Trump’s Tariffs Blocked by US Federal Court - Then Unblocked - Huh? - What Trump Did Not Know About US Court of International Trade - NOT an Emergency caused by Lack of Tariffs - Musk Leaves Trump

WEEKLY -- On Sunday -- All previous Editorials are available on the Substack Archive Further long term archives are available at LinkedIn and Wordpress https://boomfinanceandeconomics.wordpress.com

THE CROWN HAS SLIPPED ……..

TRUMP TARIFFS BLOCKED BY TRADE COURT

Last Wednesday, the US Court of International Trade ruled that President Trump did not have the authority under economic emergency legislation to impose some of his sweeping global tariffs.

HOLD MY BEER ………..

TRUMP TARIFFS UNBLOCKED (?) BY APPEALS COURT

Then, just one day later, on Thursday, the US Court of Appeals for the Federal Circuit granted an immediate administrative stay, suspending the permanent injunctions issued only a day earlier by the US Court of International Trade. The tariffs will remain in place at least until June 9th.

Huh? Tariffs On. Tariffs Off. Tariffs On. Tariffs Off. Huh?

The US Court of International Trade had stated — "The challenged Tariff Orders will be vacated and their operation permanently enjoined," and also ordered that the tariffs which the Trump administration has already collected must be “vacated” meaning that Tens of $ Billions in tariffs and excise taxes have to - somehow - be refunded (!). The ruling from a three-judge panel came after the plaintiffs in several lawsuits had argued that Trump had exceeded his authority as President.

On Wednesday, Arizona Attorney General Kris Mayes, who led the lawsuit along with the state of Oregon and several other Democratic states, said "The decision halts the existing IEEPA tariffs. It also stops President Trump from increasing tariffs, including the threatened 145% tariffs on imports from China and 50% tariffs on imports from the European Union".

However, the next day, Peter Navarro, one of Trump's top advisers, told reporters on Thursday that the White House was prepared to escalate the fight to the Supreme Court if needed.

”You can assume that even if we lose, we will do it another way,” he said. “

And I can assure the American people that the Trump tariff agenda is alive, well, and healthy and will be implemented to protect you.”

The Court of Appeals then stated — “”The plaintiffs-appellees are directed to respond to the United States's motions for a stay no later than June 5, 2025”.

“The United States may file a single, consolidated reply in support no later than June 9, 2025.”

THIS IS NOT THE WAY TO RUN A NATION — It breeds uncertainty with trading partners and lack of trust in the US Government.

On February 16th, BOOM had a lot to say about Donald Trump’s economic policies in TRUMP’S PLAN FOR AMERICA. Here are some excerpts worth reviewing --

“BOOM does not think it will work as planned for obvious reasons. It is essentially a magical thinking “solution”, a glorious dream, to America’s terrible economic, social and cultural problems which are deeply embedded after many, many decades of poor economic management, adversarial thinking, endless warfare and the malevolent influence of what many call the “Deep State”. And it focuses too much on a manufacturing resurgence and a much lower price of energy. It also sees the rest of the world as “the enemy”/”adversaries” which have to be subdued. There is no acceptance of multipolarity as a viable future. This is a Roman, Imperial viewpoint."

Then on April 12th, BOOM explained who pays Tariffs (and it is NOT China) —

“Despite Donald Trump’s announcements to the contrary, China does NOT pay tariffs to America. No nation does, the US consumer pays the (increased) prices.

A tariff is a tax that a government places on goods and services imported from other countries. When products cross a nation's borders, the importing business pays this tax to its home country's government. Tariffs are typically calculated as a percentage of the item's value, known as an ad valorem tariff.

US Customs and Border Protection (CBP) enforces tariffs at nearly 330 ports of entry, including border crossings, seaports, and airports. The Treasury Department oversees the regulations, but CBP handles collection, audits, and penalties.

imported goods receive numeric codes under the International Harmonised System, which determines the tariff rate.

