BOOM Finance and Economics 15th September 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

CHINA’S FUTURE — IS COMMUNISM ALWAYS COMMUNISM?

IS CAPITALISM ALWAYS CAPITALISM?FROM A SOCIALIST/CAPITALIST ECONOMY TO A CAPITALIST/SOCIALIST ECONOMY WITH FREE MARKETS, THE FREE MOVEMENT OF CAPITAL, THE RULE OF LAW AND DEMOCRACY

MEANWHILE IN THE WEST — FASCISM COMETH

ISLAMIC ALLIANCE TO FORM AGAINST ISRAEL?

COVID VACCINE COMPANY SHARES CRASH 15 %

SHANGHAI AND HONG KONG MARKETS CONTINUE TO DIVERGE

CHINA’S FUTURE

IS COMMUNISM ALWAYS COMMUNISM?

IS CAPITALISM ALWAYS CAPITALISM?

CAN THEY CHANGE? DO THEY CHANGE? …. YES THEY CAN AND DO

At the outset of this discussion, BOOM would like to make it clear that tyranny, totalitarianism and corruption are not acceptable in any form of government.

BOOM sees democracy based upon elections as a fragile but important concept which needs constant review and perhaps can be balanced by the introduction of sortition (selection by lottery) in some levels of government. Selections for national leadership positions by some arbitrary method are never to be tolerated. All dreams of an economic or social utopia on Earth are unacceptable.

BOOM is in favour of private property, a geographically distributed commercial/retail banking system (part shareholder owned, part state owned), a fully state owned yet independent central bank to manage that distributed banking system and to manage monetary policy. In essence, BOOM supports the concept of a capitalist economic system balanced by enough physical cash in circulation and enough state management to avoid rampant speculative forces driven by the all-too-familiar excessive availability and creation of credit for those who are more able to offer collateral assets as security.

Adam Smith is often called “the Father of Capitalism”. Smith died in 1790. He was a Scottish economist and philosopher who was a pioneer in conceptual thinking of political economy. Seen by some as "The Father of Economics" or "The Father of Capitalism" he wrote two classic works, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776). The latter, often abbreviated as The Wealth of Nations, is considered his magnum opus and the first modern work that treats economics as a comprehensive system and as an academic discipline. It is often regarded as the inspiration for what we now call “Capitalism”.

Charles Fourier is similarly often called “the Father of Utopian Socialism”. He was a Frenchman who died in 1837, forty seven years after Smith. Fourier directly inspired a diverse array of revolutionary thinkers and writers which included (1) the famous American Horace Greeley, (2) Karl Marx (an employee of Greeley for 10 years – his “European correspondent” in London) and his collaborator Friedrich Engels, (3) the parents of Hjalmar Schacht (Hitler’s famous central banker) and also (4) the two founders of the Utopian Socialist commune of Mikveh Israel in Palestine in 1870 — Charles Netter and Baron Edmond James de Rothschild.

Fourier was inspired in all of this by Thomas More, Henry the Eighth’s Lord High Chancellor and author of a little book called “Utopia” – a story of a fictional island where parents surrendered their children to the state and where they owned nothing and were, presumably, happy.

Readers may be surprised to learn that “You will own nothing and you will be happy” was not a term invented by Klaus Schwab, the founder of the World Economic Forum. It came from Thomas More in the 16th century, over 500 years ago.

By the way, Hitler’s innovative central banker, Hjalmar Schach, had interesting middle names. His real name was Hjalmar Horace Greeley Schacht. While living in America, his German parents had become dedicated followers of Utopian Socialism as espoused by Horace Greeley. And remember, Hitler’s political party was called The National Socialist German Workers’ Party.

