BOOM Finance and Economics 18th August 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

ANOTHER INTEREST RATE CUT

INFLATION COMPARISONS — US, UK, EURO AREA, CHINA

CHINA STOCK MARKET POISED TO RISE?

WHAT IS A SUKUK?

BITCOIN ABOUT TO FALL AGAIN? OR RISE?

ANOTHER INTEREST RATE CUT

On 21st July, BOOM led with the Headline “INTEREST RATE CUTS COMING”

Since then, we have seen interest rate cuts from the Bank of England, the Bank of Canada and the Peoples Bank of China. The Reserve Bank of Australia kept its rates on hold. The US Federal Reserve is expected to cut its rates at the next meeting of the FOMC on 17th - 18th September (Federal Open Market Committee).

Last week the Reserve Bank of New Zealand (RBNZ) cut their official cash rate by 25 basis points. That was their first rate cut since March 2020. In their statement, the RBNZ said: “New Zealand’s annual consumer price inflation is returning to within the Monetary Policy Committee’s one to three per cent target band.” The cut was a surprise to most analysts, but not to BOOM.

INFLATION COMPARISONS

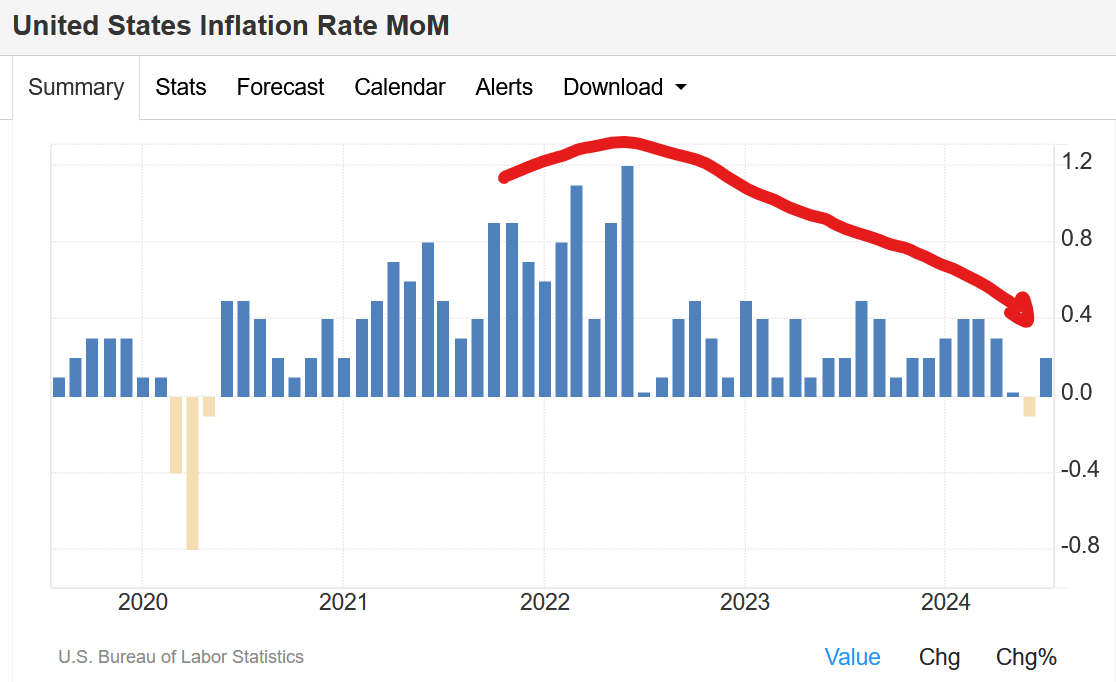

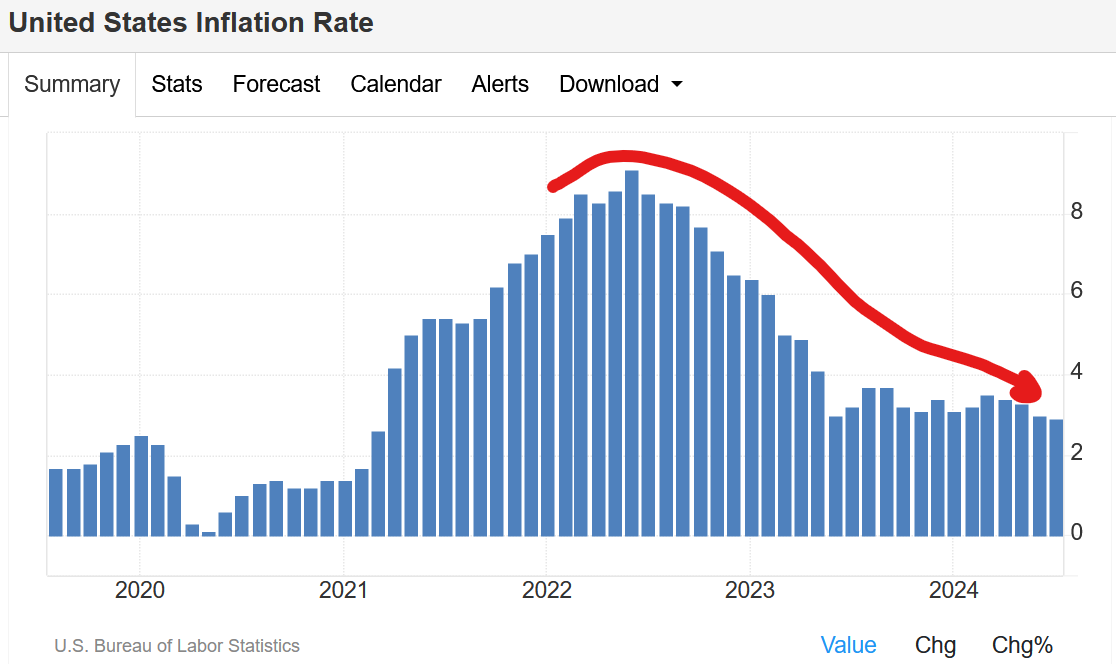

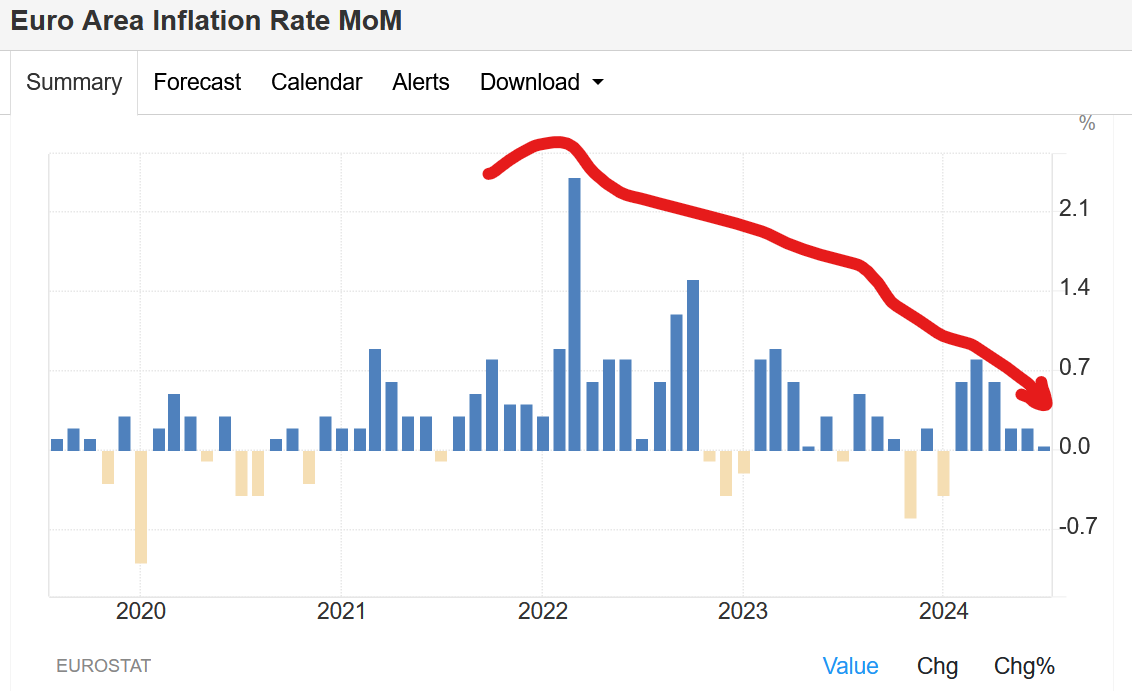

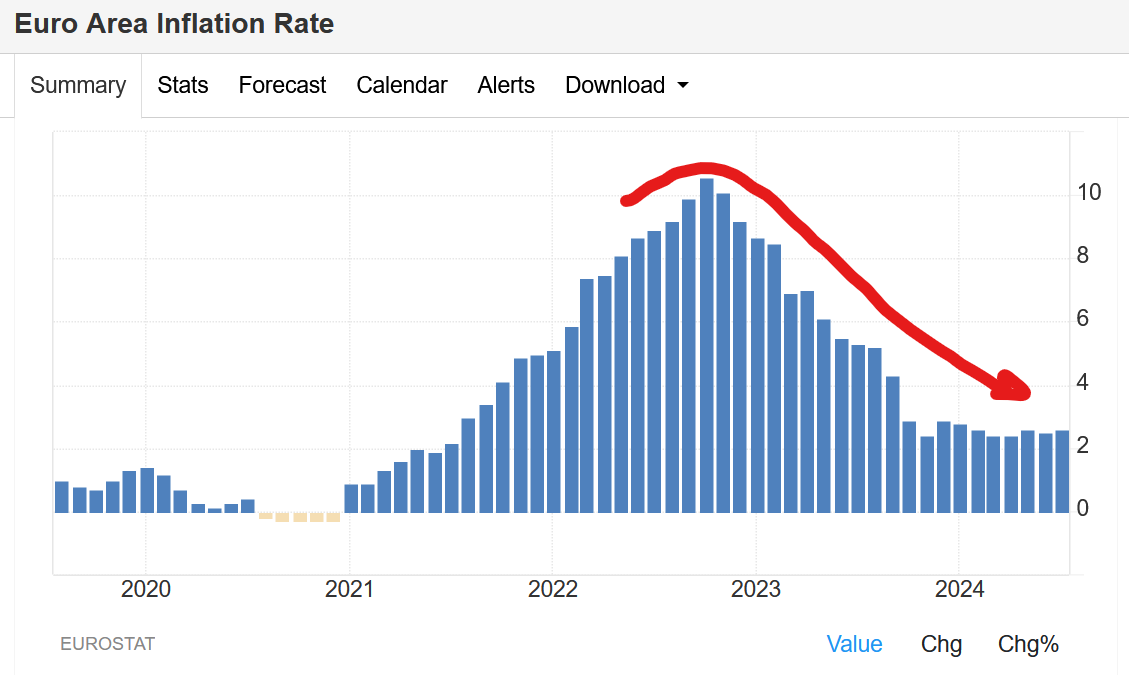

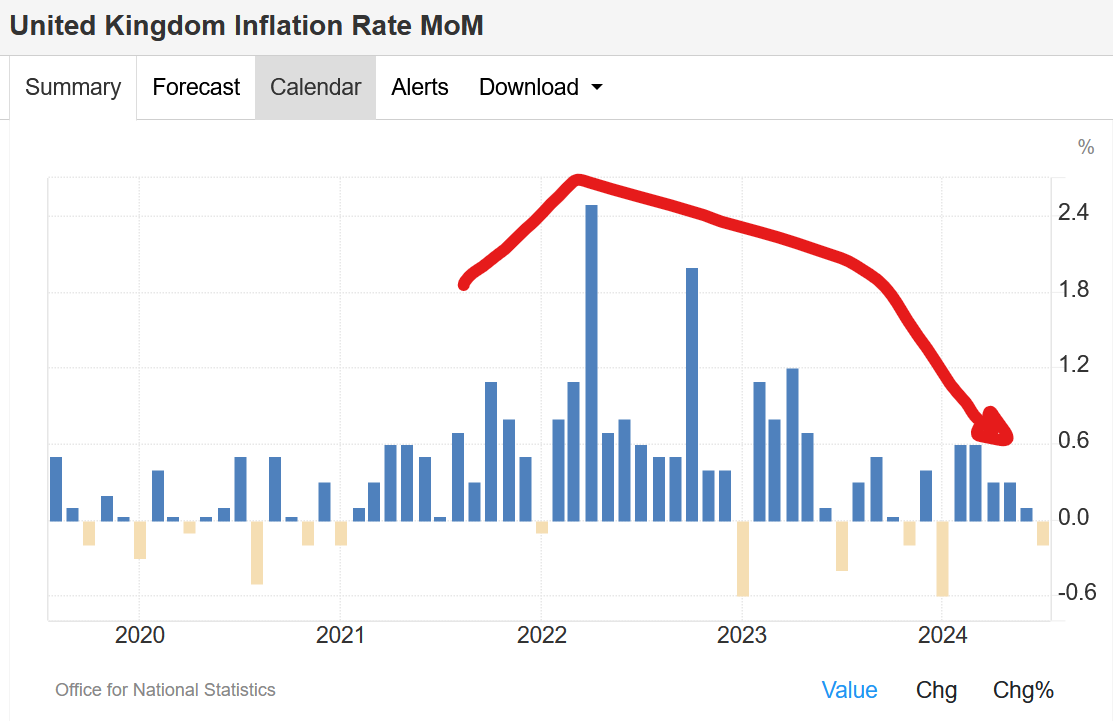

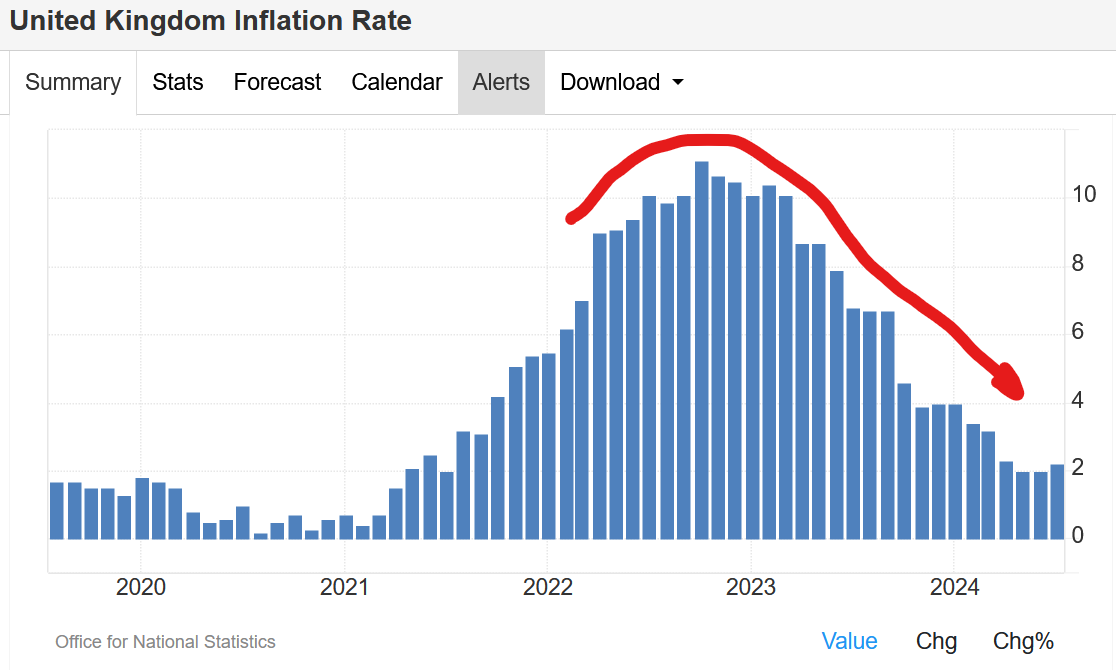

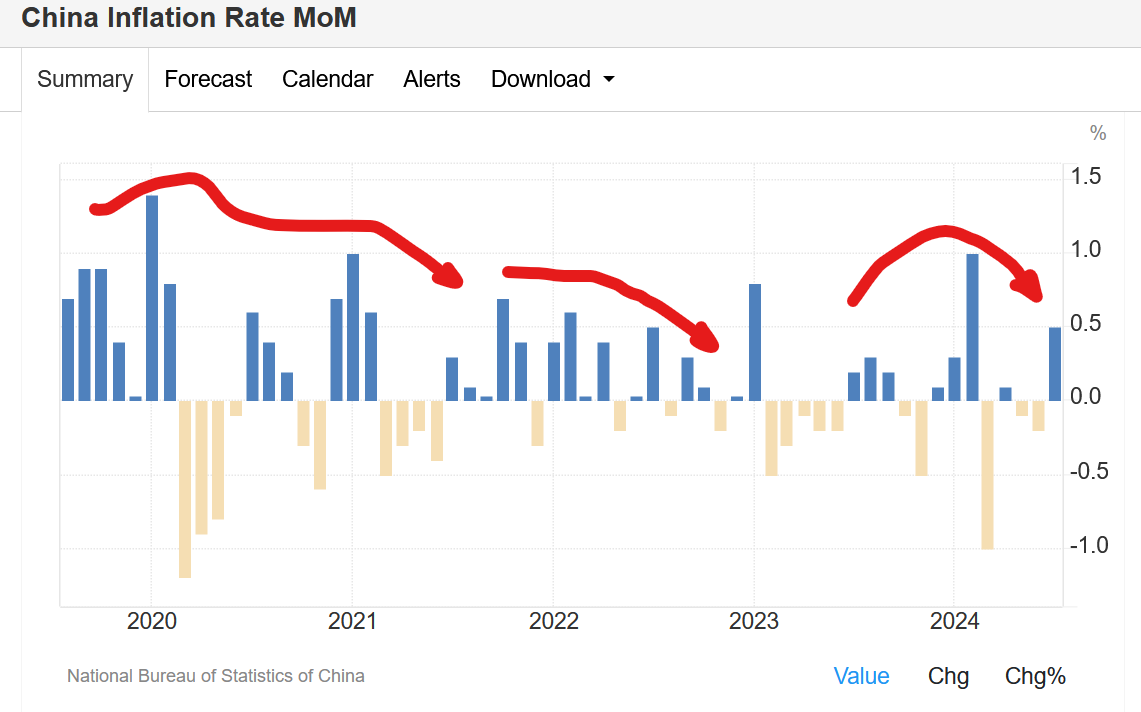

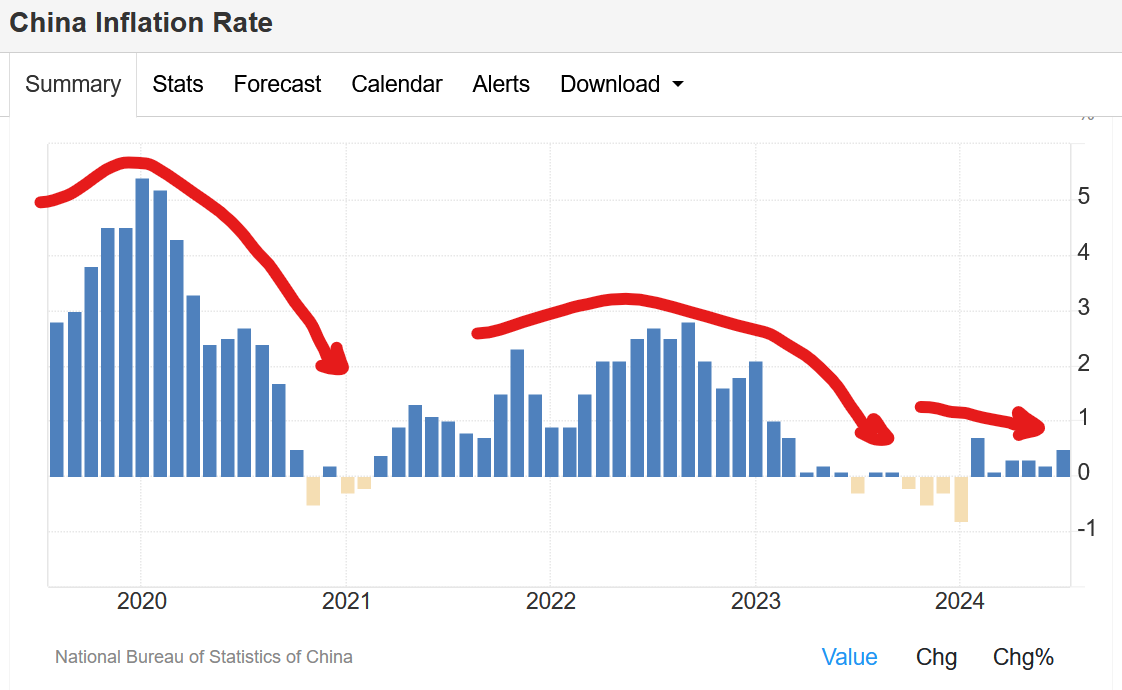

