BOOM Finance and Economics 22nd September 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

DID WE JUST AVOID A NUCLEAR WAR?

DID THE FED (FINALLY) COME TO ITS SENSES?

OFF TO A GOOD START BUT WHAT NEEDS TO HAPPEN NEXT?

CAN WE ENVISION A BETTER FUTURE?

PSYCHOPATHS ARE THE PROBLEM – THEY RULE THE WORLD

A LETTER FROM TRUMP AND KENNEDY

USED ELECTRIC CAR VALUES HALVE IN 2 YEARS

VW IN TROUBLE? MANY EU CAR MAKERS IN CRISIS

GERMAN EV DELIVERIES CRASHED BY 69 % IN AUGUST

DID WE JUST AVOID A NUCLEAR WAR?

DID THE FED (FINALLY) COME TO ITS SENSES?

Last week was an eventful week. According to various reports from various sources of information, we have learned that there are actually some responsible adults in Washington DC. We learned that they decided not to trigger a nuclear war with Russia. In fact, those adults were not only sane in making such a decision but also apparently aware that the wholesale destruction of many, many millions of people along with the cities of Washington DC, New York, Brussels, London and Berlin was a price too high to pay to “defend democracy”.

The democracy being defended is one where there is an unelected dictator very distant from Washington; President Zelensky, in Ukraine. Some readers may not know that Zelensky’s Presidential term officially ended on May 20th this year. On that date, he was reported as saying that elections can wait, that “now is not the right time” and that it was “irresponsible” to talk about elections.

It is difficult to find out exactly what is happening inside Ukraine. However, it appears that, on 6th May, Zelensky requested a further extension of his Presidency and of Martial Law from the Ukrainian parliament. That was the 11th such extension of martial law in Ukraine and as far as BOOM is aware, it is automatically renewed every 90 days. Such is the state of democracy in Ukraine at present.

However, moving back to the decision to avert nuclear war with Russia, BOOM can say -- better late than never. Perhaps a Peace negotiation may be another good idea?

Then, on Wednesday, the US Federal Reserve (in Washington DC) also discovered adulthood and perhaps some common sense as well. They cut the key US interest rate by 50 basis points, 0.50 %. Hallelujah. There are clear expectations of more to come.

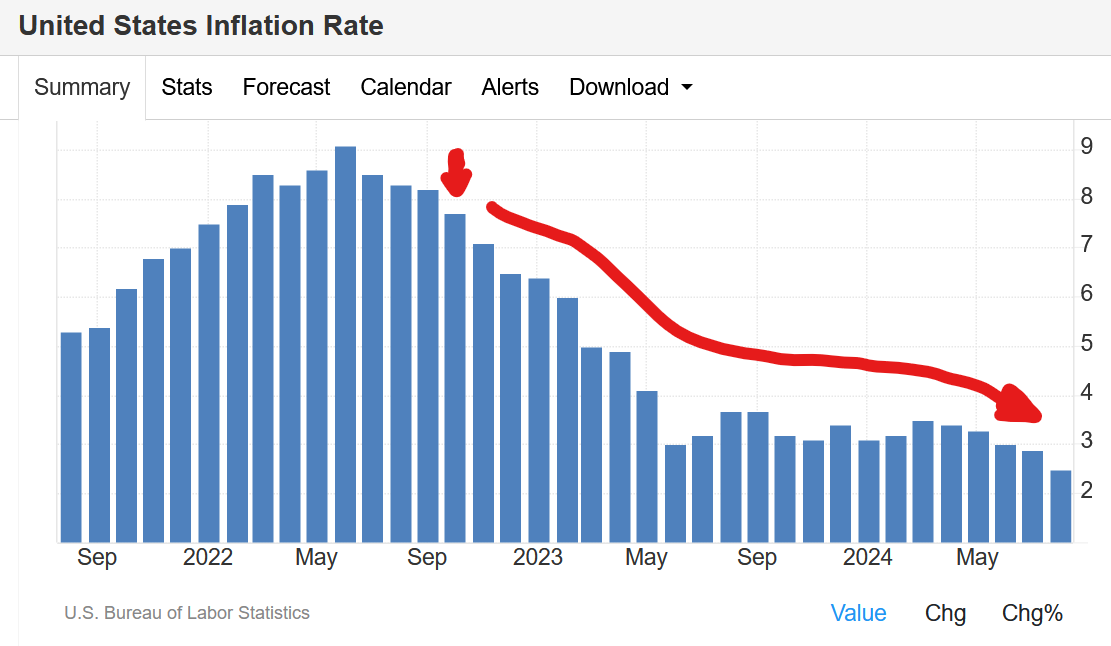

Way back in October 2022, almost 2 years ago, BOOM called the peak of CPI inflation in the US (and globally). So the famous Fed with all its many economic “experts”, took almost 2 years to comprehend the economic situation and lower rates. But, as they say, better late than never.

From BOOM editorial 16th October 2022 -- " the peak of CPI inflation may be in the past … the prices of stocks and bonds should start to rise from here". US stock prices started rising 2 days later and US bond prices started rising 5 days later.

Readers may be able to spot exactly where BOOM made those comments on the three charts presented – for US CPI Inflation, US Stocks and US Bonds.

The small red arrows indicate the 16th October 2022 when the BOOM forecast was made. The large red arrows indicate what has happened in the long run since then.

US INFLATION RATE

US STOCKS --- S & P 500 STOCK INDEX

US BONDS

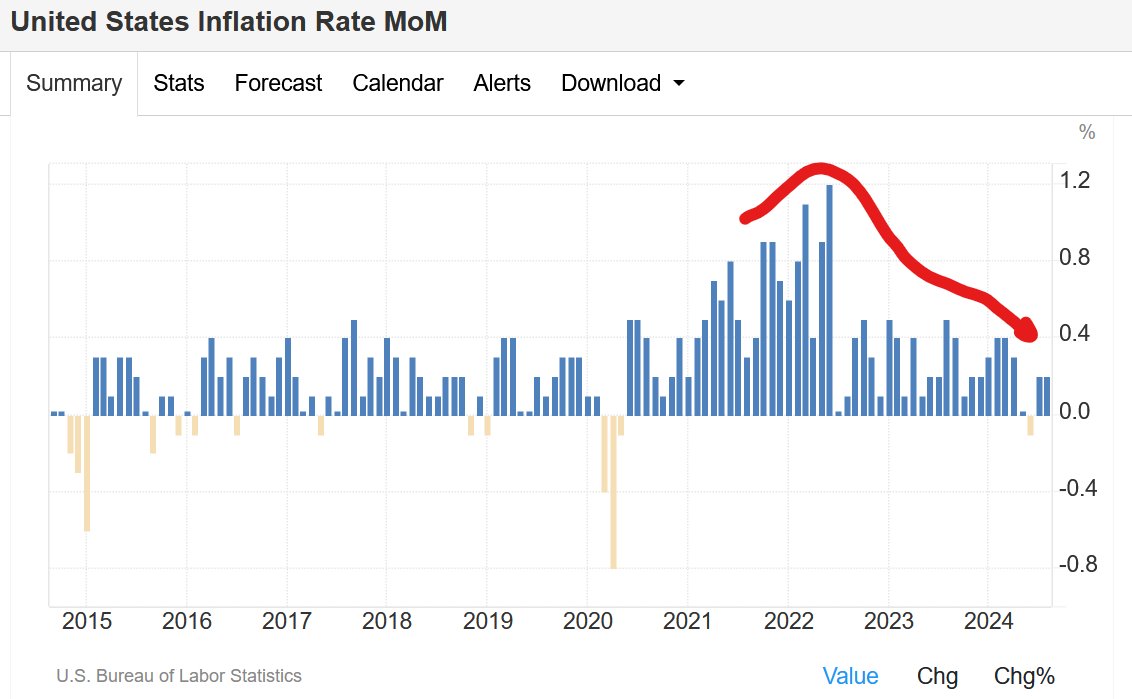

To give readers some context on the decision to lower interest rates, here is a chart showing the long term Month-on-month inflation rates for the US. The Peak of Month-on month CPI inflation clearly occurred in June 2022. And since then it has averaged around 0.25% for two long years. The Fed was cautious through that whole period until last week when the FOMC (Federal Open Markets Committee) decided that interest rates could (finally) be cut.

US INFLATION — LONG TERM — 10 YEARS

OFF TO A GOOD START BUT WHAT NEEDS TO HAPPEN NEXT? CAN WE ENVISION A BETTER FUTURE?

BOOM would describe the events of last week as a good start. After all, avoidance of a nuclear war would seem to be an obviously beneficial decision and lower interest rates in the US will certainly ease the pressure being felt by Americans dealing with an economy that is beginning to mirror that of Western Europe. And The Fed’s decision will provide leadership for other central banks worldwide.

Better late than never ……

Winston Churchill once said -- “You can always count on Americans to do the right thing - after they've tried everything else.”

As BOOM readers will know, BOOM is not a fan of the current crop of leaders of the Western world. So it’s time to use the imagination. A few more things need to happen for the future to become bright and full of hope once again. Let’s draw up a list of imaginary events.

1. A certain Billionaire obsessed with vaccines and new, unproven vaccination technology discovers the joy of sitting quietly while drinking chamomile tea, smelling roses and listening to soothing classical music. He also discovers the joy of listening to other human beings in calm, interesting conversations about a future full of serenity and peace. He sells all his investments in biotechnology and transfers the resultant cash towards more mundane humanitarian quests such as providing sufficient, clean drinking water and adequate sewerage systems to many millions of people on Earth who desperately need these precious resources. Note to Billionaire: There is no profit in any of this.

2. The next thing that needs to happen is for the leaders of the USA, UK, Western Europe (the EU), Canada, Australia, New Zealand and Japan to somehow become shipwrecked on a deserted island with no possibility of communication with the outside world. There, they can dream their Utopian Dreams in peace and quiet all by themselves and without claiming any concern for the benefit of their fellow 8 Billion human beings. Perhaps a few Billionaires can be flown in to assist? With the plane running out of fuel upon landing?

3. And as the world is rejoicing upon receiving that news, perhaps we can discover that a Peace negotiation has broken out between Israel and all of the Islamic nations of the Middle East. Ditto Ukraine and Russia.

You see, a better future is easy to imagine. 1, 2, 3.

PSYCHOPATHS ARE THE PROBLEM – THEY RULE THE WESTERN WORLD

Life could be good on Earth with a bright future if we were to stop listening to psychopaths/sociopaths who are interested only in their seemingly endless quest for power. They hide this quest under a heavy cloak of disguise – always claiming that they are only acting for “the greater good”, that they have “the best intentions” and that they (somehow) “care for the future of humanity”.

Can we have a long, calm discussion about the identification of Psychopathic tendencies in our leaders? Would that be too much to ask?

BOOM will start the ball rolling.

Psychopaths are not mentally ill. They are not “crazy”. They are not rare. The polite term used to describe them is “sociopath”. Psychopaths have easily identifiable characteristics --

They seek Power (with a capital P) and thirst for nothing else

They lack empathy – but they are often charming

They don’t care

They are egotistical

They are narcissists

They are dishonest

They are unreliable

They are untrustworthy

They are manipulative

They are impulsive

They lie, they lie, they lie

So – after identifying them, what can be done? Any experienced Policeman can explain.

These steps apply to society as a whole as well as being personal.

Step 1. Protect Yourself

Step 2. Keep all interactions with them short and to the point. Avoid engaging with them emotionally. Do not give them any personal information or sensitive details.

Step 3. Learn to identify them, their behaviors and understand their tendencies and motivations.

Step 4. Always remain neutral and composed. They are always looking for weakness. Showing emotion can leave you vulnerable to manipulation.

Step 5. Do not try to change them.

To ensure the protection of civil societies into the future, we must begin to identify these people and exclude them from positions of significant power. Psychopaths/Sociopaths are actually quite common and can be found in almost any human institution such as sporting clubs, companies, government departments, non-government organisations, charitable organisations, churches, gardening clubs, knitting circles. But especially, they can be found inside political parties to which they are naturally attracted like moths to a flame. Psychopaths will readily volunteer for positions of power. Why? Because a volunteer can easily disguise their thirst for power by “selflessly” agreeing to work for the greater good.

Power structures are their lifeblood.

So – how can this quest for power be negated? Firstly, societal recognition of this behaviour must become commonplace. Secondly, much of the answer can be found by starting to use Sortition to select leaders and organisers.

SORTITION

Sortition is the selection of public officials at random -- by lottery.

In the democracy of ancient Athens, there were no political parties. Sortition was the traditional and primary method for appointing political officials, and its use was regarded as a principal characteristic of democracy. That may come as a shock to many readers.

In ancient Athens, the birthplace of “Democracy”, nobody voted.

Officials were selected by lottery for positions in governing committees, juries and for the selection of Magistrates. The people of Athens developed complex procedures with purpose-built allotment machines called Kleroteria to avoid any corrupt practices used by oligarchs to buy their way into office.

AN ANCIENT GREEK KLERITERION

In Athenian democracy, magistrates selected by lottery generally had terms of service of one year. A citizen could not hold any particular magistracy more than once in his lifetime, but could hold other magistrate positions.

This was not a perfect society. Only free adult Greek males were enfranchised as full citizens who could hold office. Under a process called Dokimasia, they were examined in an assembly of each district to find out whether a candidate was descended on both sides from Athenian citizens, and whether he possessed the physical capacity for military service. Women, foreigners, children and slaves were not full citizens and they could not vote or hold public office. While Sortition was used for most positions in society, elections with voting were sometimes used to choose military commanders.

Any man without honour or value, who had presumably failed the Dokimasia, was declared “Atimos” and was disenfranchised and disempowered, making him unable to carry out the political functions of a citizen.

Lotteries were also used in medieval Venice, Switzerland and Florence in much the same way.

A LETTER FROM TRUMP AND KENNEDY

BOOM is certainly not a fan of most, if not all, political leaders in the Western world. However, last week, two politicians did demonstrate some good leadership and BOOM is happy to acknowledge that. The two politicians are Donald Trump and Robert F. Kennedy.

These two gentlemen wrote a letter to the people, published on “The Hill”. It is certainly worth reading in full.

Some key excerpts:-

“At a time when American leaders should be focused on finding a diplomatic off-ramp to a war that should never have been allowed to take place, the Biden-Harris administration is instead pursuing a policy that Russia says it will interpret as an act of war.”

“Imagine if Russia were providing another country with missiles, training and targeting information to strike deep into American territory. The U.S. would never tolerate it. We shouldn’t expect Russia to tolerate it either.”

“We need to demand, right now, that Harris and President Biden reverse their insane war agenda and open direct negotiations with Moscow.”

Reference:

USED ELECTRIC CAR VALUES HALVE IN 2 YEARS

The resale values of electric cars (EVs) in the UK are plummeting. The British Vehicle Rental & Leasing Association (BVRLA) has warned that fleet operators, such as car leasing firms and rental companies, are having to sell EVs at a considerable loss. The losses are actually threatening the business model of those companies and thus, their solvency.

The BVRLA said that the typical amount of “residual value” left over at the end of a car’s lease has plunged from 60% to 35%. They gave the example of a car worth £50,000 when new will now drop to £17,500 in value over three years, instead of £30,000. The leasing companies have to suffer these losses.

EV sales are very dependent upon commercial leases for business purposes and government subsidies in most Western, industrialised nations. If the fleet operators start to fail, then the whole industry will collapse. The result will be a huge number of second hand EV’s for sale with few buyers. We can only hope that the manufacturers of conventional internal combustion engine cars (ICEs) will survive long enough to produce sufficient conventional cars to replenish national fleets when it all goes belly-up.

VW IN TROUBLE? MANY EU CAR MAKERS IN CRISIS

Germany’s Volkswagen (VW) is the largest car manufacturer in the world or the second largest, in competition with Toyota for that crown. VW has gone public about the fact that their business is showing signs of acute stress.

In the first week of September, VW said that it could not rule out factory closures and redundancies. It needs to cut a reported €4 Billion ($4.25 Billion) in expenditures in order to maintain profitability.

The board said that the current strategy of offering reduced contracts and severance packages to employees nearing retirement was no longer sufficient to meet the company's targets. They announced the termination of a job security program which has been in place since 1994.

The chief executive Oliver Blume, said "The European automobile industry currently finds itself in a challenging and serious position".

"The economic environment has worsened and new competitors are pushing towards Europe. Germany is falling behind as a competitive location. As a company, we have to act."

VW shares traded on the OTC market in the US have plunged from $ 36 to $ 10 over the last 4 years.

Toyota shares have fared better in the same time period. However, they are now plunging since March this year from $ 255 to $ 160 in early August and are now back to where they were 3 and a half years ago. That share performance is better than VW’s but not by very much.

A recent report published in Just Auto shows that a third of Europe’s major car plants are currently operating at half capacity or less. This is disastrous news for the industry which accounts for over 7% of the European Union’s GDP and more than 13 million jobs. The big companies, such as VW, Mercedes Benz, Stellantis, Renault and BMW, are now producing at less than 50 % production capacity.

Audi, a subsidiary of VW, is considering closure of its Brussels factory, perhaps early in 2025. There was a large demonstration last week in the city by the employees many of whom are employed in electric vehicle (EV) production.

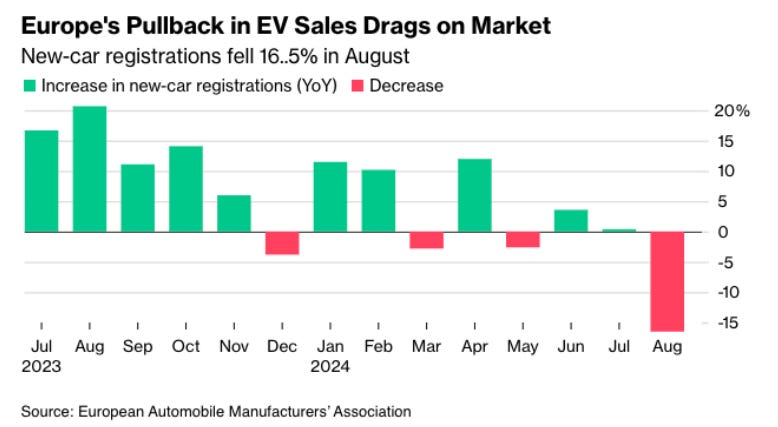

European car companies have two very big problems, lack of sales combined with expensive energy and labour costs. Germany is sliding toward a recession. According to the European Automobile Manufacturers' Association (ACEA), the demand for electric vehicles in particular has crashed.

GERMAN EV DELIVERIES CRASHED BY 69 % IN AUGUST

ACEA reported a 69% plunge in EV deliveries in Germany last month. Across the whole of Europe, there was a 36% drop in EVs and new car registrations in total tumbled 16.5% compared to a year ago.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady