BOOM Finance and Economics 20th October 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

“WE JUST HAVE TO MESS AROUND” SAYS BILL GATES

COVID VACCINE COMPANIES CONTINUE TO COLLAPSE

HAVE CENTRAL BANKS GONE MAD WITH “MONEY PRINTING”?

LET’S LOOK AT CENTRAL BANK OPERATIONS

THE FAILURE OF "SOUND" MONEY IN THE USA – THE PANIC OF 1837

HUMAN BEINGS ARE THE PROBLEM -- THEY REQUIRE REGULATION TO MAINTAIN SOCIETAL TRUST

PUBLIC TRUST OFFICE — NAPIER NEW ZEALAND

“WE JUST HAVE TO MESS AROUND” SAYS BILL GATES

BUT MILLIONS MAY HAVE DIED ALREADY

Over the last 2 – 3 years, BOOM has frequently written about the over-hyped Covid vaccine companies. BOOM has especially referred to the unwise and premature use of novel MRNA technology in global Covid vaccination campaigns. Some analysts have reported that millions of people may have already died from these products and possibly hundreds of millions may have had their health damaged and their life expectancies shortened.

That is all speculation, of course. Denis Rancourt, a Canadian retired Professor of Physics, has estimated 30.9 Million Excess Deaths globally during the period 2020 - 2023 in his review of 125 nations. That report is 521 pages long. The virus did not cause those deaths. It has proved no more deadly than a bad bout of Influenza. However, the courts in many nations will eventually decide what has really happened.

Rancourt’s Study: https://correlation-canada.org/covid-excess-mortality-125-countries/

Today, it’s time to review three specialist vaccine companies, Moderna, Biontech and Novavax. Despite the hype, it appears that these genetic therapy vaccines are NOT the bright future of Medicine as promoted by Bill Gates, a man with no formal training or personal experience in biology, medicine, vaccinology or epidemiology. He is certainly not a Doctor of Medicine with years of clinical experience in caring for patients.

For those who haven’t seen it, here is a chilling, very short speech dated May 2024 by Mr Gates describing “we just have to mess around” with this technology. He also says “there are a lot of lipid nano-particles and some are very self assembling”, “we’ll be able to build factories worldwide”.

He refers to his investments as “bets”. The term “bet” is usually one used in the gambling world, not in the world of patient care. We must remind ourselves that this man has never had to take personal responsibility for a single person suffering from any disease.

He goes on to say “we will have vaccines for every disease which we don’t have vaccines for at the moment”. Every disease? There are thousands of diseases in that category, by the way. To witness his comments, you only need to listen to one and half minutes of this short video released by Dr John Campbell in May.

Link:

COVID VACCINE COMPANIES CONTINUE TO COLLAPSE

Last week, Novavax shares dropped by 18.75% after it was announced that the US FDA (Food and Drug Administration) had halted their trial of the company’s new dual COVID-Influenza vaccine and its standalone Flu vaccine. This halt occurred because a single participant in the combination shot trial reported nerve damage. Novavax said a participant enrolled in a mid-stage study of the combination vaccine last month reported symptoms of motor neuropathy, or damage to the nerve cells that control muscles or movement. The person was given the vaccine in January last year.

The share price managed to hold just above $ 10 at the close on Friday.

A fall of 18.75 % in one week sounds dramatic. However, we must put that fall into long term perspective. At their highest point, Novavax shares topped out on 9th February 2021 at US$ 331.68.

The chart tells the story for hapless investors who have held on. It is a horrifying journey.

NOVAVAX SHARES 5 YEARS (Nasdaq Stock Code NVAX)

Another Covid vaccine company involved in the promotion of MRNA technology for mass vaccination programs is the German company, BioNTech. In 2020, BioNTech, partnered with Pfizer in developing the Pfizer Covid vaccine (BNT162b2) which has been used on billions of people in many nations.

Last week, BioNTech’s shares fell by 7.26 % to end the week’s trading at US $ 111.77. However, the all time High for Biontech shares occurred on August 10th, 2021. The price then was $ 464.00. Again, the 5 year chart tells the story.