These charts show Month--on-Month (MoM) Inflation Rates followed by Annual Inflation Rates over the last 5 years for USA, Euro Area, United Kingdom and China. The patterns are worthy of comparison and deep consideration.

UNITED STATES

EURO AREA

UNITED KINGDOM

CHINA

Note that the MoM peaks of inflation tend to precede the Annual updates in the US, UK and Euro Area. Meanwhile, China’s inflation pattern is completely different. This is explainable.

Over the last 5 years (or more) China has ensured that their monetary stimulus packages are targeted to manufacturing productivity and infrastructure. They have actively discouraged speculation in asset prices such as stocks and real estate.

Meanwhile, after the Covid debacle in 2020, the Western advanced economies created a huge monetary stimulus which largely ended up in asset price inflation fuelled by speculation. This was heightened by panic and poor leadership from all Western governments. Ignorance of the finance system is rampant. The result is economic stagnation, CPI inflation followed by deflation, growing inequality of opportunity and social disintegration.

A comparison of major Western stock market indices and house prices since the planned Covid Epi-Panic reveal this in great clarity. Owners of assets have benefited while most of society has been locked up, masked, subjected to fear narratives, jabbed against their better judgement with experimental “countermeasures”, physically injured and economically harmed. And all of that was done “for the Greater Good”, “to keep us all safe”, to “build back better”.