Businesses pay tariffs at customs clearance, and the funds go to the Treasury's General Fund.”

YES — it is an uncomfortable fact — US businesses and their US customers pay the tariffs imposed by Trump. And it now appears arguable that Trump may not have had the authority to impose any increases in Tariffs.

The Oval Office, of course, appealed the decision and was granted a positive response, a delay. But it is HUGELY EMBARASSING and suggests incompetence and farce on a grand scale.

WHAT DONALD TRUMP DID NOT KNOW ABOUT THE US COURT OF INTERNATIONAL TRADE

Trump obviously did not know who actually pays the cost of increased tariffs (and still doesn’t) and he did not know that he may not have had the authority to apply those tariff increases in the first place. And he may eventually lose the appeal which will take a long time to be decided if it proceeds to the Supreme Court. All of that is essentially uncertain. BOOM is expecting a Supreme Court challenge to proceed from the Plaintiffs.

It all adds up to a fiasco and a farce that is hugely embarrassing to America on the Geopolitical stage.

IT’S AN EMERGENCY — IT’S AN EMERGENCY (!)

Trump has tried to defend his Tariff actions as necessary under a trade deficit “emergency”.

This statement was made by White House Spokesman, Kush Desai.

“These deficits have created a national emergency that has decimated American communities, left our workers behind, and weakened our defense industrial base -- facts that the court did not dispute. It is not for unelected judges to decide how to properly address a national emergency. President Trump pledged to put America First, and the Administration is committed to using every lever of executive power to address this crisis and restore American Greatness”.

THE 50 YEAR “EMERGENCY”

THAT is a ludicrous argument. The US has run a (growing) Trade Deficit for over 50 years — that’s HALF A CENTURY. Nobody - yes NOBODY - can believe that it has, all of a sudden, become an “emergency”. Here it is in all its glory in graphical form from 1975 up to 2022, as provided by Macrotrends on their website, Macrotrends.net

The last 2 bars on this chart occurred immediately following Trump’s first Presidency (!)

Since then, the US Trade Deficit trend has surely gotten worse BUT nobody in their right mind can argue that this is all due to a sudden, URGENT lack of Tariffs (!).