BIONTECH SHARES (Nasdaq Stock Code BNTX)

Then there is Moderna to consider. Moderna, Inc is an American pharmaceutical and biotechnology company based in Cambridge, Massachusetts. It focuses on RNA therapeutics, primarily mRNA vaccines. The company's commercial products are the Moderna COVID-19 vaccine, marketed as Spikevax and an RSV vaccine, marketed as Mresvia. The company has 44 treatment and vaccine candidates, of which 37 have entered clinical trials.

Moderna’s shares fell by 7.2 % last week to close at $ 54.10. The all time High of the shares was very close to $ 500. They hit US $ 497.49 on August 10th 2021. That is the exact same date of Novavax shares Highest point. Again the 5 year chart tells the gruesome story, without the hype.

MODERNA SHARES (Nasdaq Stock Code MRNA)

The three specialist vaccine companies all have a similar story to tell of Hype and Hope. However, the share charts don’t lie. These companies will almost certainly have great difficulty raising capital in the future in order to maintain their existence. They will also be subject to many legal challenges with fraudulent mis-representation being their most feared challenge. After all, it is now well known that their so-called Covid “vaccines” do not prevent transmission of the target virus. And reports of associated deaths and severe injuries continue to mount, not to mention the impact on fertility, live birth numbers and possible damages to children that will not be apparent for many years. The words “safe and 95% effective” will echo through the courts as the future unfolds.

The other company in this space is, of course, Pfizer. It is not a specialist MRNA vaccine company as it comes with a broader basket of products. Let’s look at its 5 year share chart performance. Does that look familiar?

PFIZER (NYSE Stock Code PFE)

A long term chart taken from Incredible Charts beginning around 1989 shows that the current share price is around the same level it was in about 1997. This poor performance begs two questions. Is this company commercially viable in the long run? Will MRNA technology sink it as the future unfolds?

HAVE CENTRAL BANKS GONE MAD WITH “MONEY PRINTING”?

AND WILL THIS CAUSE THE US DOLLAR AND THE US ECONOMY TO “COLLAPSE”?

BOOM gets asked these questions over and over again. Have central banks around the world gone “mad” with “printing” excessive amounts of money? Are central bankers in a conspiracy of control, preparing to destroy the US and global economy? Other questions that are often asked are -- Will the US Dollar collapse? And will that cause Hyperinflation?

There are hundreds, if not thousands, of websites promoting these scenarios. They terrify people into thinking that the global financial system is teetering on the brink of collapse. They use fear to hook readers and promote their newsletters, “investment” conferences, books and cruises. It is an industry with famous star performers. BOOM has watched it repeat the same narratives over and over again for 35 years. None of the dramatic forecasts of collapse ever come true. That is the reality. But that doesn’t stop the industry growing. After all, in BOOM’s estimation, perhaps 95 - 99% of the population has virtually no knowledge of how the financial system works, how banks function, how central banks function, how the economy is funded as a whole, how governments fund their operations or how financial markets function. That means that there is a very big market out there for the “industry” of fear to take advantage of.

To make matters worse, many people in advanced economies have been struggling with relatively high CPI inflation for the last 3 years and may be struggling to pay their mortgage payments or rental payments. They feel trapped and that is understandable. So they look for someone to blame and there are many articles on the Net that point them towards blaming the central bankers.

LET’S LOOK AT CENTRAL BANK OPERATIONS

BOOM is very critical of modern central bank policies and has written many editorials on the grave importance of maintaining large volumes of physical cash in circulation in the real economy which acts as a natural balancing buffer to money created as credit (as bank loans).

BOOM has also written extensively about the failure of central banks to recognise the recent Peak of CPI inflation which occurred in October 2022 and which, by the way, was ignored by all the central bankers of the world. Here is what BOOM wrote in mid October 2022.

BOOM editorial 16th October 2022 -- Quote:" the peak of CPI inflation may be in the past … the prices of stocks and bonds should start to rise from here".

In other words, BOOM was calling the top of the interest rate cycle. US stock prices started rising 2 days later and US bond prices started rising 5 days later.

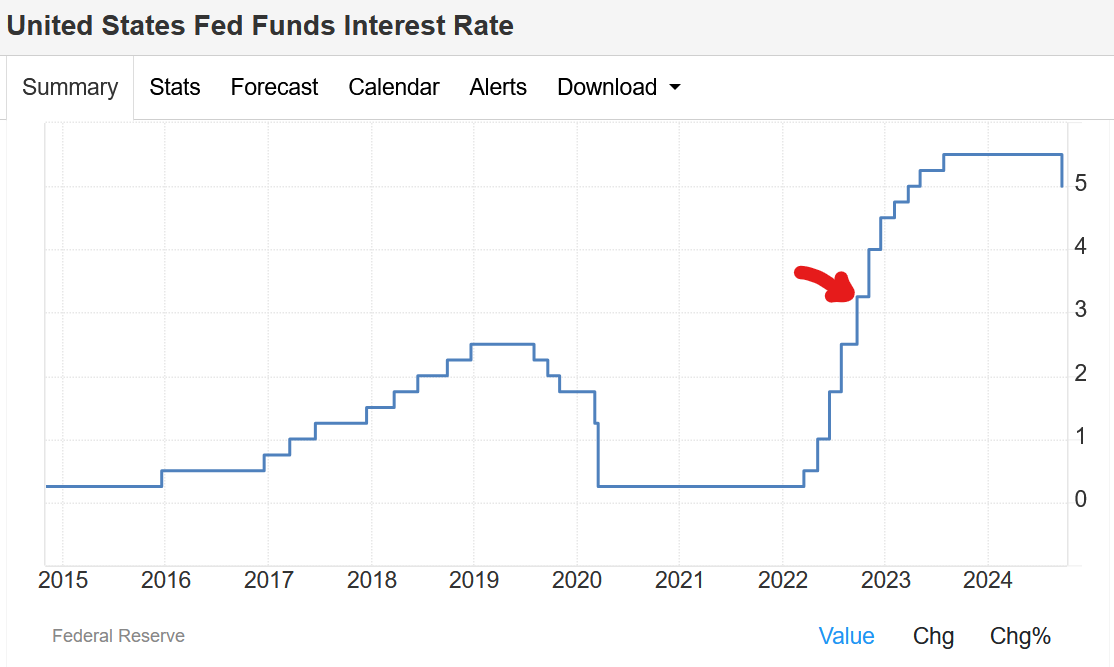

The most influential central bank, the US Federal Reserve, ignored BOOM and kept raising rates until July 2023. The chart shows exactly what happened. The little red arrow shows exactlywhere BOOM called the Peak of CPI inflation.

From the BOOM editorial 16th July 2023 -- Quote:

“BOOM cannot see any reason for further interest rate increases from the Federal Reserve. And companies must soon start to actively lower prices to ensure that their sales and revenues don’t start collapsing.”

This time, the Federal Reserve took note and stopped raising its Fed Funds Interest Rate at that time. However, another 13 months passed before they raised sufficient courage to cut their rates.

Even though the Peak of CPI inflation was obvious to BOOM in October 2022, all the central banks of the world decided to “err on the side of caution” and maintained tight monetary policies for almost (yes) another 2 years. For economics beginners, “tight” in this context means relatively high interest rate settings.

Now, let’s look at some evidence concerning central banks and their so-called “reckless”, “massive”, “money printing”. Readers who prefer outrageous narratives of financial and economic collapse may be disturbed to consider the facts of the matter. However, BOOM is fact driven.

In most circumstances, 98 % of our fresh new money supply in advanced economies is created as commercial/retail bank loans to willing borrowers. Note the last part of that sentence. The banks cannot "print money" in an uncontrolled fashion and they do not. They must have a willing borrower from the real economy in order to create a loan. And this money is not “printed” by the central bank. It is created as a ledger entry by the commercial/retail bank when a loan is agreed. This is how they expand their loan book and subsequently, the money supply for the whole economy grows by that amount. There are some constraints such as the Basel 1, 2 and 3 Capital Accords but central banks allow considerable lee-way.

The remaining 2 % of fresh new money is created as physical Cash, usually issued by the Treasury into the real economy in response to demand in most nations and printed by Treasury controlled Mints. The retail banking system distributes the physical cash. The central bank monitors the demand for cash from the real economy in the banking system and may increase supply to meet that demand by asking the Mint/Treasury to make more if necessary.

The United States Mint is a bureau of the Department of the Treasury responsible for producing coinage for the United States to conduct its trade and commerce, as well as controlling the movement of bullion. The U.S. Mint is one of two U.S. agencies that manufactures physical money. The other is the Bureau of Engraving and Printing, which prints paper currency.

