BOOM Finance and Economics 8th September 2024 -- a Global Review

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

TURKEY APPLIES TO JOIN BRICS – A MAJOR SHIFT IS UNDERWAY

The big Geopolitical news last week was that Turkey has officially applied to join the BRICS group of nations. This development was reported by Bloomberg and, according to another report from another source, a senior Turkish official had also confirmed that Turkey wants to join the BRICS bloc of economies.

Turkey’s ruling Justice and Development Party confirmed that Ankara has taken further steps to join the China-led BRICS group. “Our president has already expressed multiple times that we wish to become a member of BRICS,” party spokesperson Omer Celik told journalists during a press conference. “Our request in this matter is clear, and the process is proceeding within this framework.”

The BRICS alliance was founded in 2006 by Brazil, Russia, India and China with South Africa joining in 2010. It also now includes Iran, Egypt, Ethiopia and the United Arab Emirates. Saudi Arabia has said it's considering joining and Azerbaijan has formally applied.

Recip Erdogan, the President of Turkey, was quoted as saying … “We don’t have to choose between the European Union (EU) and the Shanghai Cooperation Organization” (SCO). He went on to say … “On the contrary we have to develop our relations with both these and other organizations on a win-win basis.” That is Politi-speak. The application to join BRICS will (probably) lead to a future membership application to the SCO. And that will lead, inevitably, to either a withdrawal from the current (unsatisfactory) relationship with the EU or a permanent threat of withdrawal from the EU application.

The European Union has steadfastly refused Turkey membership for almost 20 years. Negotiations began in October, 2005.

The next logical step would be for Turkey to threaten to leave NATO - the North Atlantic Treaty Organisation. Turkey joined the NATO military alliance in 1952. It is regarded as the second largest military force in NATO after the USA. Any threat to leave NATO would be a step towards a full rejection of the US Dollar Empire and full integration into the Global South.

By using threats to leave the EU Membership process and membership of NATO, while simultaneously joining BRICS and the SCO, Turkey can hold a very significant balance of Global political power.

ERDOGAN AND PUTIN AT SOCHI

In BOOM’s opinion, Turkey’s application to join BRICS is a very significant shift in the Geopolitical landscape. Turkey is moving East. And the reason is clear. If you look at a map of the region, you will see that Turkey is a natural land bridge between China and Western Europe. Thus, it must choose whether or not to become a critical part of China’s Belt and Road Initiative that links China to all nations West of China. For Turkey, this is what the Americans call a “No Brainer”. The decision for Turkey is an obvious one.

MAP – revealing the Geographic importance of Turkey and Ukraine

In fact, a close examination of the map reveals that the other natural land bridge linking China to Western Europe is Ukraine. But Ukraine has shot itself in the foot by not reaching a peaceful settlement with Russia. Therefore, Turkey is by far the most suitable candidate for this purpose.

BRIDGE TO THE BALKANS

Turkey is also the land bridge to the Balkans which includes ready access to the following nations -- Albania, Bosnia and Herzegovina, Bulgaria, Greece, Kosovo, Montenegro, North Macedonia, Romania, Serbia, Croatia and Slovenia. Hungary, Slovakia and Austria are also all close by geographically. The strategic significance of Turkey’s geographic position cannot be overstated.

BOOM has written about China and the Balkan Peninsula previously.

Back on February 18th this year and on 7th March 2021, BOOM referred to the enormous potential of the Balkans in an Editorial titled “CHINA AND THE BALKAN PENINSULA – RESOURCES, CONSUMERS AND LABOUR”.

On 7th March 2021, BOOM wrote -- “China has a demographic problem with insufficient labor now and in the future. This was caused by a big economic mistake that China made known as the One Child Policy which spanned 35 years from 1979 to 2015. This caused a labour shortage of about 30 - 50 Million over the next 2 decades. Maybe more.”

BOOM again from 2021: “This demographic policy mistake has resulted in a delayed labour shortage inside China and a gap in domestic consumer demand. The Chinese government is aiming to solve this problem by using labour forces in places like the Balkans. There are easily 30 to 50 million well educated, under employed people in the region. The unemployment in those areas is terrible. China’s relationship with Greece is the first big step. They own the port of Piraeus in Athens and they have established a commercial banking operation there with a banking license.”