Mussolini, the father of modern Fascism, along with Hitler and Stalin, would be proud of the outcome with militarism gone mad, endless war and hatred emerging on the streets.

“Fascism should more properly be called corporatism because it is the merger of state and corporate power.”

We are putting at risk the fragile thing we call civil society. Poor understanding of finance and economics has become the norm. Loss of trust in our institutions is rampant. Unelected individuals, institutions and corporations are assuming more and more power. Elected representatives of the people are corrupted by power and influence, carefully selected for sociopathic qualities, groomed and promoted to positions of great power. The mainstream media is a corrupt, rotting carcass heavily involved in promoting all of these disruptive influences with no independence of thought, no debate and outright censorship of ideas.

The progress of Western stock markets over the last 5 years reveals the impact on asset prices. The US Dollar Index chart reveals the dominance of the US Dollar, supported by increased global chaos and disruption.

UNITED STATES

EURO AREA

UNITED KINGDOM

CHINA

US DOLLAR DOMINANCE — THE RISE AND RISE OF THE US DOLLAR EMPIRE

CHINA STOCK MARKET ANALYSIS

Back on 4th February editorial, BOOM wrote the following —

“THE CHINA STOCK MARKET MAY BE CLOSE TO A REBOUND”

“… if the upswing in external trade continues, then we should soon see a rebound in the Chinese economy and a subsequent rebound in stock prices.”