Leaving behind the history of economic thought, the fact remains that many people are confused about both Capitalism and Communism. They think that Capitalism is always and forever the exact same phenomenon. They presume that it must always be dogmatic, always based upon Adam Smith, rigid, never changing and rigidly enforced. But that is not necessarily the case. Most (if not all) “capitalist” nations run large social welfare programs including support for the unemployed, the disabled, the sick and the elderly. In other words, they have adopted many socialist ideas. It is better to call them Capitalist/Socialist economies.

Even the so-called “bastion of capitalism”, the United States, is currently spending 22% of Government Expenditure on Social Welfare, 16 % on Medicare, 13 % on Health, 10 % on Income Security, 5 % on Veterans Benefits and Services plus 1 % on Community Development. That amounts to 67 % of their government spending. Another 13.3 % is spent on Defence and almost the same on interest payments to cover the US Govt Bond issuance (the “National Debt”). The sum total of all that is roughly equal to 95 % of the budget.

By the way, in 2023, the US government paid $ 658 Billion on Net Interest to cover the National Bond Issuance of US$ 33.88 Trillion. This is an interest cost of around 2 %. However, bear in mind that $ 7 Trillion of the Total Debt is “Intra-Governmental Debt” (owed to itself).

So the US is not about to “go bankrupt”. It can easily cover the interest payments due to US Treasury investors. It is not “insolvent”. And there is no “National Sovereign Debt Crisis”.

You can see these numbers calculated every day for yourself at the US Treasury website called “Debt to the Penny”.

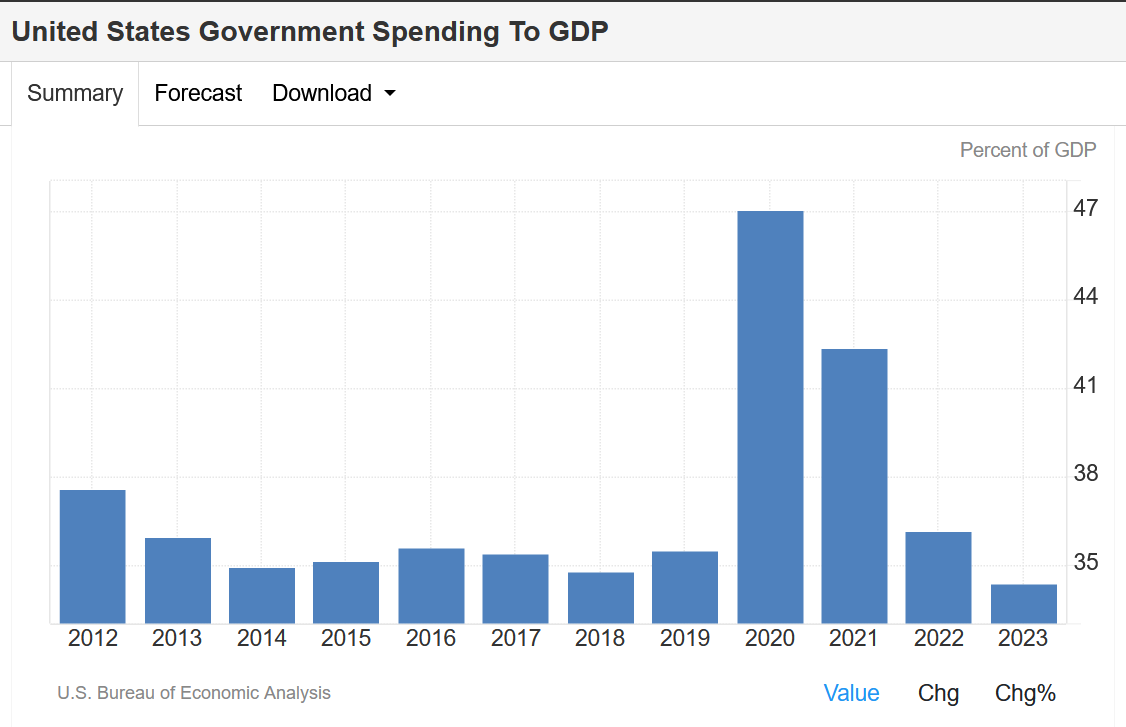

Total Government spending in the United States measured as a percentage of GDP was last recorded at 34.4 percent of GDP in 2023. The all time high of 47 % occurred, believe it or not, in 2020 during Donald Trump’s Presidency – according to the US Bureau of Economic Analysis.

