Elon -- The US Government is NOT a household -- 3rd November 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

Elon — The US Government is NOT a household

ELON – NATIONS DON’T GO “BANKRUPT” — (!)

Last week, Elon Musk made this statement --

“If I had full power to take action, I would balance the budget immediately,” adding that the government urgently needs to stop spending more than it brings in.

He was also reported as saying at a Trump rally -- "Just the interest payments on the debt are 23% of all federal tax revenue." Later, he called the situation a "financial emergency" on X. "The interest payments now exceed the Defense Department budget, which is $1 trillion a year. That's a lot of money."

“And if it’s not done, we’ll just go bankrupt.”

SOME FACTS — US Federal Government total Taxation revenues for 2023 were US $ 4.5 Trillion. In 2023, the US government paid $ 658 Billion on Net Interest to cover the National Treasury Issuance. That equates to around 14 % of total taxation revenue. NOT 23 %.

A media outlet reported --

"I think we can do at least $2 trillion, yeah," Musk told Howard Lutnick, the chief executive of Wall Street giant Cantor Fitzgerald who is also heading up Trump's transition team, when asked how much he could "rip out of" the budget.

"Your money is being wasted," Musk said, as reported by Bloomberg. "We’re going to get the government off your back and out of your pocket book."

ELON – NATIONS DON’T GO “BANKRUPT”

Nations do not apply for loans from banks to fund their deficit spending. They do not collateralise their assets in bank loans. They issue Treasury Securities to willing investors. In rather rare circumstances, usually in developing nations with unwise economic management, some nations can default on their Bond contracts although this is extremely unlikely for the US Government.

Banks do not put nations into “bankruptcy”. Nations don’t “go bankrupt”.

Over the last 40 years, the total of top 10 Sovereign Debt Defaults was almost $ 600 Billion. However, almost half of that was Greece’s default in March 2012. So the majority of defaults in that time period (excluding Greece) totals approximately $ 330 Billion.

Total Global Debt (public and private) exceeds well over $ 300 TRILLION. So, the sovereign defaults (excluding Greece) over 40 years are equal to just 0.1 % of the total. If we include the Greek fiasco, it is about 0.2 %.

TOTAL SOVEREIGN DEBT DEFAULTS (EXCLUDING GREECE) OVER 40 YEARS ARE EQUIVALENT TO JUST 0.1 % OF TOTAL GLOBAL DEBT.

TOP 10 SOVEREIGN DEBT DEFAULTS (Source: Visual capitalist)

On 15th September, BOOM summarised the US Government’s financial position concisely --

“….. in 2023, the US government paid $ 658 Billion on Net Interest to cover the National Treasury Issuance of US$ 33.88 Trillion. This is an interest cost of around 2 %. However, bear in mind that $ 7 Trillion of the Total Debt is “Intra-Governmental Debt” (owed to itself).”

The US government's Bureau of Economic Analysis (as of Q3 2023) estimates annual total government expenditure of $10,007.7 Billion ($ 10 Trillion). Thus, the Net Interest payable to cover the Nation’s Treasury Issuance is about 6.5 % of total expenditure and 14 % of total federal taxation revenue.

So the US is not about to “go bankrupt”. It can easily cover the interest payments due to US Treasury investors. It is not “insolvent”. And there is no National Sovereign Debt Crisis.

You can see these numbers calculated every day for yourself at the US Treasury website called “Debt to the Penny”.

SPENDING IS NOT “OUT OF CONTROL”

Total Government spending in the United States measured as a percentage of GDP was last recorded at 34.4 percent of GDP in 2023. The all time high of 47 % occurred, believe it or not, in 2020 during Donald Trump’s Presidency – according to the US Bureau of Economic Analysis.”

DONALD – GET SOME GOOD FINANCE ADVICE - PRESIDENTS DO NOT MANAGE A HOUSEHOLD BUDGET

If Donald Trump wins the Presidency next week, BOOM would advise him to ignore Musk’s comments on the need to “balance the budget”. The US Government is not managing a household budget. It is a sovereign nation with a population of over 300 million people, an Annual GDP of US$ 27 Trillion. And its annual spending compared to GDP of approximately 33 % has been the average over the last 25 years.