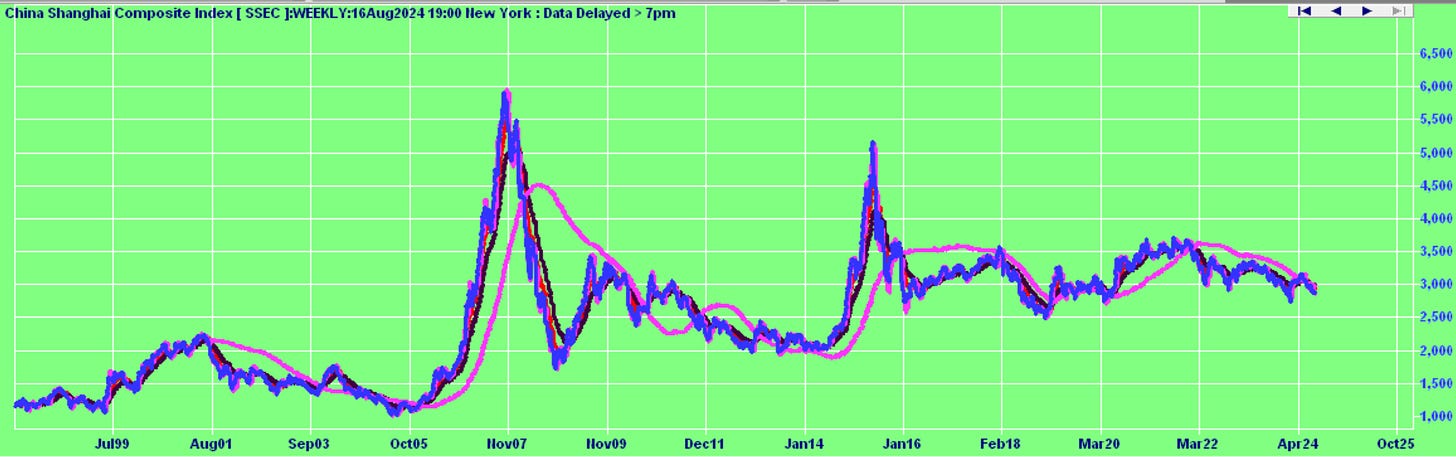

History now reveals that the Shanghai Stock Index turned on a dime on the very next day, February 5th, and started to climb.

It then rose steadily for the next 14 weeks as per BOOM’s expectations, from the Low on 5th February of 2,635 points to a High of 3,174 points on May 20th. That constituted a rise of 20 % from the low on Feb 5th.

If that rate of climb were to continue, then the index would have risen by 75 % within the 12 months following Feb 5th. That (obviously) does not tend to happen in stock markets, even ones so undervalued as the Chinese stock market.

Since May 20th, the index has declined for the last 3 months.

During those 3 months, BOOM’s famous, secret China Trade indicator slowed its rate of rise in late June and then travelled sideways over the last month. If this indicator begins to surge upwards again, BOOM expects the Chinese stock market to begin a long overdue, long term Bull market.

BOOM’s analysis of the Hang Seng Index in Hong Kong reveals that it is primed to move higher from here. Technically, it is appearing much stronger than the Shanghai Composite Index.

China must now encourage more private ownership of its productive assets. To not do so is to risk falling into the exact same traps that have ensnared the West. If productive assets fall into fewer and fewer hands, social disruption and upheaval is baked into the cake.

If BOOM’s analysis is correct, this could be one of the greatest investment opportunities ever. But if China does not encourage increased ownership of its productive assets, then the outcome will be predictable in the other direction.

Readers should watch closely over the next weeks and months. This is an historic moment. BOOM will report progress from time to time. Of course, the future is always unpredictable and BOOM does not offer investment advice.

This chart shows the Shanghai Composite Stock Index since 1999.

WHAT IS A SUKUK?

Sounds like a suck up? Or perhaps suck it up? No.

A sukuk is similar to a bond in Western finance but it is definitely not a bond. It is an Islamic financial asset, essentially a proof of part ownership that complies with Islamic religious law (Sharia or “Sharia law”). According to Wikipedia, “Sharia is a body of religious law that forms a part of the Islamic tradition based on the scriptures of Islam, particularly the Qur'an and hadith.”

Under Islamic law (Sharia), usury (riba) is strictly prohibited. The concept of usury encompasses not only interest paid on loans but also any excessive or exploitative gain made from financial transactions. So those are banned.