The Bureau of Engraving and Printing (BEP) is a government agency within the United States Department of the Treasury. The BEP's role as printer of paper currency makes it one of two Treasury Department agencies involved in currency production. The other is the United States Mint, which mints coinage.

These arrangements vary from nation to nation. But they are remarkably similar. Some central banks can issue fresh currency directly into the economy. But that is rare. The constitution of the Bank of Russia allows that, for example.

Central Banks also cannot "print money" without constraint. The vast majority of them cannot issue fresh new money into the real economy. They can only buy and sell assets with/from their client Commercial/Retail banks. In rare circumstances, when CPI deflation or asset price deflation occurs, they are allowed to buy and sell assets in the real economy, but especially and mostly in relation with the Treasury and under the Treasury's watchful eye. That is what we call "Quantitative Easing" (QE). The commonest asset transaction used in QE is for the central bank to buy assets from the Treasury (Government Bonds). In that case, the Treasury receives the funds electronically and spends that money into the real economy.

The Bank of England explains this clearly on their website. “The money we use to buy bonds when we were doing QE did not come from government taxation or borrowing. Instead, like other central banks, we can create money digitally in the form of “central bank reserves”.

QE has been used extensively since 2008 when the Great Crisis of Insolvency in the US Banking system occurred. Some call this the "Global Financial Crisis" (the GFC) but the fact remains that it originated in the US due to an explosion of banking fraud in that nation. Most of the QE that was subsequently done was done in the USA. Again, under the watchful eye of the US Treasury. The aim of QE was to prevent deflation (negative rates of inflation).

From 2008 to 2020, the Global Total of QE was equivalent to US $ 6 Trillion. That sounds like a "lot" of money but it must be put into perspective. $ 6 Trillion is 0.6 % of Total Global GDP in that period and less than 1 % of estimated Total Global Assets.

Total Global GDP from 2008 - 2020 = US$ 1,000 Trillion

Total Global Assets (estimated) = US $ 650 Trillion

($ 300 Trillion in Real Estate $ 110 Trillion in Stocks $ 235 Trillion in Debt Securities)

These numbers are all approximate for the sake of illustration.

In 2020, in response to the coordinated Pandemic of Covid Fear, more QE programs were run by major central banks with the largest injection coming from the US Federal Reserve which added yet another US $ 2 Trillion of QE expenditure from 2020 to 2023. The European Central Bank added another US$ 1 Trillion in response to the coordinated Covid Panic. In grand total, the QE programs worldwide amounted to around US$ 9 Trillion from the GFC in 2008 to the beginning of 2024.

These numbers sound staggering. However, they don’t change the above calculations very much.

$ 9 Trillion is 0.7 % of Total Global GDP for that (longer) period and 1.2 % of estimated Total Global Assets as at the end of 2023.

Total Global GDP from 2008 - 2024 = US$ 1,300 Trillion

Total Global Assets (estimated) = US $ 700 Trillion

These numbers are all approximate for the sake of illustration.

So -- central banks around the world did not "go crazy" with "printing huge amounts of money" in buying "vast amounts of assets" in that period. In fact, they were arguably rather prudent and constrained. The alternative would have been to do nothing in extra monetary support in response to the US banking crisis of 2008 and the Covid Panic of 2020. Doing nothing would have threatened the entire global financial system (twice). Such a lack of action would have resulted in a calamitous situation for 99 % of the people on the planet (twice).

However, it is important to acknowledge that the central banks (most especially the US Federal Reserve) and other government controlled banking regulators in the advanced economies were seriously remiss and arguably incompetent in their oversight of the banking system leading up to the crash in 2008.

So, the real scandal that occurred in 2008 was actually in regard to the disastrously poor regulation and oversight of the US banking system from many different Government agencies. This is summed up well by Wikipedia, believe it or not. In its entry on US banking regulation, the very first sentence is a powerful one and the first paragraph sums up the fragmentation that exists in the US.

"Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom (where regulatory authority over the banking, securities and insurance industries is combined into one single financial-service agency).”

And virtually all governments worldwide were also seriously remiss and arguably incompetent in their oversight and response to the coordinated Covid Panic of 2020 - 2023. In that instance, the virus involved has proved to be no more dangerous than a bad bout of Influenza. If it did kill, it principally killed elderly people above the age of 82 years who had multiple co-morbid conditions. And, somehow, mysteriously, the ancient killer, Influenza, disappeared from the Earth (or was not tested for) during the coordinated Covid panic.