In that time, the nation has not “gone bankrupt”, its currency has not weakened – in fact, it is as strong as ever as measured against other national currencies. And it has not suffered any persistent catastrophic CPI inflation. Its annual CPI inflation rate has averaged between 2 – 3 % during that period.

US Dollar strength since 2019

(US Dollar Index Fund UUP)

SO WHAT IS MUSK SAYING? AND WHY IS HE SAYING IT? — A COMMON MISTAKE

Musk is making a common mistake. Many people make the exact same mistake, including poorly informed economists and sensational financial commentators.

They think that a Government has to manage its financial affairs as if it is a household. And that is not the case.

The US Government is NOT a household.

Elon is essentially an engineer. He may know how to build things such as rockets, cars and tunnels. But he is not an expert on financing Governments. That is plainly obvious. If Trump were to act on Musk’s unwise financial advice and cut US government spending rapidly by $ 2 Trillion, then the US economy would head rapidly into a crisis of massive proportions.

A $2 Trillion cut would amount to a decrease in government spending of about 20 %. That spending could not be quickly replaced by consumer or corporate spending and the US economy would start to falter quickly.

ARGENTINA SHOWS THE WAY

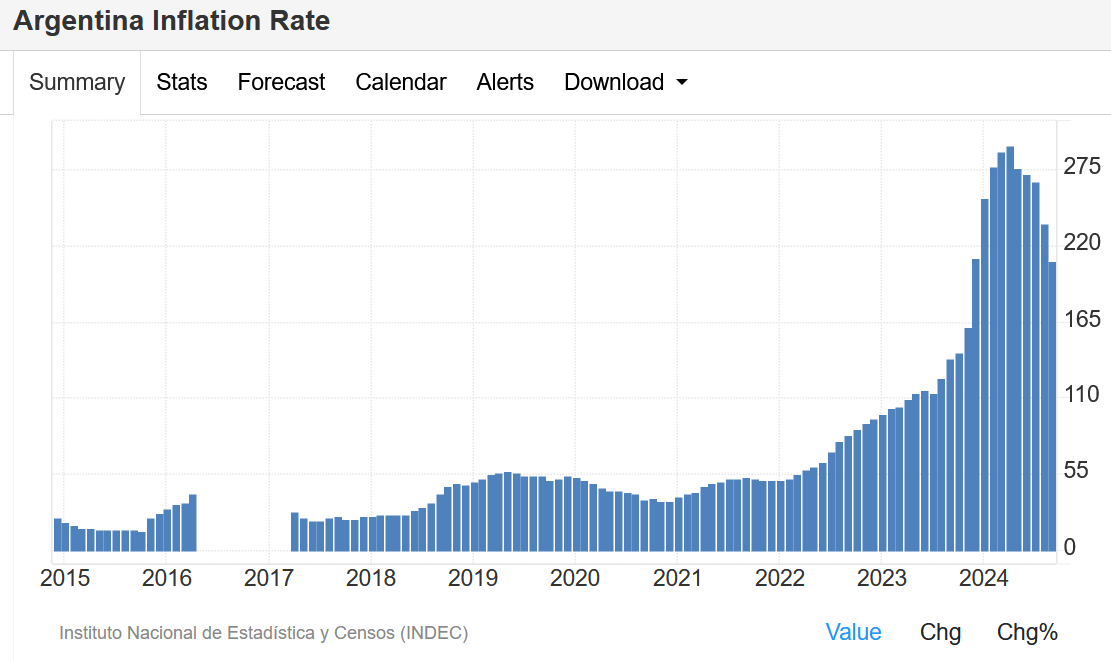

Over the last 12 months, Argentina has embarked on such an experiment. This has resulted in CPI inflation rates of 200 – 300 % and the Argentinian currency has collapsed. The consequences for many of the people of Argentina are poverty, malnutrition and starvation.

Since Javier Milei's takeover of the Presidency, the Argentine currency has collapsed in international buying power from US $ 1 = 364 Pesos to US $ 1 = 988 Pesos. And he is effectively selling Argentina's productive capacity to foreign investors at bargain basement prices. The Stock market has surged from 390,000 to 1,872,785. That is a huge Asset Price Inflation.

The CPI inflation rate is over 200 % and was as high as 300 % a few months ago.

Argentinians holding US Dollars in any quantity are experiencing a bonanza – a Hyper Deflation event. Argentinians holding Pesos as their savings are devastated by Hyper Inflation of prices and may well be unemployed as well.

The threat of poverty, homelessness and hunger are now an ever present reality for millions of Argentinians.

Argentina is Latin America's third-largest economy. It is an agricultural powerhouse. It is a key producer and exporter of soybean, corn, and wheat. Yet a growing number of Argentinians are struggling to eat and falling into poverty. There are reports of soup kitchens being unable to afford food for the poverty stricken.

Before Milei took over in late 2023, around 17 million people, or 43% of the country’s 46 million population, were living below the poverty line according to a report from the Social Debt Observatory at the Catholic University of Argentina.

A Reuters report from 1st October titled “In Argentina's poverty-hit barrios a food emergency takes hold” described a terrible situation with children now suffering from Scurvy and generalised malnutrition – Quote:

“In Argentina's poor barrios a food emergency is taking hold as poverty rises, with malnutrition on the increase and medics treating children for eye diseases and even scurvy linked to a vitamin-deficient diet.

Years of recessions and high inflation in the resource-rich South American nation have left over half the population in poverty, including around seven in 10 children.

Food insecurity has risen sharply in recent years, and is now being aggravated by a tough austerity campaign under libertarian President Javier Milei, whose new government has slashed billions of dollars of spending as part of a "zero deficit" plan to right the embattled economy.

POVERTY HAS HIT 53 % OF ARGENTINIAN CITIZENS — 18 % ARE IN EXTREME POVERTY — SCURVY HAS BROKEN OUT

Official data last week showed that poverty hit 53% in the first half of the year, up from around 42% at the end of last year. Some 18% of people are in extreme poverty, meaning their household incomes don't cover the cost of the basic food basket.

"We are seeing cases of scurvy, cases of eye injuries due to Vitamin A deficiency, with corneal injuries," said Norma Piazza, a pediatrician specializing in nutrition.

She said some kids were being admitted with neurological issues and convulsions where the only underlying pathology was deficiency of vitamins like B12, indicating a lack of meat in a country that has long prided itself on its beef-rich diet.

ARGENTINA POVERTY

There it is – the consequences of President Milei’s “Zero Deficit” strategy.

Milei thinks he is managing a household budget (!).

And so does Musk.

TRUMP KNOWS NOTHING ABOUT TRADE TARIFFS

Not content with losing a trade war with China when he was President from 2017 - 2021, last week Donald Trump reiterated that trade tariffs might replace income taxes in the US.

Tariffs are charged when imported goods enter a nation. Tariffs are often imposed on inputs, not just on final products. This raises the costs for US based manufacturers and producers. Sounds good?

This idea is foolish and impractical. Why? Because income taxes raised revenues of US$ 2.6 Trillion last year and the total value of imported goods was only US$ 3 Trillion. Trump would have to raise tariffs on all imports by almost 100% to generate the $ 2.6 Trillion of replacement revenue required if he ceased taxation of incomes.

And the tariffs would have to be paid by either the consumer in higher prices or by the importers in lower profits. Both would be disastrous. The former would raise CPI inflation and the latter would harm the profits of many large companies involved in imports and import substitution.

The top US imports are Crude Petroleum ($199B), Cars ($159B), Broadcasting Equipment ($116B), Computers ($108B), and Packaged Medicaments ($91.3B), importing mostly from China ($551B), Canada ($438B), Mexico ($421B), Germany ($153B), and Japan ($137B).

In 2022, United States was the world's biggest importer of Cars ($159B), Broadcasting Equipment ($116B), Computers ($108B), Packaged Medicaments ($91.3B). Motor vehicle parts and accessories ($88B).

Trump simply says that import substitution will occur rapidly because “we can make it all here”.

That is just magical thinking. Almost as magical as Elon saying that he will “balance the budget immediately”.

A CRISIS OF WESTERN LEADERSHIP – A KAKISTOCRACY IN CHARGE

BOOM is constantly surprised by the level of foolishness on display by the political class of the West. These pronouncements by Trump and Musk are yet another example of poor leadership in the Western advanced economies.

Of course, in the US, the Democrats are just as bad, if not much worse. BOOM is absolutely certain that Kamala Harris could not engage in any intelligent conversation about the government deficit or the consequences of increased tariff taxes on imports.

We appear to have a Kakistocracy now in charge of the West with inadequate individuals promoted to ever greater levels of power and incompetence. Is this a sign of terminal decline?

A Kakistocracy is a government run by the worst, least qualified, or most unscrupulous citizens. The word was coined as early as the seventeenth century – so the problem has been identified for a very long time. This is not a modern phenomenon.

The word is derived from two Greek words, kakistos (the worst) and kratos (to rule). It is government by the worst people.

MORE WESTERN FAILURE – GERMANY ON THE SKIDS -- VW IS IN TROUBLE – NOT PROFITABLE – TO SHUT 3 FACTORIES IN GERMANY – MUST CUT COSTS TO SURVIVE

Another example of Kakistocracy? We are now watching a disaster unfold in Germany which is the possible decline and fall of Volkswagen, a huge company that has been an icon of German engineering ever since its foundation in 1937 by the German Labour Front under the Nazi Party and the watchful eye of Adolf Hitler. Hitler’s hero was, of course, the American car magnate, Henry Ford.

Because of the German government’s disastrous policies aligned against cheap Russian energy and the “threat of climate change”, the nation simply cannot continue to be a powerhouse of mass manufacturing. For the first time ever, VW is about to start closing down factories in Germany. German manufacturing production has begun to contract and is unlikely to recover any time soon.

GERMAN MANUFACTURING PRODUCTION

Last week, VW’s Human Resources official Gunnar Kilian said "Volkswagen is at a decisive point in its corporate history. The situation is serious, and the responsibility of the negotiating partners is immense. Without comprehensive measures to restore our competitiveness, we will not be able to afford essential future investments.”

The company issued the following statement -- “Among the reasons for the necessary restructurings is the fact that the European automobile market has shrunk by two million vehicles since 2020. It is stagnating and will not recover in the foreseeable future. Volkswagen has a share of about 25 percent of this market. That means the company is short about 500,000 cars."

"We cannot continue as before. We currently don’t make enough money from our cars, while our costs for energy, materials and personnel have continued to rise. " the CEO, Thomas Schäfer said.

"We are not productive enough at our German sites and our factory costs are currently 25% to 50% higher than we had planned. This means that individual German plants are twice as expensive as the competition."

European carmakers are facing increased competition from cheaper Chinese electric cars.

VW reported a 14% drop in net profit in the first half of the year and was forced to terminate a decades-old job security agreement with unions in Germany.

The company plans to shut at least three factories in Germany while downsizing the remaining production plants in the country.

“Management is absolutely serious about all this,” said Daniela Cavallo, chairwoman of the Volkswagen local Works Council and Volkswagen Group. “This is not saber-rattling in the collective bargaining round.”

High energy and labour costs in Europe, resulting in reduced competitiveness and declining sales, were cited as main drivers for the closures.

The Volkswagen Group employs around 650,000 people at some 114 production facilities in Europe, Asia, Africa, and the Americas. It has 10 manufacturing plants and 300,000 employees in Germany.

Meanwhile, the transition from combustion engine cars to electric vehicles poses a challenge for Germany's automotive sector due to regulations in the country and in the EU. Last week, VW shares dropped by almost 6 %. The trajectory over the last 5 years tells the story for investors.

FIAT MONEY IS NOT “BACKED” SO — IS IT “UNSOUND” MONEY?

Fiat money is mostly created in commercial/retail bank loans to willing borrowers. It is “backed”-- by the market value of the collateralised assets that underlie those commercial/retail bank loans. The exception is physical cash which is not backed by any asset except the reputation of the issuer (usually a nation’s Treasury Department). But fresh new cash is now only 2 % of the new money supply in most Western advanced economies. 98 % comes from bank loan creation.

BOOM IS FACT DRIVEN

BOOM saw a comment last week from a financial commentator on Foreign Holders of US Treasury Securities. It sounded alarming and was designed to create fear in any reader.

“All major State holders of Treasuries have been liquidating them at a frightful pace. Not just China, which has been cutting its holding slowly but surely for years now, but the World’s biggest economies and America’s closest allies. The UK, France, Japan, Zion, Saudi Arabia, all have dumped up to a third of their Treasuries over the last two years.”

BOOM simply checked the facts which are readily available. They are called the “tic data”, published by the US Treasury – Major Foreign Holders of Treasury Securities (T Bonds, T Notes and T Bills). The data is updated and published each month. TIC stands for Treasury International Capital.

At the end of August 2024, the Total Holdings of Treasury Securities in Foreign hands stood at US$ 8,503 Billion ($ 8.5 Trillion).

At the end of August 2023, one year ago, the Total Holdings of Treasury Securities in Foreign hands stood at US$ 7,623 Billion ($ 7.6 Trillion).

Those are the facts. The foreign ownership of US Treasuries has INCREASED over the last 12 months by 10 percent.

If we look at individual nations –

Japan INCREASED its holdings from US$ 1,115.5 Billion to $ 1,129.2 Billion

China (Mainland) DECREASED its holdings from US$ 805.4 Billion to $ 774.6 Billion

China (Hong Kong) INCREASED its holdings from US$ 202.6 Billion to $ 235.8 Billion

The United Kingdom INCREASED its holdings from US$ 627.5 Billion to $ 743.9 Billion

China (Hong Kong) INCREASED its holdings from US$ 202.6 Billion to $ 235.8 Billion

Cayman Islands INCREASED its holdings from US$ 309.6 Billion to $ 419.5 Billion

Canada INCREASED its holdings from US$ 295.1 Billion to $ 365.4 Billion

France INCREASED its holdings from US$ 217.3 Billion to $ 312.2 Billion

Saudi Arabia INCREASED its holdings from US$ 112 Billion to $ 142.8 Billion

The author of the article then launched into a description of the “financial debt crisis that is already happening”. …. “The top five (BANKS) of Wall Street are all insolvent”.

“Bank of America, for instance, bought $500 Billion worth of Treasuries to prop up reserves, and are now faced with unrealized losses of about $100 Billion. JP Morgan, Citigroup, Wells Fargo.”

And then he explained that “that the US Dollar has already lost Reserve Status”.

All of this commentary is counter to the facts. Investors appear to be in love with the big US banks, the US Dollar and the US bond markets.

The US Bond prices are not collapsing. The big US Banks are strongly bought – the US Dollar is strongly bought. The “crisis” must be sometime in the future. As they say “Don’t Look Up” – the meteorite is coming too.

US TOTAL BOND MARKET ETF — BND — AND US FINANCIAL SECTOR SPDR FUND — XLF — LAST 5 YEARS

BRICS – THE NEW BALANCE OF POWER IN THE WORLD?

Last week, BOOM reported on the BRICS Summit meeting in Kazan, Russia. Subsequent to that report, BOOM watched a discussion between Pepe Escobar, an observer of Geopolitics and the Russian writer, Alexander Dugin. Escobar is a Brazilian journalist. Dugin is a controversial figure in the Russian intellectual landscape but is certainly worth listening to.

Readers who are interested in Geopolitics will find the one hour discussion worthy of their time. Such a discussion will never be seen on Western mainstream media. In fact, YouTube has banned the video sometime over the last week. It is, of course, still available on Rumble, a bastion of free speech.

Pepe Escobar v Alexander Dugin | BRICS expansion, de-dollarization, Russia BRICS SUMMIT 2024

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.