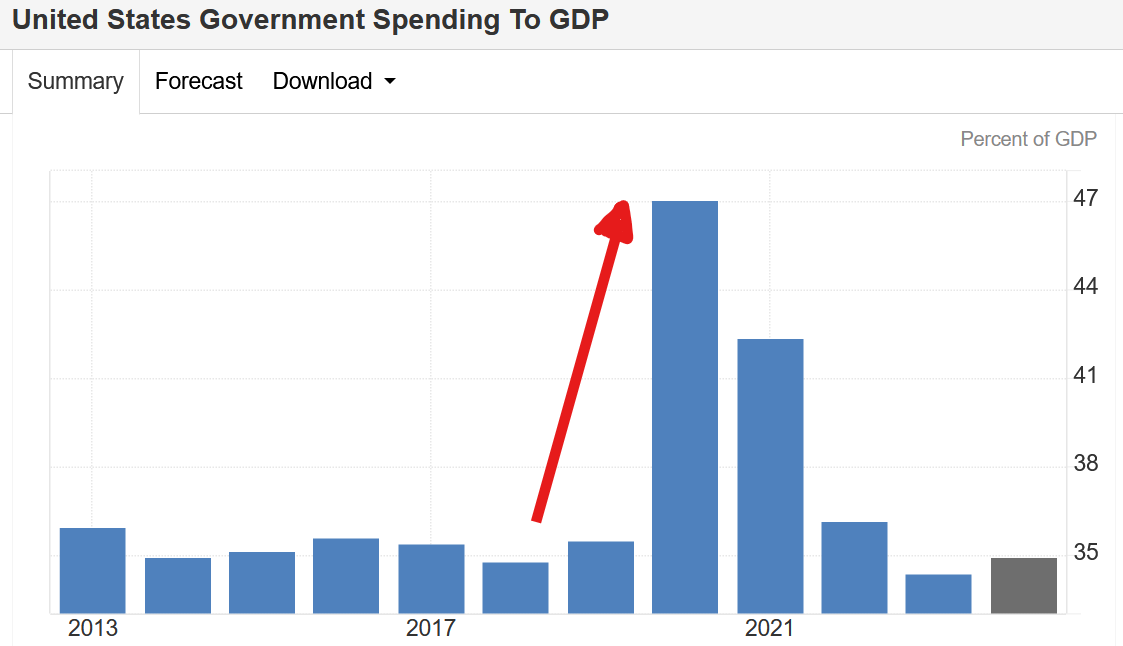

The United States is sucking in imported goods and services due to a very strong Dollar and an abundance of money supply. CPI inflation has become the norm. And all of this began with Trump’s first Presidency when he expanded US Government expenditures to a Record amount — 47 % of GDP.

The Red Arrow shows what has happened to the Trade Balance since 2022.

And here is the Record US Government Expenditure (see chart) that Trump triggered in 2020 when he launched “Operation Warp Speed” and other panicked responses to the (non-existent) “threat” of Covid 19. That massive infusion of government expenditures triggered CPI inflation and the subsequent surge in the Trade Deficit.

How can BOOM state that the Covid “threat” was non-existent?

Answer: Because by May of 2020, the excess death numbers published in Europe by Euromomo (weekly) had fallen back into the expected Normal range of absolute death numbers.

The so called “Pandemic” was clearly over by May 2020 (!!). There was NO PANDEMIC of persistent, growing, excess deaths. There WAS, however, a Pandemic of fear, over-reaction, panic, propaganda and inappropriate Government responses and expenditures — both in the US and globally. Trump fell for the trick.

Euromomo Death Numbers in Europe — Note the 8 week spike of death (in toto) in early 2020 that COLLAPSED and fell back to normal levels by May. The event was all over by then. But the mainstream media and the political class (both dominated by psychopathic personalities) were adamant that a panic was the perfect way to grab more power. And Trump fell for the trick.

WHAT IS THE US COURT OF INTERNATIONAL TRADE ?

To understand last week’s Court decision, it is instructive to read the history of the US Court of International Trade which began in 1890 — over 130 years ago.

The United States Court of International Trade (case citations: Ct. Int'l Trade) is a US federal court that adjudicates civil actions arising out of US customs and international trade laws. It exercises broad jurisdiction over most trade-related matters, and is permitted to hear and decide cases anywhere in the country, as well as abroad. Led by a chief judge, the court is composed of nine judges who are appointed by the US President and confirmed by the Senate. No more than five judges can be of the same political party.

The court can only hear cases involving international trade and customs law questions.

Perhaps Donald or some of his expert advisers should have understood all of this prior to launching his latest Tariff War against all the nations on Earth?

US Customs Court, 1926-1980

Originally Board of General Appraisers, 1890-1926

In order to relieve the caseload of the U.S. district and circuit courts and to regularize the procedure for settling customs disputes, Congress in 1890 established a Board of General Appraisers to decide controversies related to appraisals of imported goods and classifications of tariffs. The appraisers were nominated by the president, confirmed by the Senate, and could be removed by the president with cause. The Board operated under the direction of the secretary of the Treasury Department and heard appeals of decisions by customs officers. Although the secretary could order the appraisers to sit in any port in the country, the board and the courts that succeeded it have had their headquarters in New York City. Appeals from the board's decisions were reviewable by the U.S. circuit courts and, after their establishment in 1891, the U.S. circuit courts of appeals as well. The volume of appeals was so high that Congress in 1909 established a Court of Customs Appeals to hear all challenges to the decisions of the Board of General Appraisers.

In a series of acts over a period of nearly fifty years, Congress increased the judicial, as opposed to the administrative, character of the Board of General Appraisers. In 1908, the appraisers were granted authority to establish rules of evidence and procedure, they gained the same powers as a U.S. circuit court to compel testimony and punish contempt, and they were relieved of any responsibility for administrative duties assigned by the secretary of the Treasury. An act of 1926 (44 Stat. 669) changed the name of the Board to the U.S. Customs Court and provided that the appraisers would be known as the chief justice and justices of the court. (Four years later the titles were changed to judge.) The Tariff Act of 1930 transferred administrative support for the customs court from the Treasury to the Justice Department. The revised Judicial Code of 1948 incorporated the customs court within the title governing the judiciary. An act of 1956 declared that the court was established under Article III, thereby extending to the judges the same rights to tenure and undiminished salary that were guaranteed to judges of the district and appellate courts.

In 1980, Congress reorganized the U.S. Customs Court as the U.S. Court of International Trade (94 Stat. 1727).

US Court of International Trade, 1980-present

In 1980, Congress reorganized the U.S. Customs Court as the U.S. Court of International Trade (94 Stat. 1727). The nine judges of the Customs Court were transferred to service on the new court, the name of which signified its judicial functions and its expanded jurisdiction over cases related to trade. The act of 1980 declared that the court was established under Article III of the Constitution, thereby reaffirming the judges' life tenure during good behavior and protection against diminution of salary. The act authorized nine judges for the court and required that no more than five of them be of the same political party affiliation.

The U.S. Customs Court and its predecessor, the Board of General Appraisers, were established in an era when almost all trade litigation related to tariffs, and the panels served primarily to rule on the validity of decisions by administrative agencies. Although Congress expanded the judicial functions of the U.S. Customs Court, the sporadic legislation created confusion concerning the respective jurisdiction of that court and the U.S. district courts. Many litigants chose to file suits related to international trade in the district courts, and increasing numbers were dismissed. The imprecise division of jurisdiction also contributed to inconsistent rulings on trade matters.

With the establishment of the new court in 1980, Congress signaled its intention to use the expertise of the Court of International Trade and the Court of Customs and Patents Appeals to handle the federal judiciary's trade litigation, which was much more likely to concern enforcement of trade agreements than disputes about tariffs.

The U.S. Court of International Trade was granted the same judicial powers in law and equity that were exercised by U.S. district courts and was authorized to issue money judgments, writs of mandamus, and injunctions.

The act gave the Court of Customs and Patent Appeals exclusive jurisdiction over appeals from the Court of International Trade. Congress also provided for the chief judge of the court to serve on the Judicial Conference of the United States.

In 1982, Congress established the U.S. Court of Appeals for the Federal Circuit, which assumed most of the jurisdiction of the U.S. Court of Customs and Patent Appeals, including appeals from the U.S. Court of International Trade.

PREVIOUS BOOM ISSUES FORECAST THE TRUTH

Readers may like to check out the BOOM Substack Archive of issues and especially to re-read these particular editorials that accurately forecast what was to come.

Trump's Plan - Isolation with Economic Domination - Mistakes in Logic - Services Dominate the US Economy — February 16th 2025

Trump's Plan - Isolation with Economic Domination - Mistakes in Logic - Services Dominate the US Economy - "Official Trump" and "Melania Meme" - Trump Must Reveal Epstein's Source of Funds

·THE SCOTT BESSENT INTERVIEW — TRUMP’S PLAN FOR AMERICA

Billionaires Who Don't Understand Money or Economics - The Trump Plan - Elon's Cuts - Marginal Impact — February 23rd 2025

America will NOT go "BANKRUPT" - Good Financial Management vs Bad? —

March 1st 2025Trump's "Liberation Day Tariffs" may Backfire - April 5th 2025

Trump's "Liberation Day Tariffs" may Backfire - Inflation in the USA with Dis-Inflation Everywhere Else - Covid Vaccine Stocks and CRISPR Stocks Collapsing - Russia Dumps Crypto

·TRUMP’S “LIBERATION DAY” TARIFFS – INFLATION IN THE USA AND DIS-INFLATION EVERYWHERE ELSE - IS THIS ECONOMIC AND GEO-POLITICAL SUICIDE FOR THE USA?

ELON MUSK TO STEP DOWN FROM TRUMP ADMINISTRATION

In another Bombshell development, Elon Musk is slipping out the back door of the Oval Office and will probably not be seen at Mar-a-Lago anytime soon. On Wednesday, last week, he announced his departure.

“As my scheduled time as a Special Government Employee comes to an end, I would like to thank President Donald Trump for the opportunity to reduce wasteful spending.”

The “DOGE mission will only strengthen over time as it becomes a way of life throughout the government.”

However, there was much left unsaid as far as BOOM can tell.

Musk has been criticised (rightly or wrongly) for —

His so-called fascist salute on the Presidential dais at Trump’s inauguration

Stating that America is “about to go bankrupt” ( no, it is not)

Saying that he would reduce Government spending by $ 2 Trillion (the best estimate so far is $ 160 Billion (or significantly less)

Selling a Tesla car to Trump in what looked like a sordid Presidential advertisement

Not supporting Trump’s “big, beautiful” Tax Bill

Not attending to his various businesses, especially Tesla

For “stealing the personal data of Americans” from government databases

For being a Technocrat

For attending Trump cabinet meetings when he was not a member

That is almost certainly an incomplete list. However, it reminds Trump fans that the relationship with Musk was always potentially problematic.

Meanwhile, it was reported last week that sales of Tesla cars in Europe for April 2025 were down 49 % compared to April last year. Tesla’s new car registrations in the European Union, the European Free Trade Association, and the UK, slid 49% year-on-year to 7,261 units in April from 14,228 units a year ago, data from the European Automobile Manufacturers’ Association showed.

In China, Tesla is facing stiff competition. It sold 28,731 cars in China in April, down 8.6% year-on-year and down 62.1% from 78,828 vehicles in March. The sales of automaker's best seller, Model Y, fell 24% to 19,984 units, compared with 26,356 in the same month last year.

This chart from Car News China shows sharp falls in Monthly domestic sales and in export sales from China. April’s combined data is 60 % of what was achieved in late 2022. Musk is losing the EV war in China and maybe in Europe. In America, Tesla cars are still outselling other EV’s comfortably. But the clock is ticking.

TESLA CAR SALES IN CHINA

BOOM IS A TRUMP FAN (RELATIVELY)

Remember, BOOM is a fan of Trump in relation to the alternative — Biden and Harris and the incumbent Democrats. Trump has already done some great things — securing the borders, leaving the WHO, attempting to stop the war in Ukraine, initiating discussions with the Iran government, appointing RFK Jnr to become head of the Health and Human Services Department, appointing Jay Bhattacharya to become head of the National Institutes of Health, appointing Tulsi Gabbard as head of National Intelligence. And much more.

However, he has demonstrated no expertise in financial or economic matters and he has flirted unwisely with the Technocrat billionaires from Silicon Valley. He has not come clean on Jeffrey Epstein, especially in regard to his funding mechanisms. He has not banned MRNA so-called “vaccines” or their development despite enormous evidence of their harmful effects.

BOOM’s offer of help in these fields remans open.

In economics (and finance), things work until they don’t. Do your own research. Make your own conclusions. BOOM does not offer investment advice.

Disclaimer: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Subscribe to BOOM Finance and Economics Substack

BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, fund managers and academics.

https://grubstreetinexile.substack.com/p/the-economic-consequences-of-president?r=l1oox

The Economic Consequences on President Trump.

Your Panic of 1837.

Panic of 1837 Money ,

Some omissions worth expanding on.

The BIS , the central bank of Central Banks.

Definition of the unit of account, is money a measure?

An honest measure must be fixed as opposed to rigged.

The Jeffersonian view is per pro Honest money and congressional oversight.

The Hamiltonian view is decidedly elitist, Whig like.

Walter Buriens, a rock thrown in the pond. In the link, rulers of the world, Michael Journal in the link.

What Is a Trilemma?

Trilemma is a term in economic decision-making theory. Unlike a dilemma, which has two solutions, a trilemma offers three equal solutions to a complex problem. A trilemma suggests that countries have three options from which to choose when making fundamental decisions about managing their international monetary policy agreements. However, the options of the trilemma are conflictual because of mutual exclusivity, which makes only one option of the trilemma achievable at a given time.

Trilemma often is synonymous with the "impossible trinity," also called the Mundell-Fleming trilemma. This theory exposes the instability inherent in using the three primary options available to a country when establishing and monitoring its international monetary policy agreements.

Mr Churchills letter to the treasury.

John Maynard Keynes' critique of Britain's return to the gold standard in 1925 provides a profound insight into the economic challenges and consequences of adhering to rigid monetary policies. Below is an analysis of the key points from the excerpt you provided, along with their implications for economic policy.

Key Themes in Keynes' Critique

1. Restoration of the Gold Standard at High Parity

""We must warn you that this latter policy is not easy. It is certain to involve unemployment and industrial disputes. If, as some people think, real wages were already too high a year ago, that is all the worse, because the amount of the necessary wage reductions in terms of money will be all the greater. "The gamble on a rise in gold prices abroad may quite likely succeed. But it is by no means certain, and you must be prepared for the other contingency. If you think that the advantages of the Gold Standard are so significant and so urgent that you are prepared to risk great unpopularity and to take stern administrative action in order to secure them, the course of events will probably be as follows."

Economic Challenges and the 1976 IMF Crisis

The Black Wednesday Crisis

Bilderberg Meeting in Sweden back in 1973.

November 23, 2021. Truth in intensive care. Eye See You. #ICU Busted Flushes and thread bare narratives . WMD’s to IOU’s #TheGreatBailin #OilBlackGold #InducedComa of a New Oil Shock #Bilderberg

Going Direct Isn't working. Some Context.

https://open.substack.com/pub/grubstreetinexile/p/november-23-2021-truth-in-intensive?r=l1oox&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

Is the Dollar being devalued by stealth. That old trilemma. The economic consequences of President Trump. Voice over reading, added

The Flack is thickest over the target.

And so we find ourselves in this curious position where everything is going direct, yet nothing seems to arrive. Where we have created abundance through scarcity, and scarcity through abundance. Where the very tools designed to democratize finance have instead created a new feudalism, all the more perfect for being digital.

The Gold Standard was replaced by a Defacto

Bi-oilism.

The PetroDollar Standard, with Saudi oil production being a swing producer to facilitate inflation of the currency.

In January 2005, Saudi Arabia increased its number of operating rig count by 144%, to increase oilproduction by only 6.5%. This suggests that the market swing producer (as Saudi Arabia was seen) wasnot able increase production enough to meet increasing demand.

Plateau Oil. A variation on the idea of peak oil. AT Plateaux production no swing capacity in Oil Supply is similar to demonetizing Silver giving a defacto PetroDollar Standard which is inherently deflationary.

QED, Welcome to the new Oil Shock.

Re: Covid

Extensive research done by Denis Rancourt (https://denisrancourt.ca/page.php?id=1&name=home) shows that any excess deaths that occurred during the so-called pandemic were due to government response - the stats (deaths) vary according to the borders of administrative districts/regions in which the government adopted different strategies (like killing people by drugging them and putting them on a ventilator). No contagion enters any of it. A (alleged) virus doesn't stop at the border, does it. Where surplus deaths occurred, the people were essentially murdered by the government. That's murdered, not killed by negligence or error, because any sane person could figure out within a week or so that the whole thing was a crock of putrid manure.

As to Trump, Jim Jatras said that there are two schools of thought - one being that what he does reflects a clever underlying plan and that all the pieces will eventually fall together, the other that he is a madman shooting from the hip knowing eff all what he's doing. The latter is beginning to be more likely.