Islamic finance, using Sharia principles, avoids usury by focusing on profit-and-loss sharing and equity-based investments. Sharia prohibits:

Interest-based lending: Charging interest on loans or deposits is forbidden.

Excessive profits: Any excessive or exploitative gain made from financial transactions is considered usury.

Late payment fees: Charging extra for late payment is considered a form of usury.

Sharia-Compliant Alternatives

To avoid usury, Islamic finance institutions employ alternative methods, such as:

Murabaha: A credit sale where the seller buys and sells goods at a markup, with the buyer paying in instalments.

Sukuk: Islamic “bonds” that represent ownership in assets rather than debt obligations.

Partnership-based financing: Equity-based investments where profits and losses are shared between partners.

These approaches aim to promote ethical and equitable financial practices in accordance with Islamic law.

Because Islamic law prohibits usury, conventional Bonds cannot be issued because they encompass a coupon payment. The issuer of a Sukuk essentially sells an investor group a certificate, and then uses the proceeds to purchase an asset that the investor group has direct partial ownership interest in. The issuer must also make a contractual promise to buy back the bond at a future date at par value. This time limitation is an important feature.

A sukuk is a sharia-compliant bond-like instrument used in Islamic finance.

Sukuk involves a direct asset ownership interest, while bonds are indirect interest-bearing debt obligations.

Both sukuk and bonds provide investors with payment streams, however income derived from a sukuk cannot be speculative which would make it no longer halal.

Sukuks have become popular since 2000, when the first such products were issued in Malaysia. Bahrain soon followed in 2001. Sukuk are now used by Islamic corporations and state-run organizations globally. They are becoming more common year by year. BOOM expects this to continue to grow as it is a cooperative form of investment, in keeping with the principles espoused by the BRICS group of nations and the Shanghai Cooperation Agreement nations. There is no significant impediment to their use in Western nations as they are contractual in nature.

Investing in a Sukuk is more akin to a share investment rather than a bond investment. It may actually be more secure than a share investment because the ownership is more directly linked to a particular productive asset.

If the asset backing a sukuk appreciates then the sukuk can appreciate whereas a bond’s capital value is strictly linked to its interest rate at origination and, as time passes, prevailing market-driven interest rates. A Sukuk’s valuation is based on the value of the assets backing them while a bond's price is largely determined by its credit rating and its yield.

So — a Sukuk is an example of innovation in designing financial assets. It can be a win-win capital gain situation if the asset rises in price. But it can be a capital loss situation if the opposite occurs. The risk and reward dynamics are different to a bond or an equity share in a corporation.

BITCOIN ABOUT TO FALL AGAIN? OR RISE?

Bitcoin has had a good run over the last 12 months, rising strongly since early January this year from around US$ 17,000 to a High in mid-March just above $ 73,000. The charts below display that strong move. However, its momentum has faltered since March and it has acquired a downtrend. This is also clearly shown in the charts.

In such a situation, there are two likely outcomes. The 4 month downtrend may represent a consolidation which will be followed by a resurgence in strong uptrend. Or it may be a precursor to a more dramatic fall to earth.

Rather than the 24 hours-a-day price action, BOOM likes to watch the US stock market traded derivatives GBTC and BITO for major trend analysis.

GBTC — A Weekly Chart over 3 Years

GBTC — A Daily Chart over 12 Months — this more detailed chart shows the failure to rise since March

BITO — A Weekly Chart over 3 Years

BITO — A Daily Chart over 12 Months — this more detailed chart shows the failure to rise since March

The future is always unpredictable. BOOM does not indulge in predictions of the future, preferring to weigh the probabilities of outcome based upon trend analysis. Currently, this looks like a 50:50 situation for Bitcoin, a digital asset of questionable value which resembles a commodity. There is an equal chance of the short term downtrend accelerating versus an acceleration of the long term uptrend. When future reality intervenes, the probabilities of likely outcome will change. Long term and short term trends must both be considered in determining future probabilities.

This process is called Abductive Reasoning. More on this next week.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.