“China’s expansion into the Balkans will give them millions of future consumers and an educated workforce close to Western Europe. But it is not just the labor force and the future consumption that China is interested in. The Western Balkans, in particular, is richly endowed with mineral resources such as copper, chromium, lead, zinc, gold, lithium, antimony, selenium and nickel. It boasts some of the largest deposits in Europe. There are a number of already existing mines producing copper, nickel, zinc and gold in the region which provide a useful footprint of mining activity. Infrastructure is relatively good, and the workforce is skilled and educated, especially compared with some other mining target regions. In Serbia, for example, there are no restrictions on foreign ownership or government participation or restrictions on flow of capital.”

Looked at from a China perspective, Turkey is a key trade and investment ally and a very significant critical land bridge.

As far as BOOM can see, the West has essentially now lost Turkey to the East, the Belt and Road, the BRICS group and the Shanghai Cooperation Organisation. Their current membership and influence in NATO will place Turkey at the very centre of the Geopolitical balance of power.

NORDSTREAM PIPELINE AND UKRAINE A STRATEGIC DISASTER FOR THE US DOLLAR EMPIRE

Interfering politically and militarily in the Ukraine from 2014 onwards has become a strategic disaster for the USA and Western Europe. In the short term, it has boosted US weapons sales enormously but that is almost certainly a Pyrrhic victory in the long run.

A major tactical disaster was the decision to destroy the Nordstream pipeline. BOOM has previously described that as the worst tactical move in history. But that blunder is closely followed by the recent, ill conceived advancement of the Ukrainian military inside Russia at Kursk.

Who knows what is really happening inside Kursk? The Russian President Vladimir Putin said last week that Ukraine had suffered heavy casualties in the Kursk Region. He said the Ukrainian attempt to disrupt the Russian military with the massive attack across the border last month had back fired.

”Our military has stabilized the situation and is now gradually pushing the opponent from the border territories. More importantly, there is no resistance to our advancement [in Donbass],” he explained. “The opponent has weakened itself on the key axis by moving those relatively strong and well-trained units to the border areas.”

On Wednesday, the Russian Defense Ministry estimated that Ukrainian casualties in the Kursk operation had surpassed 9,700 troops. Kiev has (reportedly) also lost 81 tanks, dozens of other armoured vehicles, hundreds of cars, and multiple heavy weapons according to the Russians.

If this is true, then the Kursk operation by Ukraine is already a major military defeat. Ukraine and its supporters can continue to claim it as an “embarrassment” to Putin but relentless Russian pragmatism will not be swayed by such claims. They always counter such arguments with “just look at the scoreboard”. Winter is approaching and the Russians have maintained their stranglehold on Eastern Ukraine and have increased their missile attacks on critical infrastructure around Kiev and Lviv.

All of NATO’s efforts in the Ukraine conflict are driving more and more cooperation between Russia, China and all the nations associated with the BRICS group of nations and the nations aligned with the Shanghai Cooperation Agreement.

VENEZUELA STOCKS SKYROCKET

When citizens lose faith in their currency, the safety of their bank deposits, the protection provided by their justice system, their political system or their political class, they may turn to buying assets as a way to either preserve and/or increase their wealth or to maintain their spending power. If they cannot own real assets such as land and buildings, then they will look to whatever other assets they can own. Financial assets are an obvious target. Those assets may be inside their nation or outside if capital movements across their border/offshore are allowed.

These dynamics are present in Venezuela today. The stock market there is in skyrocket mode.

Here is the chart for the BURSATIL STOCK INDEX SINCE 2012.

During the first week of January in 2022, the Bursatil Stock Index was trading around 5,800 points.

It is now trading at 95,947. In just 32 months, it has risen by 90,000 points and has doubled in price 4 times.

However, please note what is happening to Venezuelan money.

Note that, in September 2022, one US Dollar could buy 8 Venezuela Bolivars (currency). Today, it buys 36 Bolivars. The Bolivar has depreciated.

Venezuela introduced a new currency, the Sovereign Bolivar (the VES), on August 20th 2018, in an attempt to curb hyperinflation and economic crisis in the country. The new bolivar was initially anchored to the Petro, an oil-backed digital cryptocurrency.

However, the USD/VES spot exchange rate specifies how much one currency, the USD, is currently worth in terms of the other, the VES on the open market (if you can find one).

For those in Venezuela holding US Dollar savings, it is a bonanza. For those holding the national currency, it is a disaster. This is what happens in Hyperinflation events. One currency is abandoned while the other skyrockets in purchasing power. A small group of citizens become super rich while the majority are rendered destitute. Real asset prices will eventually collapse due to a lack of borrowers/purchasers and the insolvency of banks. Commercial bank failures then follow as sure as night follows day. Their loan books will be in tatters. Then the price of financial assets (such as stocks) will collapse. Severe social unrest is the inevitable next step and then serious violence will erupt.

VENEZUELA SOCIAL UNREST

None of this should ever happen. No government should ever allow free circulation and acceptance of a foreign currency. If it does, it is committing treason against its own people. This is what has happened in Argentina for many decades. The People have been robbed by their political class. Corruption at the highest levels of government mixed with dreams and promises of a socialist nirvana have effectively destroyed the nation. Gross mismanagement of the money supply is at the very heart of the tragedy.

The Chart shows the rise and rise of the US Dollar against the Venezuelan Bolivar since 2020. In other words, it shows the decline in global purchasing power of the Bolivar versus the US Dollar. Such a dramatic fall will, inevitably, cause CPI inflation. The current annual CPI inflation rate in Venezuela is 43.6 %.

THE CRYPTO STORY CONTINUES – IN ECUADOR AND BOLIVIA

The Ecuador Central Bank (BCE) has warned citizens about the dangers of using or investing in Cryptos. These are sometimes referred to as “crypto currencies” although they have none of the features of a national currency and are perhaps best described as “digital assets” or maybe “digital commodities”. As BOOM recently wrote, they are much more akin to Casino Tokens.

The BCE stated that cryptoassets “are not legal tender” in Ecuador. It reminded citizens that the use of any Crypto as a means of payment method is “expressly prohibited”.

The bank noted that per the guidelines of the Government’s regulatory authority, the Junta de Política y Regulación Monetaria (Monetary Policy and Regulation Board), “the [only] legal currency in the Republic of Ecuador is the US Dollar”.

“All transactions, monetary, and financial operations and their accounting records carried out in the country must be conducted in United States dollars.”

From the BCE Website:

QUOTE: On the basis of article 94 of the Monetary and Financial Organic Code (COMF), the Monetary Policy and Regulation Board (JPRM) issued Resolutions No. JPRM-2022-005-M, 11 February 2022 and Nro. JPRM-2023-015-M of 9 August 2023, which state that the legal tender currency in the Republic of Ecuador is the United States dollar. Therefore, all transactions, monetary, financial transactions and their accounting records, carried out in the country, shall be expressed in United States dollars.

In June 2024, the American company Chainalysis published a study called the 2023 cryptocurrency Geography Report, which states that Latin America received about 7.3% of the total value of these digital assets worldwide, between July 2022 and June 2023. According to this study, Ecuador would be in eighth place within the region, depending on the value received in these assets, between June 2022 and July 2023, which would represent approximately USD 7 billion.

Finally, we warn citizens that the negotiation of cryptoactives could generate large losses due to their high volatility resulting from their speculative character, as has recently been evidenced by the significant falls in their contributions in international markets. UNQUOTE

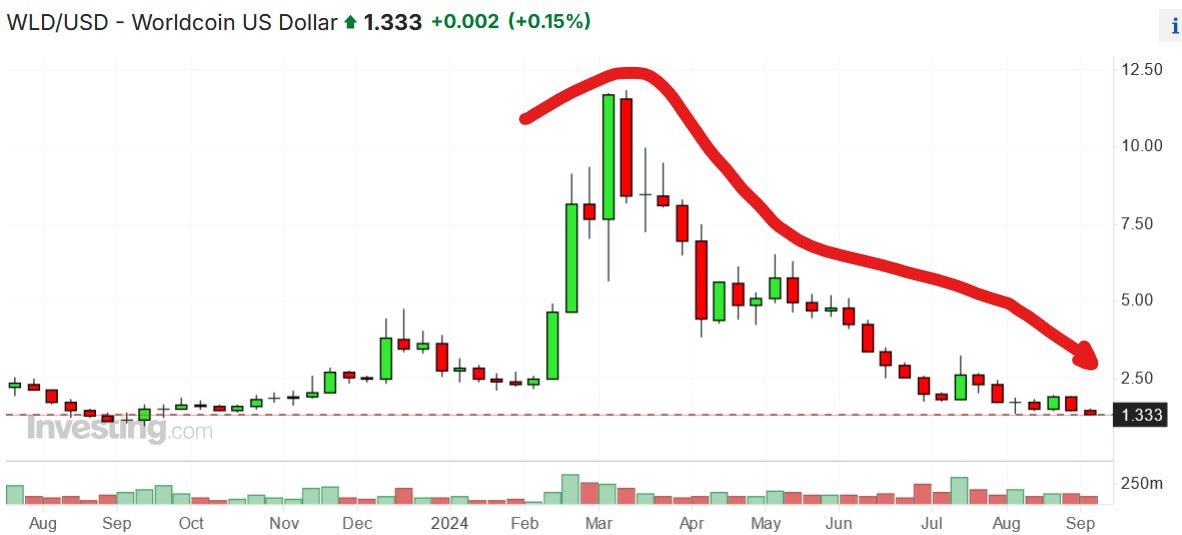

The central bank and the monetary regulator are concerned about the recent arrival in the country of Worldcoin “representatives/promoters”. Worldcoin (WLD) is a Crypto that has had a wild ride in price over the last 12 months. The price has risen from below $ 2 to $ 12 and has then collapsed back to $ 1.33 – all over the last 12 months.

WORLDCOIN CHART -- WLD

(from investing dot com and sourced from the Binance exchange)

From an official Central Bank of Ecuador (BCE) statement -- “several thousand” citizens have scanned their irises at Worldcoin offices around the nation.

In BOOM’s opinion, surrendering your Biometric Identification Data for a few US Dollars is sinister and unwise. But desperate citizens in Ecuador will (apparently) do anything for US $ 20.

On August 6, Ecuador’s Superintendency of Companies, Securities, and Insurance said it was “concerned about news circulating in the media and social media networks about irregular activity carried out [by] Worldcoin.”

The Superintendency said Worldcoin was not regulated by the Ecuadoran state and said that it encouraged citizens “not to hand over” their biometric data.

BOLIVIA AND CRYPTO

Recently, the Central Bank of Bolivia lifted its ten-year ban on Cryptos. Banks can now handle Crypto transactions, but Cryptos are not recognised as legal tender, meaning they can’t be used for everyday purchases. Businesses are not required to accept digital currencies, but people are free to buy and sell Crypto tokens between themselves.

The central bank, Banco Central de Bolivia, published an Economic and Financial Education Plan to teach the public about Cryptos, pointing out the pitfalls.

BITCOIN PRICE AND CASINO TOKENS

The most well known Crypto is, of course, Bitcoin. Its price has been in downtrend since early March. There is still considerable doubt about whether this downtrend is just a temporary consolidation of price action before a resumption of uptrend or the beginning of a longer and more significant downtrend.

This is the Weekly Chart for Bitcoin expressed in US Dollars over the last 2 years on the Bitfinex Crypto exchange. Chart taken from investing dot com as at the time of writing this editorial on 8th September 2024. Coinmarketcap dot com is another source of exchange information.

The price of all Cryptos varies from day to day, hour to hour and minute by minute. Trading never stops (theoretically) unless there are no buyers and sellers willing to exchange and accept national currencies for Cryptos. Thus, Cryptos are essentially tokens where wealth can be stored and then traded and transferred back to national currencies (usually via a Stablecoin transaction). Casino Tokens can (and do) perform the exact same function.

When participants surrender their national currency for a Casino Token, they are trusting that the owner and operator of the casino will be willing and able to reimburse them with national currency upon demand. If the operator ceases trading or registers for bankruptcy, then this trust will have been revealed as foolish and broken. The holder of any Tokens will then join the long line of creditors, hopefully awaiting reimbursement at the same value at which the initial transaction took place. That destiny however will, of course, be in the hands of the administrators of the casino bankruptcy.

Purchasers of Cryptos are in a more tenuous position however as the Crypto exchange they use is essentially in the wild West of (almost) lawless Cyberspace and (probably) operating in a foreign jurisdiction located a very long way away. Crypto Tokens can rapidly devolve to Zero in value in such a situation. And the national currency funds exchanged to buy them in the first place will have (probably) been whisked away to some unknown foreign jurisdiction long before formal bankruptcy appears for the exchange.

There are now more than 2.4 Million Crypto Tokens being traded on Crypto exchanges worldwide, 24 hours a day, 7 days a week.

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics at Substack

By Dr Gerry Brady