US GOVT SPENDING TO GDP

Many people are also confused about Communism. They think that Communism is always the exact same phenomenon. They presume that it must always be dogmatic, always Marxist, rigid, never changing and rigidly enforced. But that is not necessarily the case. Indeed, the largest avowedly communist nation on Earth, China, has a strong capitalist system operating in the real economy where goods and services are produced for export and domestic consumption. So, we could call China a Socialist/Capitalist economy.

BOOM can summarise all of this —

China is a Socialist/Capitalist economy

The USA is a Capitalist/Socialist economy

Confused yet? Let’s look more closely at China’s particular form of communism.

China appears to have abandoned strict Marxist dogma. And they have (reportedly) decided NOT to adopt Charles Fourier’s Utopian Socialism, seeing it as the work of dreamers rather than of practical men and women.

If you want to learn what the leadership of modern China aspires to for the nation, you can read the 44 page document titled --

Resolution of the Central Committee of the Communist Party of China on Further Deepening Reform Comprehensively to Advance Chinese Modernization

(Adopted at the third plenary session of the 20th Central Committee of the Communist Party of China on July 18, 2024)

Or, you can just read BOOM’s summary of the key points here —

At the very start, the Resolution of the Central Committee refers to the “First Centenary Goal of building a moderately prosperous society in all respects and set China on a new journey toward building a modern socialist country in all respects.”

The term “Modernization” is emphasised in the document. In fact, it appears numerous times on almost every page.

“The present and the near future constitute a critical period for our endeavor to build a great country and move toward national rejuvenation on all fronts through Chinese modernization. As Chinese modernization has been advanced continuously through reform and opening up, it will surely embrace broader horizons through further reform and opening up.”

Socialism with Chinese Characteristics

They frequently refer to the system of socialism with Chinese characteristics.

“Advancing reform is essential for upholding and improving the system of socialism with Chinese characteristics and modernizing China’s system and capacity for governance, for putting the new development philosophy into practice and better adapting to the evolution in the principal contradiction in Chinese society, and for adhering to a people-centered approach to see that the gains of modernization benefit all our people fairly.”

This appears to be a bold, clear statement of intent to veer away from strict Marxism. But then they refer to “making our our Marxist party stronger”. BOOM thinks that is Politi-speak or Doublespeak — language that deliberately obscures, disguises, distorts, or reverses the meaning of words. It is primarily meant to make the truth sound more palatable.

In the section titled “Guiding Philosophy”, they say -- “We must stay committed to Marxism-Leninism, Mao Zedong Thought, Deng Xiaoping Theory, the Theory of Three Represents, and the Scientific Outlook on Development and fully implement Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era.”

More Doublespeak?

Having dispensed with the past, they quickly move on to the future.

Under the Title Overall Objectives, they introduce the term a “socialist market economy” which they hope to achieve by 2035 --

“We will continue to improve and develop the system of socialism with Chinese characteristics and modernize China’s system and capacity for governance. By 2035, we will have finished building a high-standard socialist market economy in all respects, further improved the system of socialism with Chinese characteristics, generally modernized our system and capacity for governance, and basically realized socialist modernization.”

Did you notice the words “modernization”, “modernize”, “market economy”, “with Chinese characteristics”?

They broaden the argument further here -- “Building a high-standard socialist market economy. We will see that the market plays the decisive role in resource allocation and that the government better fulfils its role.”

Is that a plan to free up markets? And to get the government to stick to “fulfilling its (separate) role”?

Then, surprise, surprise. They plan to be democratic and lawful.

