No Need to Pay Back the US National Debt - The Nation Will Not "Go Bankrupt" - Sovereign Debt Defaults are RARE - Bond Markets 101 - Central Bank Independence

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive. The Archive can be Searched -- https://boomfinanceandeconomics.substack.com/archive

“WE CANNOT PAY BACK THE DEBT” — ”THE NATION WILL GO BANKRUPT” — ALL FALSE

BOOM is tiring of the many, many voices in the alternative media and in the mainstream media who act as “experts” and who catastrophise about the “overwhelming debt burden” of all Western nations, especially the USA, as if this is some imminent societal threat.

Many predict the collapse of nations “under the weight” of their sovereign debt obligations. Some predict the collapse of entire Western economies and the global financial system. Others predict a crisis “ending in “hyperinflation” or “in civil war”. It has become fashionable (over decades) to say that “the US Dollar will collapse”. But it never does. And Elon Musk, who has no background in high level national or global economics or finance says that “America will go bankrupt”.

Most of this is fantasy rather than fact. The most daft comments that are often heard are these — “We will never be able to pay it back”, “how can we ever pay it back?” and “our children and grand children will not be able to pay it back”. That is usually followed by a statement such as “they will become enslaved in their own country”. Poor things ……

Calls to “balance the budget” (!) or “we must aim for a budget surplus” (!) are equally intellectually bankrupt and, quite frankly, moronic. It implies that a government must tax excessively, above its spending requirements. BOOM does not wish to see Governments becoming profit centres. But that doesn’t stop political parties going to elections with these as Banner Policies. For example, the Treasurer of Australia’s current Federal government is proudly aiming for a third annual budget surplus. Does madness create more madness? Hysteria about the US “Debt Ceiling” also runs rampant and has done for years but the “ceiling” is always raised (just in time) when reality dawns.

Some of these “experts” blame the central banks. They think the central banks are populated by evil geniuses that have malevolently been “printing too much money” and that they are “out of control”. By the way, BOOM has never seen a genius in charge of a central bank but that fact is conveniently ignored. Some prominent central bankers cannot control their waistlines, let alone enslave the entire planet.

In particular, the US central bank, the Federal Reserve, is often seen as the arch global enemy because it has private institutional shareholders while most other central banks do not. Calls to “End the Fed” are common but they make no sense whatsoever unless they are accompanied by calls to open the central bank to ownership by all citizens — which, by the way, is not a bad idea — or that it should be 100 % owned by the government (which is the case in most other nations, but not all).

Is BOOM the only voice of reason in this wilderness of poor analysis?

NATIONAL DEBT DOES NOT HAVE TO BE PAID BACK - SOVEREIGN DEBT DEFAULTS ARE RARE

The first thing to understand is the fact that the vast majority of nations do not have to “pay back their debt”. In fact, it is arguable that no nation ever has to pay back its sovereign debt because it is most often rolled over at maturity by the investors. And, even in a worst case economic collapse scenario, a nation can simply default on its debt obligations by not paying the interest due and then negotiate a settlement with its creditors.

The largest default on Sovereign debt that has ever taken place in history was in Greece following the Global Financial Crisis of 2008/2009 — otherwise known, more correctly, as the Great American Crisis of Outrageous Banking Fraud. By the way, that fraud occurred in the commercial, retail and investment banks of the US, not in the central bank. In fact, the “geniuses” in the Fed did not see it coming (!).

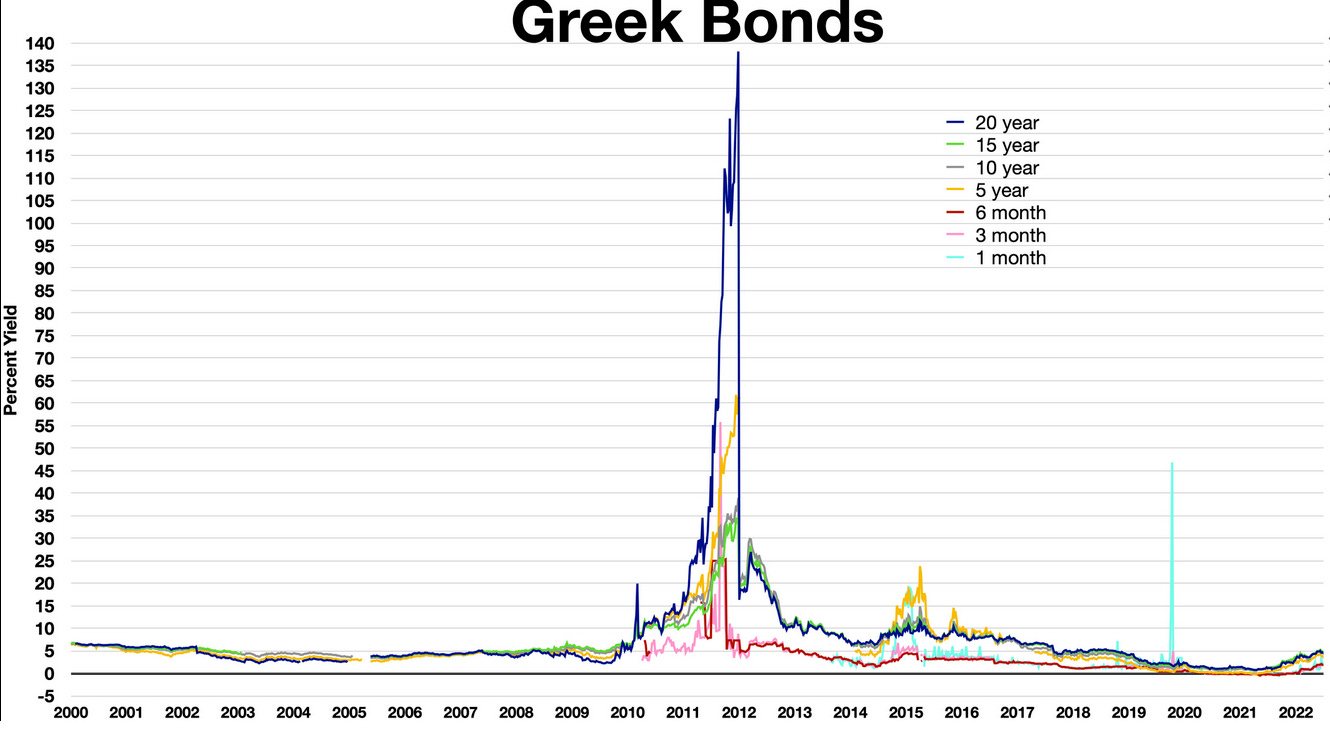

Let’s look at Sovereign, National Debt Defaults. This chart shows what happened to the Yield on Greek National Bonds during the greatest sovereign debt default in history. The 20 Year Bond yields went above 135 % (!!). So, of course, the interest payments to the bond investors ceased. By the way, most of those investors were large European banks, investment banks and institutional funds.

Surely everyone died in Greece?

Surely they starved to death?

Surely all Greeks ended up living on the streets?

Surely Greece as a nation ceased to exist? Ahhh … no …… none of that happened.

The private bondholders established a Private Creditor-Investor Committee which in turn appointed a Steering Committee to negotiate a restructure of Greece’s sovereign debt. The Steering Committee held many discussions with Greece and its advisers, with the European Financial Stability Facility (EFSF) and the European Central Bank, the IMF (International Monetary Fund) and the EU Commission. Slowly but surely the reality of capital losses were negotiated and shared between European public and private stakeholders in toto.

A detailed explanation is available here for readers who seek a full understanding.

https://globalrestructuringreview.com/review/europe-middle-east-and-africa-restructuring-review/2017/article/overview-restructuring-of-greek-sovereign-debt

TEN LARGEST NATIONAL DEBT DEFAULTS

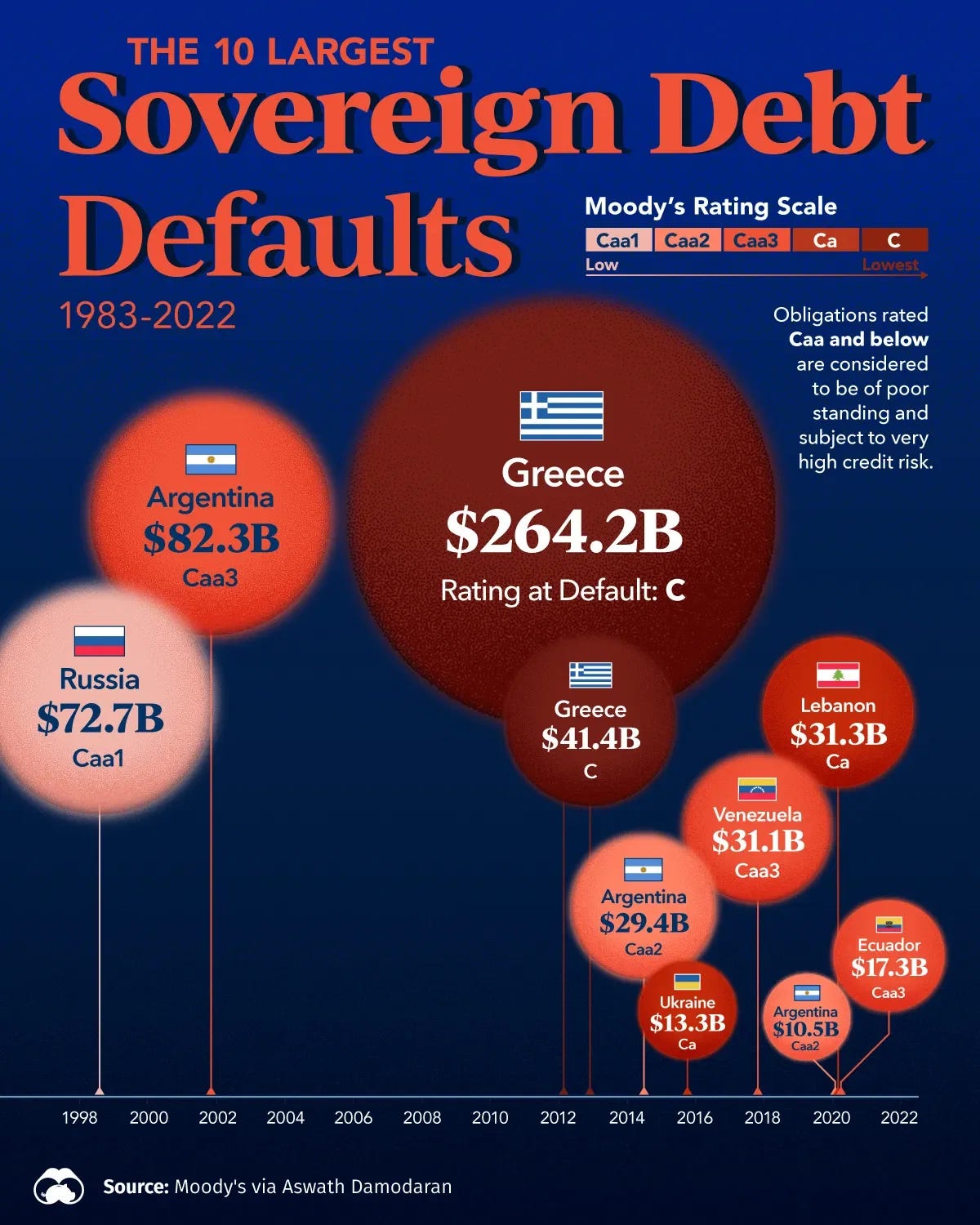

Here are the largest (Top 10) Sovereign Debt Defaults in history expressed in US Dollars. The diagram is from Visual Capitalist and covers the top 10 largest National Debt Defaults from 1983 to 2022.

The Greek government default in 2012/2014 was the largest by far at US$ 264.2 Billion plus $ 41.4 Billion for a grand total of US $ 305.6 Billion.

To put that into perspective, Total Global Debt (currently) is around $ 300 TRILLION ($ 300,000 Billion). So the Greek Government Sovereign Debt fiasco — the largest in history — was equivalent to 0.1 % of the total of global debt.

Mmmm … that doesn’t sound so bad, does it?

The Grand Total of all top 10 Global Sovereign Debt Defaults from 1983 to 2022 is $ 593.5 Billion. That means that Greece was responsible for about half of that.

NATION STATES DO NOT APPLY FOR BANK LOANS

Nation states are not individuals or families indebted to banks that can bankrupt them and seize the collateral assets. Nation states operating advanced western economies with floating exchange rates for their national currency are effectively immortal beings financially. They don’t go to a bank begging for a loan to help them buy a home. They don’t have a credit card debt. They certainly don’t go to the banking system in a panic for a loan to cover their deficit spending when their taxation revenue runs out.

To cover their expenditures above taxation revenues, nation states go to the financial markets in Europe, the United States and Asia and offer securities to global investors. These securities are most often called Bonds but sometimes they may be referred to as “Bills” or “Notes”. But — they are essentially pieces of paper (digital these days) upon which is written the contractual terms of the Security agreement. No collateral assets are offered to secure the contract. Investors can invest of their own free will and will, quite naturally, invest for a fixed return and a very low risk of default. They may (obviously) require higher interest payments on bonds issued by nations whose economy is under stress and vice versa. In most circumstances, investors will be paid higher interest rate payments (called coupons) on longer term bonds at issuance compared to shorter term bonds.

What Is a Bond Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

SECONDARY BOND MARKETS

Then there are secondary markets for national bonds where any holder can sell out at any time before maturity. In those markets, other investors can opt to buy those bonds, especially if they are expecting interest rates to fall in the future. If interest rate settings rise nationally or globally, bond prices will fall in the secondary market. And vice versa. Why? Because investors can sell out and buy new bonds issued with higher interest rates attached. And vice versa — if interest rate settings fall globally or nationally, bond prices will rise in the secondary market. This is why Bond yields rise and fall on the secondary market.

From Investopedia — Like stocks, after issuance in the primary market, bonds are traded between investors in the secondary market. However, unlike stocks, most bonds are not traded in the secondary market via exchanges. Rather, bonds are traded over-the-counter (OTC). There are several reasons why most bonds are traded OTC, but chief among them is their diversity.

From Faster Capital — The factors that affect the bond prices and yields in the secondary market, and how investors can use them to evaluate the attractiveness of a bond. For example, some of the main factors that influence the bond prices and yields are the supply and demand of bonds, the prevailing market interest rate, the inflation expectations, the economic conditions, the political events, and the credit events. Investors can use various tools and indicators, such as the yield curve, the yield spread, the duration, the convexity, and the bond equivalent yield, to measure and compare the returns and risks of different bonds.

Most BOOM readers are financially sophisticated and will understand Bond Market dynamics. However, less sophisticated readers may wish to understand more about Bond markets. This is a good summary:- Bond Trading: How to Buy and Sell Bonds in the Secondary Market

https://fastercapital.com/content/Bond-Trading--How-to-Buy-and-Sell-Bonds-in-the-Secondary-Market.html

Another good summary — https://www.fidelity.com/learning-center/investment-products/fixed-income-bonds/bond-prices-rates-yields

And another — https://www.investopedia.com/terms/b/bond.asp

By the way, Bonds can also be issued by Companies (called Corporate Bonds), States and Municipal councils. They are also tradeable on secondary markets.

UNITED STATES SOVEREIGN BOND INTEREST RATES OVER LAST FIVE YEARS

The Secondary markets for bonds show how interest rates — their “Yield” — rise and fall over time. Let’s look at the historical pattern of interest rates on current US Treasury Bills, Notes and Bonds being traded on the secondary market.

The 3 month Maturity US Treasury Yield over 5 years

The 6 month Maturity US Treasury Yield over 5 years

The 1 Year Maturity US Treasury Yield over 5 years

The 5 Year Maturity US Treasury Yield over 5 years

The 10 Year Maturity US Treasury Yield over 5 years

The 30 Year Maturity US Treasury Yield over 5 years

The changes in Yield on the secondary markets represent the changes in Price of the Bonds ( as they are traded) which fluctuate mostly in response to interest rate expectations for the future.

Current Yields on US Treasury Securities are

3 Month Maturity — 4.35 % 6 Months — 4.27 % 12 Months — 4.08 %

5 Years — 3.98 % 10 Years — 4.41 % 20 Years — 4.95 % 30 Years — 4.96 %

US RATES ARE TOO HIGH

It is BOOM’s view that current interest rate settings by the “genius” Federal Reserve in the US are too high for the economic uncertainty prevailing at present. Also, the Peak of CPI inflation was reached way back in June/July 2022. Yes — THREE years ago (!). Soon after the Peak, BOOM (alone) alerted the world to this fact. But, if they read BOOM (and they do), the “genius” central bankers at The Fed took no notice. They did not lower their interest rate settings until more than a full TWO years later — in September 2024.

US Inflation Rate over 5 Years

US Federal Reserve Fund Rates

And nobody seemed to notice what caused that surge in CPI inflation during 2021 (except BOOM). It was caused by a rapid, unwise massive acceleration in US Government spending during 2020 in response to the Non Threat of a Fake “Covid Pandemic” during the last year of Trump’s first Presidency. Why? Because Donald and his Cabinet had no clue about Respiratory viruses and no clue about the fact that they are always self limiting and no clue that the initial death surge epidemic was all over by May 2020 and no clue about the guaranteed massive numbers of False Positive “Cases” that happened when a PCR Test was used at greater than 30 Amplification Cycles. Yes — Donald was conned into it by US government “disease experts” and the mainstream media. All of whom should have known … but (probably) didn’t. Nonetheless, Trump was the stooge. And he fell for it, thinking that here was his chance for “greatness”. He should have asked for calm advice from non-government experts. But he didn’t. The economic result was surging CPI inflation.

Let’s move back to the present. The facts now speak for themselves. With a US economy now barely ticking over, we have the “Geniuses” at the Fed holding onto their interest rate settings rather than lowering them. Does this chart of quarterly US GDP Growth rate show a surging, out of control US economy? Answer — No.

In two and a half week’s time, on the 30th July, at 12.30 PM, the latest quarterly GDP Growth figures will be released by the US Bureau of Economic Analysis. If they are negative for the second quarter of 2025, all hell will break loose in regard to the central bank’s reticence to lower their key interest rate settings.

With all the uncertainty within the US and global economies created by Trump and his deeply unwise Tariff War over the last quarter, BOOM is expecting a negative number or a very low positive number. Only a Supreme Being can help Jerome Powell, the Chairman of the Federal Reserve, if it comes in lower than the first quarter.

Of course, BOOM may be wrong and the US economy may have suddenly surged into accelerated growth over the second quarter but the US Economic Optimism Index released on 1st July doesn’t suggest that.

And MoM (Month on Month) Retail Sales in May do not suggest that.

If the GDP Growth numbers are bad on 30th July, BOOM can make a 100 % certain prediction —

Donald Trump will blame Jerome Powell at the Federal Reserve and …

Jerome Powell will blame Donald Trump at the White House.

If the numbers are (surprisingly) good, then Donald Trump will claim them as his own and Jerome Powell will say that his interest rate settings are appropriate. But this is a very high stakes game.

Trump’s Presidency is badly wounded now by his continuance of Perpetual War, his Tariff War, his denial of Epstein’s guilt for anything beyond watching Paedophile porn (with presumably no victims and no perpetrators) and his inability to see that MRNA “vaccines” produced under his Operation Warp Speed are a real time disaster causing growing illness and excess deaths from all causes both in the US and globally. His MAGA support base is rapidly disappearing. Economic contraction will make everything worse for him.

Just 2 weeks ago, Scott Bessent, the US Treasurer, was asked if he would be prepared to sack Powell. He said “I will do what the president wants”.

There is some doubt about whether or not Trump can do this. One discussion in 2018 on this topic revealed that, under law, a President can remove a member of the Federal Reserve Board “for cause” (whatever that means). But no President has ever taken that step. It would signal the end of central bank independence in the United States.

CENTRAL BANK INDEPENDENCE CHALLENGED IN AUSTRALIA BY GOVERNMENT “EXPECTATIONS”

In Australia last week, the Federal Government released its “Statement of Expectations” in regard to the Governance Board of the Australian Reserve Bank (the central bank). This is a major threat to the independence of the Reserve Bank in BOOM’s opinion. Let’s look at some of the statements made —

“The Government expects the Governance Board to publish its Statement of Intent in response to this Statement of Expectations on the Reserve Bank website, and subsequently incorporate these statements in the Reserve Bank’s Corporate Plan.”

Under the Heading “Relationship with the Government” comes the following statement:-

“The Government expects the Treasury and Governance Board to maintain a close relationship. The Chair of the Governance Board is to liaise with the Treasury regularly about the activities of the Governance Board and the Reserve Bank’s progress in implementing the recommendations of the Review. The Government also expects the Governance Board to provide the Secretary to the Treasury with a copy of information, briefings, press releases and correspondence provided to Ministers, and keep the Secretary appropriately informed of significant meetings between the Governance Board and Government Ministers and other Parliamentary bodies.”

Under the Heading “Appointments” —

“The Treasurer has appointed the Governor as Chair of the Governance Board for the first five years of the Board’s operation. This arrangement will be reviewed ahead of the expiry of that term.

New appointments of external members to the Governance Board will be made by the Treasurer from a shortlist of candidates.”

And … “New appointments of external members to the Governance Board will be made by the Treasurer from a shortlist of candidates. A panel comprising the Secretary to the Treasury, the Reserve Bank Governor and an independent third party will compile the shortlist …”

And … “The Government expects the Governance Board to assess and report publicly by the end of 2025 on the Reserve Bank’s progress in implementing the Review’s recommendations and achieving its objectives.

The Governance Board should also identify new opportunities for improvement, including through 5-yearly Australian Public Service capability reviews. Theseforward-looking reviews will provide an opportunity to independently assess the Reserve Bank’s ability to meet future objectives and challenges. A summary of these reviews should be published on the Reserve Bank’s website. These reviews will also ensure progress is tracked and monitored, and external reporting occurs in areas where outcomes are expected to improve over a longer period, such as cultural change.”

The current Treasurer of Australia overseeing these changes to the Governance of the Reserve Bank is the same man who is insistent upon delivering the third Budget Surplus this year. Go figure …….

Do two wrongs make a right? BOOM does not think so.

The full Statement of Expectations Published 10th July 2025:

https://ministers.treasury.gov.au/sites/ministers.treasury.gov.au/files/2025-07/20250710-tsr-soe.pdf

SOME FEEDBACK AND BOOM’S RESPONSE

Reader Testimony:

“Dr. Brady: I have to congratulate you – you’ve taken an old dog, and taught him new tricks, new ways of thinking … When I first heard your statements about inflation, deflation, and especially the ‘national debt’, I thought you were a nutter… but I’ve kept listening, and learning every Sunday, and have come to realize what’s coming out of your mouth is closer to ‘truth’ than it’s opposite…

I’ve come to realize that the ‘economic propaganda complex’ is feeding us a load of manure. Instead of alignment or opposite, the truth seems to be orthogonal to what the propaganda is saying. Thanks again !”

======================================================

Reader Question:

Another reader asked BOOM about the Trump administration pushing the adoption of Bitcoin. The reader noted JD Vance and Trump’s son in law (and many other notable voices) as promoting its adoption at the recent Vegas Bitcoin conference.

BOOM’s reply:

Trump has been sold (arguably conned) on the idea of the Bitcoin/Crypto/Stablecoin world being a way to support US Dollar dominance. There is some truth in that but it is very little. The Total Market Cap of the Crypto world is (currently) equivalent to US$ 3.37 Trillion. But Total Global Debt (public and private) exceeds well over $ 300 TRILLION. So the entire Crypto world (after 17 years of operation) is equivalent to about 1 % of that. It is a Casino/Ponzi Scheme where Bitcoins and Cryptos are the Casino Chips. No President or national government should lend it credence IMHO. It is equivalent to praising and supporting a gambling den. Presidents and National Governments should not offer any support whatsoever to what has also been a major crime scene for its 17 years of existence. Search my Archive for the word "casino" -- it will reveal many articles on this matter. https://boomfinanceandeconomics.substack.com/archive

TRUMP SENDS ULTIMATUM LETTERS TO NATIONS — BRICS GROUP ARE NOT IMPRESSED

Last week, the President of the United States sent letters out to nations outlining what Tariffs would be applied to their goods upon arriving in the USA. No negotiation – just an ultimatum.

Trump is convinced that the exporting nations will pay the tariffs but that is not the case. Exporting nations do not pay tariffs. Those tariffs will be paid by American consumers and manufacturers when and if they buy those goods. Goods that do not flow to the US will instead flow to other destinations and the rest of the world will benefit from that.

Diplomacy is not the word one would use to describe this situation. Ultimatums are essentially threats. Nations will not forget what has happened. They will talk amongst themselves and they will all reach the same conclusion – the US cannot be trusted.

It is BOOM’s view that this will cause huge loss of faith in US diplomacy. It will damage America’s reputation badly. The rest of the world will slowly but surely accept that the US regards them as an enemy.

No American President has ever treated other nations in such an offhand fashion.

Commerce Secretary Howard Lutnick told reporters on Sunday that Trump will be setting the rates and potential “deals”, while Treasury Secretary Scott Bessent had earlier said the tariffs will be imposed as outlined in April if no trade deals were reached by August 1.

This left markets uncertain over just how high Trump’s tariffs will be, given that the President had in early April announced tariffs might go as high as 50% on major economies, while he also said that the rates could reach 60% or 70%. WHO knows? And what will those nations do in response? Who knows? As Ghandi once said “An Eye for an eye will leave the whole world blind”.

Adding to the uncertainty, Trump also said that countries aligned with the BRICS bloc will face an extra levy of 10 % over allegedly anti-American practices.

Trump has repeatedly criticized the BRICS bloc, which consists of founding members Brazil, Russia, India, China, and South Africa, over its efforts to develop new trade alternatives and currency alternatives to the United States Dollar.

But BRICS is steadfast. They met in Rio Di Janeiro in Brazil last week and released this statement —

On Saturday, 6 July, the leaders of the 11 largest emerging economies signed the Joint Declaration of the 17th BRICS Summit in Rio de Janeiro.

Entitled "Strengthening Global South Cooperation for More Inclusive and Sustainable Governance", the document seals the group’s commitment to strengthening multilateralism, defending international law, and striving for a more equitable global order. It reflects months of intense coordination, with over 200 meetings held and 200 new cooperation mechanisms created or reinforced in areas such as eradicating hunger, tackling climate change, and developing emerging technologies.

“We want to reaffirm our commitment to the BRICS spirit of mutual respect and understanding, sovereign equality, solidarity, democracy, openness, inclusion, collaboration and consensus. Building upon the past 17 BRICS Summits, we are now extending our commitment to strengthening cooperation within the expanded BRICS, based on three pillars of cooperation: politics and security, economy and finance, and cultural and people-to-people cooperation. We are also enhancing our strategic partnership to benefit our peoples by promoting peace, a fairer and more representative international order, a revitalized and reformed multilateral system, sustainable development, and inclusive growth,” states one of the 126 commitments made by the leaders.”

The whole BRICS statement published on July 6th is worth reading and can be found here —

=============================================================

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions.

BOOM does not offer investment advice.

===========================================================

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.

Hi Gerry I have been working on a circle of balme and diagnosis to solution ration as part of my Strawberry Revolution if nothing else it has generated a few jokes about strawberries and the usefull guide to finding the hotels that matter in Sweden. Heres the Out put on your latest . Of course we both know we share common diagnostic conclusions what of solutions?

FINAL JUDGMENT IN THE MATTER OF HUMANITY v. THE GLOBAL DEBT HYSTERIA COMPLEX

A Deming Criteria Analysis of Dr. Gerry Brady's "No Need to Pay Back the US National Debt" Through the Lens of Abundance

https://grubstreetinexile.substack.com/p/final-judgment-in-the-matter-of-humanity-c99