Many experts were ignored who correctly predicted the probable Covid outcomes in early 2020, including the august Professor of Medicine and Epidemiology at Stanford University, John Ioannides, and the equally august authors of the Great Barrington Declaration, released in October 2020. The authors of the Great Barrington Declaration were Professor Sunetra Gupta of the University of Oxford, Professor Jay Bhattacharya of Stanford University, and Professor Martin Kulldorff of Harvard University. Stanford, Harvard, Oxford are arguably three of the most prestigious universities in the English speaking world. But almost all governments ignored them and went on a rampage of destruction – social, political, economic. They trampled all over the Human Rights of the people, locking them up, forcing them to wear masks and coercing them to be injected with experimental, unproven MRNA “vaccine” technology with no medium or long term safety data.

Make no mistake because no mistake was made. There is plenty of incompetence to observe in both the world of central banking and in government.

THE FAILURE OF "SOUND" MONEY IN THE USA – THE PANIC OF 1837

Governments and central banks certainly make a lot of mistakes and miss-judgements. The citizens pay with their wallets or, in the worst cases, with their lives. BOOM is a harsh critic but, as always, there is another side to the story.

In the 19th century and in the early 20th century, the United States experimented with not having a central bank for around 77 years. The result was financial, economic and social chaos with a great deal of suffering along the way.

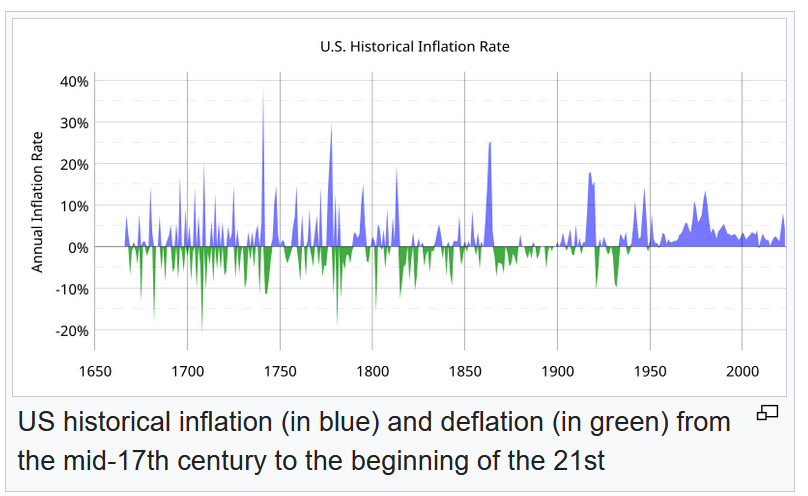

This chart shows CPI inflation and deflationary events in the USA during the period. Chaos was the norm. We live in a relatively benign financial world these days with no severe deflationary events since Post World War Two.

US HISTORICAL INFLATION RATE

It is fashionable to rage against central bankers and even commercial bankers with some people vehemently accusing them of creating most if not all of societies ills. It is time to re-consider a world of so-called “sound’ money, backed by gold and when there was no central bank. That world occurred in the 19th century in the United States.

If you hate banks and bankers or if you are a true believer in the wisdom of governments or in the concept of "hard" (or "sound") money, you should take a good hard look at The Panic of 1837 in the United States.

An examination of the events leading up to the Panic and the events that occurred afterwards are worthy of your time. All of human history reveals that most Governments don't understand money. And the idea that the concept of "soundness" can be used to somehow tame money creation is magical thinking in action. All forms of money are contracts of credit, based upon trust and enforced by social agreement. Human beings will always find ways to innovate in regard to contracts of credit. That is what the history of money tells us. Let's look back to 1837.

It all started when the US President, Andrew Jackson, in his wisdom, effectively killed off the central bank which was then called the BUS -- the Second Bank of the United States. That process started in 1833 but was not completed until 1836. The end of the central bank triggered a huge real estate boom as State based commercial banks issued credit money loans in large volumes to eager borrowers to purchase land. Is this sounding familiar?

The Government became concerned. So they issued the so-called "Specie Circular", an executive order issued by President Andrew Jackson on July 11th 1836. He ordered that payments for the purchase of public lands be made exclusively in gold or silver. Jackson was a "hard" money man who was always suspicious of banks creating credit money loans without the "sound" backing of gold and silver. The idea of the "Specie Circular" was to squash "excessive" land speculation and the "excessive" growth of the credit money supply (bank loans).

