either. In a fiery speech, their Foreign Minister Diana Mondino declared the Milei administration was not in favor of the UN’s “Pact for the Future” and would not support it. “Many points in this pact go against or would hold back Argentina’s new agenda,” said the nation’s top diplomat, complaining that Buenos Aires’ criticisms had not been taken into account.

Argentina’s Religion & Civilisation Secretary Nahuel Sotelo was also critical.

"Argentina announces its dissociation from the Pact of the Future. In the new Argentina, there is no place for totalitarian international agendas," he declared in a post on social media.

“Argentina wants to have wings for its development, without being subjected to the undue weight of decisions alien to our goals. Argentina will be a Beacon of Freedom”.

There are two Annexures at the end of the document. BOOM will deal with those on a later date.

Annex 1 -- Global Digital Compact

Annex 2 -- Annex II Declaration on Future Generations

TESLA SHARES FAIL TO MOVE ABOVE US $270 AND FALL ALMOST 13 % OVER THE WEEK

BOOM watched Elon Musk being interviewed by Tucker Carlson during the week. It was worth watching. Musk was candid and relaxed and showed considerable humanity. However, BOOM suspects that some of his comments may have damaged Tesla’s prospects because Musk seemed to infer that the company’s future was potentially fragile. In reference to Trump’s prospects in the coming US Presidential election, he said “"If he loses, I'm fucked." This was not something that Tesla shareholders would have enjoyed hearing.

TESLA ROBOTAXI — a sports car or a taxi?

Musk presented Tesla’s self driving “Robotaxi” on Thursday at the Warner Brothers studios in Hollywood. However, the show did not impress investors. One comment made by an analyst from Wells Fargo unkindly likened the show to a “slow and short amusement park ride”.

Tesla shares subsequently fell sharply on Friday and ended down almost 13% for the week at the close on Friday. They closed at $ 218. This was a poor performance. The long term downtrend from late 2021 was confirmed by this fall and readers must remember that the downtrend began at above $ 400 per share. Three years have passed since then and the shares have lost almost 50 % of their price. If the downtrend continues to gather pace from here, it is easy to imagine the price falling towards $ 170 and then $ 100.

BOOM has been heavily critical of the Electric Car industry in Western, advanced economies in the past and his views have not changed. Long term buyer resistance and a lack of sufficient recurring net profits are the key problems. But, more importantly, this industry is in deep trouble in regard to attracting future risk capital. That does not augur well for any of the specialist EV companies participating in the Western, capitalist economies. China’s industry is another story altogether with a huge domestic market and a centrally commanded economy.

Tesla will be posting its financial results for the third quarter of 2024 after market close on Wednesday, October 23, 2024. That is just 10 days away and will be the next big challenge for the Tesla stock price.

Let’s compare Tesla share performance and financial performance to that of BYD, the rapidly rising Chinese EV company.

Stock Prices over the last 3 years —

TESLA (Nasdaq Stock Code: TSLA)

BYD (OTC Mkt Stock Code: BYDDF)

BYD’s Financial Performance over the last 12 months has been very good indeed and especially when compared to Tesla. Both companies have roughly equal revenues of approximately US $ 25 Billion.

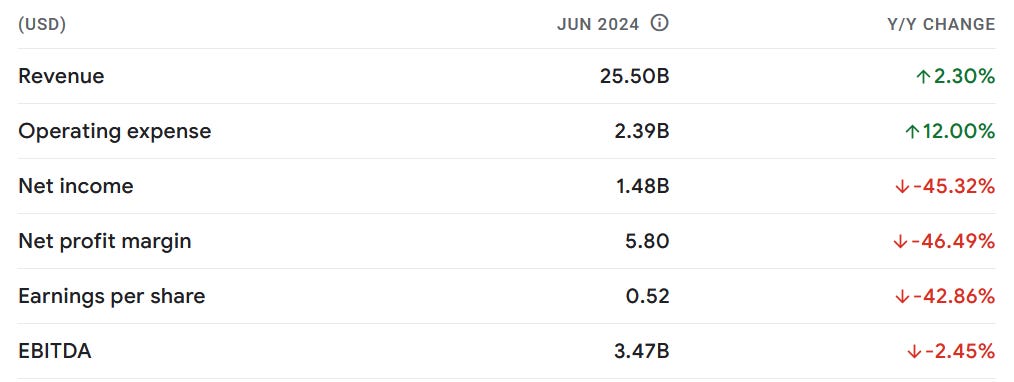

BYD FINANCIALS (taken from Google Finance) – Qtr 2 – 2024 plus YoY Change

Expressed as Chinese Yuan

TESLA FINANCIALS (taken from Google Finance) – Qtr 2 – 2024 plus YoY Change

Expressed as US Dollars

BOOM has compared these two EV companies on a number of occasions previously. Each time, it seems that BYD is on the ascendance.

Tesla’s Market Capitalisation is currently US $ 682 Billion.

BYD’s current Market Capitalisation is currently US$ 118 Billion.

Meanwhile, the legacy car companies appear to be relatively very much undervalued.

Volkswagen Market Capitalisation is US $ 55 Billion

Ford Market Capitalisation is US $ 42 Billion

General Motors Market Capitalisation is US $ 53 Billion

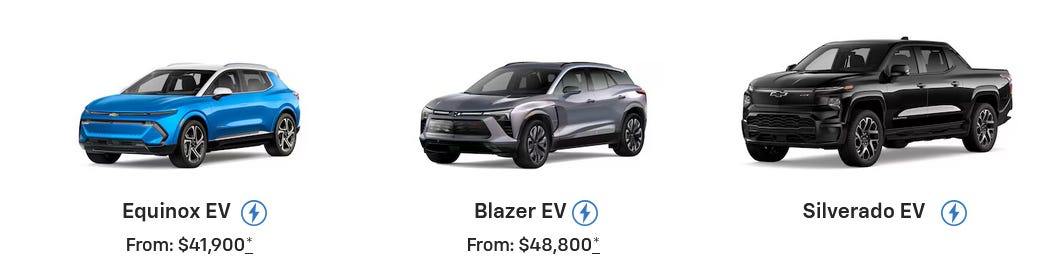

During the week, General Motors announced that nearly 10 percent of their light vehicle sales in the United States were electric vehicles during the second quarter (Q2) of 2024.

THE GM RANGE OF EV CARS

So – of these major car companies, which is the best value at present? Can Tesla’s valuation of US $ 682 Billion be justified?

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady