BOOM Finance and Economics 25th August 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

THE END OF THE US DOLLAR BULL RUN FROM MAY 2021?

ASIAN STOCKS IN REVIEW -- ASIA RESUMES BULL MARKET – INDIA THE STANDOUT -- CHINA LAGGING

ABDUCTIVE REASONING EXPLAINED

FALSE POSITIVE RESULTS – THE COVID SCAM

IS THIS THE END OF THE US DOLLAR BULL RUN FROM MAY 2021?

Technically, the US Dollar Bull market that began in early 2021 is now weakening significantly. BOOM expects it to continue to weaken in the coming weeks and months. The Invesco US Dollar Index Fund (NYSE Code: UUP) is shown in the chart above from 2020. It could quickly wash off 12 - 15 % of its current price in the near future in a technical correction. And that could herald the end of the Bull run that began in 2021. If this occurs, it will have an immediate effect on the attractiveness of other currencies and will cause hot investment flows to run into the stock and bond markets of the advanced and developing economies outside the USA. BOOM expects that would especially affect the markets of Asia and Australasia. This would cause a dramatic decline in interest rates right across the maturity spectrum outside the United States. And stocks should surge in response. Only the speed of change and the exact timing are unknowns in such a scenario.

Let’s take a look at the stock markets in Australasia and Asia.

ASIAN STOCKS IN REVIEW -- ASIA RESUMES BULL MARKET – INDIA THE STANDOUT -- CHINA LAGGING

In China, the Hong Kong stock market again showed strength last week while Shanghai stocks wallowed. BOOM’s secret China trade indicator moved sideways, not up, not down. China equities are still in the balance. In BOOM’s opinion, the Chinese government in Beijing must soon encourage individual citizens to invest in their nation’s productive assets. If they do not, the ownership of those assets will inevitably continue to fall into fewer and fewer hands, risking the development of a Chinese capitalist oligarchy. Perhaps that is their aim? However, theoretically, a communist government should not encourage that to happen.

HONG KONG STOCK INDEX — — DAILY — 6 MONTHS

SHANGHAI COMPOSITE STOCK INDEX — DAILY — 6 MONTHS

Japanese stocks have been steaming upwards since the short, sharp correction in early August. In fact, the market has gained over 22% in just 3 weeks. A remarkable achievement. The DOOM and Gloomers have been defeated soundly.

JAPAN NIKKEI STOCK INDEX — DAILY — 6 MONTHS

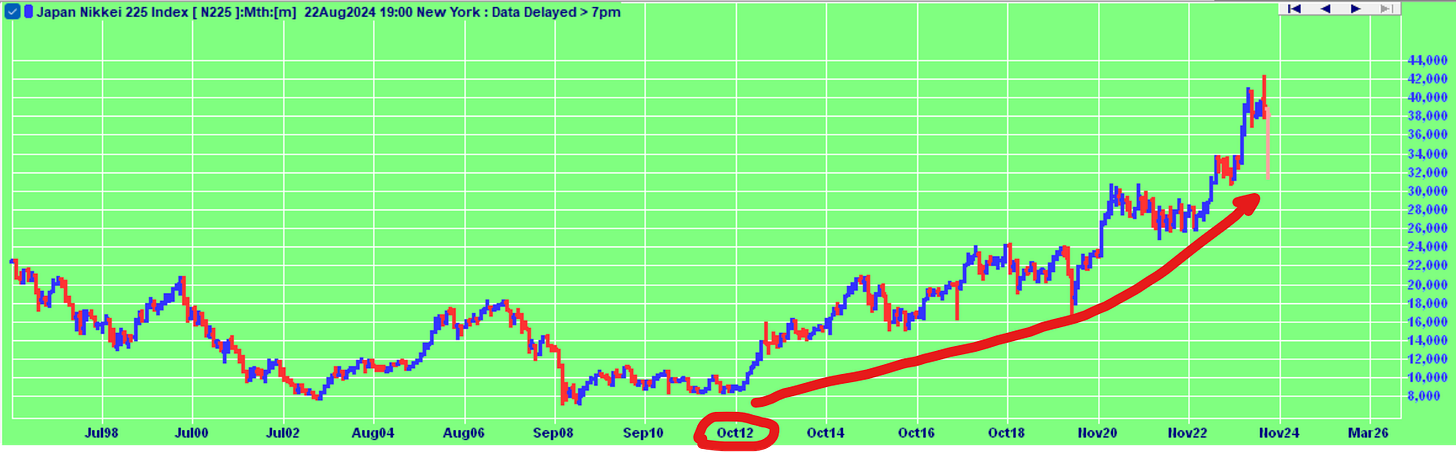

The long term view reveals that Japanese stocks have been in a long, strong Bull Market since 2012 — 12 years of growth.

This chart shows the Nikkei Stock Index since 1998. It has risen from 8,000 in 2012 to 42,000. However, the Japanese Yen has halved in value against the US Dollar since 2007.

JAPANESE YEN ETF (FXY traded in NY) — MONTHLY — SINCE 2007

Malaysian stocks have been super impressive since the early August market test. The Dow Jones Malaysia Stock Index has risen sharply by more than 8 % over the last 3 weeks. Malaysian stocks have been in a bull market since October 2022, having risen by 23 % in that time frame.

MALAYSIA DOW JONES STOCK INDEX — DAILY — 6 MONTHS

Singapore stocks have been in a bull market since April 2020. The Straits Times Index now seems headed for higher ground. However, it has still not recovered its all time High which occurred way back in 2007. Note that it has also recovered strongly since the sharp correction in early August.

SINGAPORE STRAITS TIMES INDEX — DAILY — 6 MONTHS

The Australian stock market has been in an indecisive bull market since the Covid 19 shock in early 2020 although that did not become apparent to investors until October 2023. There was an initial recovery from the Covid-19 panic-demic into mid 2021 which then stalled as Australian State and Federal Governments experimented with tyrannical authoritarianism and outright Fascism bending to the demands of Big Pharma companies, the unelected WHO and other nefarious unelected entities such as the World Economic Forum (WEF) . The citizens were sorely tested during this period by politicians who had lost their minds with seemingly no memory of the elements of a civil society.

However, in October 2022 and again in October 2023, the Bull market began to take shape.

Writing about the United States markets, BOOM saw through the global gloom on October 15th 2022 -- “…. overall, the inflation statistics and retail sales figures were a good result, offering some firm evidence that the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here”

And on 5th November, 2023, BOOM wrote --

“In summary, BOOM is expecting US investors to become more aggressive here in buying all financial assets. If so, a new Bull market especially in stocks but also in bonds will be confirmed”

AUSTRALIAN ALL ORDS COMPOSITE STOCK INDEX — WEEKLY — 5 YEARS

New Zealand’s stocks have been volatile since the Covid-19 shock in early 2020 during the term of Jacinda Ardern’s radical, damaging Prime Ministership where tyranny and totalitarianism threatened the nation. However, since October 2022, there has been a steady return of investor confidence. The Dow Jones New Zealand stock index is still a long way below its peak in late 2021 so the confidence may well be fragile unless the nation can regain its democratic principles and its sanity. The dalliance with totalitarianism, terror and tyranny must be put well in the past for this nation to regain its prosperity. The current government however does not show any signs of assisting in such a recovery as far as BOOM can tell from afar so the Jury is still out. This nation is in peril.

NEW ZEALAND DOW JONES STOCK INDEX — WEEKLY — 5 YEARS

The Indian stock market has been on fire since the Covid-19 shock in early 2020. A super strong bull market began way back in 2007 after the now forgotten Global Financial Crisis which was caused by massive US bank fraud and insolvencies.

INDIA NIFTY STOCK INDEX — — WEEKLY — 5 YEARS

The long term chart shows an incredibly strong Indian stock market since 2007.

INDIA BSE SENSEX INDEX — MONTHLY SINCE 1998

ABDUCTIVE REASONING EXPLAINED

Last week, BOOM referred to Abductive reasoning towards the end of the editorial and promised to revisit the subject this week.

There are three forms of reasoning – Inductive, Abductive and Deductive. Induction is the generation of hypothesis from observation. Deduction is absolute certainty, often mathematically precise.

Abductive reasoning is sometimes called abduction or abductive inference. It is a form of logical inference that seeks the most probable conclusion from a set of observations. Probability analysis is at the very core of this problem solving method. It was formulated and advanced by the American philosopher and logician Charles Sanders Peirce in the latter half of the 19th century.

Unlike deductive reasoning, abductive reasoning yields plausible conclusions but does not definitively verify them. There is always an element of doubt. The Abductive process itself does not eliminate uncertainty or doubt. Conclusions are always expressed in terms such as "best available" or "most likely". Some people call it “best fit”.

Inductive reasoning is essentially the generation of hypotheses as possible solutions to a problem. That is the end of induction which draws general conclusions that may (or may not) apply.

Abductive conclusions are much more specific and confined to the particular observations in question. But that is not the end of the process. Abductive reasoning moves to testing in order to sort through the various possible conclusions and then arranges them in a list based upon probability. More testing is then conducted to improve the process. By repeating this process of testing, the list of possible conclusions or solutions is refined and arranged in order. If a mathematically precise solution becomes apparent, the list can then rapidly devolve to just one answer. That then becomes a Deductive conclusion where certainty takes over from probability.

Diagnostic expert systems frequently employ abduction. Good doctors of medicine are especially skilled in it. The famous mythical and fictional problem solver, Sherlock Holmes, used it to solve crimes. In fact, some people call abductive reasoning “Sherlock Holmes logic”.

The American philosopher Charles Sanders Peirce introduced abduction into modern logic. Over the years he called such inference hypothesis, abduction, presumption, and retroduction.

In medicine, abduction is a component of clinical evaluation and judgment. The Internist-I diagnostic system, the first Artificial Intelligence system that covered the field of Internal Medicine, used abductive reasoning to converge on the most likely causes of a set of patient symptoms that it acquired through an interactive dialogue.

In intelligence analysis, analysis of competing hypotheses and in Bayesian networks, probabilistic abductive reasoning is used extensively. Similarly in medical diagnosis and legal reasoning, the same methods are being used, although there have been many examples of errors, especially caused by the base rate fallacy and the prosecutor's fallacy.

When using Abductive reasoning, it is very important to be acutely aware of the possibility that false assumptions may result in the formulation of false hypotheses and false conclusions. And when employing tests to allow improved probability assessments, it is equally important to be aware of the possibility of false positive results or false negative results.

FALSE POSITIVE RESULTS – THE COVID SCAM

We have seen an example of False Positivity during the Covid-19 Epi-Panic where PCR Tests were used unwisely as diagnostic tests.

When performing PCR (Polymerase Chain Reaction) tests to determine the presence or absence of genetic material of a virus, it is necessary to amplify any genetic material that may be present in a biological sample. Each amplification cycle potentially doubles the volume of genetic material that may be present. The inventor of PCR, Karry Mullis, said that no more than 28 – 30 Amplification Cycles should be done. The reason? Because with each amplification cycle, the chance of accidentally finding minute amounts of genetic material increases. After 30 cycles, the chance of a False Positive is very much increased and with each subsequent cycle, the chance increases dramatically. Many diagnostic labs around the world were instructed by government “experts” to do 40 – 45 amplification cycles during the Covid Epi-Panic. That is unwise in the extreme.

That many cycles would have inevitably boosted the False Positive rate. Some analysts state that the rate rose to 90 – 95 %, guaranteeing huge numbers of “cases”, resulting in a “Casedemic”. Exaggerated panic and fear was the outcome.

During 2020, while the media and governments were conducting their massive Covid-19 horror and fear campaigns, the “Casedemic” numbers boomed. In retrospect, we can now look at the overall death numbers from 2020 and we can see that, in most nations, there was no excess death phenomenon during that year of the “fearful once in a century pandemic”. We can now look back and see that it was all constructed from an epidemic of False Positive PCR Tests.

We actually witnessed a Pandemic of Lies and Tyranny, not death. Even today, some “experts” in the mainstream media still say “millions of deaths” occurred from the “horrible virus” in a “pandemic of death”. Others say that “millions of lives were saved by the Covid vaccines”.

BOOM now sees mainstream media stories routinely referring to “26 million deaths from Covid” during the so-called “pandemic”. THAT number is a lie.

Perhaps 7 million excess deaths occurred globally either from Covid-19 or with False Positive PCR Tests. There are no large autopsy studies available to verify the facts. If the False Positive Test rate was 90 %, then we can say that perhaps 1 million of those may have actually died from the SaRS-CoV2 virus.

Reference: Worldometers.info 704,753,890 Cases 7,010,681 Deaths in Total

https://www.worldometers.info/coronavirus/

The numbers can be contextualised by remembering that 10 million people die EVERY year in just one nation, India. That is 200,000 Funerals per week. And 12 million die in China. Overall, globally, around 60 million deaths occur annually on average — over a million funerals EVERY WEEK. Death is an ever present phenomenon and the years 2020 - 2022 were not extraordinary in that regard.

If no PCR Tests were conducted and 1 million people had died around the Globe from Covid throughout the entire “pandemic” period, nobody on the street would have noticed. If the Panic and Fear campaign had not been launched by governments and the mainstream media, life would have gone on as usual with the hospitals and funeral operators taking care of business as usual.

There is a lesson to learn here ……

False Assumptions and False Positives must never be used again to impose governmental tyranny. Lies must be exposed through open debate and analysis.

If we don’t learn this lesson, the future will inevitably be one of Totalitarian dictatorship run by a misguided technocratic priesthood of psychopaths.

Beware. Be on guard. Civil society and democracy has been put at risk.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady

BOOM has developed a loyal readership over 5 years on other platforms which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Thanks for reading BOOM Finance and Economics Substack! Subscribe for free to receive new posts and support my work.