Elon and Donald - Increase Cash - Cash can be an Economic Policy Instrument - How to Cut the Deficit and the National Debt - MAKE CASH KING AGAIN

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive and for long term archive -- Visit LinkedIn and/or Wordpress https://boomfinanceandeconomics.wordpress.com/

ELON AND DONALD — INCREASE CASH – CASH CAN BE AN ECONOMIC POLICY INSTRUMENT —

HOW TO CUT THE DEFICIT AND GET THE AMERICAN ECONOMY HUMMING — MAKE CASH KING AGAIN — THE BANKERS WILL HATE YOU ELON – BUT THE ANSWER IS TO PRINT MORE CASH (!!)

Last week, BOOM issued a strong warning to Elon Musk (and Donald Trump) to be wary of radical ideas about “balancing” the US Budget immediately by reducing government expenditures and the deficit by $ 2 Trillion. These ideas were stated by Elon Musk in an interview prior to the election and revealed a poor knowledge of government finances. He even went so far as to suggest that the US Government was close to “bankruptcy”.

Elon may be a good engineer but these statements reveal a woeful lack of understanding in regard to how the US government finances its budget deficit and how it runs its expenditure programs.

BOOM was not the only commentator who reacted to Elon over those ambitions. The Australian economics Professor Steve Keen issued a powerful Twitter post that was (correctly) titled “Elon is Wrong”. Steve is a big fan of engineer Elon but he showed how rapidly reducing government deficits is a terrible mistake in economic management and, if that policy is taken to its ultimate manifestation, will eventually lead to economic collapse. He was able to demonstrate that by using his latest (excellent) computer model of the money system in an advanced economy. That model has been in development for over 20 years and is now a mature representation of money movements within an economy using double entry bookkeeping methodologies to keep track of the money flows. Prof Keen also showed that economic stability is the outcome over time if budget deficits are used wisely.

BOOM encourages readers to watch the fascinating video presented by Steve Keen after reading today’s BOOM editorial.

"Elon Musk Is Wrong" Top Economist Warns

(if short on time, skip forward to the 3 minute mark)

Link: https://x.com/ProfSteveKeen/status/1853520089217421745

In last week’s editorial, BOOM gave the example of Argentina where the newly elected President Javier Milei has embarked upon a dramatic, shock reduction in government expenditures and deficit reduction. Milei’s policies have resulted in currency collapse, CPI hyperinflation (measured in Argentine Pesos), CPI hyper-deflation (if measured in US Dollars), poverty, starvation and malnutrition – all in a nation of vast resources and huge agricultural output. Many children are now suffering from Scurvy. It will be a very long road back from this economic collapse to economic stability for the people of Argentina. Many decades will be required while Javier Milei will have been personally rewarded for the whole mess.

This week, BOOM is going to explain to Elon and Donald how to

(1) cut the National "Debt"/Issuance of Treasuries in America,

(2) maintain Government Expenditures at current levels and

(3) still maintain a strong US economy with

(4) no CPI inflation impact and

(5) no currency effect.

PHYSICAL CASH CAN BE A POWERFUL POLICY INSTRUMENT

The answer lies in the recognition of Physical Cash as a powerful economic policy instrument of great potential value in the management of any modern economy.

Physical cash (notes and coins) is Sovereign, non-interest bearing, does not depend upon the emergence of willing borrowers, is a perfect counter-balance to the dangers of excess private credit money creation (private bank loans) and allows the government’s Treasury department to play a complementary role with the central bank in the money supply function.

WE HAVE A MONEY SUPPLY MONOPOLY

Currently, after many decades of reduction in the use of physical cash, most advanced Western economies have wound up with the banking system holding a stranglehold monopoly on the supply of fresh new money. That monopoly is now causing major economic distortions with the prices of existing homes in many nations moving to levels that are simply out of reach for the average new family to afford. Even China with its centrally controlled, Potemkin Village distributed banking system has been affected by this economic scourge.

This distortion has happened because the housing stock of any nation is the most easily collateralized asset upon which to create excess amounts of fresh new credit money (bank loans).

This has resulted in the banking system being in control of and the source of 98 % of the money supply in most advanced economies. In fact, we are now faced with the grim economic reality where the creation of fresh new physical cash from the Treasury has declined towards only 2 – 3 % of the money supply at origination. House price super inflation is now a major problem in almost all advanced economies especially in the USA, Australia, the UK, China and many parts of Western Europe. Japan is an outlier due to its peculiar demographics and lack of immigration.

Money is like water for the economic garden. If you were managing a farm replete with vegetables, grain crops, and feed stock for animals, would you hand over the control of your water supply to a committee of non-farmers sitting in the centre of a far flung city?

Or would you (wisely) build your own dam, catch the rain water and then manage the distribution of that water to areas of the farm in most need, depending upon demand? BOOM suspects that you would build the dam.

Most governments have overseen the steady erosion of sovereign cash usage in their economies without realising the economic damage this has caused. Their economies have become hostage to the banking system. This is a modern phenomenon. Things were different not so long ago.

In the post war period, the banking system was in disarray after World War Two with credit demand at very low levels due to borrowers being traumatised by the massive death toll (60 Million) and property damage combined with the huge social and economic disruption that resulted from the global war effort. Governments globally had little choice but to use physical cash in large volumes. They paid all their employees with cash. And so did private enterprise.

WHEN CASH WAS KING

Cash was King in the 1950’s and 1960’s. All employees were paid weekly (or fortnightly) with an envelope containing their pay in Cash notes and a statement confirming their PAYE taxation contribution (Pay as you Earn) and occasionally some other Government levies e.g. for national security insurance or government supplied healthcare. They were able to spend the cash immediately at any and all merchants and they could deposit the remaining cash into their bank accounts as savings. Utilities collected their revenues from post offices or at designated government offices. The economy received a giant boost to the money supply every week in physical cash, usually on a Thursday or a Friday.

Companies, factories and large government departments had huge safes where the cash was stored. And the transport of cash became a large industry. Cash was King.

Slowly but surely, nations began to recover over the 1950’s and 1960’s and confidence in the future slowly returned. With confidence came increased borrower demand, a baby boom and a built up demand for money which was supplied by the banking system in mortgages to build new homes. Economic expansion returned to the Western economies in the 1960’s and 1970’s and computerised bank ledgers helped. As credit money growth exploded, CPI inflation broke out and peaked in 1981.

Since then, CPI inflation has been progressively tamed to some degree by central banks but asset price inflation has provided ever higher prices for real property and stocks.

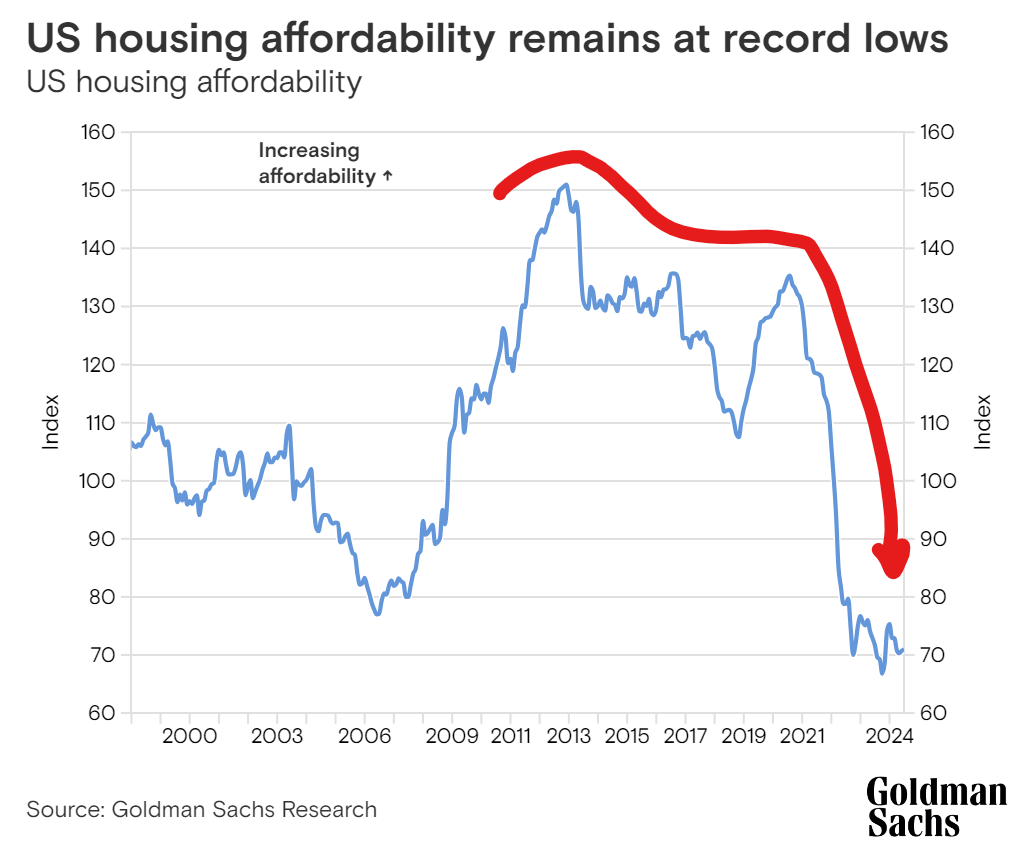

US HOUSING AFFORDABILITY – over the last 10 years, house affordability in the US has dropped dramatically as prices have risen. This phenomenon is seen in many other nations as well.

Cash has been ignored as a policy tool and we have wound up with a money creation monopoly held by the commercial/retail banking system with 98 % of the fresh new money generating interest payments because it is created as bank loans (to borrowers).

ASSET PRICE INFLATION WITH EPISODES OF CYCLICAL CPI INFLATION

This has resulted in the persistent slowing of the velocity of money in the real economy, cycles of troublesome CPI inflation and cyclical economic recessions.

Why? Because most of the new credit money being created is being put to work in Asset Price speculation.

This results in asset price inflation with episodes of cyclical CPI inflation. The central bank then raises interest rates to keep a lid on CPI inflation and the rest is well known history. The economy slows, CPI inflation falls, asset prices fall (or stagnate) and then the cycle repeats.

VELOCITY OF MONEY FALLING FOR 25 YEARS

CYCLES OF CPI INFLATION AND ECONOMIC RECESSIONS

HOW CAN WE BREAK THIS SEEMINGLY ENDLESS CYCLE OF ASSET PRICE INFLATION WITH CYCLICAL CPI INFLATION?

THE ANSWER IS TO USE MORE CASH IN THE REAL ECONOMY.

MAKE CASH KING AGAIN – BUT FIRST THE HYPOTHETICAL SCENARIO

Physical cash can come from the Treasury’s Mint straight into the real economy via Government expenditures. It would have a buffering effect on excessive private credit creation and would not be inflationary if it simply replaced government expenditures mediated via digital money transfers.

Let’s look at the wages and salary costs of Government in the US economy.

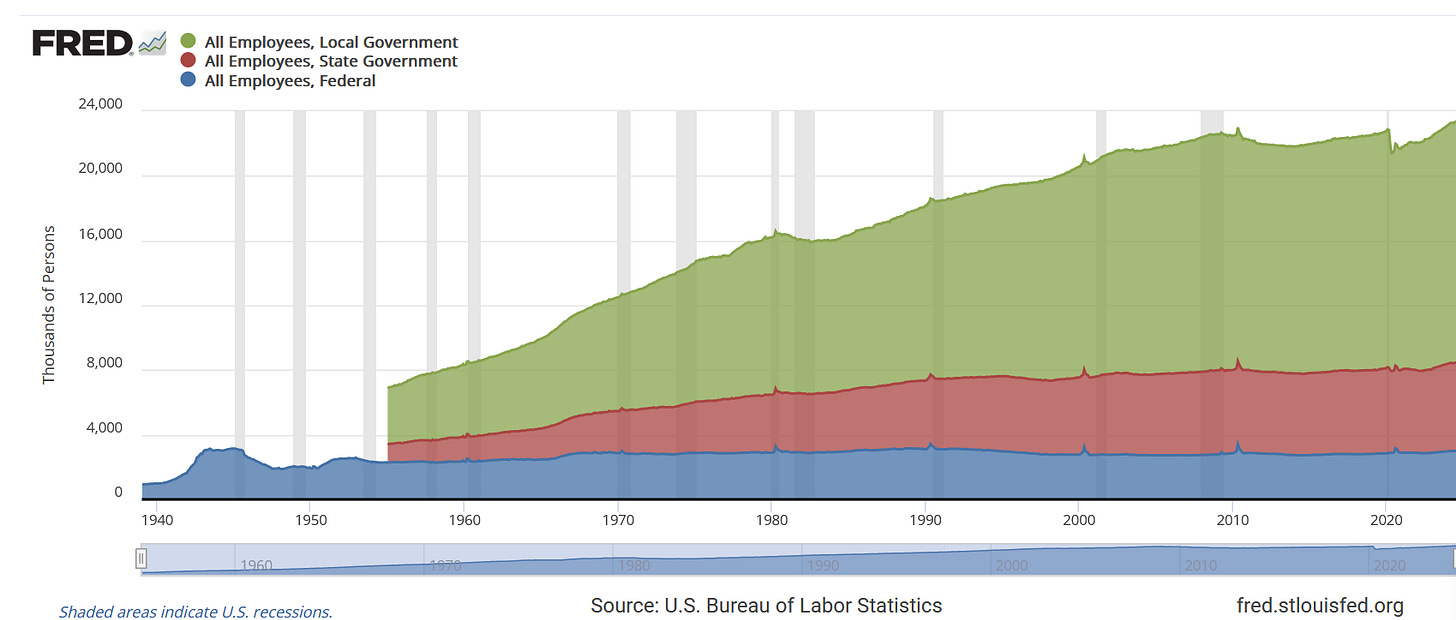

GOVERNMENT EMPLOYEE NUMBERS

Federal Govt = 3 Million

State Govts = 5.5 Million

Municipal = 15 Million

Total Govt Employees = 23.5 Million

Let’s assume an average annual wage/salary/cost to the Government of $ 100,000 per employee. And let’s assume that there are only 23.5 Million people being paid by the various US governments (a gross underestimate, by the way).

There are many non-employee citizens reliant upon government funding e.g. social security pensioners etc.

Using that assumption, the total annual expenditure on US Government employees is roughly equivalent to 23.5 Million X 100,000 = $ 2,350,000,000,000

That is $ 2.35 TRILLION

Now what is stopping US governments from paying all of those employees in physical cash?

NOTHING.

The US Government could easily pass an Act of Congress which directed all government employees to be paid in cash weekly.

Within 12 months, $ 2.35 Trillion of physical cash would have been injected straight into the real economy. No interest charges would be generated from this policy, there would be no increase in the Government Bond issuance (the National ”debt”) and the total budget deficit would be reduced by an equal amount. Treasury issuance of T Bonds, Bills and Notes would be reduced by that same amount.

Much of the cash would be used by the government employees to pay for day to day living expenses but much of it would be deposited into the banks as savings.

There would be no decrease in government expenditure, no boost to CPI inflation, no effect on foreign currency exchange rates and the National deficit would be decreased.

The goals of the strategy would have been met.

(1) the National "Debt"/Issuance of Treasuries would be cut

(2) Government Expenditures would be maintained at current levels

(3) the US economy would not be negatively impacted

(4) there would be no CPI inflation impact (CPI inflation may even fall) and

(5) no currency effect.

RADICAL? YES – BUT AN ILLUSTRATION OF THE POWER OF CASH

THE BANKERS WILL HATE YOU ELON – BUT THE ANSWER IS TO PRINT MORE CASH (!!)

Such a radical example of change in money origination is for illustration purposes only. BOOM is not suggesting that this should be done immediately. Such a dramatic change would have to (obviously) be introduced gradually. There would be resistance but that could be lessened if the purpose of the policy was carefully explained to government employees and the central bank.

BOOM’s intention here is to illustrate, admittedly in a rather blunt and crude way, the power of physical cash as an instrument of government finance. This lesson has been progressively forgotten over the last 70 years as digital money transfers have replaced cash transfers.

Yes, digital transfers are convenient and relatively secure. However, despite much effort, central banks have failed to create electronic cash (CBDC’s). BOOM has been at the forefront of stopping CBDC’s and is still very opposed to their development for many reasons. Without electronic cash, all digital forms of money must inevitably be originated as credit money from bank loans and must generate an interest cost. Government Treasury securities must also generate an interest cost.

Physical cash, produced by the Treasury’s Mint, is very different indeed.

So, Elon – tell Donald Trump to print CASH and ignore the screams of “it will cause terrible inflation” which will come from the ignorant economists and financial doomsters.

DEMOCRAT KAKISTOCRACY COLLAPSES -- GERMAN GOVERNMENT COLLAPSES

In last weeks editorial, BOOM was again highly critical of the leadership of the advanced Western economies – the Kakistocracy.

Trump’s massive win in the election is a decisive move away from the divisive, identity driven, threat ideology politics of the Democratic Party. That is, indeed, a good thing but the Kakistocracy cannot be defeated by a single election. It will continue in the US under Trump but to a lesser extent.

BOOM has often singled out Germany as being a prime example of poor quality in the political class. That has reached its obvious peak of idiocracy and the German coalition government has finally fractured. A Federal election will ultimately have to be held. This is another good thing.

The German government has been captured by ideologues for far too long. The “threats” of global warming and “Putin” have been grossly exaggerated and the bizarre responses to the Covid “threat” in Germany were disturbing with the nation falling rapidly towards fascism and totalitarianism.

TRUMP HAS TO MAKE A FEW CALLS ON THE FIRST DAY

In early January, Donald Trump will be sworn into office as the 47th US President.

BOOM expects that he will then make a few quick calls on his first morning in the Oval Office.

1. To Vlodomir Zelensky – “No more weapons, we will assist in Peace negotiations”

2. To Benjamin Netanyahu -- ““No more weapons, we will assist in Peace negotiations”

3. To the head of the Department of Health and Human Services – “You’re fired”

4. To the head of the FDA -- “You’re fired”

5. To the head of the CDC -- “You’re fired”

6. To the head of the FBI -- “You’re fired”

7. To the head of the CIA -- “You’re fired”

8. To the head of the Department of Defense -- “You’re fired”

9. To the head of the Department of Justice -- “You’re fired”

10. To the head off Department of Homeland Security -- “You’re fired”

11. To the head of the National Security Council -- “You’re fired”

12. To the head of the Homeland Security Council -- “You’re fired”

13. To the head of the Council of Economic Advisers -- “You’re fired”

14. To the head of the White House Office -- “You’re fired”

Then he will fire all of the other heads of the White House Office --

After lunch, he will make a few more calls. But his first day in the Oval Office this time will be well organised and efficient. In his last Presidency, he had no knowledge of the power game in Washington and was urged to appoint many people who worked against him in office. Destructive Neocons were amongst them.

Hopefully, that naivety is now gone. BOOM will watch closely to see who he appoints this time.

BOOMING RUSSIAN GAS EXPORTS – PIPELINES AT MAX CAPACITY THROUGH UKRAINE

A recent report on Russian gas flows caught BOOM’s eye last week. Apparently the pipeline network that takes the gas from East to West through Ukraine is operating at maximum capacity.

This was reported in the Vedomosti newspaper with the source quoted as the Russian energy company, Gazprom. Russian gas also flows to the West via the Turkstream pipelines.

Last month, the Agency for the Cooperation of Energy Regulators (ACER) said the share of Russian liquefied natural gas (LNG) in the EU market had reached 20% this year, growing by 6% compared to 2023.

All of this is occurring as the Ukraine war rages. BOOM has this to say about that. MMMmmm ……

INTEREST RATES CUT IN USA AND UK

Last week, the Bank of England and the Federal Reserve in Washington DC both lowered their key interest rates by 0.25 %. BOOM called the peak of CPI inflation TWO YEARS ago —

On 16th October 2022, BOOM wrote -- "the inflation statistics and retail sales figures were a good result, offering some firm evidence that the peak of CPI inflation may be in the past. If we are past the peak, then the prices of stocks and bonds should start to rise from here". US stock prices started rising 2 days later and US bond prices started rising 5 days later.

The central banks have been overly cautious ever since. There are many BOOM readers inside those banks but, unfortunately, Group Think is dominant and the wheel turns very slowly. They hesitated to raise rates when the surge in CPI inflation occurred in early 2021 and they hesitated to lower rates when the peak was obvious in late 2022. In fact, the Federal Reserve waited 12 months (after the CPI surge in early 2021) before raising rates and 24 months (after the CPI peak in late 2022) before lowering rates.

The charts illustrate where the CPI surge began and where the Fed began to raise rates (12 months later).

US INFLATION RATE

US FED FUNDS RATE

BOOM wonders what all those PhD economists are doing in all those central banks around the world.

They have never understood the importance of using Physical Cash as a monetary policy instrument.

They have stuck to the “Loanable Funds” theory of how banks operate when it is clearly incorrect and when the Bank of England and the Bundesbank has told them so.

They have indulged in cautious Group Think.

They have delayed (for long periods) making monetary policy adjustments.

This amounts to (almost) complete failure of their economic theories, their economic models and their monetary actions.

Perhaps all those economists could be replaced by BOOM?

In November 2008, at the height of the Global Financial Credit Crisis, the British Crown, Queen Elizabeth, spoke at the London School of Economics. She described what was happening as “awful” and she asked the now famous question —

“Why did nobody notice it?”

In response to the Queen, the UK Financial Services Authority made the following statement some time afterwards.

"We've widely acknowledged that the regulatory approach before the financial crisis in 2008 was flawed and has since been completely changed.”

THAT is clearly not the case and we are 16 years on from 2008.

Here are BOOM’s suggestions for the central banks of the world —

Please understand the importance of using Physical Cash as a monetary policy instrument. Increase cash in circulation in the real economy ASAP

Abandon the “Loanable Funds” theory of how banks operate. It is clearly incorrect according to public statements and explanatory videos from the Bank of England and the Bundesbank

Abandon cautious Group Think. Adopt vigorous debate and consult with the real economy

Do not delay in making monetary policy adjustments. Small adjustments, frequently made are better than slamming on the brake and the accelerator.

Until next week …………..

In economics, things work until they don’t. Until next week, make your own conclusions, do your own research. BOOM does not offer investment advice.

ALL SUBSTACK EDITORIALS ARE AVAILABLE AT BOOM SUBSTACK ARCHIVE. https://boomfinanceandeconomics.substack.com/archive

ALL PREVIOUS EDITORIALS ARE AVAILABLE AT BOOM ON WORDPRESS.

https://boomfinanceandeconomics.wordpress.com/

BOOM Finance and Economics is also available on LinkedIn

https://www.linkedin.com/in/gerry-brady-706025157/recent-activity/articles/

Sources: BOOM uses charts from Trading Economics, Incredible Charts and Stockcharts. Investopedia is useful source for financial definitions.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.