Advancing whole-process people’s democracy -- “We will uphold the unity between leadership by the Party, the running of the country by the people, and law-based governance. We will improve the institutions through which the people run the country, promote extensive, multilevel, and institutionalized development of consultative democracy, and refine the system of socialist rule of law with Chinese characteristics.”

Improving the people’s quality of life -- “We will refine the income distribution, employment, and social security systems, make basic public services more balanced and accessible, and facilitate more notable, substantive progress in promoting people’s well-rounded development and common prosperity for all.”

Adhering to a people-centered approach -- “We must respect the principal position and pioneering spirit of the people and make our reform measures highly responsive to the call of the people, so as to ensure that reform is for the people and by the people”.

Then they clearly state the intention to grow the private sector of their economy.

“We will continue to implement principles and policies that help foster a favorable environment and create more opportunities for the development of the non-public sector. We will formulate a private sector promotion law.”

To encourage better access to credit for SMEs.

“We will move faster to set up a system for comprehensively evaluating private enterprises’ credit status and refine the credit enhancement system for small and medium private enterprises.”

To promote Entrepreneurship.

“We will refine the modern corporate system with distinctive Chinese features and promote entrepreneurial spirit.”

To improve property rights to all forms of ownership.

“We will improve the property rights system to ensure law-based, equitable protection of the property rights of economic entities under all forms of ownership on a long-term basis and establish an efficient system for the comprehensive management of intellectual property rights.”

And to bolster the laws surrounding property rights.

“We will work to bolster law enforcement and justice administration to protect property rights”

They will improve the system of dealing with bankruptcies.

“We will refine the enterprise bankruptcy mechanism, explore the establishment of a bankruptcy system for individual persons, move ahead with integrated reforms concerning the deregistration of enterprises, and improve the market exit system. We will also improve the social credit system and related oversight institutions.”

Deepening reform of the financial system — improving financial quality and encouraging equity financing.

“We will move faster to improve the central bank system and the monetary policy transmission mechanism. We will actively develop technology finance, green finance, inclusive finance, pension finance, and digital finance and work to ensure quality financial services for major strategies, key fields, and weak links. We will refine the role and governance of financial institutions and the incentive and constraint mechanisms for ensuring that they serve the real economy. We will diversify equity financing, step up the development of multilevel bond markets, and increase the proportion of direct financing.”

They will encourage foreign investment into China.

This statement is tantamount to adopting a full capitalist financial system open to the world.

“We will facilitate the entry of long-term capital into the market. We will improve the overall quality of listed companies, strengthen relevant regulation and delisting systems, and establish long-term mechanisms to enhance the underlying stability of the capital market. We will improve the mechanisms for regulating and constraining the behaviours of major shareholders and actual controllers. We will optimize dividend incentive and constraint mechanisms for listed companies and improve the mechanisms for protecting investors.”

And yet more on that same theme (!!) …..

“We will improve the financial regulatory system to ensure that all financial activities are placed under regulation in accordance with the law, strengthen regulatory responsibility and accountability systems, and improve regulatory coordination between the central and local levels. We will build secure and efficient financial infrastructure, unify the rules and systems for registration, custody, settlement, and liquidation for the financial market, establish binding constraints for defusing risks at an early stage, and build a robust system to effectively fend off and control systemic risks and ensure financial stability.”

“We will improve the mechanisms for protecting financial consumers and cracking down on illegal financial activities and establish a firewall for industrial and financial capital. We will promote high-standard opening up of the financial sector, steadily and prudently advance the internationalization of the RMB, and develop offshore RMB markets. We will make steady progress in the R&D and application of digital RMB and move faster to build Shanghai into an international financial center.”

Further reforming the management systems for inward and outward investment

“We will foster a first-rate business environment that is market-oriented, law-based, and internationalized and protect the rights and interests of foreign investors in accordance with the law.”

Advancing Whole-Process People’s Democracy

“Developing whole-process people’s democracy is integral to Chinese modernization. We will develop diverse forms of democracy at all levels and ensure that the principle of the people running the country is manifested in concrete and visible ways in all aspects of China’s political and social activities.”

Improving the mechanisms for consultative democracy

“The system of consultative democracy will be improved, with the introduction of more diverse forms of consultation”

On Religion

“We will make systematic efforts to ensure that religions in China are Chinese in orientation and establish a more solid legal footing for the governance of religious affairs.”

Improving the mechanisms for building a law-based society

“We will improve the public legal services system covering both urban and rural populations and further reform the systems related to lawyers, notarization, arbitration, mediation, and forensic evidence management.”

So …… IS CHINA CHANGING ITS SPOTS?

FROM A SOCIALIST/CAPITALIST CENTRAL COMMAND ECONOMY TO A CAPITALIST/SOCIALIST DE-CENTRALISED ECONOMY ?

China seems to be evolving towards a society where free, well regulated markets, law and “democracy” play a major role while the government plays its “separate” role. BOOM sees that as perhaps an Autocracy based upon merit.

This is a progression from a being a Socialist/Capitalist Communist society to becoming a Capitalist/Socialist Democratic society with free markets, the free movement of capital, the rule of law and democracy. But retaining the autocratic meritocracy as the ruling class.

MEANWHILE, IN THE WEST …… FASCISM COMETH

Meanwhile, in the West, nation states who proclaim “democracy”, “freedom” and “capitalism” are steadily moving towards authoritarian, centralised control mechanisms held and operated by a tightly selected political class allied with unelected, unrepresentative, corporate, global bodies such as the WHO (World Health Organisation), the European Union Commission, the UN, the WEF (the so-called “World Economic Forum” - a private organisation), the IMF, the World Bank, the International Court of Justice (the “World Court”) in The Hague and a number of globally dominant Corporations.

During the Covid fiasco, many Western governments became “the single source of truth”, tyrannical and dictatorial while simultaneously crushing many of the basic Human Rights which they so often avow and (supposedly) hold so dear.

This is a non-democratic, global, centralised authoritarian movement allied closely with the major Western corporations.

These terms are more commonly used to describe Fascism.

Benito Mussolini —

“Fascism should rightly be called Corporatism, as it is the merger of corporate and government power.”

ISLAMIC ALLIANCE AGAINST ISRAEL

In the 11th August editorial, BOOM discussed the possibility of the formation of a military alliance between the Islamic nations that surround Israel. “An alliance of Turkey, Iran, Egypt and Yemen would be a sizeable threat to Israel. And then Saudi Arabia, Qatar, Kuwait and the UAE nations would be forced to choose sides”.

In last Sunday’s editorial, BOOM wrote about Turkey’s recent move to apply for membership to the BRICS group of nations. “As far as BOOM can see, the West has essentially now lost Turkey to the East, the Belt and Road, the BRICS group and the Shanghai Cooperation Organisation. Their current membership and influence in NATO will place Turkey at the very centre of the Geopolitical balance of power.”

So, BOOM was not surprised last week, when Turkish President Recep Tayyip Erdogan called for the creation of a broad alliance of Islamic countries to tackle a perceived “threat of expansionism” coming from Israel.

“The only step that will stop Israeli arrogance, Israeli banditry, and Israeli state terrorism is the alliance of Islamic countries,” Erdogan claimed. He went on to say that Turkey has already taken steps aimed at “forming a line of solidarity against the growing threat of expansionism”.

“Israel will not stop in Gaza. If Israel continues in such a manner, it will set its sights elsewhere after occupying Ramallah. The turn will come for other countries in the region. It will come for Lebanon, Syria. They will set their eyes on our homeland between the Tigris and Euphrates”.

However, later in the week, Erdogan maintained his reputation for being belligerently independent when he said “the return of Crimea to Ukraine is "a requirement of international law."

BOOM interprets that as a direct message aimed at Moscow to put the Russians on alert about his desire to remain someone who demands respect. Erdogan chooses his words well. He was referring to "a requirement of international law".

He was not saying that it would necessarily be a good thing or something that Turkey would insist upon or assist in achieving. The distinction is important to observe.

COVID VACCINE COMPANY SHARES CRASHED 15 % INTRADAY IN ONE DAY LAST WEEK

Moderna Inc is a company that develops and manufactures biological products based upon MRNA technology and is one of the major proponents of Covid MRNA Vaccines. Last week, Moderna announced that it plans to cut $ 1.1 Billion in expenses on R & D by 2027 as it charts a path forward after the rapid decline of its Covid business. Despite Billions in revenues from its Covid vaccine, the company is struggling to achieve break-even.

BOOM has written extensively about this subject in the past.

Eleven months ago, BOOM wrote an editorial on the issue titled COVID COMPANIES IN FREE FALL – IS THIS THE BIGGEST AND FASTEST WIPE OUT OF AN ENTIRE INDUSTRY IN HISTORY? Readers can access that article on the BOOM Substack Archive.

Last week, Moderna shares collapsed (yet again) during Thursday’s trading session on the New York stock exchange. They fell by 12.36 % on the day. At one point, intraday, they had fallen more than 15 %. Over the week, the shares ended down 6.32%.

Investors are leaving. And there may not be going back. MRNA technology is now understood (and feared) by many people in the street, non-biologists. And they are almost all thinking that this technology is perhaps not safe. Why are they worried? The fact is that many of them were coerced into being jabbed with an MRNA product to save their job, to continue to travel and to alleviate the extreme anxiety induced by politicians and the mainstream media about a virus that has turned out to be no more dangerous than a common Influenza.

In other words, they believed the “safe and effective” messaging and are now beginning to wonder if they have been treated like Lab Rats.

Moderna Shares on Nasdaq daily for 6 months

An analyst, Mani Foroohar, from Leerink Partners was reported as saying in an email that the company's announcement "put to rest key elements of the bull thesis" for its stock and "reflect a worsening financial position." He also apparently said "R&D reductions are too far out chronologically to be credible from a management team that we think has proven serially unable to project the performance of their business".

According to other analysts, the announcement will make it hard for the company to reach break-even. Other financial media reports have stated that the company “has been struggling to shift away from its COVID vaccine”.

However, Moderna’s chief rival in the MRNA technology space is called BioNTech (BNTX), a German company, also listed on Nasdaq. As the market became disenchanted with Moderna’s announcement, the gamblers decided to back its rival. BNTX shares shot up by over 17 % on Friday.

BioNTech Shares on Nasdaq daily for 6 months

However, readers should examine the long term trends before jumping into bed with the excited gamblers.

BioNTech BNTX — Shares on Nasdaq weekly for 5 Years

SHANGHAI AND HONG KONG STOCK MARKETS CONTINUE TO DIVERGE

Last week, the Shanghai Composite Stock Index continued to weaken. The Hong Kong Hang Seng stock index also weakened early in the week but then rallied in the last 2 days. BOOM continues to watch closely. The Shanghai Composite Index is a broad stock market index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. Its current Market Capitalisation amounts to 42,088 Billion RMB which is equivalent to US $ 6,000 Billion (US $ 6 Trillion).

The S & P 500 Stock Index in the USA is currently valued at about US$ 47.22 Trillion as at the close of trade on Friday last week. This is almost 8 times the value of the Shanghai Composite Index.

If China’s economy continues to grow at its current rate (around 5 % per annum) into the future, then surely the Shanghai Composite is undervalued as compared to the S & P 500?

Readers might like to go back and re-read BOOM’s analysis of China’s future plans. It is titled — CHINA’S FUTURE — IS COMMUNISM ALWAYS COMMUNISM?

Hong Kong Hang Seng Stock Index daily for 6 months

Shanghai Composite Stock Index daily for 6 months

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.