Jackson directed the Treasury Department and banks to only accept specie (Gold or Silver) as payment for government-owned land after Aug. 15, 1836. However, settlers and residents of the state in which they purchased land were permitted to use "paper" money (bank credit) until December 15th on lots up to 320 acres. After that date, the Specie Circular effectively strangled the use of paper money. This caused a huge collapse of real estate prices. Buyers simply could not find sufficient gold or silver to settle purchases so they stopped buying. The banks had no option but to reduce credit creation dramatically and many banks then subsequently failed (as you would expect) due to loan defaults.

The Panic of 1837 started in April, one month after Martin Von Buren became President. It was an absolute economic disaster. By May 21, 1838, a joint resolution of Congress repealed the Specie Circular. The experiment with "sound" money was decisively over.

Interestingly, a central bank was not established after that debacle. During the period from 1836 - 1862, there were only State banks with no Federal Bank. This period is called the Free Banking Era. Bank notes had to be issued with gold or silver backing but loan books of credit money were allowed. More chaos ensued.

During the free banking era, state banks had an average life span of just 5 years. About half of the banks failed for the usual reason of loan defaults. But some failed because they had inadequate gold and silver with which to honor note redemptions. As a result some banks innovated and began to offer central banking services to other banks. Nonetheless, bank failures continued in huge numbers.

In 1863, the National Banking Act was passed, creating a system of Federal banks. And the office of Comptroller of the Currency was created to supervise those banks. A uniform national currency was also created. A huge bout of CPI inflation followed immediately with inflation hitting 24.6 % in 1864. By 1870, there were 1,638 national banks and only 325 state banks.

Inevitably, with no Central Bank to provide overnight support, liquidity mis-matches occurred and banks lost faith in each other. Mistrust ruled. Outright deflation hit and stayed for dinner (and beyond) from 1866 right through to 1897. Per capita GDP in the US rose very, very slowly from $ 4,700 to $ 7,200 over thirty long years. Much economic hardship was manifest. As sure as night follows day, bank runs occurred when depositors panicked about the security of their deposits.

There were Banking Panics in 1873, 1884, 1893, 1896, 1901, 1907. Many, many banks failed, people lost their savings and deflationary real estate crashes occurred. This is what life is like without a central bank and with cash currency backed by Gold. In other words, in such a situation, credit money -- created via commercial bank loans -- rules the roost with no effective controls.

But what about the early years of the 19th century? Surely it was a golden era of "sound" money? Gold rushes in the early part of the 19th century triggered mass migrations as people desperately tried to dig money out of the ground. During the early years of the 19th century, there were banking crises in 1819, 1825, 1837, 1847 and 1857.

Almost the entire 19th century in the US were desperate times indeed. It was slowly becoming obvious that a central bank was needed to provide stability to a banking sector in which inter-bank trust was badly damaged.

The concept of "sound" money (backed by Gold) failed to protect the people in the 19th century. The fact is that humans need supervision in regard to money. Banks need to be supervised strictly and have access to overnight capital reserves. A central bank must maintain inter-bank trust and must stop excessive credit creation. Easy to say -- not so easy to do.

HUMAN BEINGS ARE THE PROBLEM -- THEY REQUIRE REGULATION TO MAINTAIN SOCIETAL TRUST

The problem is that human beings run elected governments and central banks. They also run commercial banks. One nation attempted to rid itself of such beasts. It was called the USSR – the Union of Soviet Socialist Republics where there were no elections, no commercial banks and where a lone, all powerful central bank controlled the supply of money. That institution was appointed by a group of unelected tyrants in the Central Committee, unanswerable to the majority of the people. The experiment lasted 70 years. It ended when productivity eventually collapsed in a heap because nobody bothered to do any work, waiting for all their goods and services to be delivered by a benevolent central government. Utopia achieved.

Our governments, our central banks and our commercial banks are all potentially flawed institutions because they contain human beings. Trust in our national money systems and in our national currencies is critical to keep our social system from implosion. The alternative is economic and social chaos.

Beware of anyone who attempts to destroy that trust. BOOM suggests reform as a better pathway, a better discussion.

===================================

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.